Texas Term Nonparticipating Royalty Deed from Mineral Owner

Description

How to fill out Term Nonparticipating Royalty Deed From Mineral Owner?

Finding the right lawful file design can be quite a battle. Needless to say, there are a variety of themes available on the Internet, but how can you get the lawful form you require? Utilize the US Legal Forms website. The assistance gives a huge number of themes, including the Texas Term Nonparticipating Royalty Deed from Mineral Owner, that you can use for organization and personal requires. Every one of the varieties are checked by specialists and satisfy state and federal needs.

In case you are presently registered, log in to your profile and then click the Acquire switch to get the Texas Term Nonparticipating Royalty Deed from Mineral Owner. Make use of profile to appear with the lawful varieties you might have purchased earlier. Check out the My Forms tab of your respective profile and acquire an additional backup from the file you require.

In case you are a brand new user of US Legal Forms, allow me to share basic recommendations that you can comply with:

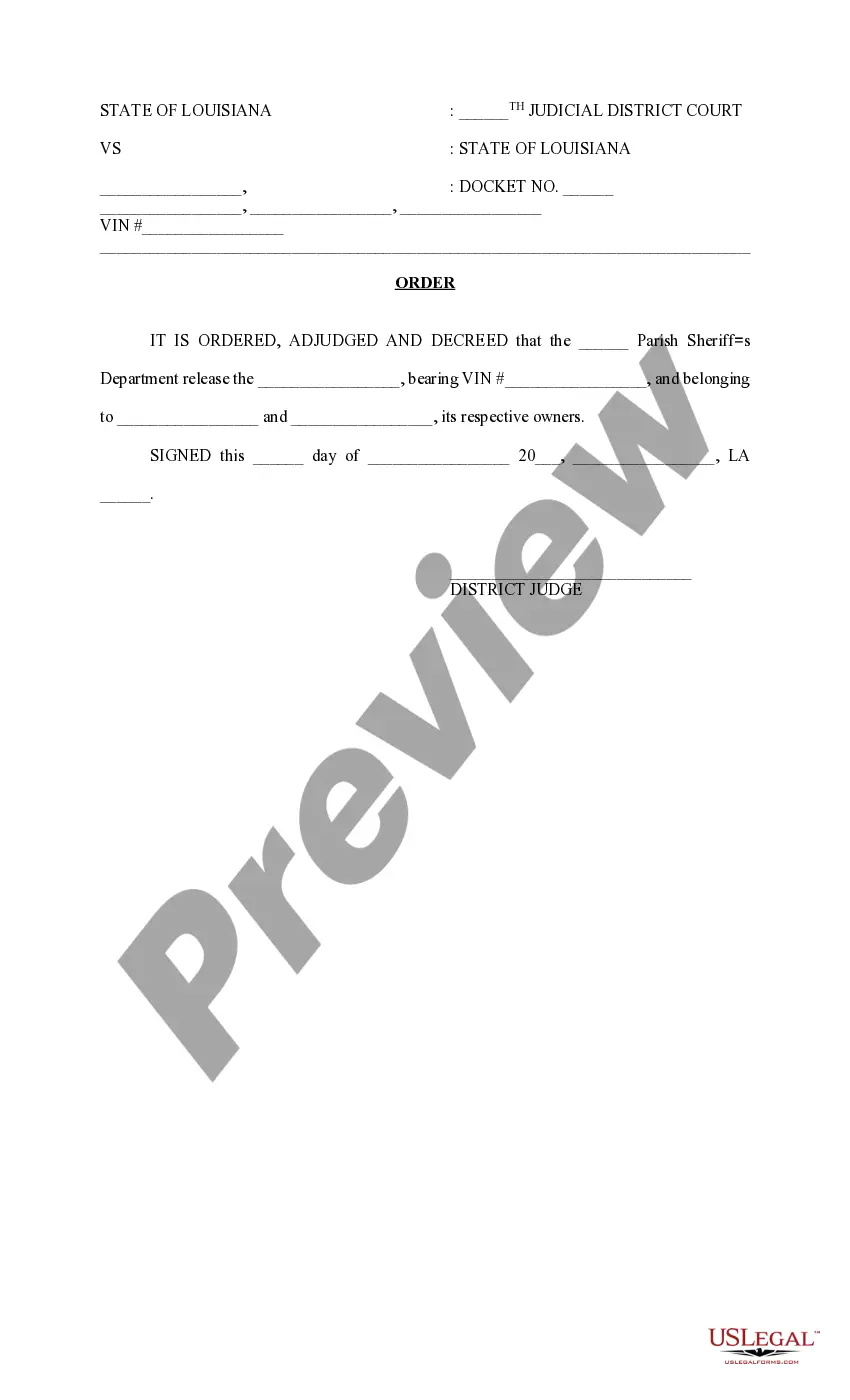

- Initial, make certain you have selected the correct form for the metropolis/county. You may look over the shape making use of the Review switch and browse the shape explanation to make sure this is the best for you.

- In case the form fails to satisfy your needs, make use of the Seach discipline to obtain the proper form.

- Once you are certain that the shape is proper, go through the Purchase now switch to get the form.

- Opt for the pricing plan you need and enter in the needed information and facts. Design your profile and buy the order with your PayPal profile or Visa or Mastercard.

- Select the submit structure and down load the lawful file design to your gadget.

- Complete, change and print out and signal the acquired Texas Term Nonparticipating Royalty Deed from Mineral Owner.

US Legal Forms is the most significant local library of lawful varieties that you can discover a variety of file themes. Utilize the service to down load professionally-manufactured documents that comply with state needs.

Form popularity

FAQ

Lessees can maintain all of the leased interests by production in paying quantities on any part of the lease. This is because a community lease serves to pool the interests. The lessee generally treats the lease as a single property except that royalties are paid in proportion to their ownership.

Non-Apportionment Rule The rule?followed in the majority of states?that royalties accruing under a lease on property that has been subdivided after the lease grant are not to be shared by the owners of the various subdivisions but belong exclusively to the owner of the subdivision where the producing well is located.

You will need to sign the mineral deed form in front of a notary to confirm its authenticity, have it notarized, and have it recorded. The recorder of the deed can send a copy back to us, and you will keep a copy. And you are done!

The formula to calculate NPRI without proportionate share reduction is LRR ? RI = NPRI. As an example, reducing your revenue interest from 25% LRR results in 1/16 NPRI, leaving 75% NRI for working interest owners.

Under Texas law, there is a rule of non-apportionment. It sets out that when the property is subdivided after the lease is already in place on the tract, the royalties are not apportioned but given to the royalty interest owner on whose property the well physically sits. Delay rentals however are apportioned.

In such a circumstance, the Payor may elect to file what is known as an Interpleader action to determine the proper owner (or might be encouraged to do so). In an Interpleader, the stakeholder sues the parties who are asserting conflicting claims to the royalties due and deposits the royalties into the court.

The following are methods for establishing mineral rights ownership: Deed. A deed is used to transfer mineral rights ownership from one party to another. Lease. ... Severance. ... Adverse Possession. ... Surface Use Agreement. ... Royalties. ... Mineral Estate. ... Texas Railroad Commission.

Typically, NPRIs are created by an express grant or reservation in a deed and are entirely different from a ?leasehold? royalty. The holder of a NPRI has no power to negotiate or execute an oil and gas lease and has no power to enter upon the land to extract the hydrocarbons.