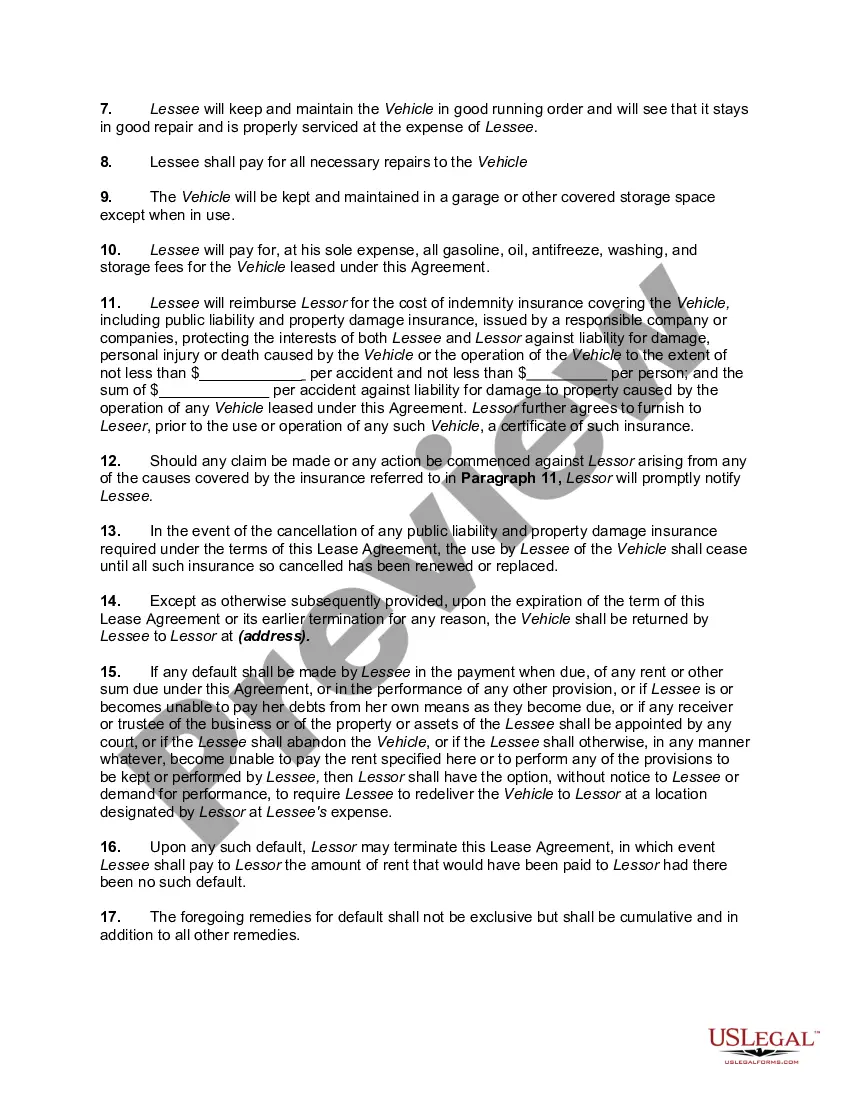

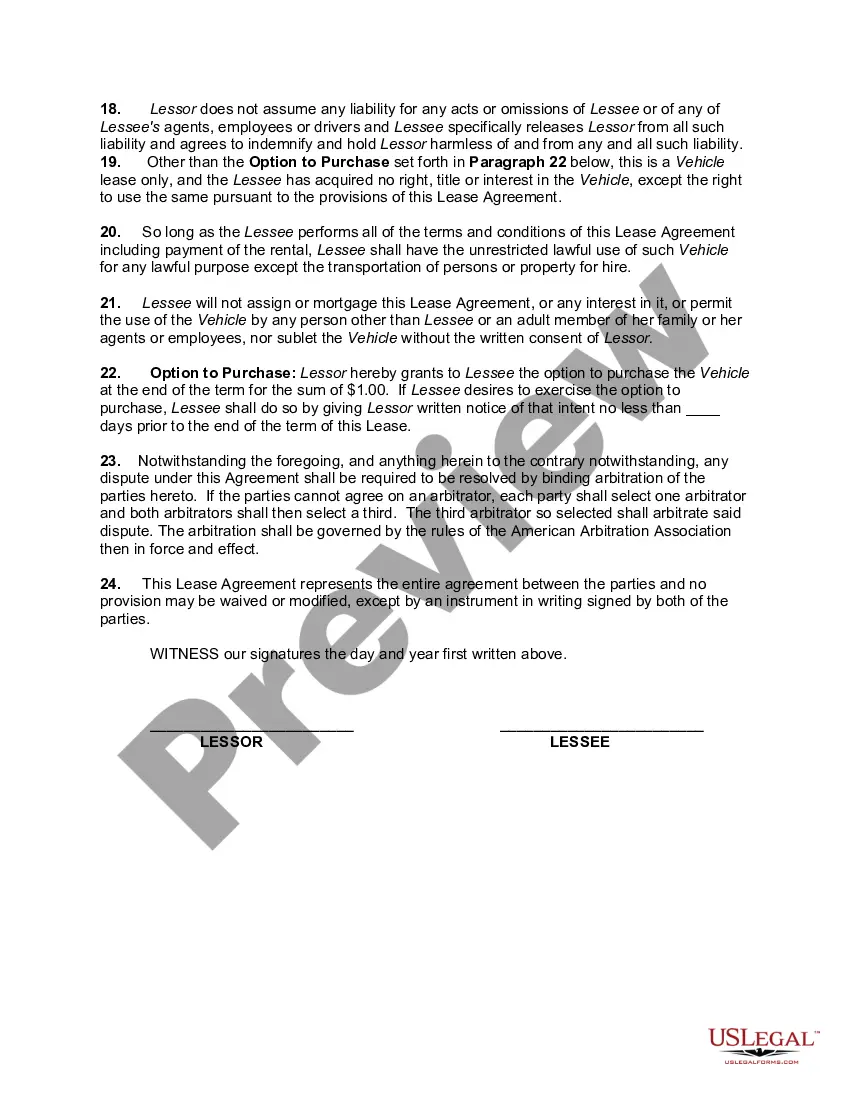

The following Lease or Rental Agreement is meant to be used by one individual dealing with another individual rather than a dealership situation. It therefore does not contain disclosures required by the Federal Consumer Leasing Act.

Arkansas Lease or Personal Rental Agreement of Automobile with Option to Purchase and Own at the End of the Term for a Price of $1.00 - Selling Car - Rent to Own

Description

How to fill out Lease Or Personal Rental Agreement Of Automobile With Option To Purchase And Own At The End Of The Term For A Price Of $1.00 - Selling Car - Rent To Own?

Are you presently in a position where you require documentation for various business or specific tasks almost every working day.

There are numerous reliable document templates accessible online, but finding forms you can trust is not easy.

US Legal Forms offers thousands of form templates, including the Arkansas Lease or Personal Rental Agreement of Automobile with Option to Purchase and Own at the End of the Term for a Price of $1.00 - Selling Car - Rent to Own, that are designed to meet state and federal regulations.

Choose a convenient document format and download your copy.

Access all the document templates you have purchased in the My documents section. You can download an additional copy of the Arkansas Lease or Personal Rental Agreement of Automobile with Option to Purchase and Own at the End of the Term for a Price of $1.00 - Selling Car - Rent to Own whenever needed. Simply click the desired form to download or print the document template.

Utilize US Legal Forms, the most extensive collection of legitimate forms, to save time and prevent mistakes. The platform offers expertly crafted legal document templates that can be used for a variety of purposes. Create your account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Next, you can download the Arkansas Lease or Personal Rental Agreement of Automobile with Option to Purchase and Own at the End of the Term for a Price of $1.00 - Selling Car - Rent to Own template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it corresponds to the correct city/state.

- Utilize the Review button to examine the form.

- Check the description to confirm that you have selected the right form.

- If the form does not meet your expectations, use the Lookup field to find the form that suits your needs and criteria.

- Once you find the appropriate form, click Acquire now.

- Select the pricing plan you desire, fill in the required information to create your account, and complete the payment with your PayPal or credit card.

Form popularity

FAQ

Leasing a car is similar to a long-term rental. You'll generally have to make an upfront payment, plus monthly payments, and get to use a car for several years. At the end of the lease, you'll return the vehicle and have to decide if you want to start a new lease, purchase a car or go carless.

optiontobuy arrangement can be a solution for some potential homebuyers, but it's not right for everyone. If you're not certain that you're going to be able to purchase the rental home at the end of the lease period, you might be better served with a standard rental agreement.

If you have signed up to a Personal Contract Hire (PCH) plan, which is like a long-term rental, you do not have the option of buying the car at the end of the lease. You just hand the car back and it is then your decision as to whether you'd like to start another contract on a new model.

If the car is worth more than the residual value projected at the start of your lease, buying it could be a bargain. If it's worth less, you may not want to buy it unless you can negotiate a lower buyout price.

The biggest difference between buying and leasing a car is ownership. Buying a vehicle gives you complete ownership to do what you want with it, while leasing a vehicle only gives you temporary ownership with restrictions on what you can do with it.

If you've been thinking about purchasing your lease, you may be searching for the answer to the question, Can you negotiate a lease buyout? In short, yes. Most leasing agreements include an estimated buyout price in the contract, but in most cases, it's possible to negotiate a better deal.

Know how leasing is different than buying. That means you're paying for the car's expected depreciation or loss of value during the lease period, plus a rent charge, taxes, and fees. At the end of a lease, you have to return the car unless the lease agreement lets you buy it.

Here is a list of our partners and here's how we make money. You typically can buy your leased car at any point during your lease; most people do so when the lease ends. By doing so, you're buying a car you know and trust and avoiding the potential costs and hassle involved in turning the vehicle back in.

Lease Purchase is a form of Hire Purchase or Conditional Sale agreement - requiring you to take ownership of the vehicle after all payments have been made - but the regular payments are structured like a lease/rental agreement.

Financing your vehicle is where you borrow the money to buy it. You pay regular payments to the lending company. Leasing your vehicle is where you borrow the vehicle and pay regular payments to the company lending it to you. With financing, you own the car.