Arkansas General Form for Bill of Sale of Personal Property

Description

How to fill out General Form For Bill Of Sale Of Personal Property?

If you wish to aggregate, obtain, or create legitimate document templates, utilize US Legal Forms, the most extensive selection of legal documents, available online.

Employ the site's straightforward and efficient search to find the documents you require. Numerous templates for commercial and individual purposes are categorized by type and state, or keywords.

Use US Legal Forms to find the Arkansas General Form for Bill of Sale of Personal Property in just a few clicks.

Every legal document template you purchase is yours permanently. You have access to every form you acquired in your account. Go to the My documents section and select a document to print or download again.

Be proactive and download, and print the Arkansas General Form for Bill of Sale of Personal Property using US Legal Forms. There are countless professional and state-specific forms available for your business or individual needs.

- If you are currently a US Legal Forms user, Log In to your account and click the Download option to retrieve the Arkansas General Form for Bill of Sale of Personal Property.

- You can also access forms you previously obtained in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to view the form’s details. Don’t forget to read the description.

- Step 3. If you are not satisfied with the document, use the Search box at the top of the screen to find other types of your legal document template.

- Step 4. Once you have found the form you need, select the Purchase now option. Choose your preferred pricing plan and enter your information to register for an account.

- Step 5. Complete the transaction. You may use your Mastercard or Visa, or a PayPal account to finalize the payment.

- Step 6. Select the format of your legal document and download it to your device.

- Step 7. Fill out, edit and print or sign the Arkansas General Form for Bill of Sale of Personal Property.

Form popularity

FAQ

To avoid paying sales tax on a used car in Arkansas, you may explore specific exemptions, such as gifts or family transfers. However, it’s critical to follow legal guidelines when making a transfer to ensure compliance. When documenting such transactions, the Arkansas General Form for Bill of Sale of Personal Property can help you outline the specifics clearly and can also serve as proof of the transaction for tax purposes.

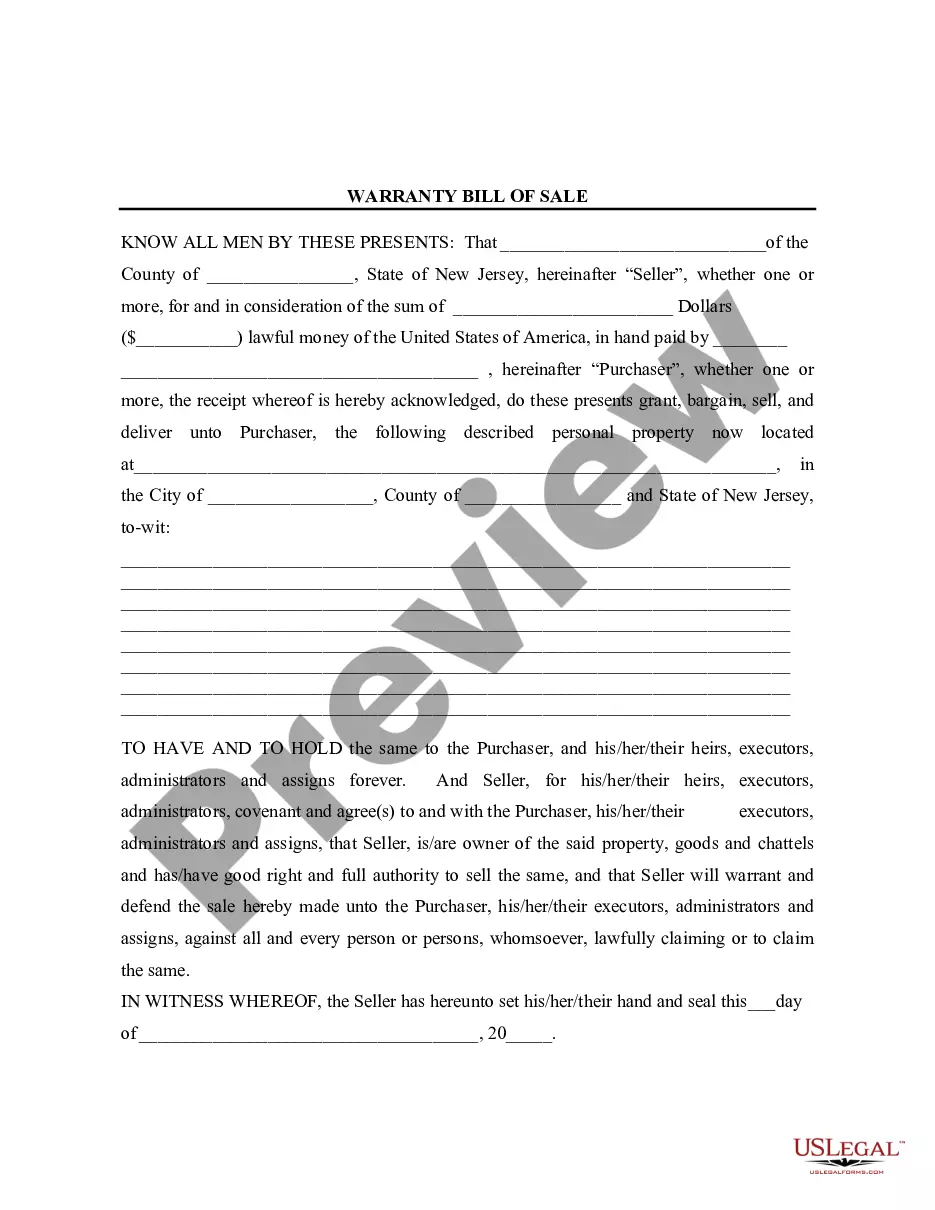

A general bill of sale in Arkansas is a document that outlines the sale of personal property between a buyer and a seller. It typically includes information about both parties, a description of the property, and the terms of the sale. Using the Arkansas General Form for Bill of Sale of Personal Property can simplify the process and ensure all necessary information is clearly documented for future reference.

The tax credit bill of sale in Arkansas refers to a document that captures the information regarding a transaction that might involve tax credits applicable to personal property. This type of document aids both buyers and sellers in understanding potential financial benefits. Utilizing the Arkansas General Form for Bill of Sale of Personal Property can help you seamlessly include relevant tax credit details in your transactions.

The property tax credit in Arkansas is a financial benefit that reduces the tax burden on property owners. This credit can be applied annually and varies based on specific eligibility requirements. When drafting documents related to personal property, such as those utilizing the Arkansas General Form for Bill of Sale of Personal Property, being aware of these credits can provide financial advantages during your transactions.

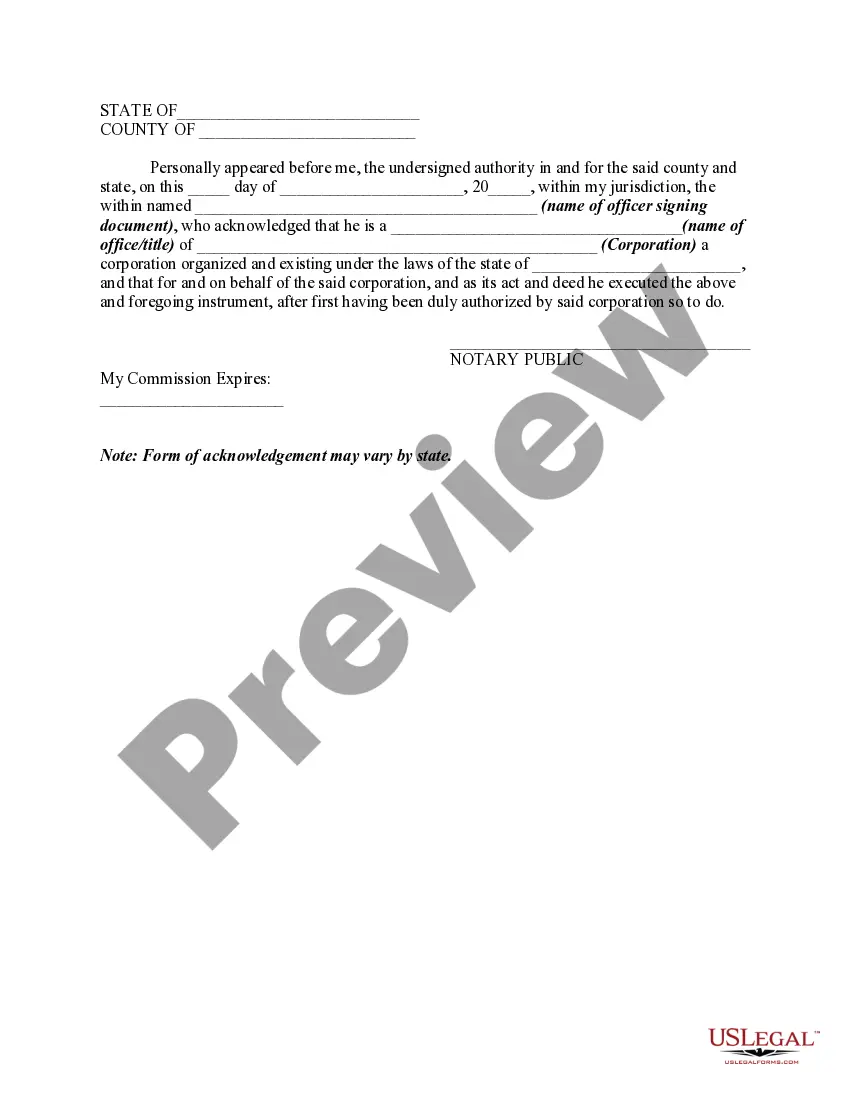

In Arkansas, a bill of sale does not need to be notarized for most personal property transactions, but notarization can provide added security. When parties want to establish a higher level of authenticity, having the document notarized could be advantageous. Consider using the Arkansas General Form for Bill of Sale of Personal Property, since it often includes options for notarization to enhance validity.

Yes, a hand-written bill of sale is legal in Arkansas as long as it includes all necessary details about the transaction. This document must capture the buyer's and seller's information, a description of the personal property, and the date of the transaction. However, using the Arkansas General Form for Bill of Sale of Personal Property can provide clarity and reduce the chances of disputes. It is a more formal option that offers structured guidance.

The $150 tax credit in Arkansas is a benefit that individuals can claim against their personal property tax liabilities. It helps reduce the amount of tax owed on personal property, ensuring that residents are not overburdened by taxes. Understanding this credit can assist you during the transaction process when using the Arkansas General Form for Bill of Sale of Personal Property. It’s an essential financial aspect to consider when buying or selling personal items.

A Louisiana bill of sale does not have to be notarized, but doing so can enhance the document's validity. Notarization adds an official acknowledgment of the transaction, helping prevent disputes down the line. If you're in need of a reliable template, consider using the Louisiana General Form for Bill of Sale to ensure you have a complete and legal document.

In Arkansas, a bill of sale is not typically required for all transactions, but it is highly recommended for major purchases like vehicles or boats. This document provides evidence of ownership and protects both parties in the transaction. For those unfamiliar with drafting this document, the Arkansas General Form for Bill of Sale of Personal Property offers a clear solution.

In Louisiana, a firearm bill of sale does not require notarization to be valid. However, having it notarized can add an extra layer of security and credibility to the transaction. This is especially important for protecting both the buyer and seller in case of disputes.