Michigan Notice of Adverse Action - Non-Employment - Due to Credit Report

Description

How to fill out Notice Of Adverse Action - Non-Employment - Due To Credit Report?

If you are looking to finalize, download, or print legal document templates, utilize US Legal Forms, the largest selection of legal templates available online.

Employ the website's straightforward and user-friendly search feature to locate the documents you require.

Various templates for commercial and personal purposes are categorized by groups and states, or keywords.

Step 4. Once you have found the form you need, click on the Purchase now button. Choose your preferred pricing plan and provide your information to register for your account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Utilize US Legal Forms to obtain the Michigan Notice of Adverse Action - Non-Employment - Due to Credit Report in just a few clicks.

- If you are an existing US Legal Forms user, Log In to your account and click on the Download button to access the Michigan Notice of Adverse Action - Non-Employment - Due to Credit Report.

- You can also view forms you have previously obtained in the My documents section of your account.

- If this is your first time using US Legal Forms, follow these steps.

- Step 1. Ensure you have selected the correct form for your city/state.

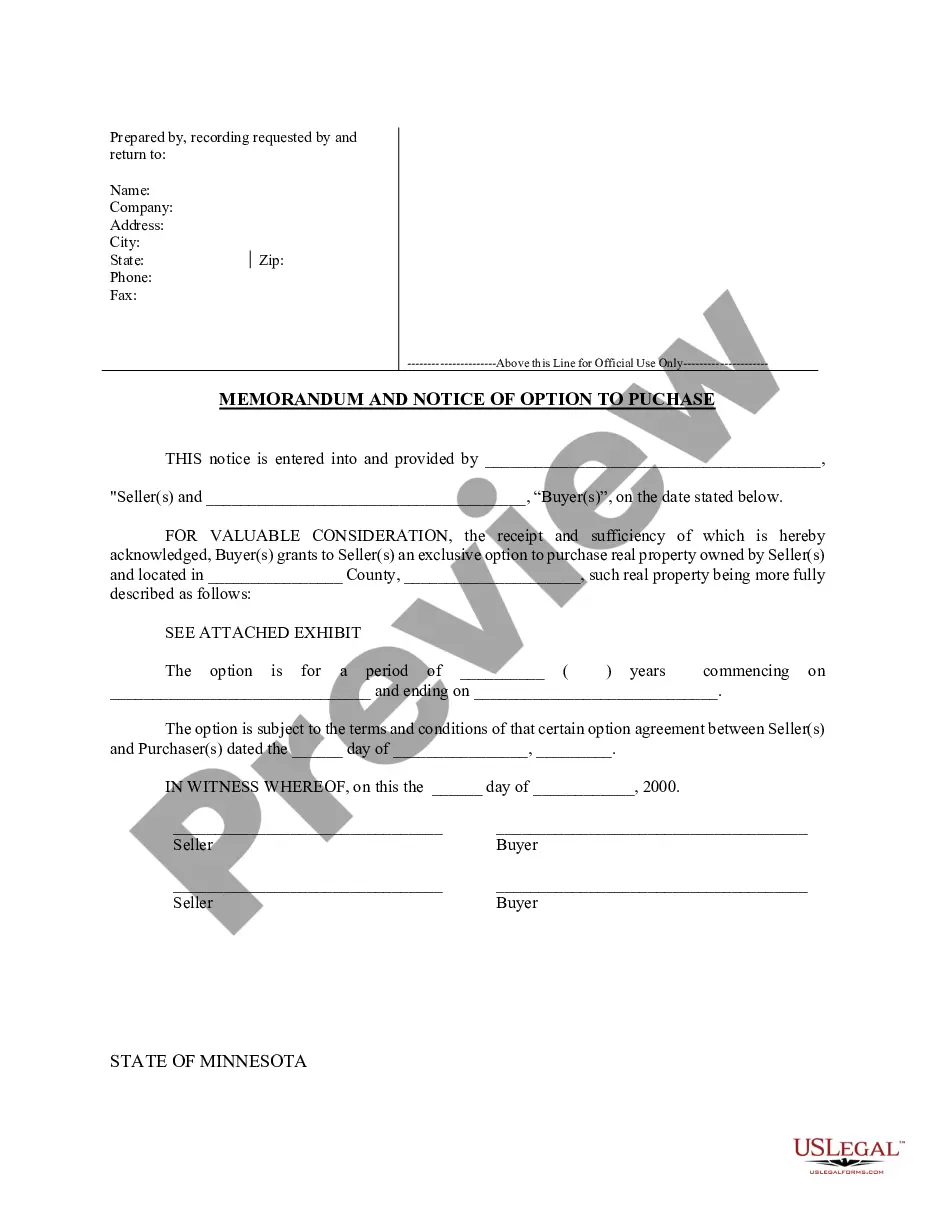

- Step 2. Use the Preview option to examine the content of the form. Don't forget to review the summary.

- Step 3. If you are not satisfied with the form, make use of the Search section at the top of the page to find other versions of the legal template.

Form popularity

FAQ

To dispute employment listed on a credit report, first contact the credit reporting agency that issued the report. You can provide documentation proving the discrepancy, along with a written request. It's vital to address these issues promptly, as inaccuracies can impact your Michigan Notice of Adverse Action - Non-Employment - Due to Credit Report.

It must include information about the credit bureau used, an explanation of the specific reasons for the adverse action, a notice of the consumer's right to a free credit report and to dispute its accuracy and the consumer's credit score.

In the credit score exception notices, creditors are required to disclose the distribution of credit scores among consumers who are scored under the same scoring model that is used to generate the consumer's credit score using the same scale as that of the credit score provided to the consumer.

In particular: if you deny a consumer credit based on information in a consumer report, you must provide an adverse action notice to the consumer. if you grant credit, but on less favorable terms based on information in a consumer report, you must provide a risk-based pricing notice.

An adverse action notice is to inform you that you have been denied credit, employment, insurance, or other benefits based on information in a credit report. The notice should indicate which credit reporting agency was used, and how to contact them.

The following are examples of adverse actions employers might take: discharging the worker; demoting the worker; reprimanding the worker; committing harassment; creating a hostile work environment; laying the worker off; failing to hire or promote a worker; blacklisting the worker; transferring the worker to another

If you're an organization that processes credit applications, it is your duty to provide an Adverse Action Notice if a consumer is denied credit. And you've got to provide it within 30 days of receiving a credit application.

The credit score exception notice (model forms H-3, H-4, H-5) is a disclosure that is provided in lieu of the risk-based-pricing notice (RBPN, which are H-1, H-2, H-6 & H-7). The RBPN is required any time a financial institution provides different rates based on the credit score of the applicant.

adverse action might also occur at pointofsale transactions where an account transaction is denied in real time. Notably, the ECOA does not consider an adverse action to have occurred where an action or forbearance on an account is taken in connection with inactivity, default, or delinquency as to that account.

A creditor must disclose a consumer's credit score and information relating to a credit score on a risk-based pricing notice when the score of the consumer to whom the creditor extends credit or whose extension of credit is under review is used in setting the material terms of credit.