Arkansas Balloon Secured Note Addendum and Rider to Mortgage, Deed of Trust or Security Agreement

Description

How to fill out Balloon Secured Note Addendum And Rider To Mortgage, Deed Of Trust Or Security Agreement?

Are you presently in a location where you need documents for either business or personal reasons nearly every day.

There are numerous legal document templates accessible online, but finding versions you can rely on is challenging.

US Legal Forms offers thousands of template designs, such as the Arkansas Balloon Secured Note Addendum and Rider to Mortgage, Deed of Trust or Security Agreement, which are crafted to meet federal and state regulations.

Avoid altering or removing any HTML tags. Only synonymize plain text outside of the HTML tags.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Subsequently, you can download the Arkansas Balloon Secured Note Addendum and Rider to Mortgage, Deed of Trust or Security Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the template you require and ensure it is for the correct city/county.

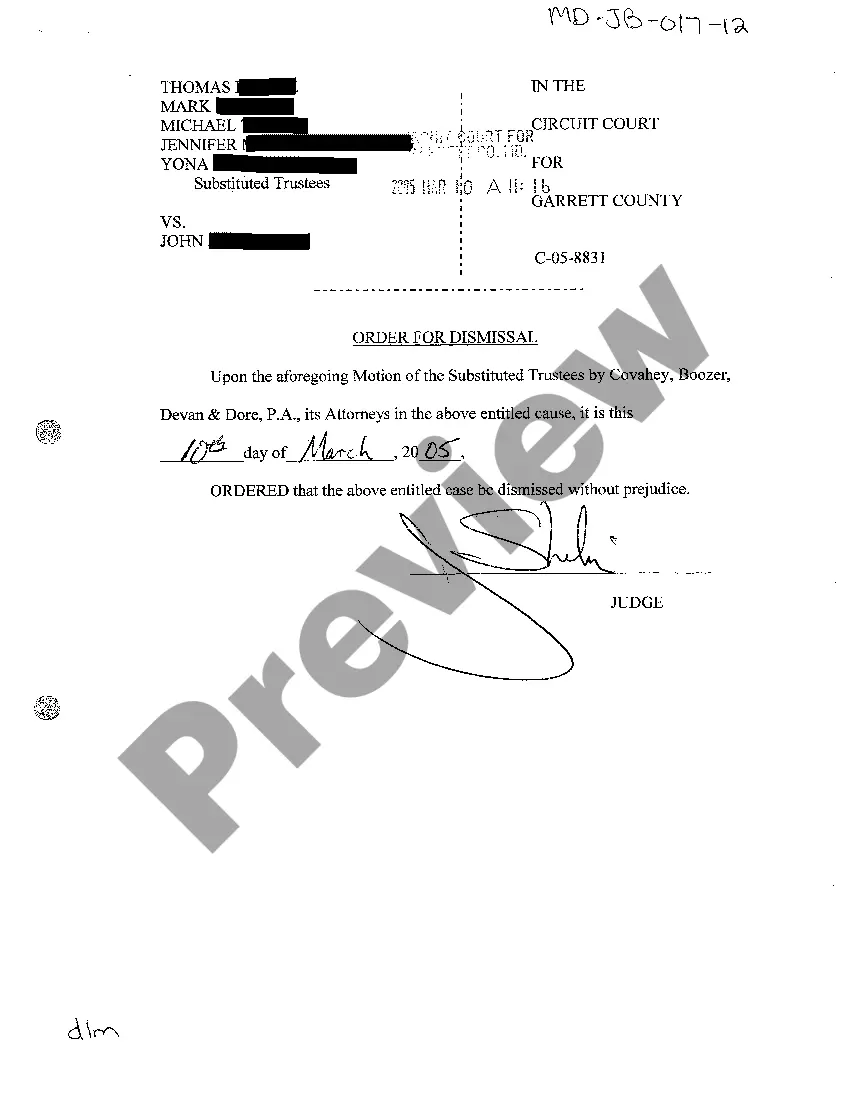

- Utilize the Preview option to review the document.

- Read the description to confirm that you have selected the right template.

- If the template is not what you seek, use the Search field to locate the document that fits your needs and requirements.

- Once you find the correct template, click Get now.

- Choose the pricing plan you prefer, enter the necessary details to create your order, and complete the purchase using your PayPal or credit card.

- Select a convenient file format and download your copy.

- Access all the document templates you have purchased in the My documents menu. You can obtain an additional copy of the Arkansas Balloon Secured Note Addendum and Rider to Mortgage, Deed of Trust or Security Agreement at any time, if needed. Click the desired template to download or print the document design.

- Utilize US Legal Forms, the largest collection of legal forms, to save time and prevent errors. The service provides properly crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start simplifying your life.

Form popularity

FAQ

A balloon payment is a lump sum principal balance that is due at the end of a loan term. The borrower pays much smaller monthly payments until the balloon payment is due. These payments may be entirely or almost entirely interest on the loan rather than principal.

A balloon payment is a larger-than-usual one-time payment at the end of the loan term. If you have a mortgage with a balloon payment, your payments may be lower in the years before the balloon payment comes due, but you could owe a big amount at the end of the loan.

Borrowers may plan to refinance or sell the home to avoid making that large final payment at the end of the term. Of course, if you have the cash, you can pay off a balloon mortgage early or when the balloon payment comes due.

Yes, it's obvious, but if you simply pay the balloon payment in advance, you'll technically avoid it ? but you'll still be out a hefty amount of cash. Most partially amortizing loans do have prepayment penalties in place, though, so it's unlikely you will be able to pay too far in advance without extra costs.

If you like to upgrade your car every few years, a balloon payment could be an option that suits your needs. Selling or trading in your car allows you to payout the balloon payment at the end of the loan term and buy a new car through a new loan or with cash.

Paying the balloon payment in full is the most straightforward way to handle this financial obligation. This option requires adequate savings and financial planning. By setting aside a specific amount monthly or annually toward the future balloon payment, you can accumulate the necessary funds over the loan term.

Talk to Your Lender You will still need to pay the money, of course, but your lender may be willing to negotiate an extension to the loan's term, which will delay the inevitable ? while also reducing the total balloon payment amount.

One of the most common ways to handle a balloon payment is to simply refinance the loan. The new loan pays the balloon payment, and you're either left with a fully amortizing loan ? with no balloon involved ? or at least a completely new timeline.