Arkansas Lease or Rental of Computer Equipment

Description

How to fill out Lease Or Rental Of Computer Equipment?

It is feasible to dedicate numerous hours online seeking the legal document template that fulfills the state and federal requirements you need.

US Legal Forms offers thousands of legal forms that can be reviewed by experts.

You can easily obtain or print the Arkansas Lease or Rental of Computer Equipment from my service.

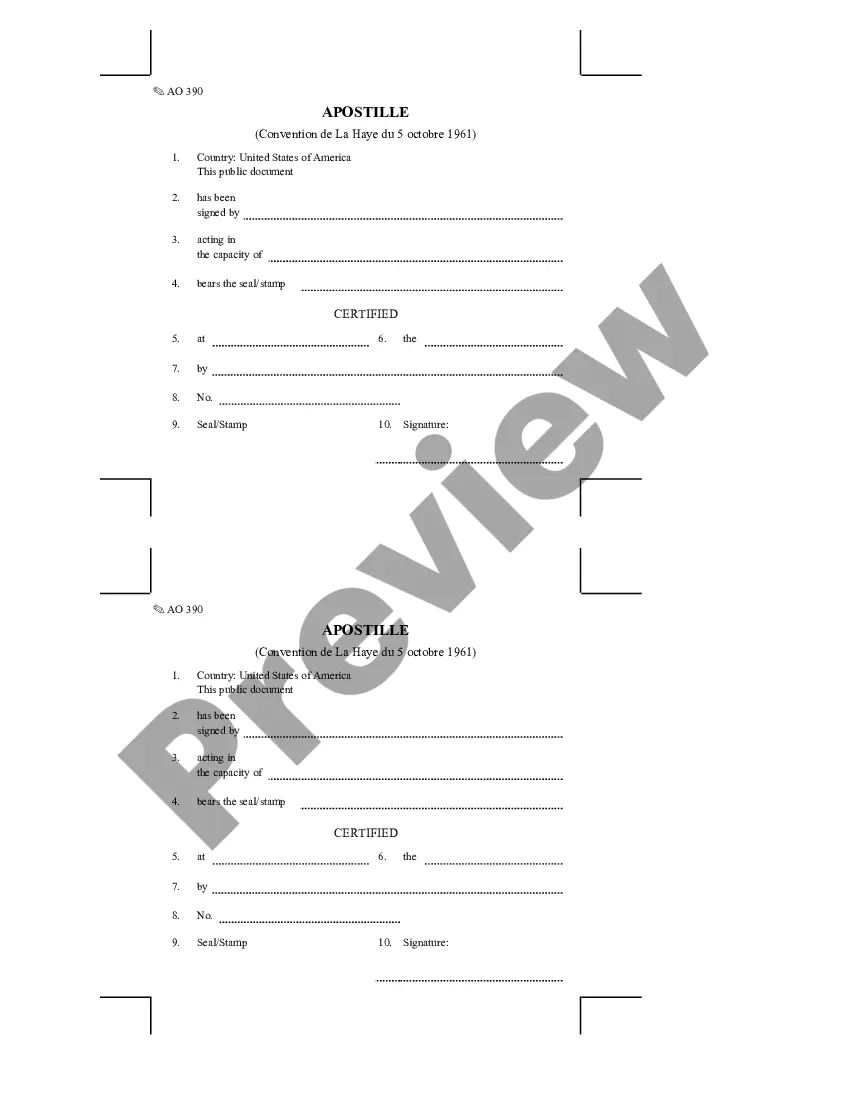

If available, utilize the Preview button to review the document template as well.

- If you already possess a US Legal Forms account, you may Log In and click the Obtain button.

- Then, you can complete, modify, print, or sign the Arkansas Lease or Rental of Computer Equipment.

- Every legal document template you purchase is yours indefinitely.

- To get another copy of the purchased form, navigate to the My documents tab and press the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions listed below.

- First, ensure you have chosen the correct document template for your desired area/city.

- Review the form description to ensure you have selected the appropriate form.

Form popularity

FAQ

In Arkansas, certain items are exempt from sales tax, including some medical equipment, certain types of food, and certain services. Specifically related to the Arkansas Lease or Rental of Computer Equipment, any equipment that is considered necessary for medically related purposes may qualify for tax exemption. Familiarize yourself with these exemptions to potentially reduce your overall costs.

Yes, digital products are generally subject to sales tax in Arkansas. This includes items that you may download or access online, along with software and other digital assets. When leasing or renting digital products tied to the Arkansas Lease or Rental of Computer Equipment, be sure to factor in applicable taxes to ensure compliance.

Yes, software licenses are taxable in Arkansas. This taxation applies to licenses for both software as a service and traditional software that you rent or lease under the Arkansas Lease or Rental of Computer Equipment. Understanding the tax obligations related to software licenses can help you navigate your budgets and financial planning effectively.

In Arkansas, software is generally considered a taxable item, including both prewritten computer software and custom software. This applies to software that is leased or rented as part of the Arkansas Lease or Rental of Computer Equipment. If you are involved in software leasing, be sure to account for tax implications to avoid any legal issues.

Yes, Arkansas does require a resale certificate when you are purchasing items that you intend to resell, which can include equipment related to the Arkansas Lease or Rental of Computer Equipment. This certificate helps you avoid paying sales tax on items you plan to sell in the future. If you are renting or leasing equipment, ensure you understand the resale certificate process to stay compliant.

In Arkansas, most equipment purchases are subject to sales tax. However, certain types of equipment may be eligible for tax exemptions, such as those used for specific industrial purposes. When considering purchasing or renting equipment, particularly for your Arkansas Lease or Rental of Computer Equipment needs, it’s beneficial to research applicable tax rules.

Equipment held for lease refers to machinery or tools owned by a company that are available for rental to customers. This is a common practice in the equipment rental industry. If you're looking for an Arkansas Lease or Rental of Computer Equipment, understanding this concept can help you make informed choices.

Generally, rental equipment is not tax exempt in Arkansas. There are specific exemptions that may apply based on the use of the equipment, such as for manufacturing. When considering an Arkansas Lease or Rental of Computer Equipment, consult with a tax professional to identify any potential exemptions.

Yes, rental equipment can often be a tax write-off for businesses. When you enter into an Arkansas Lease or Rental of Computer Equipment, you may deduct the rental payments as a business expense. This can help lower your taxable income, so keep detailed records of your rental agreements.

A lease does not have to be notarized in Arkansas to be enforceable. However, if you prefer to have the lease agreement notarized for added credibility, it's a good practice. Ensure that your Arkansas Lease or Rental of Computer Equipment includes all essential terms to protect your interests.