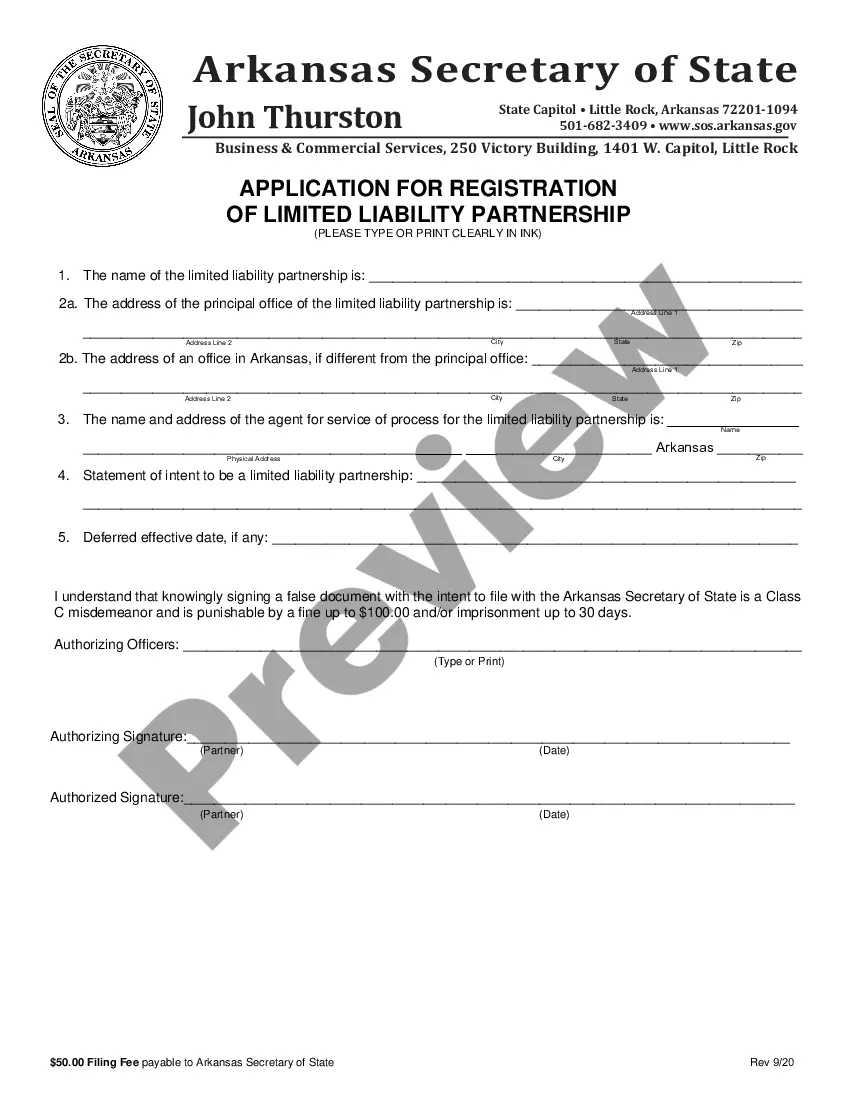

The Arkansas Application For Registration Of Limited Liability Partnership (LLP) is a document that is used to register a Limited Liability Partnership (LLP) in the state of Arkansas. The application must be filed with the Arkansas Secretary of State in order to conduct business in the state. The document requires the applicant to provide detailed information about the LLP, including its name, address, registered agent, and members. The application must also contain a statement of purpose for the LLP and be signed by a majority of the partners. There are two types of Arkansas Application For Registration Of Limited Liability Partnership: the Initial Registration and the Annual Renewal. The Initial Registration must be filed when the LLP is first formed, while the Annual Renewal must be filed annually in order to keep the LLP in good standing.

Arkansas Application For Registration Of Limited Liability Partnership

Description

How to fill out Arkansas Application For Registration Of Limited Liability Partnership?

Engaging with official documentation necessitates diligence, accuracy, and utilizing properly formulated templates. US Legal Forms has been assisting individuals across the country with this for 25 years, ensuring that when you select your Arkansas Application For Registration Of Limited Liability Partnership form from our collection, it adheres to both federal and state statutes.

Utilizing our service is straightforward and efficient. To acquire the necessary document, you only need an account with an active subscription. Here’s a brief guide to help you secure your Arkansas Application For Registration Of Limited Liability Partnership in mere minutes.

All documents are designed for multiple uses, such as the Arkansas Application For Registration Of Limited Liability Partnership displayed on this page. Should you need them in the future, you can fill them out without additional payment - just visit the My documents tab in your profile and complete your document whenever necessary. Experience US Legal Forms and efficiently prepare your business and personal documentation in full legal conformity!

- Be sure to carefully review the form details and its alignment with general and legal criteria by previewing it or reading its summary.

- Seek out another official document if the one you’ve accessed does not fit your circumstances or state regulations (you can find the tab for this at the top corner of the page).

- Log In to your account and save the Arkansas Application For Registration Of Limited Liability Partnership in your desired format. If this is your first visit to our website, click Buy now to proceed.

- Register for an account, choose your subscription tier, and complete the payment through your credit card or PayPal account.

- Choose the format in which you wish to receive your form and click Download. Print the template or upload it to a professional PDF editor for electronic submission.

Form popularity

FAQ

Arkansas LLC Cost. Arkansas charges a $45 state fee to form an LLC ($50 by mail). You'll also need to pay $150 every year to file a franchise tax report, and you may have to pay for additional services for your LLC?such as filing a DBA or hiring a professional registered agent.

All LLCs operating in Arkansas must file an annual report and pay a flat-rate tax of $150 each year. The $150 tax and the annual report together are known as the Annual LLC Franchise Tax Report. We'll walk you through how to file and pay this tax here: Arkansas LLC Annual Franchise Tax.

The process of adding a member to a Arkansas LLC may involve amending the company's articles of organization to include the new member. Depending on the terms in the agreement, current LLC members may need to vote on it for the amendment to pass.

Forming an Arkansas LLP File a Statement of Qualification.Choose a business name.Name a statutory agent.Apply for an Employer Identification Number (EIN)Register with the Arkansas Department of Finance.Draft a partnership agreement.Get your business license.File your annual report.

Arkansas LLC Cost. Arkansas charges a $45 state fee to form an LLC ($50 by mail). You'll also need to pay $150 every year to file a franchise tax report, and you may have to pay for additional services for your LLC?such as filing a DBA or hiring a professional registered agent.

How to form an Arkansas General Partnership ? Step by Step Step 1 ? Business Planning Stage.Step 2: Create a Partnership Agreement.Step 3 ? Name your Partnership and Obtain a DBA.Step 4 ? Get an EIN from the IRS.Step 5 ? Research license requirements.Step 6 ? Maintain your Partnership.

You can get an LLC in Arkansas in 3-7 business days if you file online (or 4-5 weeks if you file by mail).

Do LLCs need to obtain business licenses in Arkansas? Legal entities such as LLCs still require the appropriate business licenses depending on the type of work conducted.