Illinois Certification of Corporate Surety is an official document issued by the State of Illinois to corporations that wish to become surety (bond) companies for public works projects. It is required for any company that wishes to provide surety bonds to any public works project in the state of Illinois. There are two types of Illinois Certification of Corporate Surety: Qualified Surety and Licensed Surety. The Qualified Surety is a lower level of certification and is given to companies that have met the minimum requirements for surety companies, such as financial stability. The Licensed Surety is a higher level of certification and is given to companies that have met the more stringent requirements for surety companies, such as providing proof of financial stability and having a good track record in the industry. The requirements for both types of certification are established by the State of Illinois and must be met in order to receive the certification.

Illinois Certification of Corporate Surety

Description

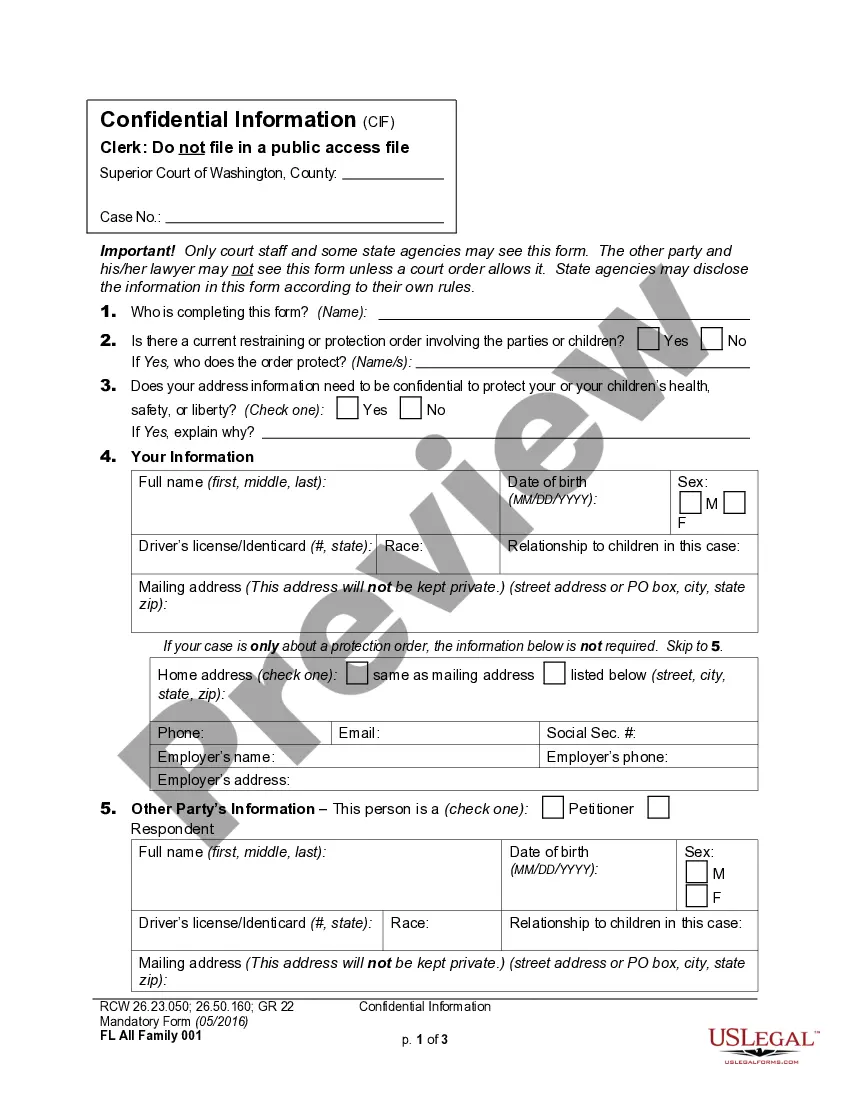

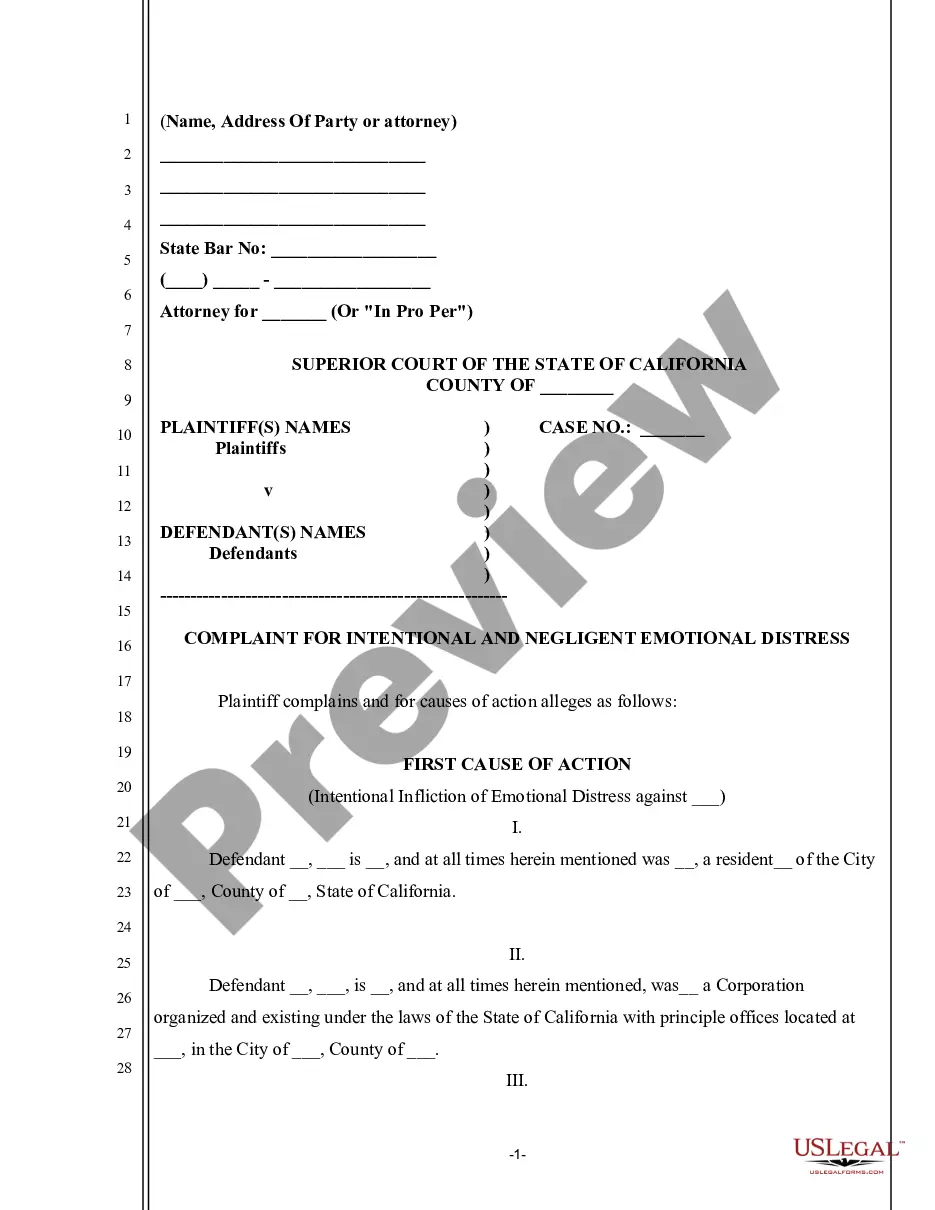

How to fill out Illinois Certification Of Corporate Surety?

Completing official documentation can be quite a hassle if you lack readily available fillable forms. With the US Legal Forms online collection of formal documents, you can trust the blanks you discover, as all of them align with federal and state statutes and have been validated by our specialists.

Acquiring your Illinois Certification of Corporate Surety from our selection is as straightforward as ABC. Previously authorized users who possess a legitimate subscription simply need to Log In and click the Download button after finding the appropriate template. Subsequently, if necessary, users can access the same blank from the My documents section of their account. However, even if you are not familiar with our service, registering with a valid subscription will only take a few moments. Here’s a concise guide for you.

Haven't you explored US Legal Forms yet? Subscribe to our service today to quickly and effortlessly obtain any official document whenever you require it, and maintain your paperwork in order!

- Document compliance verification. You should carefully examine the content of the form you intend to use and determine whether it meets your requirements and complies with your state’s regulations. Previewing your document and reviewing its overall description will assist you in doing just that.

- Alternative search (optional). If you encounter any discrepancies, explore the library using the Search tab above until you find an appropriate template, and click Buy Now once you find the one you desire.

- Account setup and form acquisition. Create an account with US Legal Forms. After verifying your account, Log In and choose the subscription plan that suits you best. Make a payment to proceed (PayPal and credit card options are provided).

- Template retrieval and additional use. Choose the file format for your Illinois Certification of Corporate Surety and click Download to save it onto your device. Print it to manually finish your documents, or utilize a multi-featured online editor to prepare an electronic version quicker and more efficiently.

Form popularity

FAQ

Most Popular Surety Bonds in Illinois You'll need to post a $50,000 bond to get your car dealer license from the Illinois Secretary of State. Roofing contractors in Illinois need a $10,000 or $25,000 bond, while plumbers need a $20,000 bond.

Public adjuster surety bond ? public adjusters in Illinois are required to post a $20,000 bond to protect their clients. A public adjuster bond ensures that all public adjusters in the state conduct themselves to the required professional standards.

Surety Bond Requirements in IL You must have a proper surety bond in place if you are an appraisal management company (AMC), motor vehicle dealer, plumbing contractor, roofing contractor, or residential mortgage broker. Most Illinois surety bonds have a fixed liability amount, while some vary.

Illinois title bond amounts must be 1.5 times the vehicle's appraised value. The Secretary of State will provide the exact bond amount required. You will need this amount in order to request your bond.

The first step to getting an Illinois surety bond is to apply for your bond. Not everyone can get approved for a bond, so this is the first step to getting bonded. Most companies all you to apply for your bond online. You can apply for a bond at your local insurance agency, or a specialized surety bond company.

Illinois law requires Notaries to purchase and maintain a surety bond for the duration of their 4-year commission.

Illinois title bond amounts must be 1.5 times the vehicle's appraised value. The Secretary of State will provide the exact bond amount required.