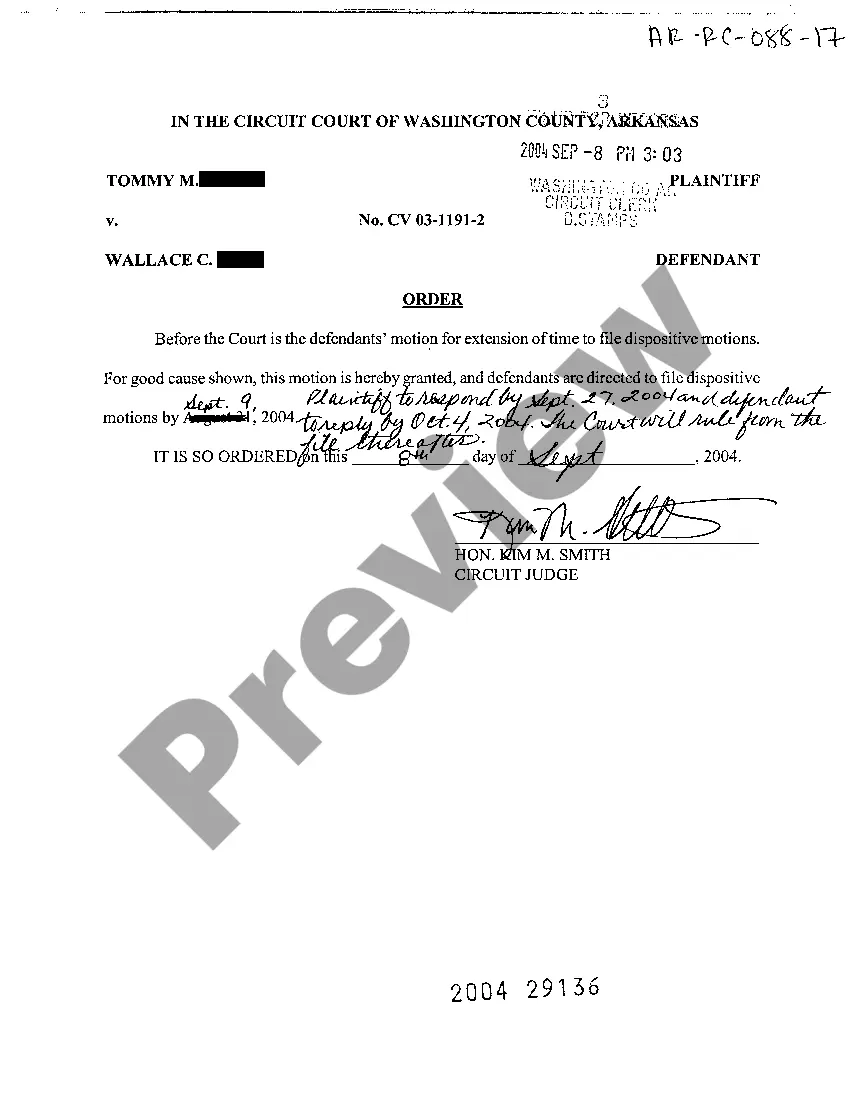

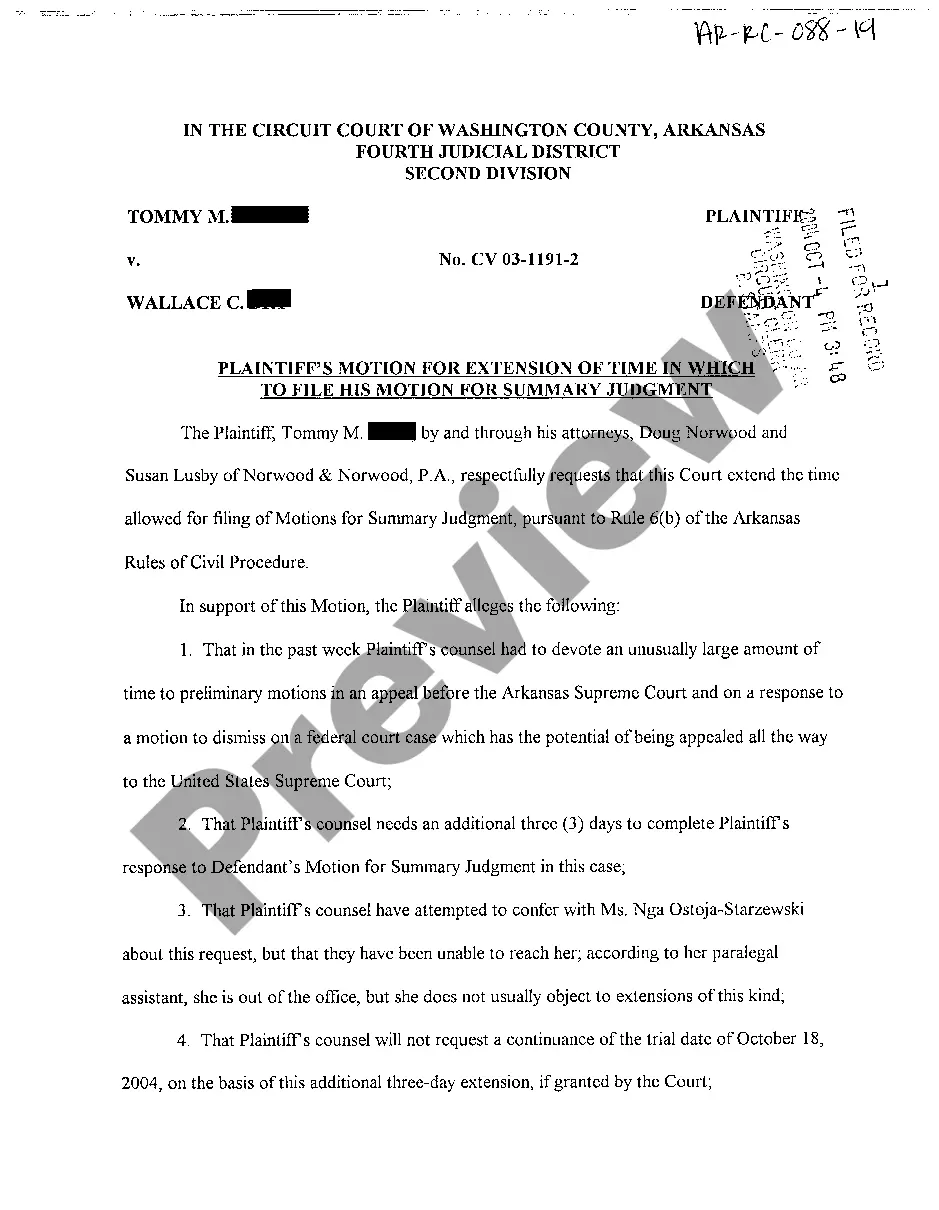

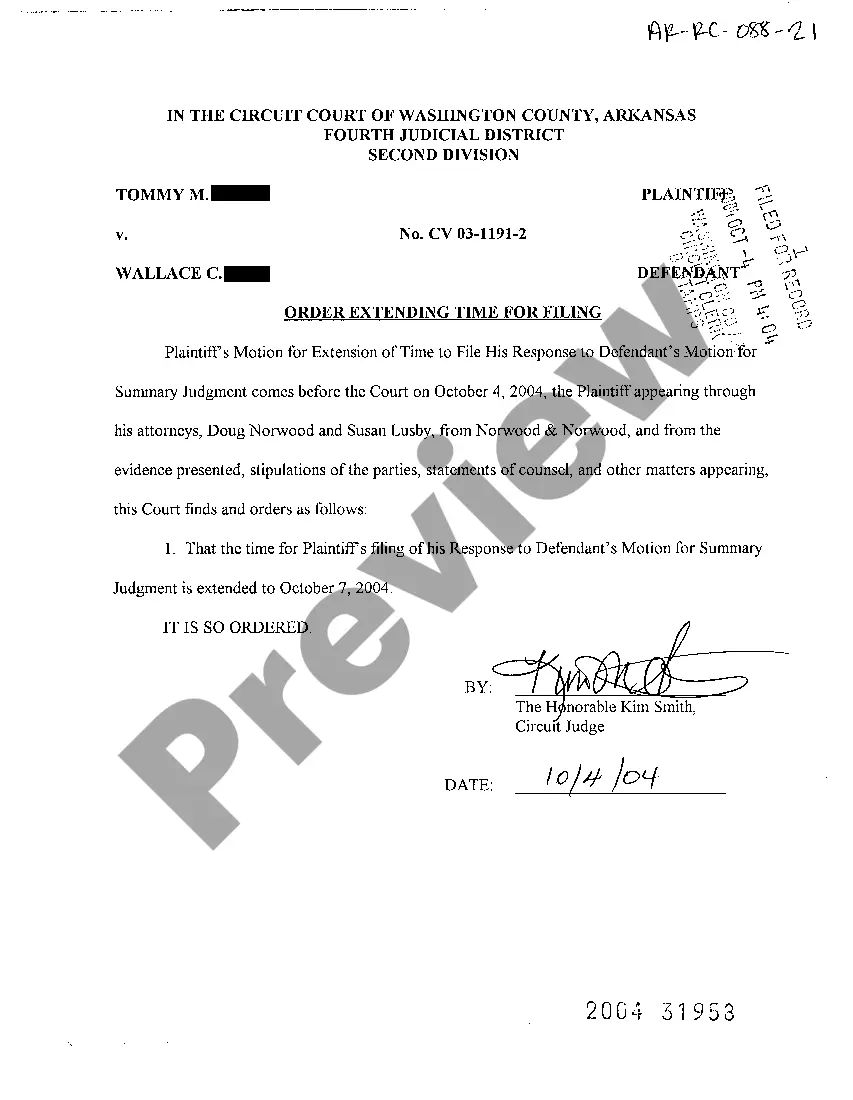

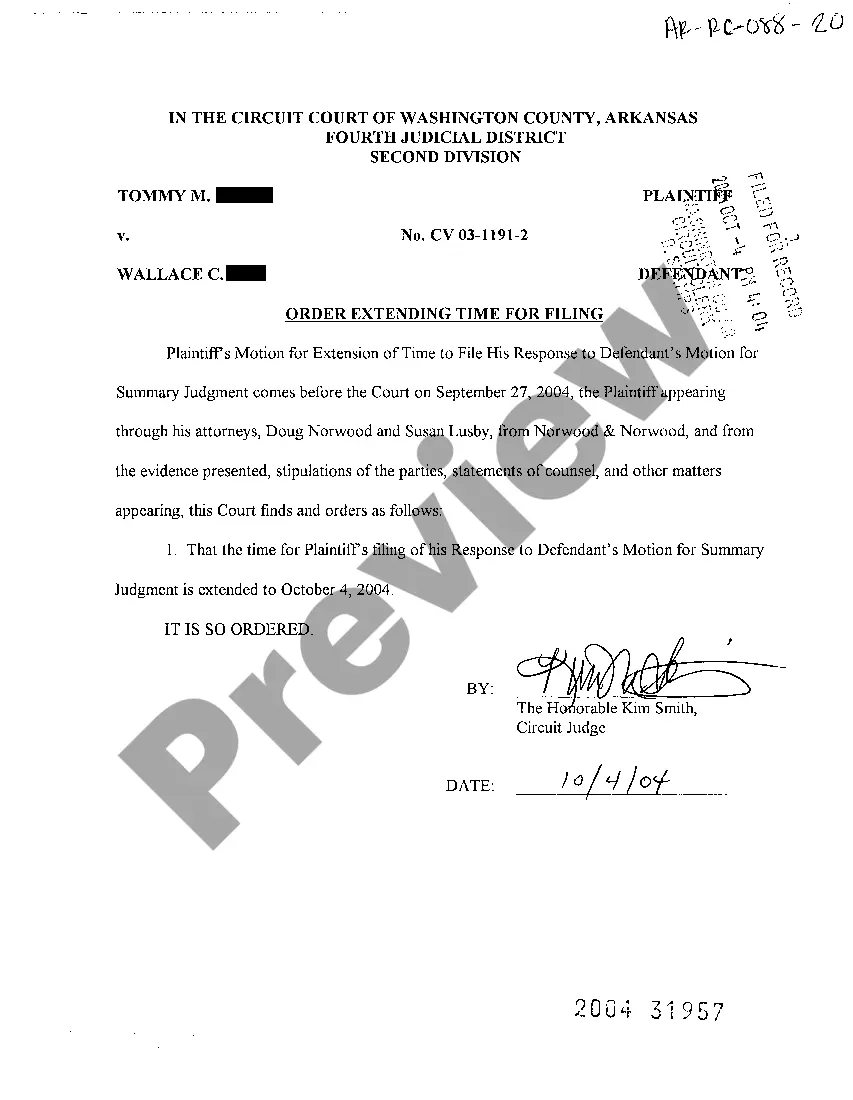

Arkansas Order Extending Time for Filing

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Arkansas Order Extending Time For Filing?

Among a variety of paid and complimentary templates that you can discover online, you can't ascertain their dependability.

For instance, who designed them or whether they possess the expertise to manage your requirements.

Stay calm and make use of US Legal Forms!

Proceed with clicking Buy Now to initiate the ordering process or search for another example using the Search box located in the header.

- Find Arkansas Order Extending Time for Filing templates crafted by proficient lawyers and avoid the costly and tedious process of searching for an attorney and subsequently compensating them to draft a document for you that you can obtain independently.

- If you have a subscription, Log In to your account and locate the Download button next to the form you’re seeking.

- You will also have access to all your previously downloaded templates in the My documents section.

- If you’re using our website for the first time, adhere to the instructions below to acquire your Arkansas Order Extending Time for Filing swiftly.

- Ensure that the file you choose is valid in your residing state.

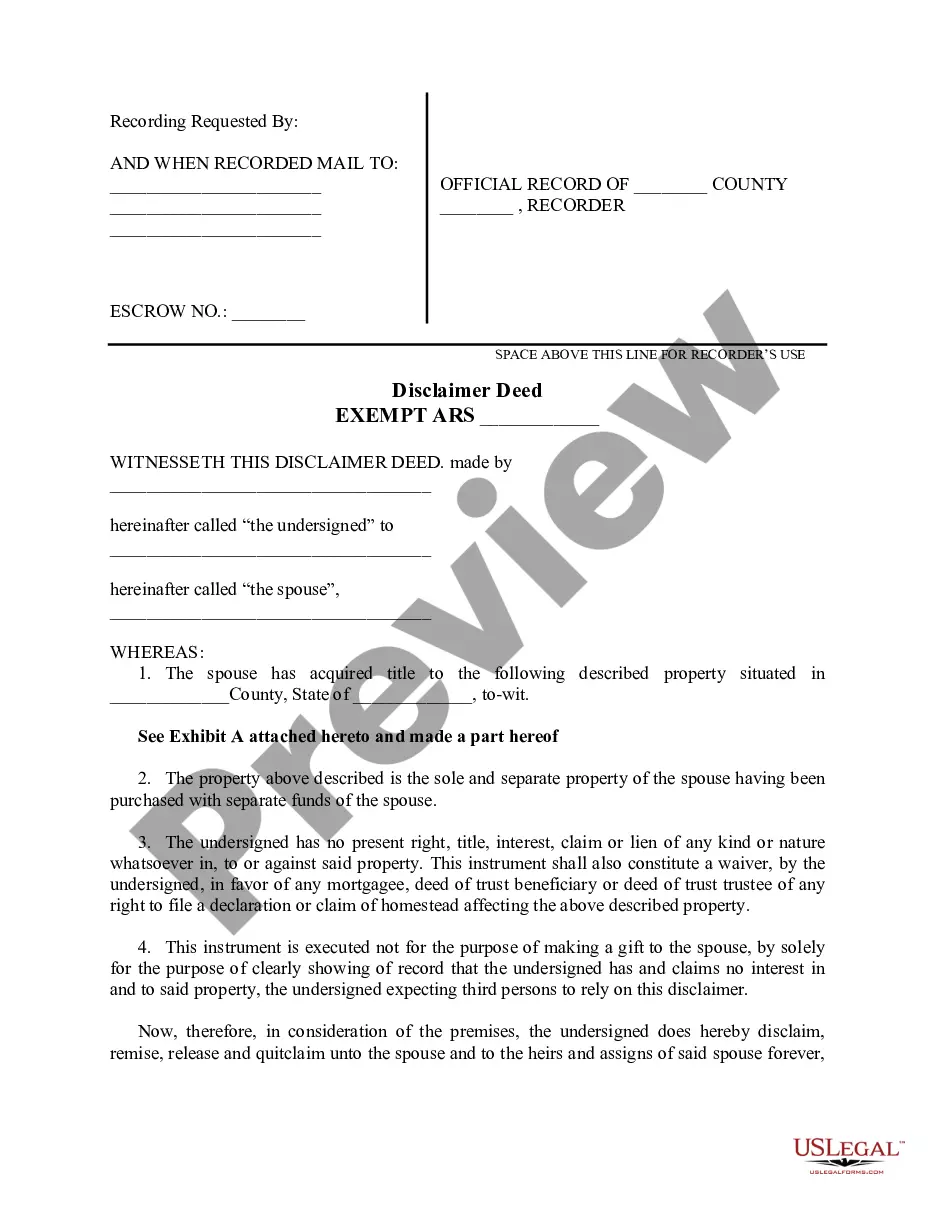

- Examine the file by reviewing the description utilizing the Preview feature.

Form popularity

FAQ

You are generally required to file an Arkansas state tax return if you meet certain income thresholds. Even if you do not owe tax, filing may be necessary, especially to comply with the Arkansas Order Extending Time for Filing. Not filing when required can lead to penalties and interest. It's wise to review your situation or consult a tax professional.

Yes, Arkansas has made provisions to extend the tax filing deadline for various circumstances. This is part of an Arkansas Order Extending Time for Filing, which allows individuals and businesses extra time to submit their tax returns. If you qualify for this extension, you can benefit from a more manageable filing schedule. Always check the official announcements to confirm the latest updates on deadlines.

The time file extension typically refers to a designation assigned to files containing time-related data. It might be relevant in computing or programming contexts rather than legal situations. However, if you seek to understand deadlines concerning legal filings, focus on the specifics of Arkansas Order Extending Time for Filing. This document ensures you meet your legal obligations, giving you peace of mind.

An extension to file is a formal request made by an individual or entity to postpone a filing deadline. In legal contexts, this often involves submitting an Arkansas Order Extending Time for Filing. This extension can provide you with additional time to prepare your documents and comply with court requirements. Ensuring you file this request on time is crucial to avoid penalties.

The term 'extension of Time Machine file' generally refers to the file format used by Apple's Time Machine backup software. It's not directly related to the Arkansas Order Extending Time for Filing but signifies a software feature. If you have concerns about file types or backups, it might be helpful to consult with technical support or refer to Apple's documentation. For legal matters, focus on the specific forms applicable to your situation.

To request an extension of time to file in Arkansas, you typically use a specific form designed for this purpose. This form outlines your reasons for needing an extension and is essential for legal compliance. When filling out the application, ensure you provide all requested information clearly. Using the Arkansas Order Extending Time for Filing can help streamline this process.

Granting an extension of time typically involves submitting a formal request to the relevant authority or court in your jurisdiction. In the context of tax filings, this may mean directing your application for an Arkansas Order Extending Time for Filing to the IRS. For other legal matters, it's essential to follow local court rules and provide any necessary documentation. Consider using platforms like USLegalForms to simplify and ensure compliance with this process.

To file an extension of time, you should complete Form 4868 and submit it to the IRS. You can do this either electronically through e-file software or by mailing a paper version. This process grants you an Arkansas Order Extending Time for Filing. Ensure you meet all deadlines to avoid penalties, and keep a copy of the submitted form for your records.

In Arkansas, the response time for civil procedures typically depends on the specific rules governing the case. Generally, after receiving a complaint, defendants have 30 days to respond. A timely response is essential in any legal matter, including those related to an Arkansas Order Extending Time for Filing. Being aware of these timelines can help you maintain your legal rights.

The IRS form for requesting an extension to file is Form 4868. By completing and submitting this form, you can secure an Arkansas Order Extending Time for Filing for an additional six months. This is critical for individuals who may need extra time to gather necessary documents. Make sure to file this form electronically or mail it before your tax deadline.