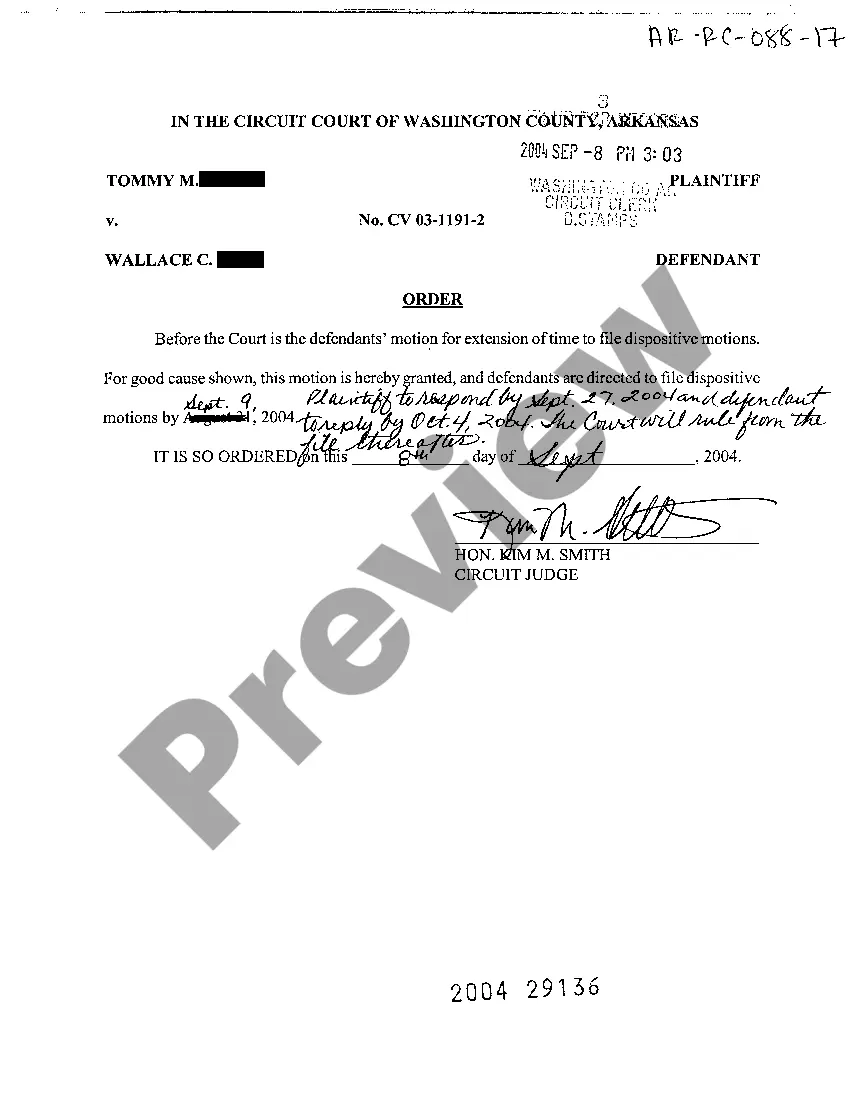

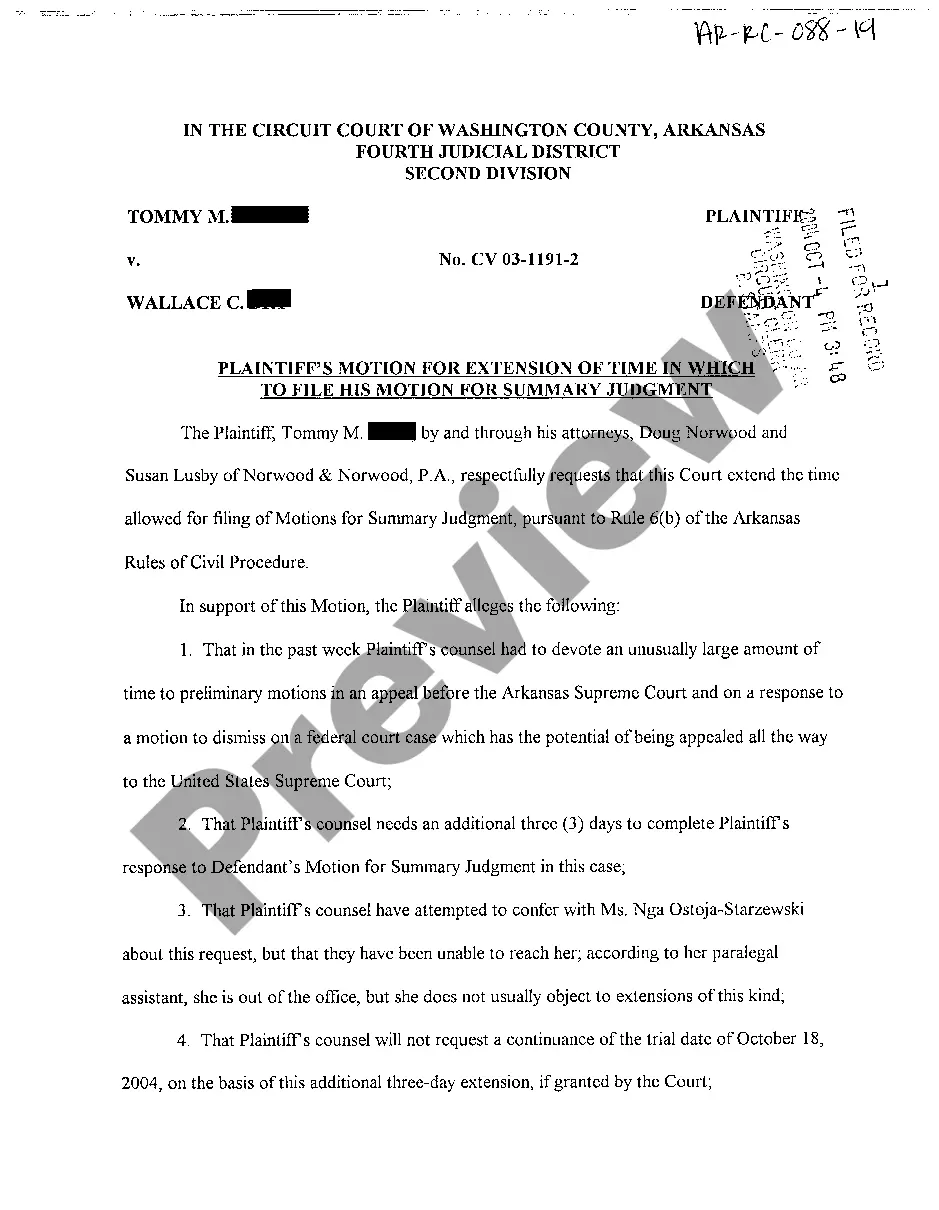

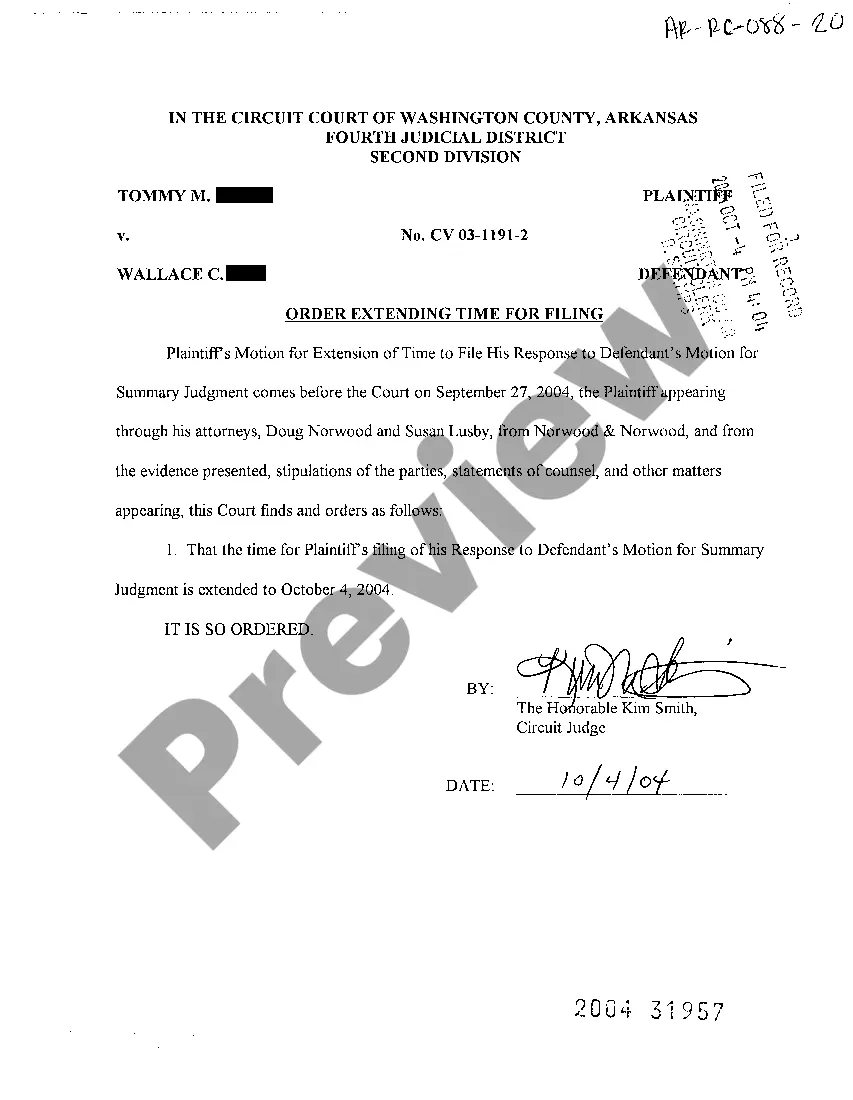

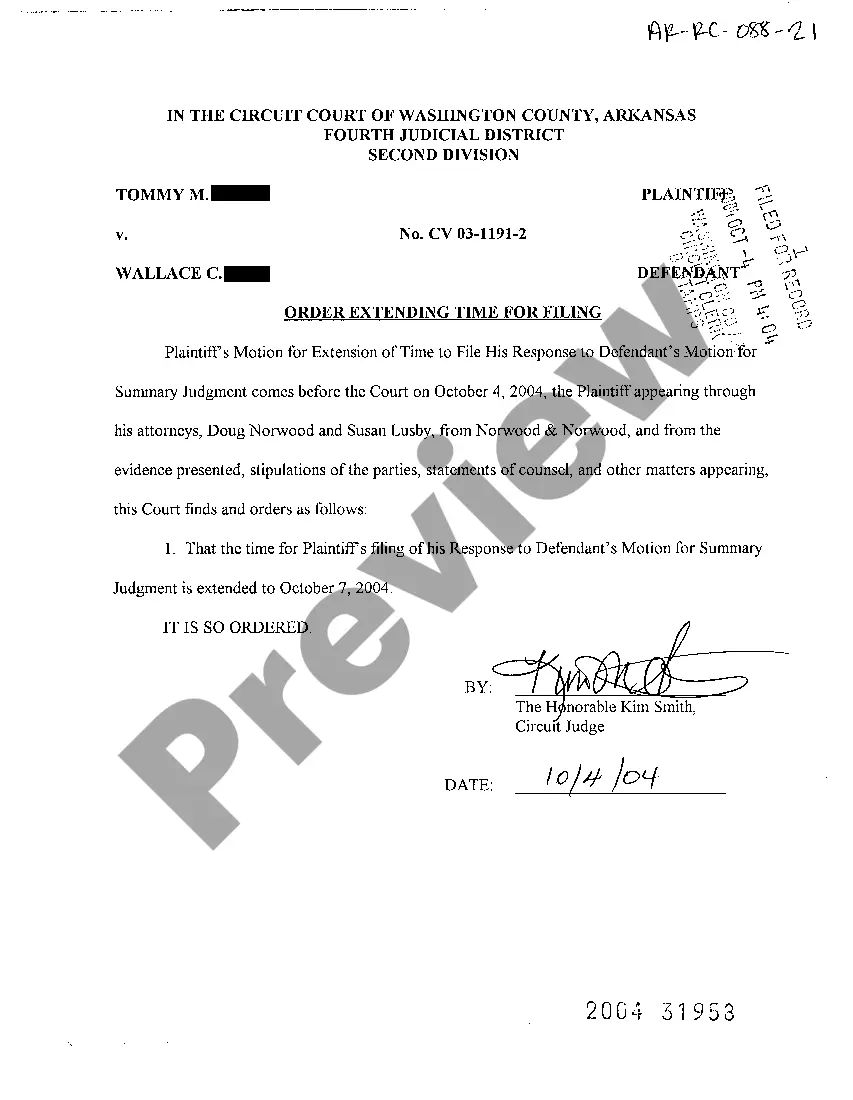

Arkansas Order Extending Time for Filing

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Arkansas Order Extending Time For Filing?

In a multitude of paid and complimentary templates available online, one cannot guarantee their trustworthiness.

For instance, who designed them or if they possess enough expertise to fulfill your requirements.

Remain composed and take advantage of US Legal Forms!

Acquaint yourself with US Legal Forms and optimize your efforts for less!

- Find Arkansas Order Extending Time for Filing templates created by proficient attorneys and avoid the costly and tedious process of searching for a lawyer and subsequently paying them to draft a document that you can obtain yourself.

- If you possess a subscription, Log In to your account and locate the Download button adjacent to the form you seek.

- You will also have access to all your previously downloaded templates in the My documents section.

- If this is your initial visit to our website, adhere to the instructions below to acquire your Arkansas Order Extending Time for Filing swiftly.

- Ensure that the document you find is applicable in the state where you reside.

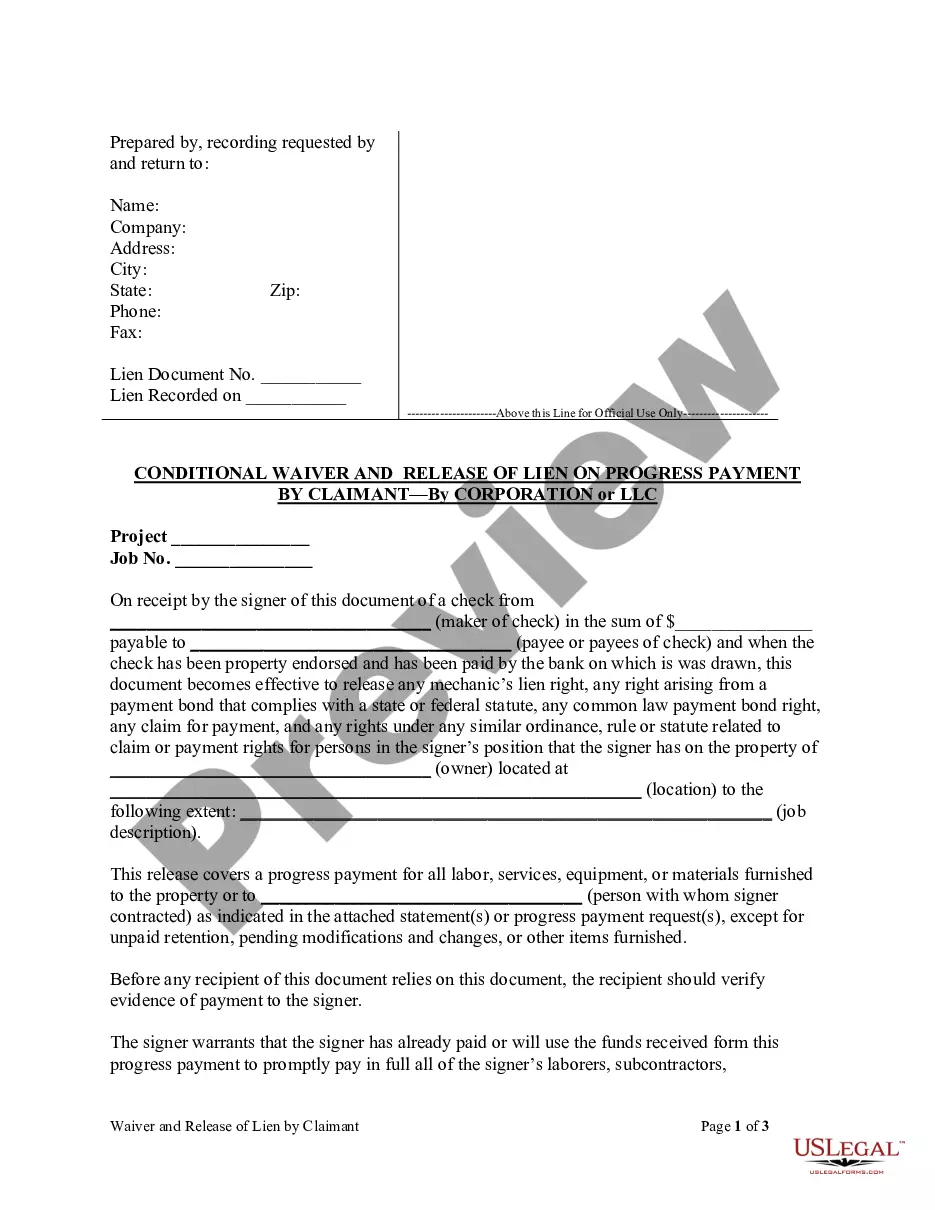

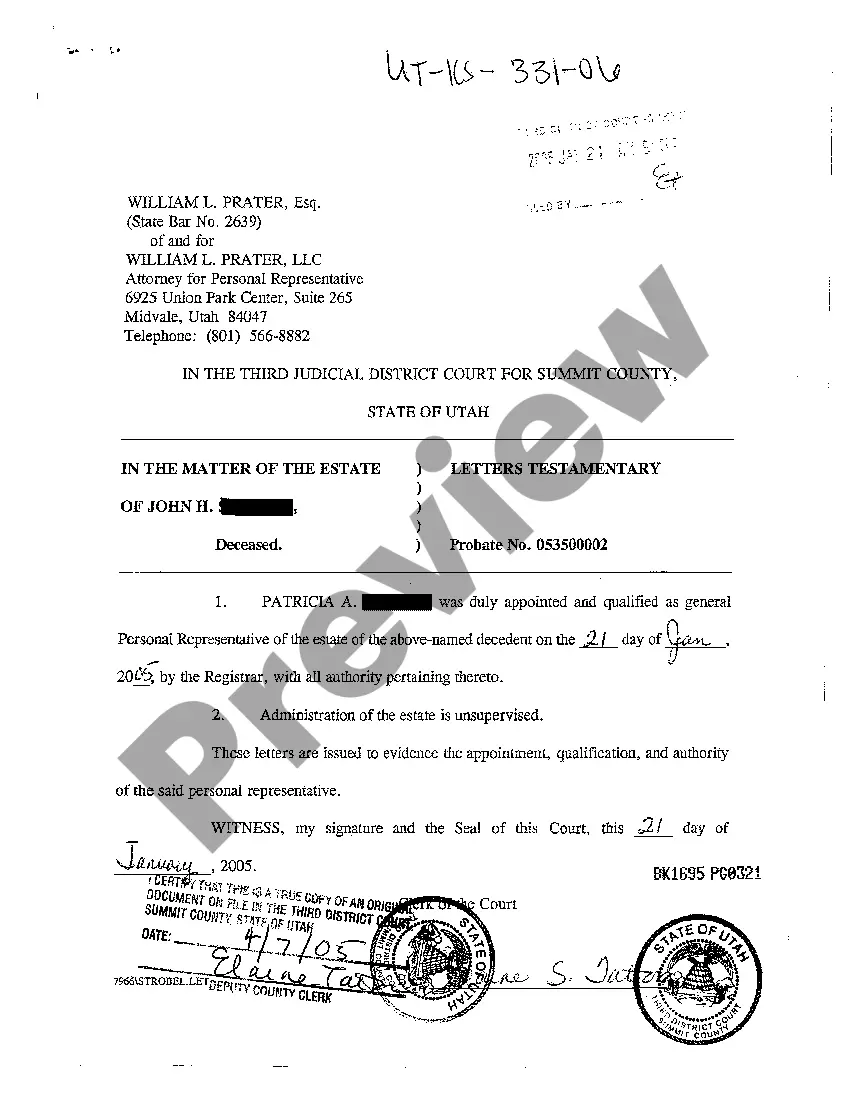

- Review the document by examining the description through the Preview feature.

Form popularity

FAQ

A time file extension generally refers to types of files that track time or schedule events, such as .time or other related formats. While this isn’t directly linked to an Arkansas Order Extending Time for Filing, knowing about various file types can assist you in managing your documents effectively. Organized files help streamline your legal processes.

The extension of a Time Machine file refers to the backups created by Apple's Time Machine utility, which helps users save files. While this topic may not relate directly to an Arkansas Order Extending Time for Filing, understanding digital file extensions is valuable for preserving important documents in your legal affairs. Always keep backup copies of essential filings.

Filing an extension in Arkansas involves completing the designated form and submitting it to the appropriate agency. You can easily manage this process by using the US Legal Forms platform, which provides clear guidance and the necessary forms for an Arkansas Order Extending Time for Filing. Ensure you file before the deadline to avoid complications.

To request an extension of time to file in Arkansas, you typically need to use specific forms mandated by the state. The form required for an Arkansas Order Extending Time for Filing ensures that your request is documented correctly. Make sure to check the latest guidelines or consult resources on the US Legal Forms platform to access the right form.

An extension to file is a legal provision that permits you to delay your submission of documents like tax returns. In the context of Arkansas, an Arkansas Order Extending Time for Filing is specifically designed to assist residents in managing their deadlines. By obtaining this extension, you can ensure that you meet all requirements, even if you need extra time.

An extension of time to file allows you additional time to submit necessary legal documents or tax returns without facing penalties. In Arkansas, you can request an Arkansas Order Extending Time for Filing to avoid late fees. This extension gives you peace of mind to prepare your filings accurately and thoroughly.

Yes, Arkansas recognizes S Corporations, which allows businesses to enjoy tax benefits at the personal income level. An S Corp designation can help mitigate double taxation, making it a favorable choice for many businesses. Understanding how to manage your filing requirements is crucial, and utilizing the Arkansas Order Extending Time for Filing can provide you with the additional time you may need to ensure compliance and maximize your benefits.

Yes, Arkansas accepts Form 7004, which is the federal application for an automatic extension of time to file certain business tax returns. By using Form 7004, you can extend your timeline for filing while remaining compliant with state requirements. The Arkansas Order Extending Time for Filing works in conjunction with this form, ensuring you still have enough time to gather necessary information without penalties.

Arkansas does accept federal tax extension forms for corporations, which can help businesses manage their filing periods more effectively. When you file a federal extension, it gives you additional time to submit your Arkansas state taxes as well. This is where the Arkansas Order Extending Time for Filing can play a vital role, making it easier for companies to navigate their tax obligations without feeling rushed.

Yes, Arkansas does have a corporate income tax that applies to corporations operating within the state. This tax is assessed based on the corporation's net income. It's important for businesses to understand their tax responsibilities, especially when considering the Arkansas Order Extending Time for Filing. By filing for an extension, you can ensure you have adequate time to prepare your tax documents accurately.