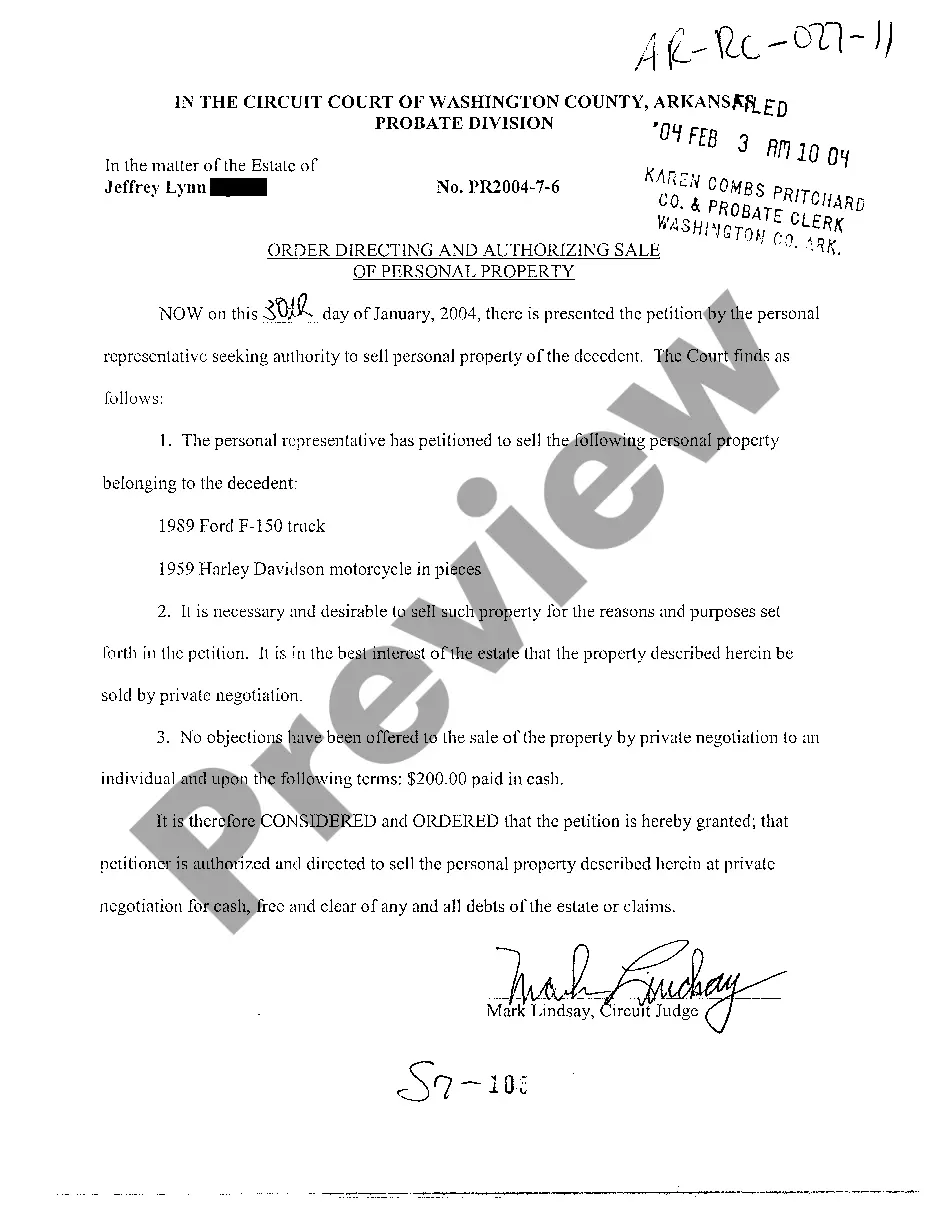

Arkansas Order Directing and Authorizing Sale of Personal Property

Description

How to fill out Arkansas Order Directing And Authorizing Sale Of Personal Property?

Amid numerous complimentary and paid templates available online, you cannot guarantee their dependability.

For instance, it's uncertain who created them or whether they possess the expertise necessary for your requirements.

Stay calm and utilize US Legal Forms!

Ensure the document you select is recognized in your residing state. Check the file by reviewing the description via the Preview feature. Hit Buy Now to begin the ordering process or seek another template using the Search bar in the header. Select a pricing plan to create an account. Make the payment for your subscription using your credit/debit card or Paypal. Download the document in your preferred format. Once you’ve registered and completed your payment, you can use your Arkansas Order Directing and Authorizing Sale of Personal Property as frequently as you wish or while it remains active in your state. Modify it with your preferred offline or online editor, complete it, sign it, and print it. Achieve more for less with US Legal Forms!

- Explore Arkansas Order Directing and Authorizing Sale of Personal Property templates crafted by proficient attorneys.

- Avoid the costly and lengthy task of searching for a lawyer only to pay them for drafting a document.

- You can easily find it on your own.

- If you already have an account, Log In and locate the Download button beside the file you need.

- You will also have access to all previously downloaded forms in the My documents section.

- If this is your first time using our service, follow the steps below to obtain your Arkansas Order Directing and Authorizing Sale of Personal Property promptly.

Form popularity

FAQ

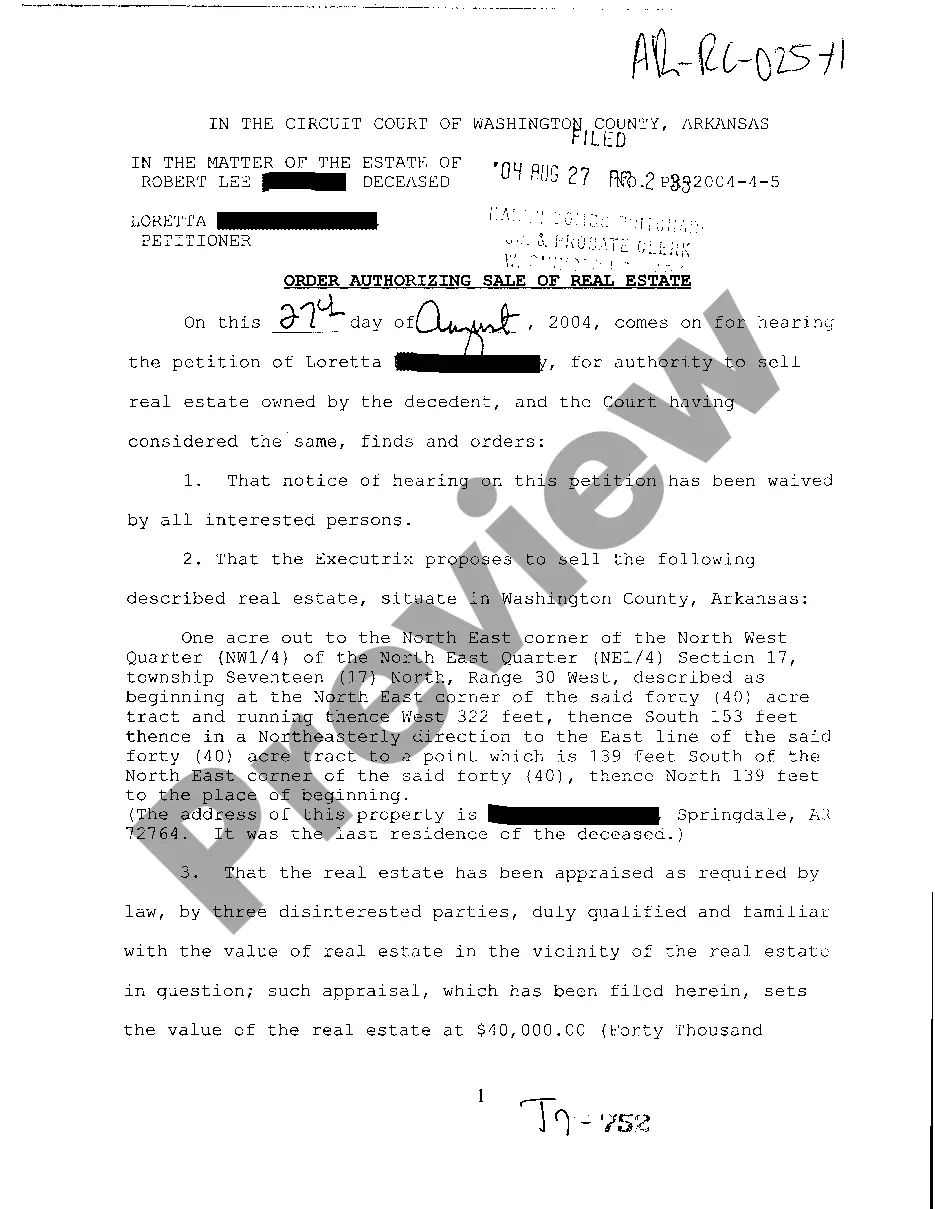

The abandoned personal property law in Arkansas outlines the process for handling personal property that has been left behind by the owner. According to the law, if the property remains unclaimed for a specific period, it may be publicly auctioned or sold. To initiate this process, a court may issue an Arkansas Order Directing and Authorizing Sale of Personal Property. This ensures that the sale is conducted legally and fairly, providing an opportunity for recovery of the property's value.

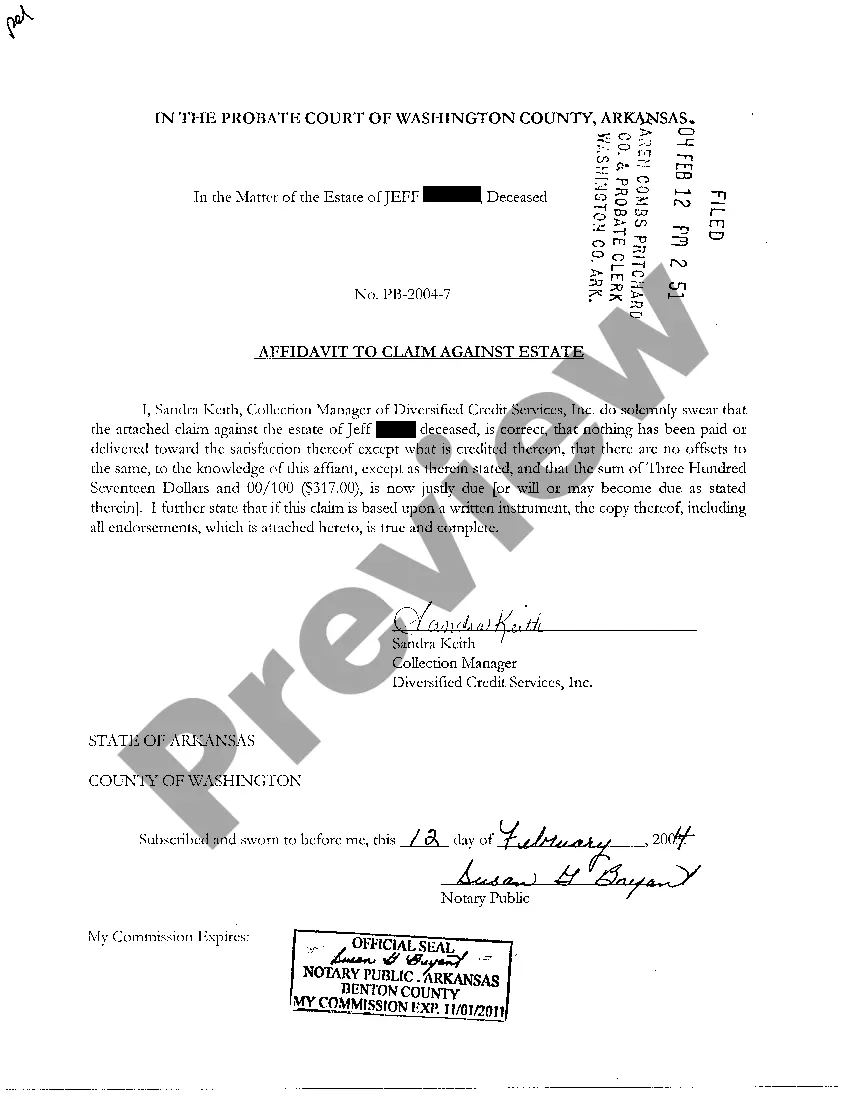

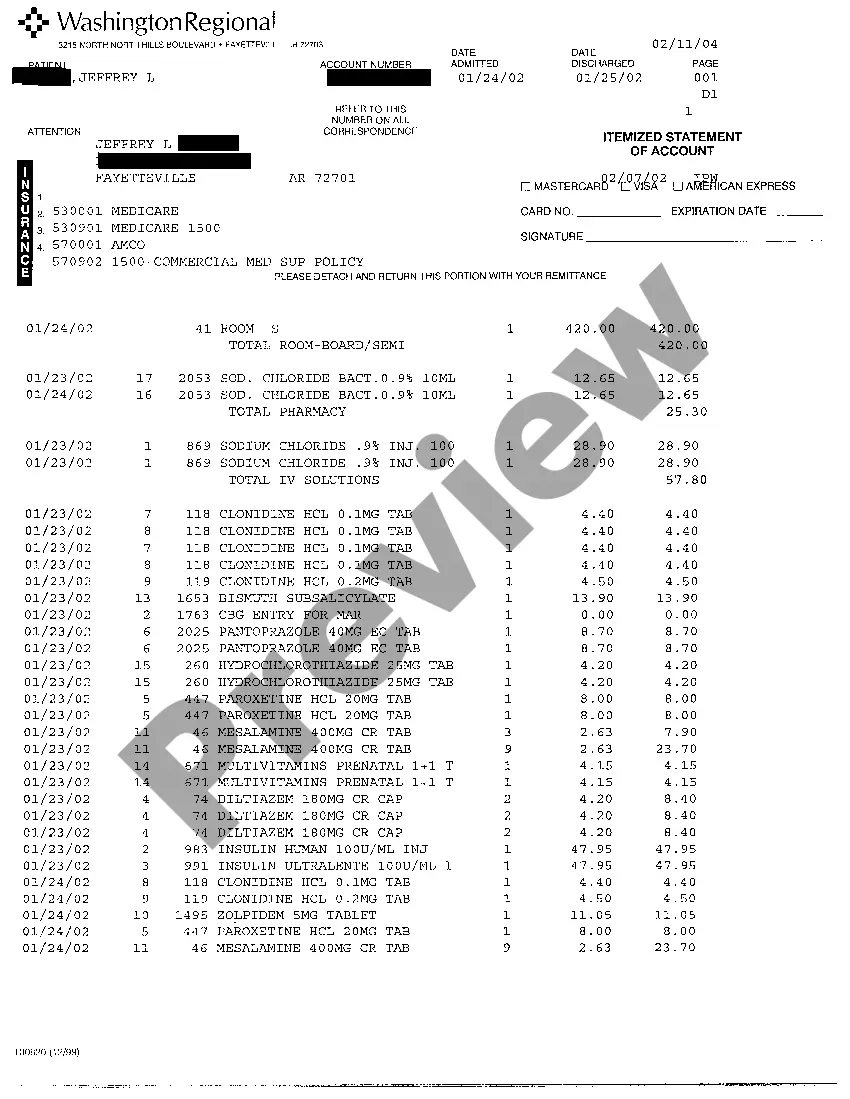

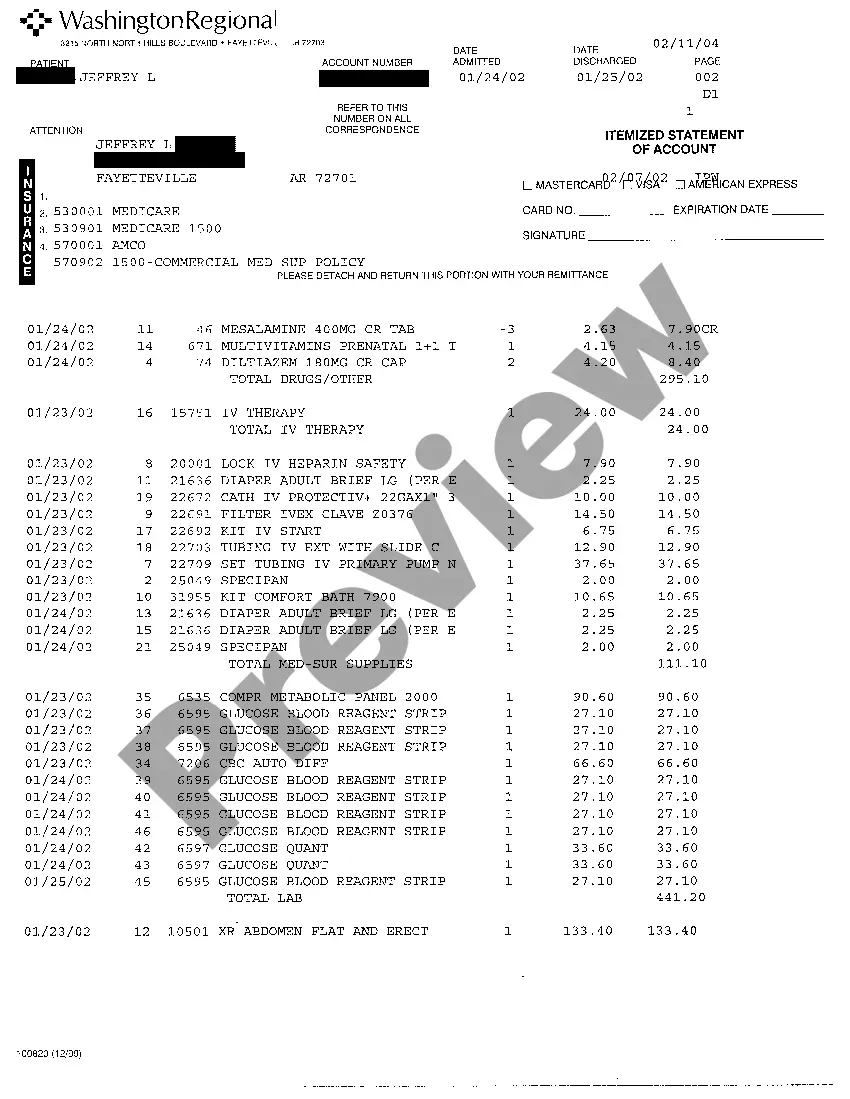

A personal representative in Arkansas is an individual appointed to administer a deceased person's estate. This person manages the estate's assets, pays debts, and ensures that distributions comply with the will or state laws. Understanding the role of a personal representative is crucial, especially in proceedings involving an Arkansas Order Directing and Authorizing Sale of Personal Property.

In Arkansas, there is no universal time limit for how long someone can leave their belongings on your property. However, property owners must consider abandoned property laws which provide certain guidelines. If the situation arises involving an Arkansas Order Directing and Authorizing Sale of Personal Property, timely action may be necessary to resolve any disputes.

In Arkansas, there is no specific age at which individuals automatically stop paying personal property taxes. However, seniors may qualify for certain exemptions or relief programs. It is wise to consult local tax authorities or resources provided by US Legal Forms to understand your options related to taxes on personal property.

The personal property law in Arkansas outlines the rights and responsibilities related to movable items. This law governs how personal property is bought, sold, and disposed of, including specific processes for auctions and sales. When dealing with an Arkansas Order Directing and Authorizing Sale of Personal Property, it's important to adhere to these laws to ensure compliance.

Yes, Arkansas operates under common law principles regarding property rights. This means that many property laws evolve from judicial decisions rather than statutes. Knowing these common law rules can provide clarity, especially for estates subject to an Arkansas Order Directing and Authorizing Sale of Personal Property.

In Arkansas, personal property includes items that are movable and not attached to real estate. This can range from furniture and vehicles to equipment and jewelry. Understanding what qualifies as personal property is essential, especially when considering an Arkansas Order Directing and Authorizing Sale of Personal Property, as specific regulations apply.