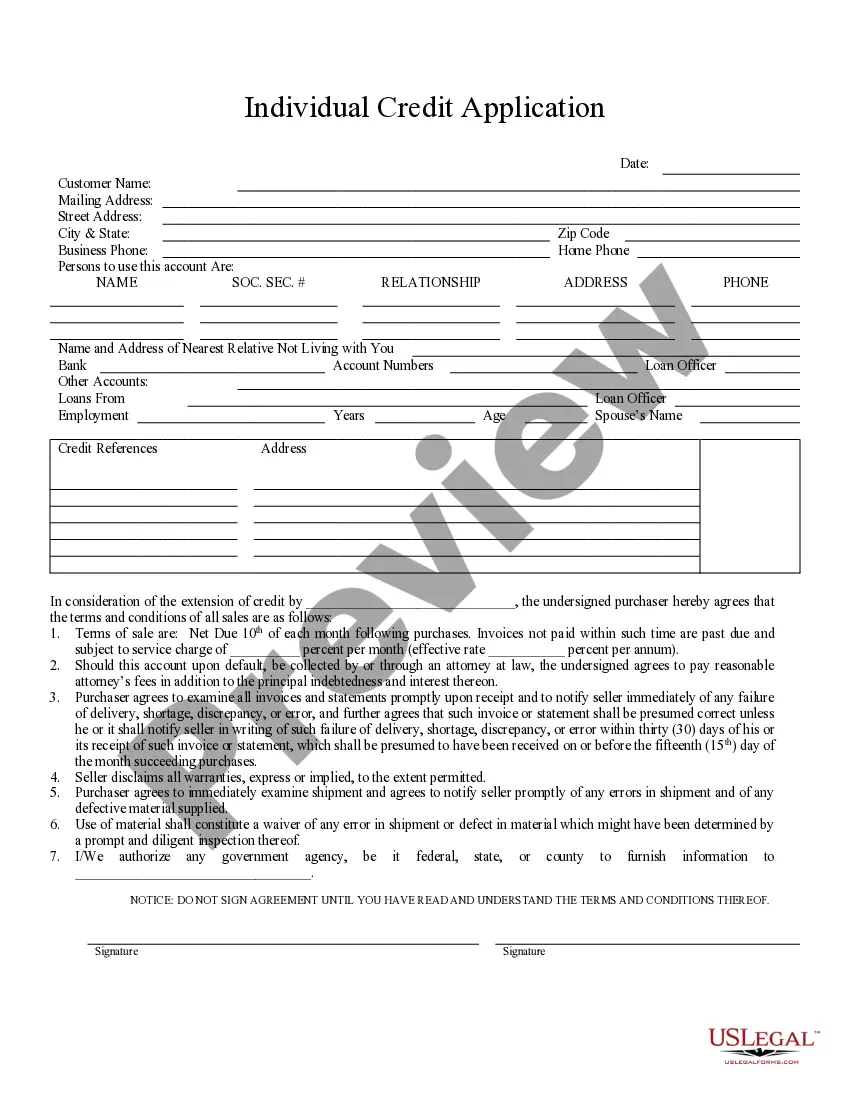

This is an Individal Credit Application for an individual seeking to obtain credit for a purchase. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and permission for Seller to obtain personal information about purchaser from government agencies, if necessary.

Arkansas Individual Credit Application

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Arkansas Individual Credit Application?

Utilizing Arkansas Individual Credit Application samples crafted by skilled attorneys allows you to sidestep stress when completing paperwork.

Easily download the document from our site, fill it in, and have a lawyer review it.

This approach can save you significantly more time and expenses than having an attorney draft a document from scratch tailored to your requirements.

Remember to verify all entered information for accuracy before sending it or submitting it. Reduce the time you spend on document creation with US Legal Forms!

- If you’ve previously purchased a US Legal Forms subscription, just Log In to your account and go back to the form web page.

- Locate the Download button next to the template you’re examining.

- After downloading a file, you'll find all your saved samples in the My documents section.

- If you don’t have a subscription, that’s not a major issue.

- Simply follow the steps below to register for an account online, obtain, and fill out your Arkansas Individual Credit Application template.

- Double-check and confirm that you are downloading the accurate state-specific form.

Form popularity

FAQ

Yes, if you have earned income or meet certain thresholds, you need to file an Arkansas state tax return. This includes situations where you owe tax or wish to claim a refund. To ensure you meet all requirements for your Arkansas Individual Credit Application, taking advantage of tax filing resources can make the process smooth and compliant.

Yes, you can file your taxes by yourself online without any problem. Many tax software programs are designed to walk you through the entire process, making it user-friendly. Additionally, using platforms like USLegalForms can provide you with the necessary documents to properly complete your Arkansas Individual Credit Application.

Absolutely, you can file your Arkansas taxes online. Various approved software options facilitate this process, helping you complete your Arkansas Individual Credit Application efficiently. Not only does this save time, but it also often leads to quicker refunds.

The tax credit for individuals in Arkansas can help reduce your overall tax liability. One notable option is the Arkansas Individual Income Tax Credit, which applies to various specific scenarios. Properly incorporating these credits into your Arkansas Individual Credit Application can lead to significant savings, so be sure to check for all available options.

Yes, Arkansas does accept federal extensions for individuals, but it's important to understand how they work. When you file a federal extension, you automatically get an extension for your Arkansas tax return as well. To make the most of your extension while handling your Arkansas Individual Credit Application, consider using reliable platforms that guide you through the process.

There are several reasons you might not be able to e-file your Arkansas state taxes. Your tax returns may include certain forms that do not qualify for electronic submission, or you might be missing required information. To resolve this, using platforms like USLegalForms can help ensure that your Arkansas Individual Credit Application is correctly filled out and compliant with all e-filing requirements.

Yes, you can file your Arkansas state taxes online. The Arkansas Department of Finance and Administration provides options for electronic filing, which speeds up the process. Using user-friendly platforms like USLegalForms can also streamline your Arkansas Individual Credit Application, making your tax experience simpler and faster.

A good credit score for buying a house is usually considered to be 700 or higher. However, scores above 620 can still qualify you for various mortgage options. Knowing the range that lenders look for can help you prepare your Arkansas Individual Credit Application and improve your chances of approval.

A personal credit application is a formal request from an individual seeking credit from lenders. This application collects personal information, financial history, and credit score details to help lenders assess creditworthiness. When applying for loans in Arkansas, an Arkansas Individual Credit Application is a vital step in securing the financing you need.

The individual tax credit in Arkansas allows residents to reduce their taxable income, thus potentially lowering their tax liability. This credit varies based on factors such as income and filing status. By thoroughly completing your Arkansas Individual Credit Application, you can explore eligibility and ensure you take advantage of available credits.