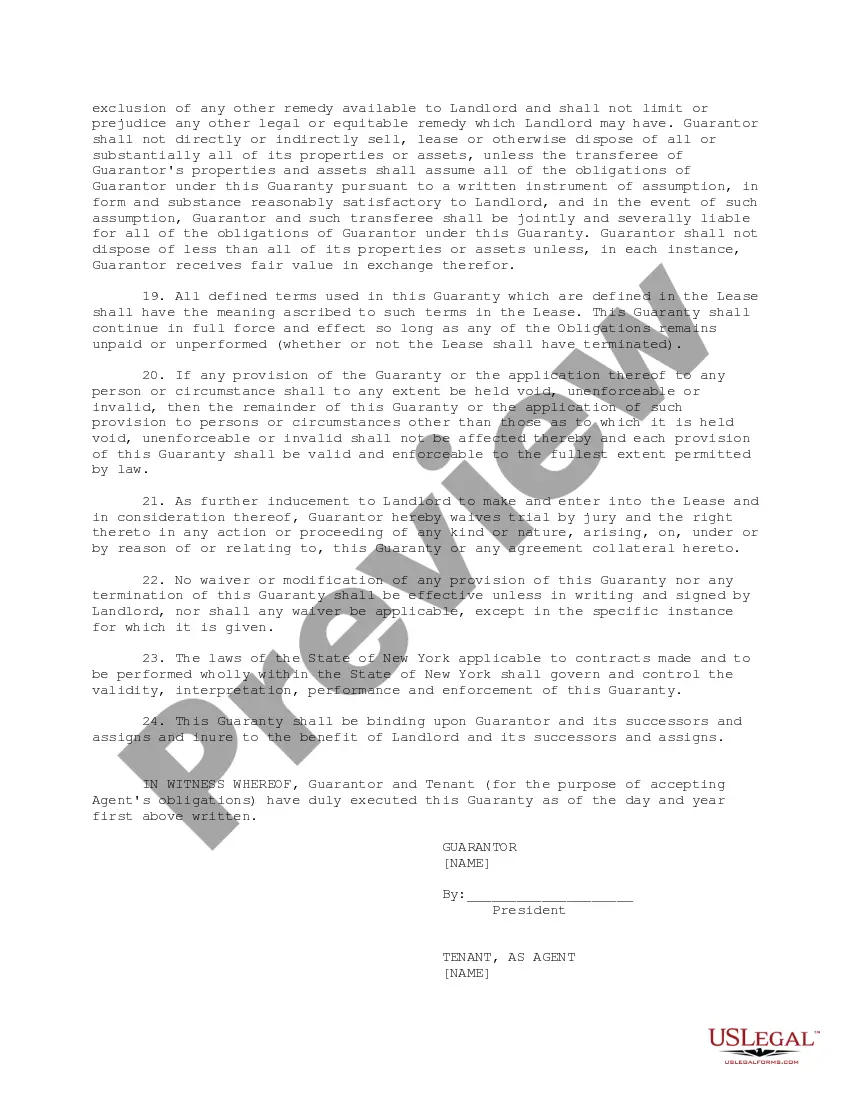

This office lease form is a guranty that absolutely, unconditionally and irrevocably guarantees the landlord the full and prompt performance and observance of all of the tenant's obligations under the lease, including, and without limitation, the full and prompt payment of all rent and additional rent payable by the tenant under the lease and tenant's indemnity obligations benefiting the landlord under the lease.

Alabama Joint and Several Guaranty of Performance and Obligations

Description

How to fill out Joint And Several Guaranty Of Performance And Obligations?

US Legal Forms - one of the greatest libraries of authorized forms in the States - delivers a wide range of authorized papers templates you are able to down load or printing. Making use of the website, you will get a huge number of forms for organization and person functions, sorted by types, states, or search phrases.You will find the most up-to-date types of forms like the Alabama Joint and Several Guaranty of Performance and Obligations within minutes.

If you have a membership, log in and down load Alabama Joint and Several Guaranty of Performance and Obligations from the US Legal Forms library. The Download switch will appear on each and every type you see. You get access to all earlier downloaded forms inside the My Forms tab of your respective bank account.

If you would like use US Legal Forms initially, allow me to share straightforward recommendations to get you started off:

- Be sure to have picked the best type for your personal town/county. Select the Review switch to analyze the form`s content. Look at the type description to ensure that you have selected the appropriate type.

- In case the type does not suit your needs, take advantage of the Look for field at the top of the display to discover the the one that does.

- When you are happy with the shape, affirm your selection by clicking on the Buy now switch. Then, pick the pricing prepare you like and provide your credentials to register to have an bank account.

- Procedure the deal. Make use of your charge card or PayPal bank account to accomplish the deal.

- Find the file format and down load the shape on the product.

- Make adjustments. Complete, modify and printing and signal the downloaded Alabama Joint and Several Guaranty of Performance and Obligations.

Every single template you put into your money lacks an expiry particular date and it is yours for a long time. So, if you want to down load or printing another duplicate, just visit the My Forms section and click on around the type you will need.

Get access to the Alabama Joint and Several Guaranty of Performance and Obligations with US Legal Forms, the most substantial library of authorized papers templates. Use a huge number of specialist and state-distinct templates that fulfill your small business or person requirements and needs.

Form popularity

FAQ

With a ?several? guaranty, each guarantor is agreeing to be liable to the lender for up to $500,000 irrespective of what the other guarantor has repaid. In our example, ?several? guaranties from the guarantors would provide for full coverage of the $1,000,000 loan.

A guarantor is a third party who 'guarantees' a loan, mortgage or rental agreement. This means they agree to repay the total amount owed if the borrower or renter can't pay what they owe. By guaranteeing the agreement, you become responsible for any arrears that occur.

The primary difference between a co-signer and a guarantor is how soon each individual becomes responsible for the borrower's debt. A co-signer is responsible for every payment that a borrower misses. However, a guarantor only assumes responsibility if the borrower falls into total default.

Another essential point to understand is that a co-borrower is first accountable for the loan. A guarantor, on the other hand, is not liable unless the underlying borrower defaults and the lender initiates collection attempts against the borrower, depending on the conditions of the guaranty.

(d???nt ?nd ?s?vr?l ??ær?n?ti? ) noun. law. a legal guarantee undertaken by multiple people in which any one guarantor can be held fully responsible for repaying the whole of the debt despite each guarantor only being partially responsible for that debt.

A joint guarantee means that the signatories as a group are jointly and severally liable for the borrower's debts. If one guarantor fails to pay, the others must meet their obligation to repay that debt in full. The words "jointly" and "severally" refer to the nature of the guarantors' liability under the guarantee.

A joint guarantee means the signatories are jointly liable as a group for the borrower's indebtedness. If one guarantor does not pay, the others are on the hook to fulfill the group's obligation to repay the full amount of that indebtedness.

Joint liability is different from joint and several liability in that in joint liability the responsibility is spread equally among the defendants whereas in joint and several liability responsibility shifts depending on the degree/share of defendant's responsibility that is found by a judge or a jury.