Alabama Personal Guaranty - Guarantee of Lease to Corporation

Description

How to fill out Personal Guaranty - Guarantee Of Lease To Corporation?

If you need to download, access, or create legal document templates, utilize US Legal Forms, the largest compilation of legal forms available online.

Take advantage of the site's user-friendly search to find the documents you require.

A variety of templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you locate the form you want, select the Get Now button. Choose the pricing plan you prefer and provide your details to register for an account.

Step 5. Process the purchase. You can use your credit card or PayPal account to complete the transaction.

- Use US Legal Forms to obtain the Alabama Personal Guaranty - Guarantee of Lease to Corporation in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to receive the Alabama Personal Guaranty - Guarantee of Lease to Corporation.

- You can also access forms you previously downloaded from the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the correct area/region.

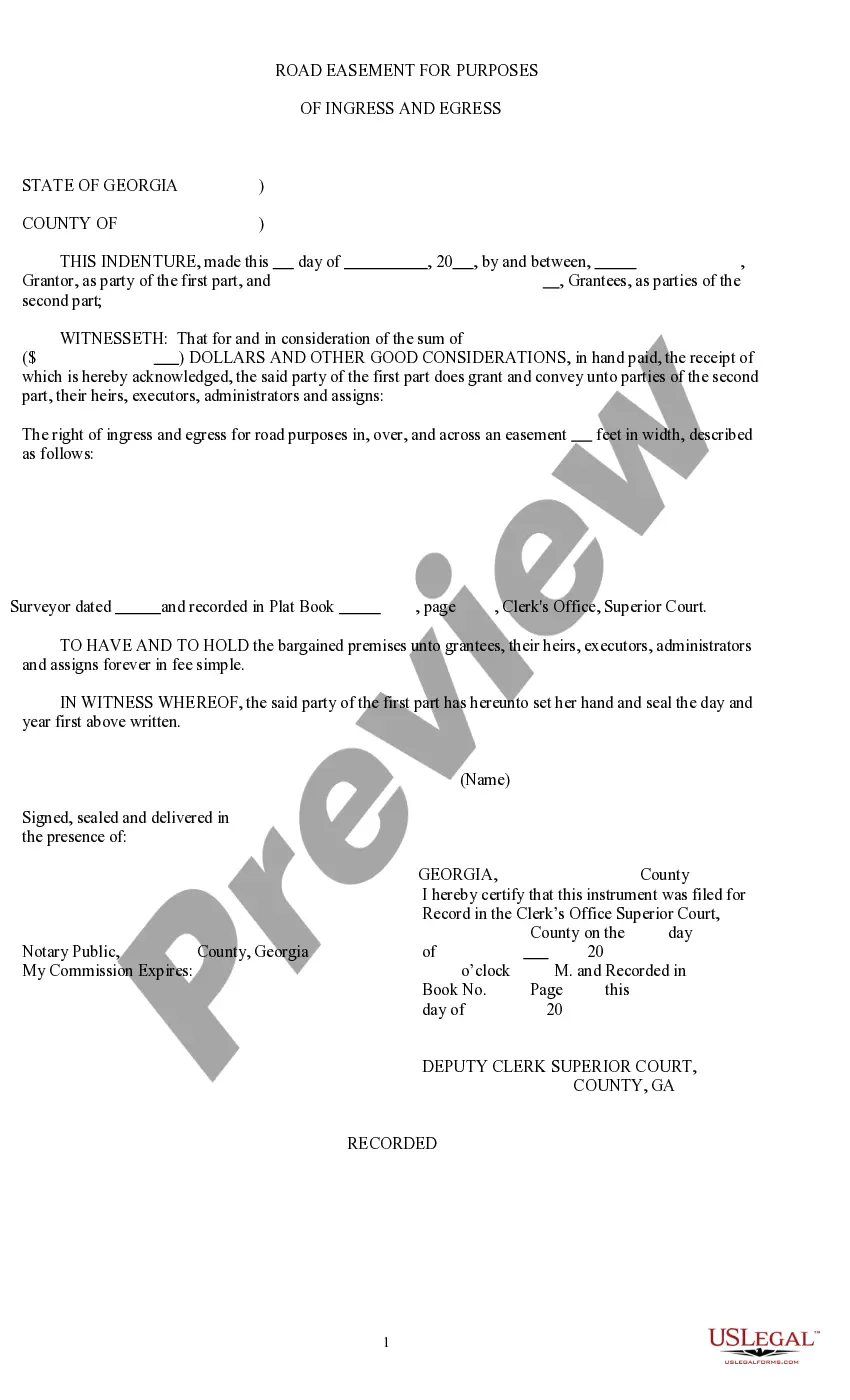

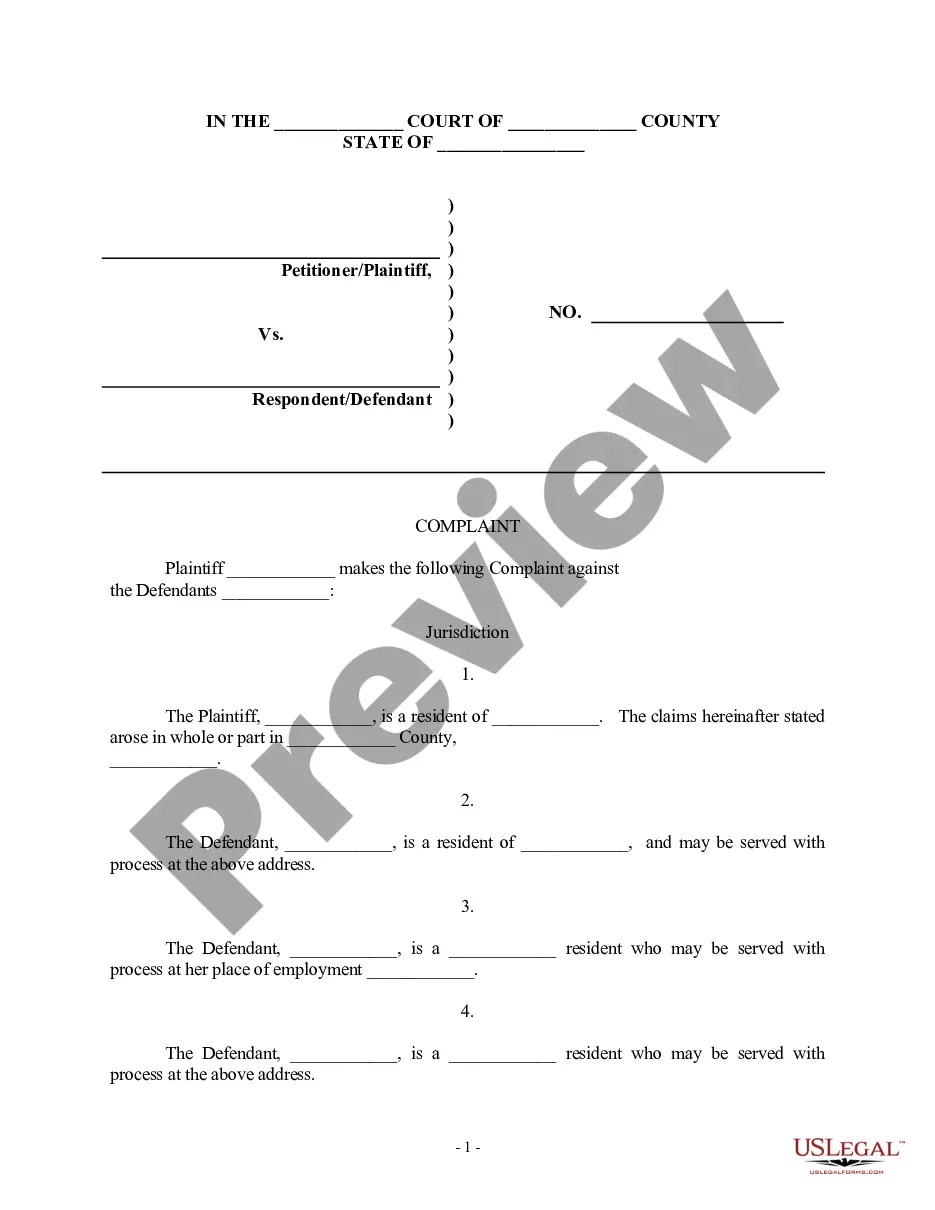

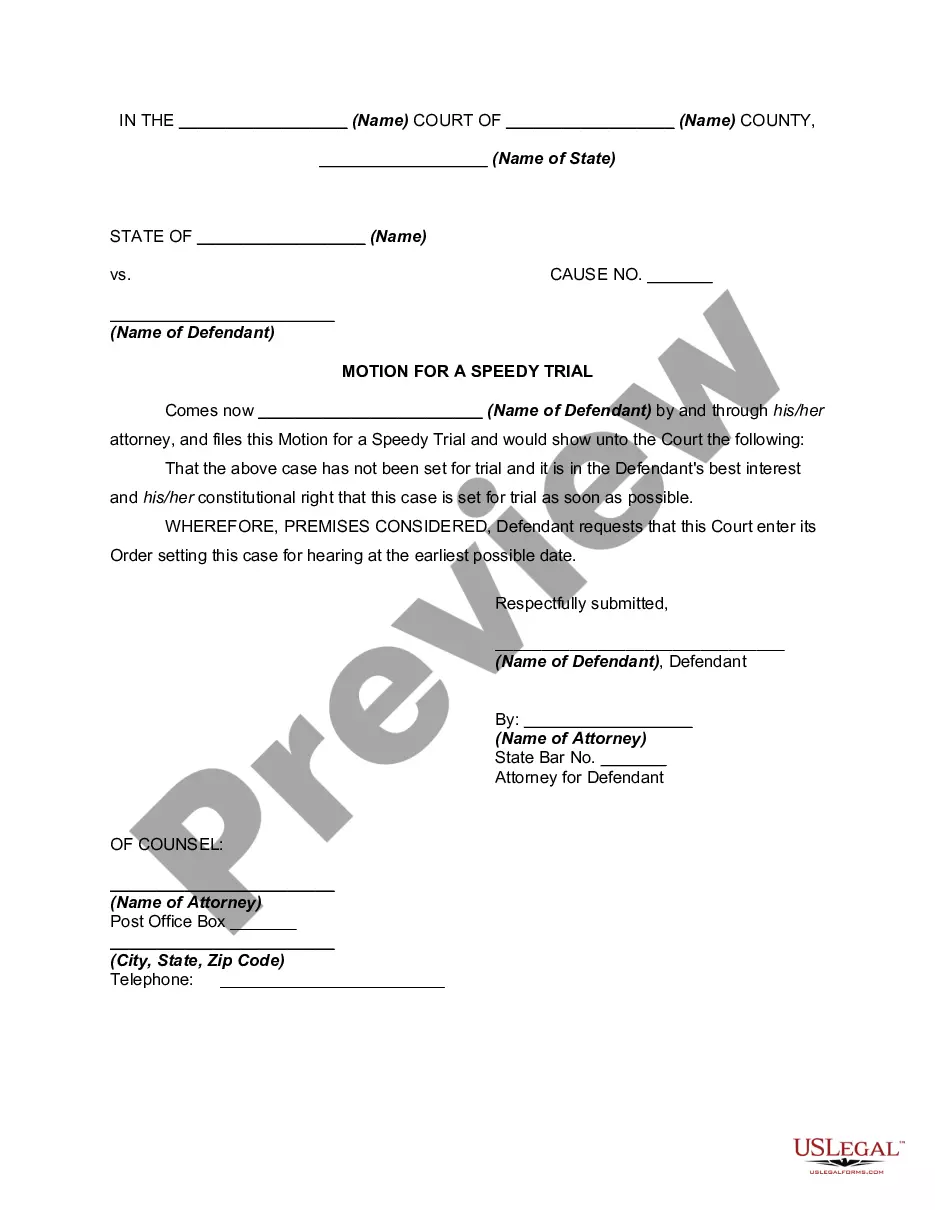

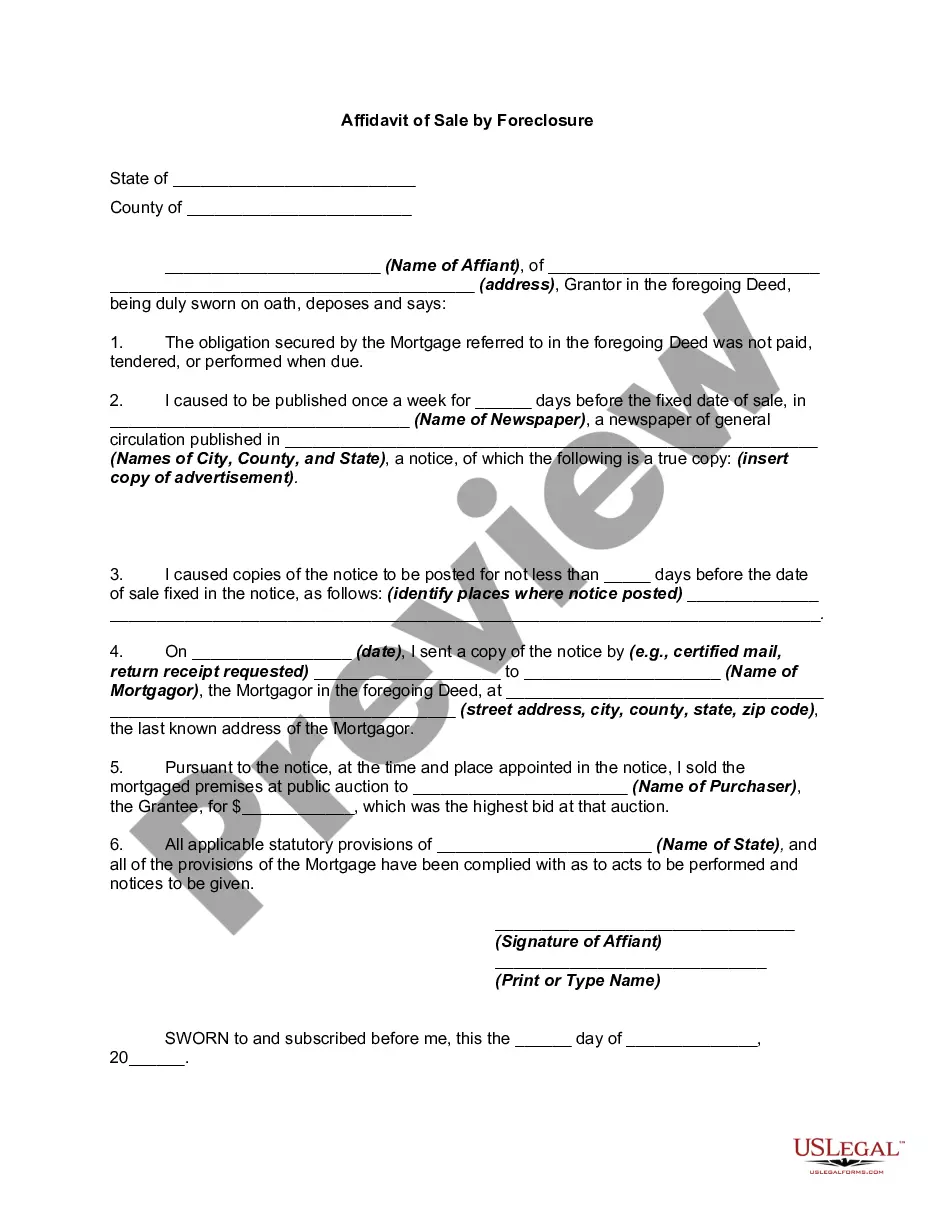

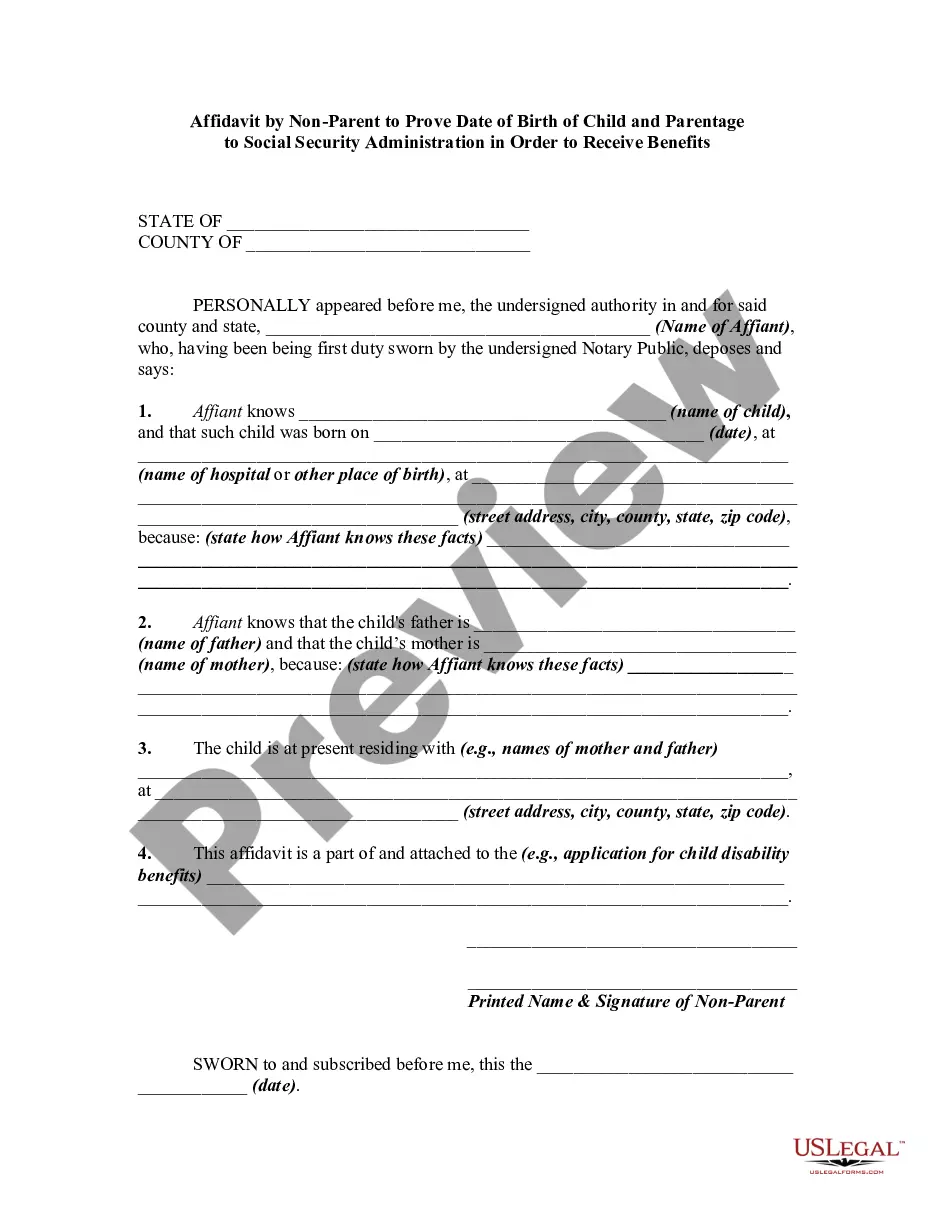

- Step 2. Use the Preview option to review the form's content. Be sure to read the details.

- Step 3. If you are unhappy with the document, use the Search section at the top of the screen to find alternative types of the legal document format.

Form popularity

FAQ

In writing The guarantee must be evidenced in writing to be enforceable. Signed The document must be signed by the guarantor or their authorised agent. Their name can be written or printed. Secondary liability The document must establish that the guarantor has secondary liability for the debt.

A personal guarantee is an agreement that allows a lender to go after your personal assets if your company, relative, or friend defaults on a loan. For instance, if your business goes under, the creditor can sue you to collect any outstanding balance.

Corporate credit cards. Instead, by using a credit that are issued to an individual are another example of a personal guarantee. The individual or employee is responsible for the debt that the organization takes on and the overall spending on the credit card. Here, the cardholder takes the role of a guarantor.

A lease guarantee is a contract signed by the tenant, landlord and the third party. It stipulates the financial obligations of all the parties involved and safeguards them from future risks.

The term personal guarantee refers to an individual's legal promise to repay credit issued to a business for which they serve as an executive or partner. Providing a personal guarantee means that if the business becomes unable to repay the debt, the individual assumes personal responsibility for the balance.

A personal guarantee is an agreement between a business owner and lender, stating that the individual who signs is responsible for paying back a loan should the business ever be unable to make payments.

A personal guarantee is a provision a lender puts in a business loan agreement that requires owners to be personally responsible for their company's debt in case of default. Lenders often ask for personal guarantees because they have concerns over the credit history, age or financial stability of your business.

Rolling guaranty: this can be a 12 month, 24 month or some other number of months, rolling guaranty. It means that the total exposure is the number of months regardless of how many months are remaining in the lease (unless the remaining months are less than the rolling months.

A corporate guarantee is a contract between a corporate entity or individual and a debtor. In this contract, the guarantor agrees to take responsibility for the debtor's obligations, such as repaying a debt.