Alabama Assignment of Promissory Note & Liens

Description

How to fill out Assignment Of Promissory Note & Liens?

Are you inside a position in which you need files for possibly business or individual reasons nearly every time? There are a lot of legitimate papers templates available on the Internet, but locating types you can depend on isn`t simple. US Legal Forms delivers thousands of develop templates, like the Alabama Assignment of Promissory Note & Liens, which are created in order to meet federal and state needs.

Should you be currently informed about US Legal Forms web site and possess your account, just log in. Afterward, you may obtain the Alabama Assignment of Promissory Note & Liens template.

Should you not have an bank account and want to begin to use US Legal Forms, abide by these steps:

- Find the develop you require and ensure it is for that right city/region.

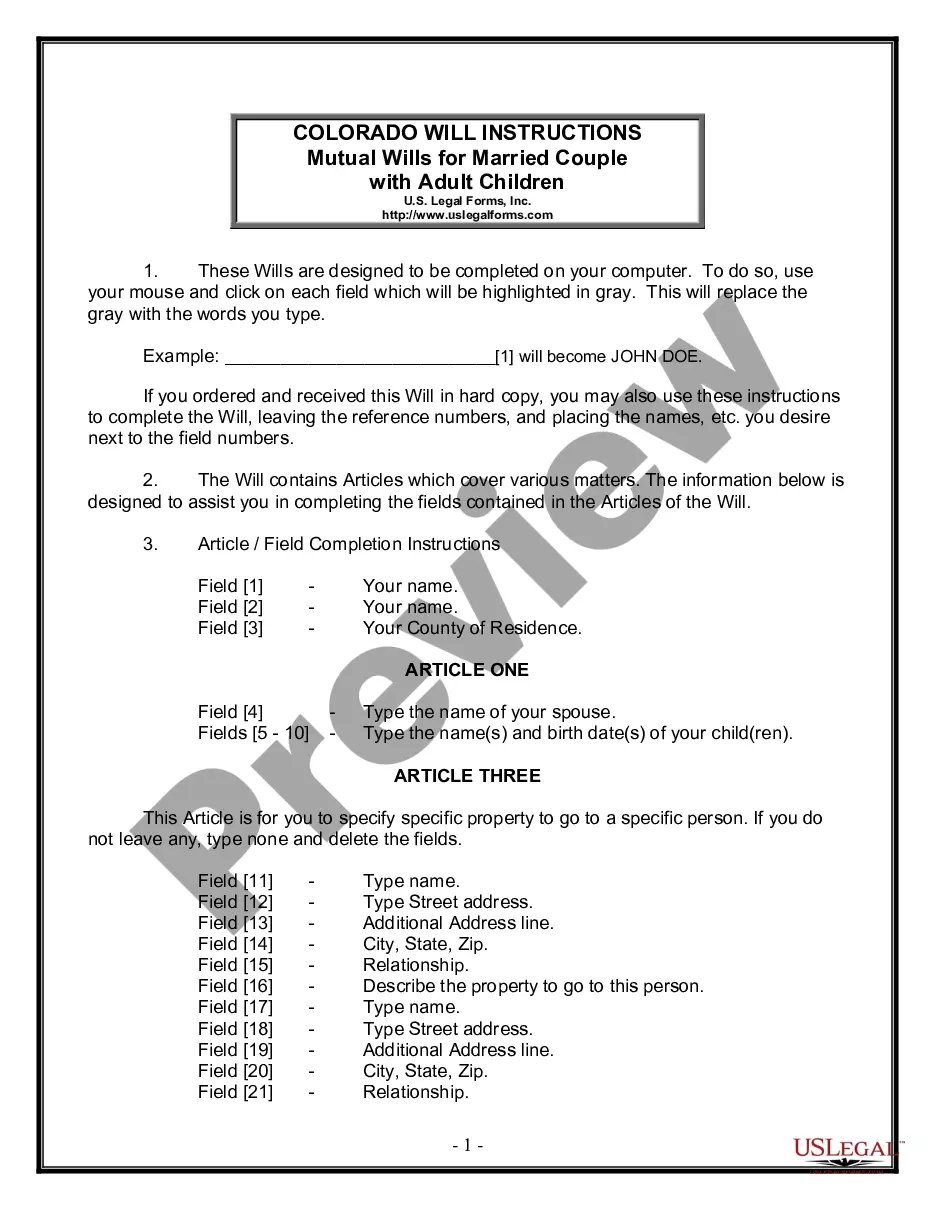

- Utilize the Review option to analyze the form.

- Browse the explanation to actually have chosen the proper develop.

- When the develop isn`t what you`re seeking, use the Search field to obtain the develop that suits you and needs.

- If you find the right develop, simply click Acquire now.

- Opt for the rates plan you want, fill out the desired information to produce your bank account, and purchase an order using your PayPal or bank card.

- Pick a practical paper formatting and obtain your version.

Get all the papers templates you have bought in the My Forms food selection. You can aquire a more version of Alabama Assignment of Promissory Note & Liens anytime, if necessary. Just click on the needed develop to obtain or print out the papers template.

Use US Legal Forms, one of the most substantial selection of legitimate forms, to conserve efforts and prevent errors. The services delivers appropriately made legitimate papers templates that you can use for a selection of reasons. Produce your account on US Legal Forms and initiate producing your life a little easier.

Form popularity

FAQ

Promissory notes don't have to be notarized in most cases. You can typically sign a legally binding promissory note that contains unconditional pledges to pay a certain sum of money. However, you can strengthen the legality of a valid promissory note by having it notarized.

In Alabama, only the borrower and their co-signer have to sign the document. However, the lender can add their signature to it as well. Though not required by Alabama law, you can choose to have the promissory note notarized. Notarization could be helpful in the event of a lawsuit.

To be legally enforceable, a promissory note must meet multiple legal conditions. Moreover, it must contain both an offer of agreement and an acceptance of agreement. All contracts state the type of services or goods rendered and indicate how much they cost.

However, a promissory note is never assignable by the borrower, without the express written consent and approval of the lender.

First and foremost, understand that personal loan agreements fall into the classification of contracts. Technically, you don't have to notarize these documents. But if you want to make this document legally binding, then notarization is the best course of action.

By way of example, the statute of limitation periods for enforcement of promissory notes in the states of Alabama, Arkansas and Florida are as follows: Alabama: Statute of Limitation on a Note is six (6) years. See, ALA. CODE § 6-2-34.

A promissory note could become invalid if: It isn't signed by both parties. The note violates laws. One party tries to change the terms of the agreement without notifying the other party.