Alabama Assignment of Contract as Security for Loan

Description

How to fill out Assignment Of Contract As Security For Loan?

US Legal Forms - one of the largest collections of valid forms in the USA - provides a vast selection of legitimate document templates that you can download or print.

While using the website, you can access thousands of forms for business and personal use, categorized by types, states, or keywords.

You can acquire the latest templates such as the Alabama Assignment of Contract as Security for Loan within moments.

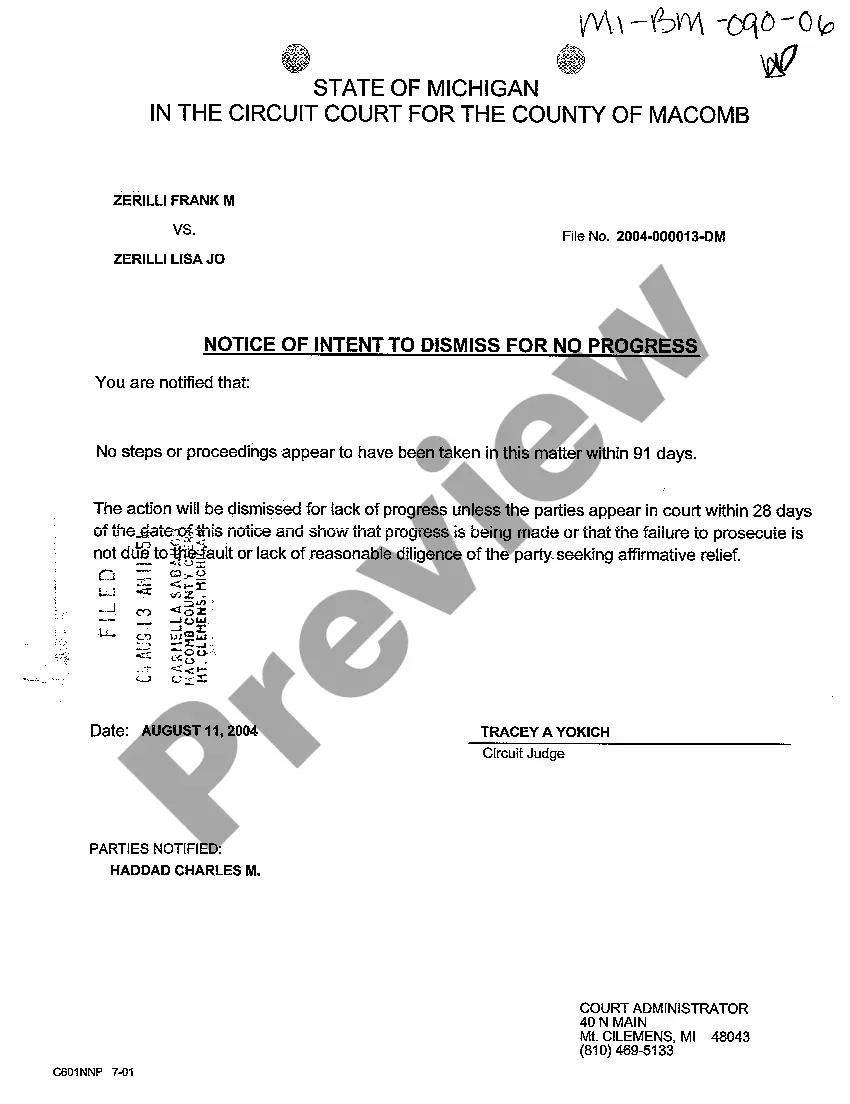

Click the Preview button to examine the form’s contents. Review the description of the form to confirm that it meets your requirements.

If the form does not fulfill your needs, utilize the Search field at the top of the screen to find one that does.

- If you have a current monthly subscription, Log In and download Alabama Assignment of Contract as Security for Loan from your US Legal Forms library.

- The Download button will be visible on every form you view.

- You can retrieve all previously obtained forms from the My documents section of your account.

- If you wish to use US Legal Forms for the first time, here are simple steps to help you get started.

- Ensure you have selected the correct form for your city/region.

Form popularity

FAQ

Key Takeaways. A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

Loans from banks or other institutional lenders are always made using a number of documents, two of which are a promissory and security agreement. In general, the promissory note is your written promise to repay the loan and a security agreement is used when collateral is given for the loan.

Mortgage is different from a security agreement. A mortgage is used to secure the lender's rights by placing a lien against the title of the property. Once all loan repayments have been made, the lien is removed.

WHEREAS, it is a condition precedent to the Secured Party's making any loans to Debtor under the Credit Agreement that the Debtor execute and deliver a Security Agreement in substantially the form hereof. a. Overview: A security agreement is frequently one of many loan documents executed in conjunction with a loan.

Collateral on a secured personal loan can include things like cash in a savings account, a car or even a home.

Security agreements are generally used to supplement a secured promissory note. The note is the borrower's actual promise to repay the money it received. The enclosed security agreement assumes the existence of a secured promissory note, but that agreement is not included with this package.

Companies that operate by contractually agreeing to provide services or products for a specific project or event can use the contract as collateral to secure necessary funding.

Certain specific requirements are required for the security agreement to form the foundation for a valid security interest, namely 1) it must be signed, 2) it must clearly state that a security interest is intended, and 3) it must contain a sufficient description of the collateral subject to the security interest.

To draft a Loan Agreement, you should include the following:The addresses and contact information of all parties involved.The conditions of use of the loan (what the money can be used for)Any repayment options.The payment schedule.The interest rates.The length of the term.Any collateral.The cancellation policy.More items...

The Collateral Assignment of Mortgage and related Collateral Assignment of Assignment of Leases, if any, or assignment of any other agreement executed in connection with such Mortgage Loan constitutes the legal, valid and binding assignment of such Mortgage from Borrower to or for the benefit of Agent, and validly