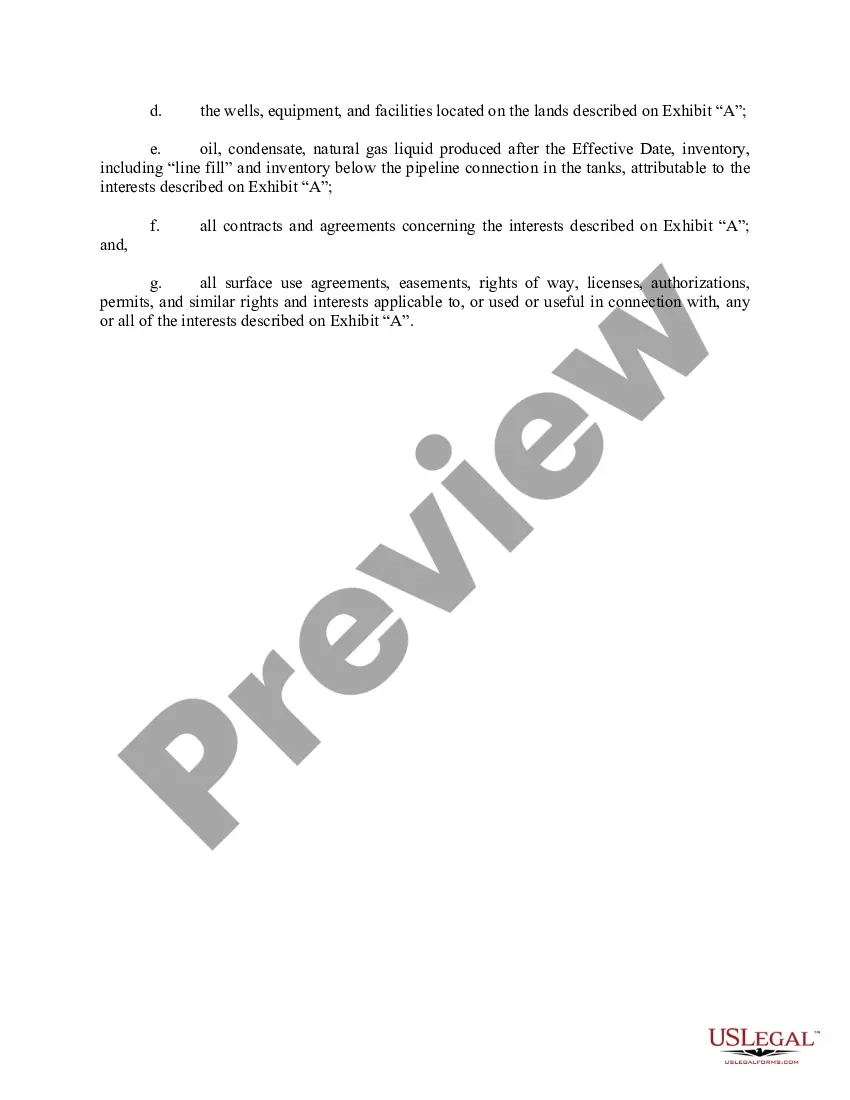

Alabama Granting Clause

Description

How to fill out Granting Clause?

You are able to commit hrs on the web trying to find the legitimate file web template that meets the state and federal requirements you want. US Legal Forms offers 1000s of legitimate forms that are reviewed by pros. It is possible to down load or printing the Alabama Granting Clause from our service.

If you currently have a US Legal Forms profile, you may log in and click on the Acquire button. Following that, you may comprehensive, revise, printing, or sign the Alabama Granting Clause. Every legitimate file web template you purchase is the one you have for a long time. To acquire an additional duplicate associated with a bought form, go to the My Forms tab and click on the corresponding button.

Should you use the US Legal Forms web site the very first time, keep to the simple instructions beneath:

- Very first, make certain you have chosen the correct file web template for the state/area of your choosing. Read the form explanation to make sure you have chosen the right form. If accessible, take advantage of the Review button to check from the file web template too.

- In order to locate an additional model of the form, take advantage of the Lookup discipline to obtain the web template that meets your requirements and requirements.

- Once you have discovered the web template you need, click on Purchase now to carry on.

- Find the costs strategy you need, enter your credentials, and register for a merchant account on US Legal Forms.

- Total the financial transaction. You should use your charge card or PayPal profile to purchase the legitimate form.

- Find the format of the file and down load it to your product.

- Make changes to your file if necessary. You are able to comprehensive, revise and sign and printing Alabama Granting Clause.

Acquire and printing 1000s of file themes utilizing the US Legal Forms web site, which provides the most important collection of legitimate forms. Use professional and state-certain themes to take on your business or individual demands.

Form popularity

FAQ

An easement provides the grantee with the right to use the non-owning property in a certain way. The grantee does not legally own or possess the property, they can only use the property for whatever specific purpose is described in the agreement.

In Alabama, this form of joint ownership is available: Joint tenancy. Property owned in joint tenancy automatically passes to the surviving owners when one owner dies. No probate is necessary.

Alabama: Alabama does not recognize joint tenancy by the entirety, and therefore, we recognize husband and wife as tenants in common. Each is free to dispose of this ownership interest.

If transfer involves a deceased owner and owner's estate has not and will not be probated, then the individual signing on behalf of deceased owner's estate must provide a Next of Kin Affidavit (MVT 5-6) and a copy of the deceased owner's death certificate. See Administrative Rule: 810-5-75-.

Unlike some states, Alabama does not currently allow the use of TOD deeds for real estate. Instead, other instruments such as joint tenancy or revocable living trusts are typically used to avoid probate when transferring real estate upon death.

If you pass away with no surviving children, during probate your spouse will receive the first $100,000 of your estate and half of the remaining balance. Front here, your parents and siblings will receive a share of any leftover assets, respectively. Of course, Alabama Intestate Succession Laws are technically finite.

If the owner of a jointly-owned property dies, the surviving owner will typically receive full ownership of the home. In most states, the property will completely avoid Probate and be transferred directly to the surviving owner.

Alabama Code § 35-4-7 states that ?in the event it is stated in the instrument creating such tenancy that such tenancy is with right of survivorship or other words used therein showing such intention, then, upon the death of one joint tenant, his interest shall pass to the surviving joint tenant or tenants ing to ...