Alabama Dissolution of Pooled Unit

Description

How to fill out Dissolution Of Pooled Unit?

Have you been in the placement the place you will need files for both business or person uses almost every day time? There are tons of authorized papers web templates accessible on the Internet, but discovering types you can rely is not simple. US Legal Forms gives a huge number of kind web templates, much like the Alabama Dissolution of Pooled Unit, that are written to meet state and federal needs.

Should you be already acquainted with US Legal Forms internet site and also have a merchant account, simply log in. Next, you can obtain the Alabama Dissolution of Pooled Unit design.

If you do not have an bank account and wish to begin to use US Legal Forms, abide by these steps:

- Discover the kind you will need and make sure it is to the appropriate city/state.

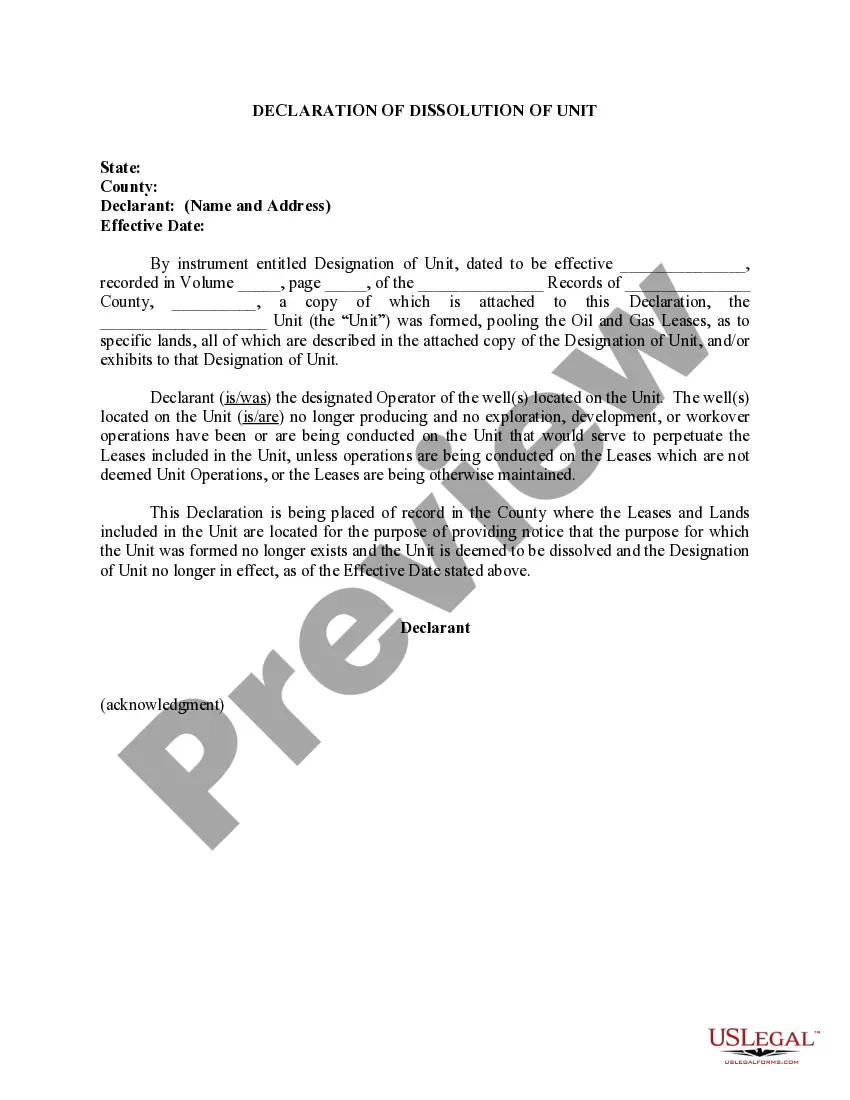

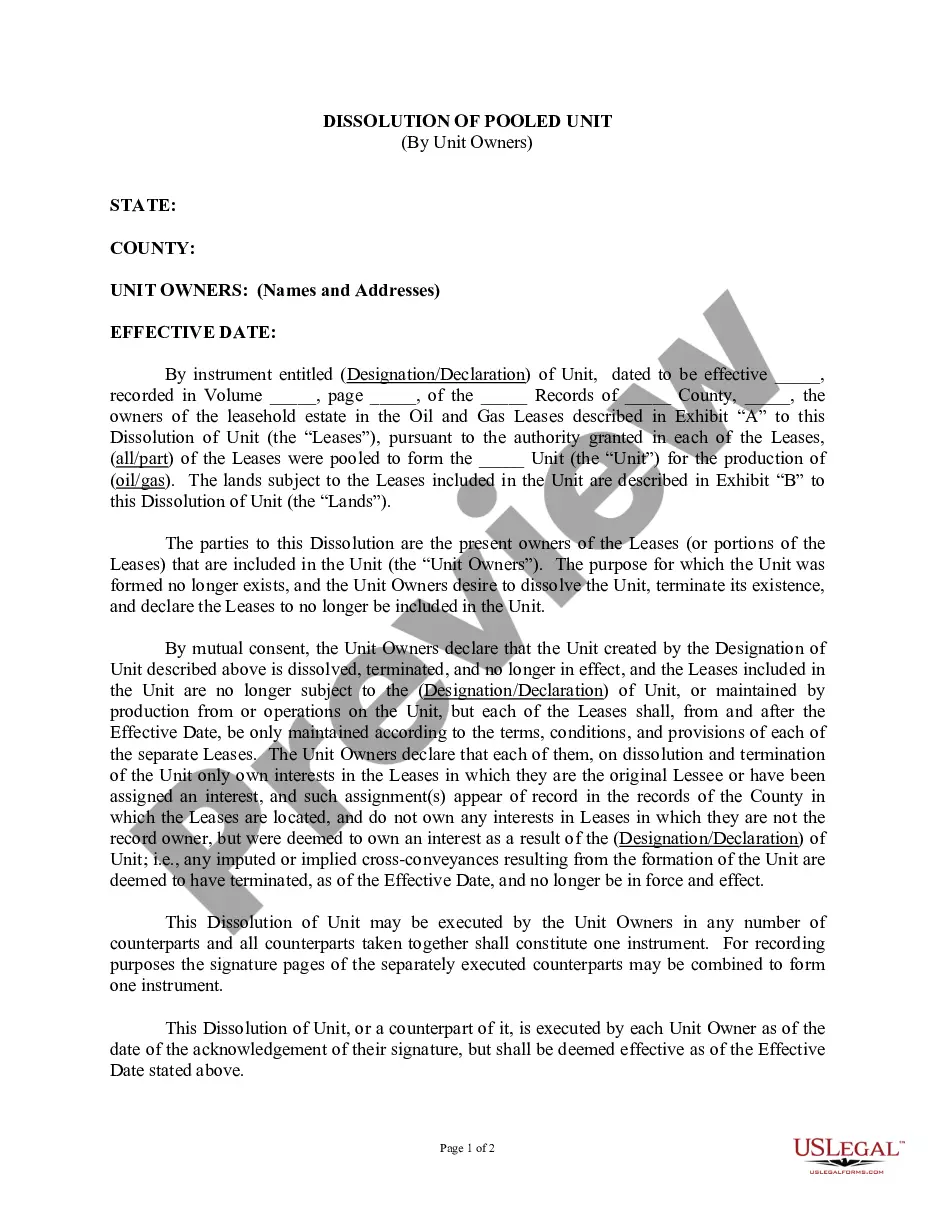

- Take advantage of the Preview button to examine the form.

- Read the description to ensure that you have selected the appropriate kind.

- In case the kind is not what you`re looking for, use the Search industry to get the kind that suits you and needs.

- When you find the appropriate kind, simply click Acquire now.

- Choose the rates program you want, complete the necessary details to make your money, and pay money for the order utilizing your PayPal or bank card.

- Choose a hassle-free file structure and obtain your backup.

Get all the papers web templates you have bought in the My Forms menu. You can obtain a extra backup of Alabama Dissolution of Pooled Unit anytime, if possible. Just click the essential kind to obtain or printing the papers design.

Use US Legal Forms, by far the most comprehensive assortment of authorized kinds, to save time as well as avoid errors. The support gives appropriately created authorized papers web templates which can be used for an array of uses. Generate a merchant account on US Legal Forms and initiate making your daily life a little easier.

Form popularity

FAQ

To dissolve your Alabama corporation, you must provide the completed original and two copies of the Domestic Business Corporation Articles of Dissolution form, to the Judge of Probate in the county where the original Certificate of Formation was recorded, by mail or in person. An original signature is required. Free guide to dissolve an Alabama Corporation Northwest Registered Agent ? corporation Northwest Registered Agent ? corporation

$100.00 *Include a check, money order, or credit card payment for the $100.00 processing fee. *The request is only accepted via mail or courier and will not be accepted via email. *You may file the dissolution online in the time it takes to type this request. Domestic LLC Dissolution - Alabama Secretary of State alabama.gov ? sites ? default ? files ? Do... alabama.gov ? sites ? default ? files ? Do...

To dissolve your LLC or corporation in Alabama, the Secretary of State filing fee of $100 is required. You will need to contact the Judge of Probate Office to verify their recording fees, but it is a minimum $50. Two separate checks are required.

Complete Articles of Dissolutions Form based on the entity type. Follow the instructions on the form pertaining to the type of entity you are dissolving. Provide any missing returns and payments as determined by ADOR staff, if found not to be in compliance to ADOR. Receive Certificate of Compliance from ADOR. How do I Withdraw or Dissolve my business? Alabama Department of Revenue (.gov) ? faqs ? how-do-i-... Alabama Department of Revenue (.gov) ? faqs ? how-do-i-...

Complete Articles of Dissolutions Form based on the entity type. Follow the instructions on the form pertaining to the type of entity you are dissolving. Provide any missing returns and payments as determined by ADOR staff, if found not to be in compliance to ADOR.

To close a business tax account administered by the Sales & Use Tax Division, complete and mail the Business Closing Form. To close your withholding tax account, select the box on Line 1 of Form A-1 or A-6. You will be instructed to complete Form A-7.

Decide to close a business. Sole proprietors can decide by themselves that they should close up shop. ... Get expert advice. ... File dissolution documents. ... Cancel registrations, permits, licenses, and business names. ... Comply with employment and labor laws. ... Resolve financial obligations.