This is the accounting form used in an accounting of a law firm on the complaint of a former partner. It includes assets, liabilities, total liabilities, net assets, and a computation of the former partner's share.

Alabama Form of Accounting Index

Description

How to fill out Form Of Accounting Index?

Have you found yourself in a situation where you regularly require documents for either business or personal purposes nearly every working day.

There are numerous legal document templates available online, but locating ones you can depend on is challenging.

US Legal Forms offers thousands of form templates, including the Alabama Form of Accounting Index, designed to adhere to both state and federal requirements.

Once you locate the correct form, click Buy now.

Select the pricing plan you prefer, provide the necessary information to create your account, and pay for the order using your PayPal or credit card. Choose a convenient file format and download your copy. Access all the document templates you have purchased in the My documents menu. You can obtain an additional copy of the Alabama Form of Accounting Index at any time if needed. Simply navigate to the required form to download or print the document template. Take advantage of US Legal Forms, one of the most extensive collections of legal forms, to save time and avoid errors. This service offers professionally crafted legal document templates suitable for various purposes. Create your account on US Legal Forms and start simplifying your life.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- Then, you will be able to download the Alabama Form of Accounting Index template.

- If you do not possess an account and wish to start using US Legal Forms, follow these instructions.

- Identify the form you need and ensure it is for the correct city/county.

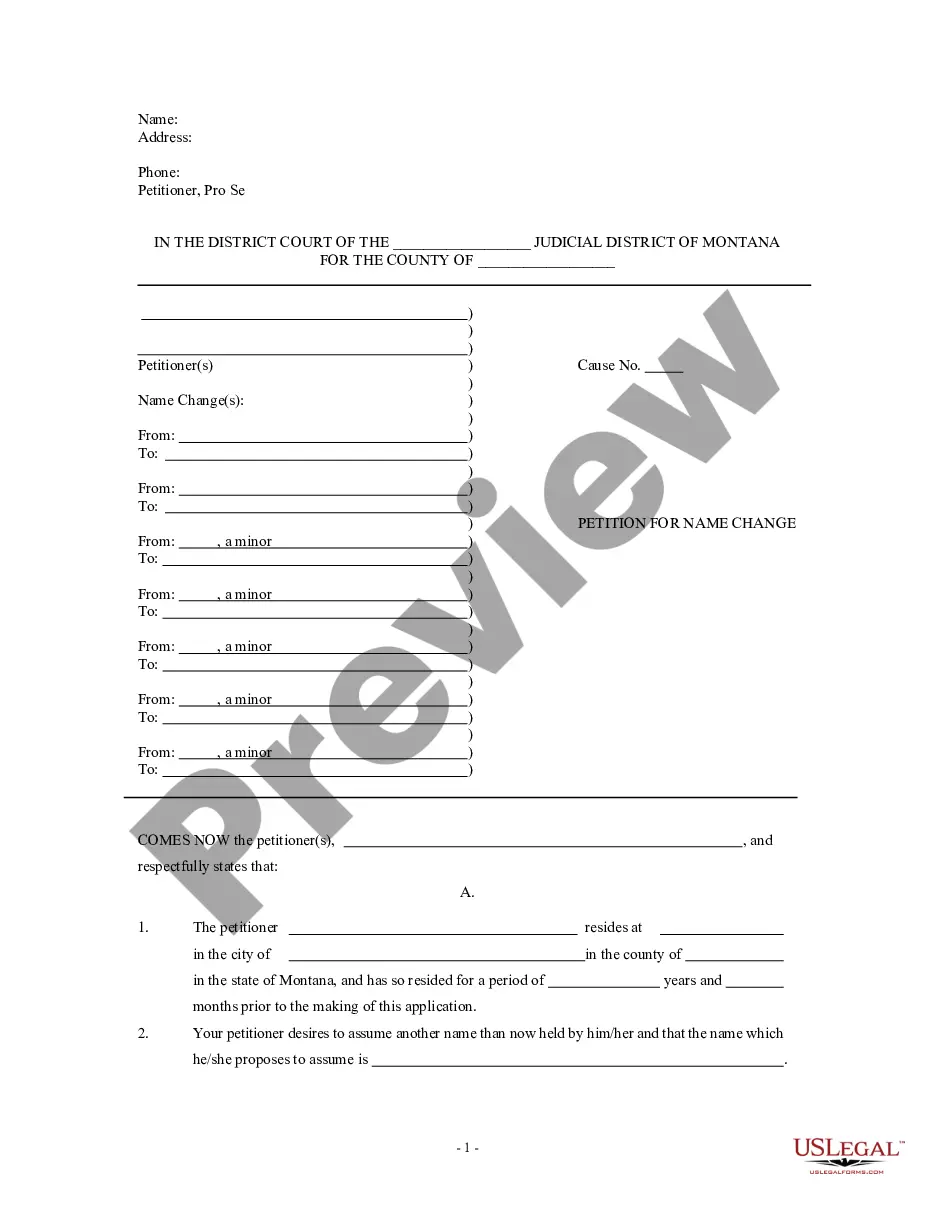

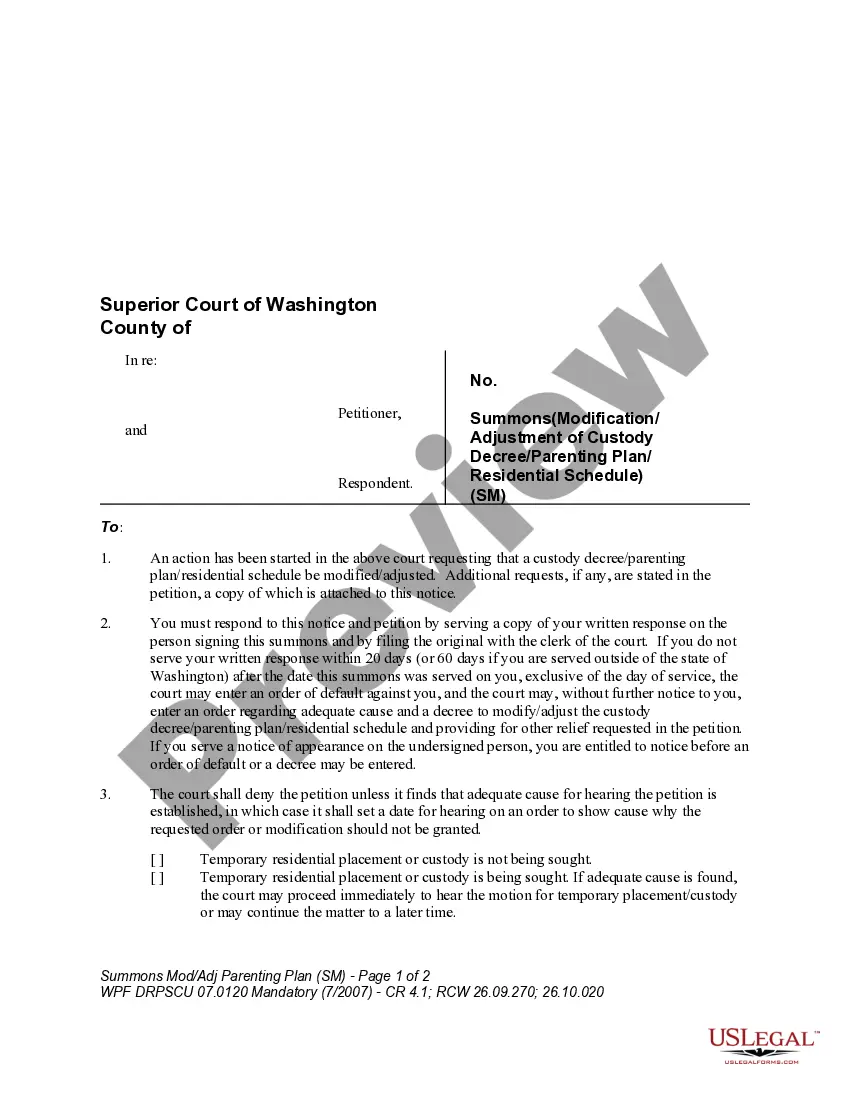

- Utilize the Review feature to examine the form.

- Check the details to confirm that you have selected the correct form.

- If the form is not what you are looking for, use the Search section to find a form that meets your needs and requirements.

Form popularity

FAQ

Calculating your Alabama AGI starts with your federal AGI, making necessary adjustments for specific Alabama regulations. This process usually includes adding back certain deductions and modifying income sources. Referencing the Alabama Form of Accounting Index can help ensure your calculations are precise, preventing errors during your tax filing.

Getting Alabama Form 40 is straightforward. You can download it directly from the Alabama Department of Revenue’s website or request a physical copy through the mail. Understanding how to use the Alabama Form of Accounting Index can guide you in filling out Form 40 accurately.

Yes, you can look up your AGI online through the IRS website if you have a copy of your prior year’s tax return. Additionally, some tax preparation services and platforms may provide access to this information. Utilizing tools related to the Alabama Form of Accounting Index can streamline this process.

To find your Alabama AGI, start by reviewing your federal tax return, as it often mirrors the amount for state purposes. You can also use the Alabama Department of Revenue's resources for guidance. With the Alabama Form of Accounting Index, you can accurately calculate your AGI for a thorough state tax review.

Your W-2 form does not directly display your AGI. Instead, it shows the total income you earned from your employer for the year. However, the information on your W-2 plays a crucial role in determining your AGI, which is vital when utilizing the Alabama Form of Accounting Index.

The A4 tax form in Alabama is used for certain tax computations, including local taxes. Many residents rely on it to clarify their tax obligations, particularly when filing state returns. Understanding its role can enhance your use of the Alabama Form of Accounting Index for accurate reporting.

Your Adjusted Gross Income (AGI) appears on various tax documents. For instance, you can locate it on your federal tax return, typically on line 11 of Form 1040. It's essential to know your AGI, especially when considering the Alabama Form of Accounting Index for state tax preparation.

To find your Alabama AGI, start by checking your federal income tax return. Your adjusted gross income will be reported on your Form 1040. For specific guidance on how this AGI affects your Alabama tax situation, consult the Alabama Form of Accounting Index to navigate potential adjustments and deductions.

Yes, Alabama offers certain tax exemptions specifically for senior citizens. These exemptions may include a portion of Social Security benefits and other retirement income. To explore all available exemptions, refer to the Alabama Form of Accounting Index for comprehensive guidelines and eligibility requirements.

You can find your AGI by reviewing your federal tax return, specifically on Form 1040. The AGI is typically found on line 11 of the form. For assistance in understanding your AGI in the context of Alabama taxes, consider checking the Alabama Form of Accounting Index for additional details and resources.