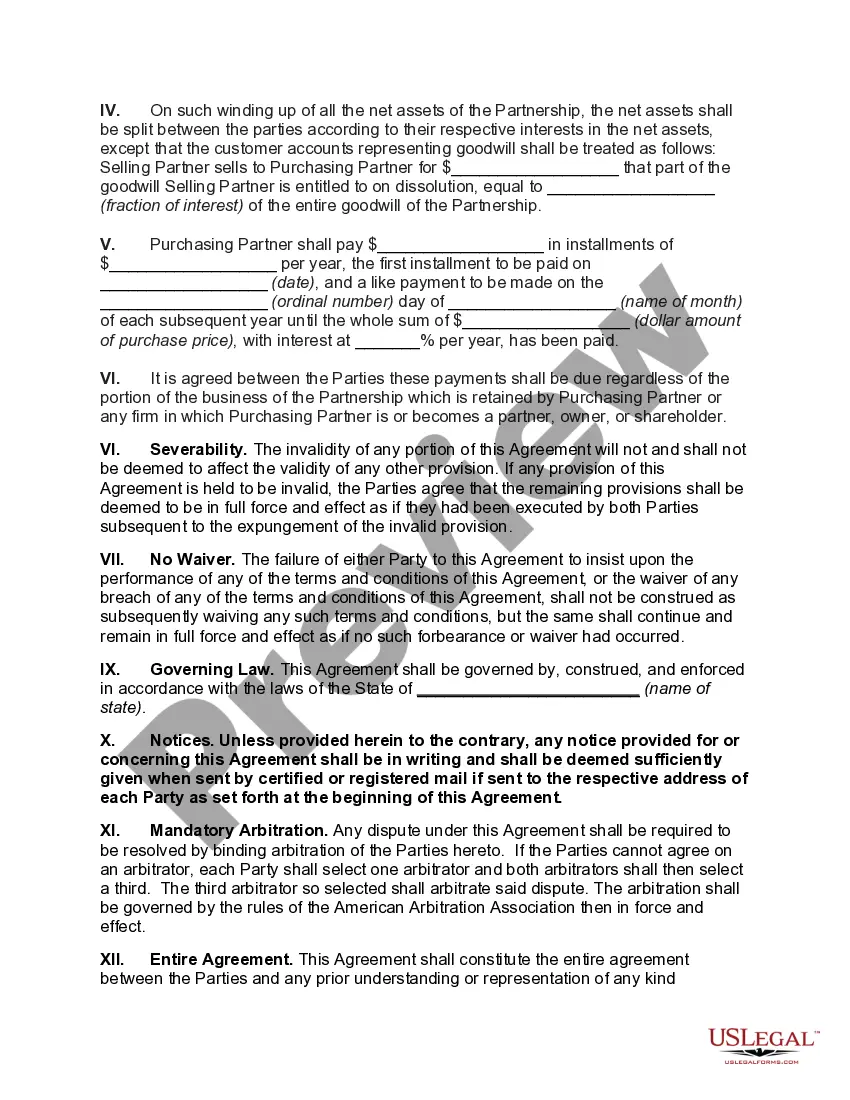

Alabama Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets

Description

How to fill out Agreement To Dissolve And Wind Up Partnership With Sale To Partner And Disproportionate Distribution Of Assets?

If you need to thorough, download, or print legal document templates, utilize US Legal Forms, the largest assortment of legal forms available on the internet.

Take advantage of the site's straightforward and user-friendly search to locate the documents you require.

Various templates for commercial and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you want, click on the Get now button. Choose the pricing plan you prefer and enter your information to register for the account.

Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Employ US Legal Forms to find the Alabama Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets in just a few clicks.

- If you are already a US Legal Forms user, Log Into your account and click on the Obtain button to locate the Alabama Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets.

- You can also access forms you previously submitted electronically in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the guidelines below.

- Step 1. Ensure you select the form for the correct city/state.

- Step 2. Use the Preview option to review the form's content. Don't forget to read the overview.

- Step 3. If you are unhappy with the type, use the Search box at the top of the screen to find different versions of the legal form template.

Form popularity

FAQ

Removing a partner from a general partnership is the act of removing someone from your business that operates as a partnership. It can happen in several different ways, but the most common option is through a clause in the partnership agreement itself.

If dissolution is not covered in the partnership agreement, the partners can later create a separate dissolution agreement for that purpose. However, the default rule is that any remaining money or property will be distributed to each partner according to their ownership interest in the partnership.

To dissolve an LLC in Alabama, simply follow these three steps: Follow the Operating Agreement....Step 1: Follow Your Alabama LLC Operating Agreement. For most LLCs, the steps for dissolution will be outlined in the operating agreement.Step 2: Close Your Business Tax Accounts.Step 3: File Articles of Dissolution.28-Feb-2022

Can Partners Take Unequal Distributions? You may be entitled to unequal distribution of partnership profits regardless of the partners' share of capital under a partnership agreement. An S Corporation cannot take advantage of this tax break because it cannot adjust its tax bill in this way.

LLCs are not required to periodically distribute profits to members. If profits are distributed, a member still has an equal claim for future distributions.

Do partnership distributions have to be equal? Partner equity does not typically equate to equivalent investment contributions from all business partners. Instead, partners can make equal contributions to the company and possess equal ownership rights, but make contributions in a variety of different forms.

There are only two ways in which a partner can be removed from a partnership or an LLP. The first is through resignation and the second is through an involuntary departure, forced by the other partners in accordance with the terms of a partnership agreement.

There are 4 steps to follow for changing the partnership deed:Step 1: Take the mutual consent of partners.Step 2: Prepare for making a supplementary partnership deed.Step 3: Executing supplementary partnership deed.Step 4: Do the filing with Registrar of Firm (RoF).14-Sept-2018

A distribution is disproportionate if a partner receives more or less than his pro rata share of IRC 751(b) hot assets. Partnership distributes money and/or property to a partner.

A disproportionate distribution is a payout of corporate profits whereby some shareholders receive cash or other assets and others receive an increased interest in the company.