Maine Final Notice of Past Due Account

Description

How to fill out Final Notice Of Past Due Account?

Are you facing the circumstance where you require documents for either business or personal purposes nearly every day.

There are numerous legal document templates accessible online, but finding ones you can trust is challenging.

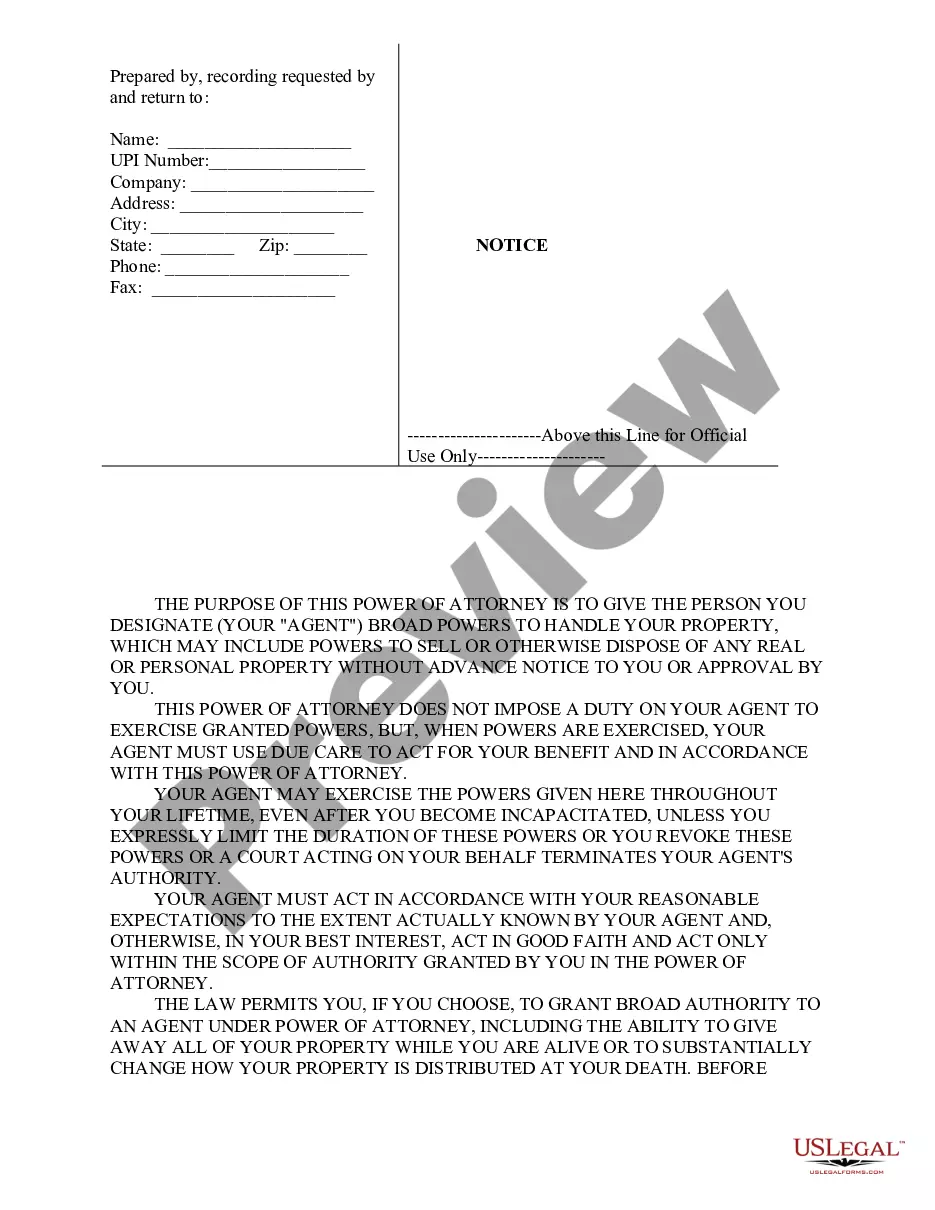

US Legal Forms offers thousands of form templates, including the Maine Final Notice of Past Due Account, designed to comply with federal and state regulations.

Once you find the correct form, click Buy now.

Choose the pricing plan you prefer, fill in the required information to create your account, and pay for the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have your account, simply Log In.

- After that, you can download the Maine Final Notice of Past Due Account template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it corresponds to the correct city/state.

- Use the Preview button to review the form.

- Check the description to confirm you have chosen the right form.

- If the form does not match what you are looking for, use the Search field to locate the form that suits your needs and requirements.

Form popularity

FAQ

How do you cancel your sales tax permit in Maine? In order to cancel your sales tax permit in Maine, you will need to check a box on your Maine sales tax return indicating that you have closed or sold your business. You may do this on Maine's online portal as well.

Electronic payments can be made using Web Pay on the Franchise Tax Board's (FTB's) website, electronic funds withdrawal (EFW) as part of the e-file tax return, or your credit card. For more information or to obtain the waiver form, go to ftb.ca.gov/e-pay.

Taxpayers must understand that, even if they file for an extension on their tax return, they are only given an extension to 'file' not to 'pay'. Meaning, even if you file an extension, you are still required to pay or incur penalties.

Maine personal extensions are automatic, which means there is no form or application to submit. A Maine tax extension will give you 6 more months to file, moving the deadline to October 15. Note that a tax extension does not give you more time to file your return.

You can get an automatic extension of time to file your tax return by filing Form 4868 electronically. You'll receive an electronic acknowledgment once you complete the transaction. Keep it with your records. Don't mail in Form 4868 if you file electronically, unless you're making a payment with a check or money order.

If you are unable to file your return by the original due date, Maine will allow an automatic six-month extension of time in which to file your return. Requests for additional time beyond the automatic six-month extension to file must be submitted in writing prior to the expiration of the six-month period.

Extensions - Maine allows an automatic extension of six months. At least 90% of the tax owed must be paid by the original return due date to avoid a penalty. Any extension granted is for time to file and does NOT extend time to pay.

General Instructions Employers and other payers who withhold Maine income tax during the calendar year must file an annual reconciliation (Form W-3ME) on or before February 28 of the following year.

A Maine tax extension will give you 6 more months to file, moving the deadline to October 15. Note that a tax extension does not give you more time to file your return. To avoid penalty charges, your Maine tax liability must be fully paid by the original due date (April 15).