Alabama Underwriter Agreement - Self-Employed Independent Contractor

Description

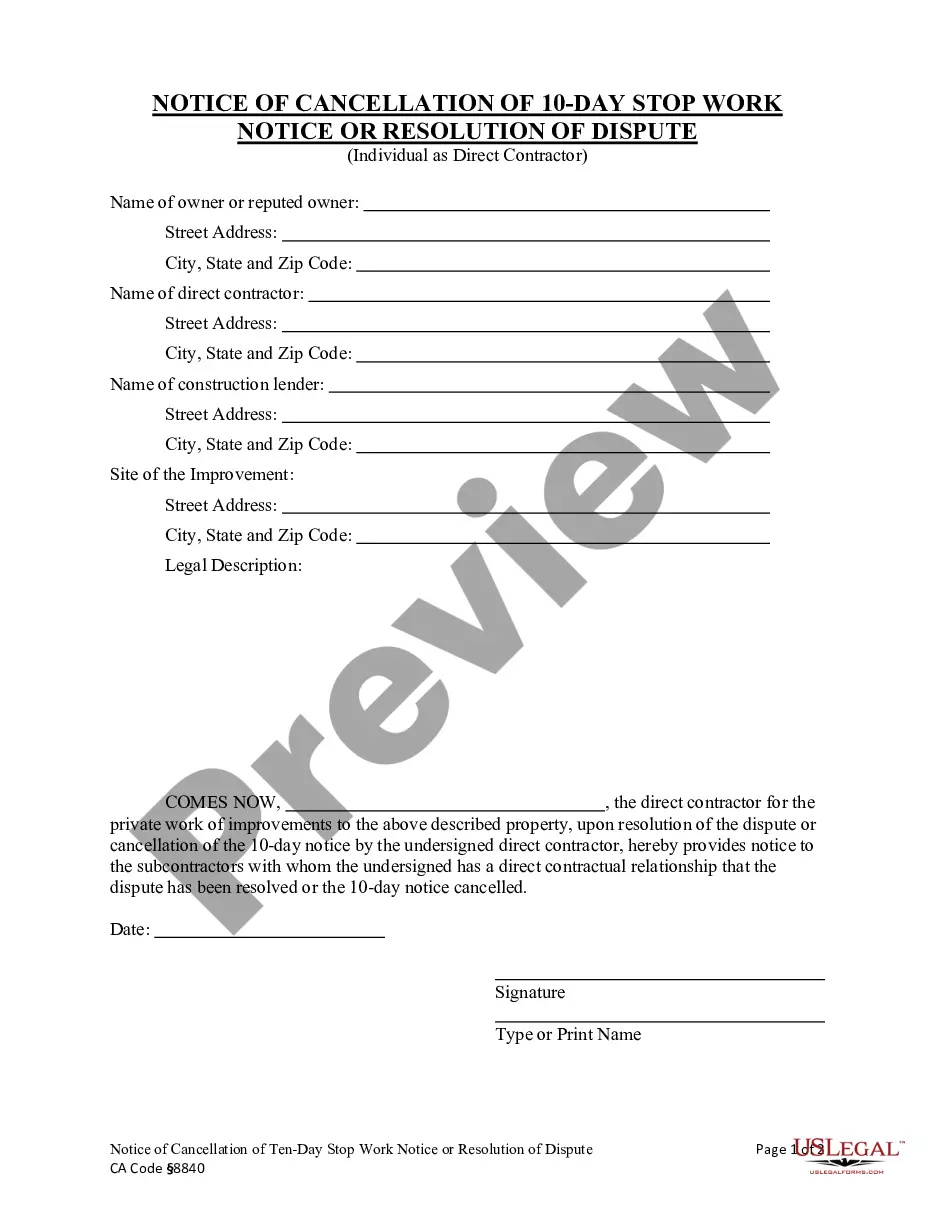

How to fill out Underwriter Agreement - Self-Employed Independent Contractor?

If you want to complete, download, or create legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site's simple and user-friendly search to find the documents you require.

A range of templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Buy now button. Choose the pricing plan you prefer and enter your information to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment. Step 6. Choose the format of the legal form and download it onto your device. Step 7. Complete, modify, and print or sign the Alabama Underwriter Agreement - Self-Employed Independent Contractor. Every legal document template you purchase is yours indefinitely. You will have access to every form you saved within your account. Select the My documents section and choose a form to print or download again. Complete and download, and print the Alabama Underwriter Agreement - Self-Employed Independent Contractor with US Legal Forms. There are countless professional and state-specific forms available for your business or personal needs.

- Use US Legal Forms to acquire the Alabama Underwriter Agreement - Self-Employed Independent Contractor with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Alabama Underwriter Agreement - Self-Employed Independent Contractor.

- You can also access forms you have previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Make sure you have selected the form for the correct city/state.

- Step 2. Use the Review option to examine the form's content. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

Creating an independent contractor agreement involves outlining the terms of your relationship with the client. Start with basic information, including the project scope, payment terms, and deadlines. Utilizing the Alabama Underwriter Agreement - Self-Employed Independent Contractor template can simplify this process, as it provides a clear framework and ensures compliance with relevant regulations. Make sure both parties review and sign the agreement before beginning any work.

As a self-employed independent contractor, you can receive payments through various methods. Many clients prefer direct bank transfers, which are efficient and secure. You can also use payment platforms like PayPal or Venmo for quick transactions. When working under the Alabama Underwriter Agreement - Self-Employed Independent Contractor, ensure you clearly establish your payment terms with each client to avoid any misunderstandings.

To fill out an independent contractor agreement, begin with the names and addresses of both parties involved. Clearly outline the services provided, payment terms, and duration of the contract. Additionally, make sure to incorporate relevant aspects of the Alabama Underwriter Agreement - Self-Employed Independent Contractor to ensure that all legal obligations are met and understood.

Yes, independent contractors file taxes as self-employed individuals. They report their income on Schedule C when filing their personal tax return. Using the Alabama Underwriter Agreement - Self-Employed Independent Contractor can help clarify tax reporting obligations, ensuring that you remain compliant and organized.

Filling out an independent contractor form begins with entering your personal information such as name and address. Next, specify your services and payment details, ensuring you comply with requirements under the Alabama Underwriter Agreement - Self-Employed Independent Contractor. Double-check for accuracy, as this information will be essential for tax and legal purposes.

To write an independent contractor agreement, start with a clear introduction of both parties, followed by the scope of work and payment terms. Include provisions for confidentiality and termination, as well as details regarding the Alabama Underwriter Agreement - Self-Employed Independent Contractor. This structure helps to establish clear expectations and protects both parties involved.

Independent contractors in Alabama generally need to complete a W-9 form to provide their taxpayer identification information. Additionally, they may need to fill out any specific forms related to the Alabama Underwriter Agreement - Self-Employed Independent Contractor, depending on their industry. Ensuring you have the right documentation protects both you and your clients.

In Alabama, a subcontractor typically has six months from the date of the last work performed or materials supplied to file a lien. It is crucial to adhere to this timeframe to protect your rights on the job site. Understanding the Alabama Underwriter Agreement - Self-Employed Independent Contractor is vital, as it can help to clarify your responsibilities regarding lien rights.

Yes, being an independent contractor means you are self-employed. You maintain control over how you complete your work, and you aren’t under the direct supervision of an employer. This relationship is further clarified by the Alabama Underwriter Agreement - Self-Employed Independent Contractor, which outlines your rights and responsibilities.

Yes, you can certainly be self-employed and operate under a contract. Contracts are common in self-employment, detailing the services you provide and terms of payment. They serve as a crucial document that protects both you and your clients, particularly in the context of the Alabama Underwriter Agreement - Self-Employed Independent Contractor.