Alabama Payroll Deduction Authorization Form for Optional Matters - Employee

Description

How to fill out Payroll Deduction Authorization Form For Optional Matters - Employee?

Are you presently in a location where you will require documents for both business or personal purposes almost every day.

There are numerous legal document templates available online, but finding reliable ones is challenging.

US Legal Forms offers thousands of document templates, such as the Alabama Payroll Deduction Authorization Form for Optional Matters - Employee, that are designed to meet federal and state requirements.

Access all the document templates you have purchased in the My documents menu.

You can always retrieve an additional copy of the Alabama Payroll Deduction Authorization Form for Optional Matters - Employee if needed. Just select the desired form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Alabama Payroll Deduction Authorization Form for Optional Matters - Employee template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

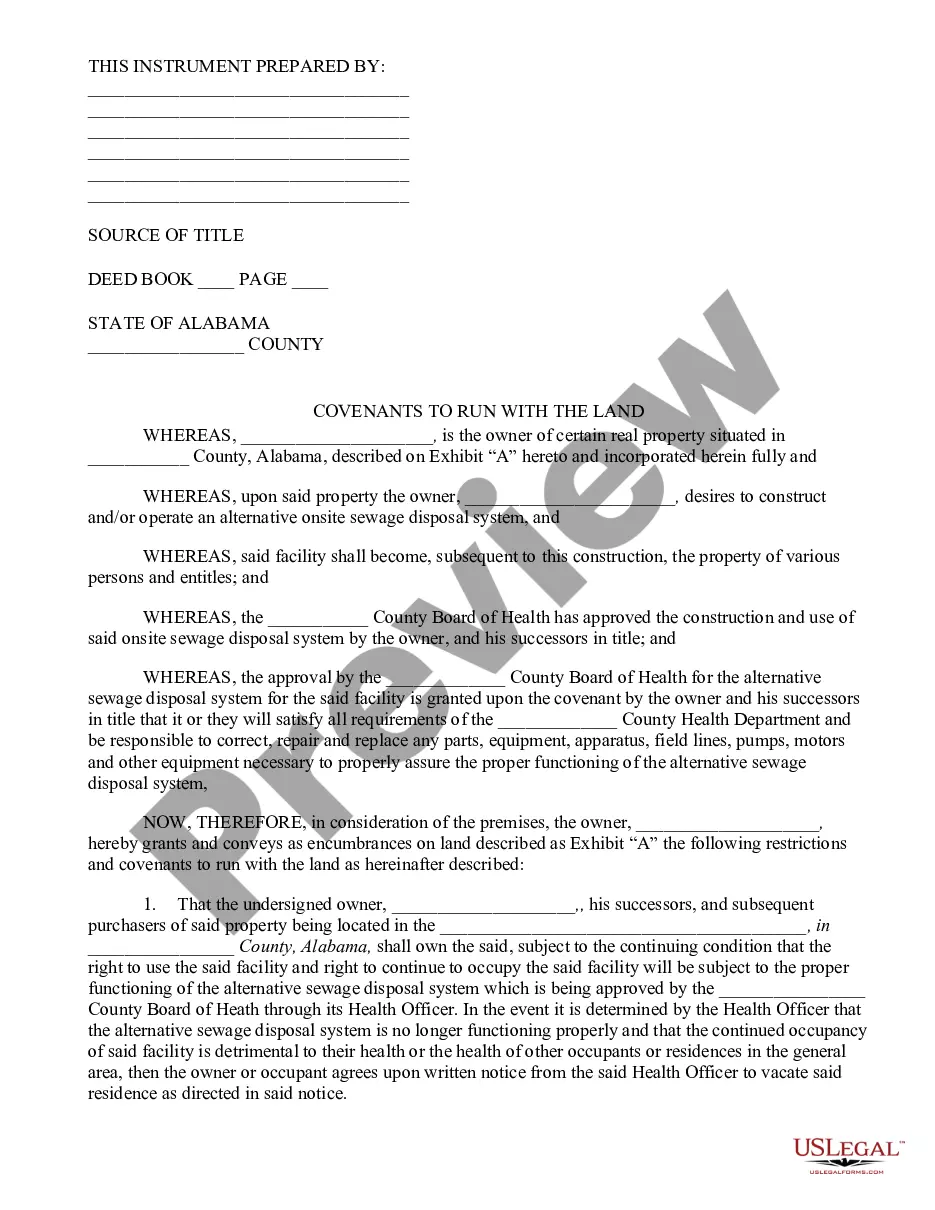

- Use the Preview button to review the form.

- Check the description to confirm you have selected the right form.

- If the form is not what you are looking for, use the Search field to locate the form that meets your requirements.

- Once you find the correct form, click Get now.

- Select the pricing plan you want, fill in the necessary information to create your account, and pay for the order using your PayPal or Visa/Mastercard.

- Choose a suitable file format and download your copy.

Form popularity

FAQ

Yes, Alabama allows employers to deduct federal income tax from employees' wages as mandated by federal regulations. This deduction is standard practice and is crucial for compliance with tax laws. For additional optional deductions, the Alabama Payroll Deduction Authorization Form for Optional Matters - Employee helps clarify what other deductions can be made in alignment with Alabama state guidelines.

Form 2159 is used to request a payroll deduction authorization for various purposes, including voluntary contributions to retirement accounts or other benefits. This form is essential for maintaining records of employee authorizations. Completing the Alabama Payroll Deduction Authorization Form for Optional Matters - Employee can simplify this process, making it easier to track and manage payroll deductions efficiently.

The form for payroll deduction permission is designed to grant employers the authority to withdraw specified amounts from an employee's wages. Employees can indicate their preferences for various optional deductions on this form. By using the Alabama Payroll Deduction Authorization Form for Optional Matters - Employee, you ensure that all deductions are properly documented and compliant with state laws.

Payroll authorization is the process where an employee gives consent for their employer to deduct specific amounts from their paycheck. This process protects both the employer and the employee by formalizing the expectations for deductions. The Alabama Payroll Deduction Authorization Form for Optional Matters - Employee provides the necessary legal framework for this agreement, fostering transparency and trust.

A payroll request form is a tool used by employees to request specific deductions or changes to their payroll options. It typically includes details such as the type of deduction and the amount to be deducted. Utilizing the Alabama Payroll Deduction Authorization Form for Optional Matters - Employee can streamline these requests, ensuring they are processed efficiently and accurately.

A payroll deduction agreement is a document that outlines the specific deductions that an employer will make from an employee's paycheck. This agreement is crucial for managing optional matters like insurance, retirement contributions, and other benefits. By using the Alabama Payroll Deduction Authorization Form for Optional Matters - Employee, both employers and employees can ensure clarity and compliance in their payroll processes.

A payroll deduction authorization form is a document that employees use to request specific deductions from their paychecks. This form outlines the types of deductions, their amounts, and the employee's consent to have these amounts deducted. Utilizing the Alabama Payroll Deduction Authorization Form for Optional Matters - Employee ensures that all deductions are properly documented.

An optional payroll deduction is a voluntary deduction taken from an employee's paycheck for various benefits or services. Employees can select what deductions they wish to have, typically varying by employer. The Alabama Payroll Deduction Authorization Form for Optional Matters - Employee plays a crucial role in properly establishing these choices.

Optional deductions often include items like union dues, charitable contributions, or health and wellness benefits. These deductions are initiated by employees based on their individual preferences. When completing the Alabama Payroll Deduction Authorization Form for Optional Matters - Employee, make sure to specify your choices clearly.

To fill out form A4, gather the necessary information such as your name, employee identification number, and the details about the optional deduction. Follow the provided instructions closely, ensuring accuracy to avoid processing issues. If you need assistance, the Alabama Payroll Deduction Authorization Form for Optional Matters - Employee can guide you through the necessary steps.