Alabama Stock Option Grants and Exercises and Fiscal Year-End Values

Description

How to fill out Stock Option Grants And Exercises And Fiscal Year-End Values?

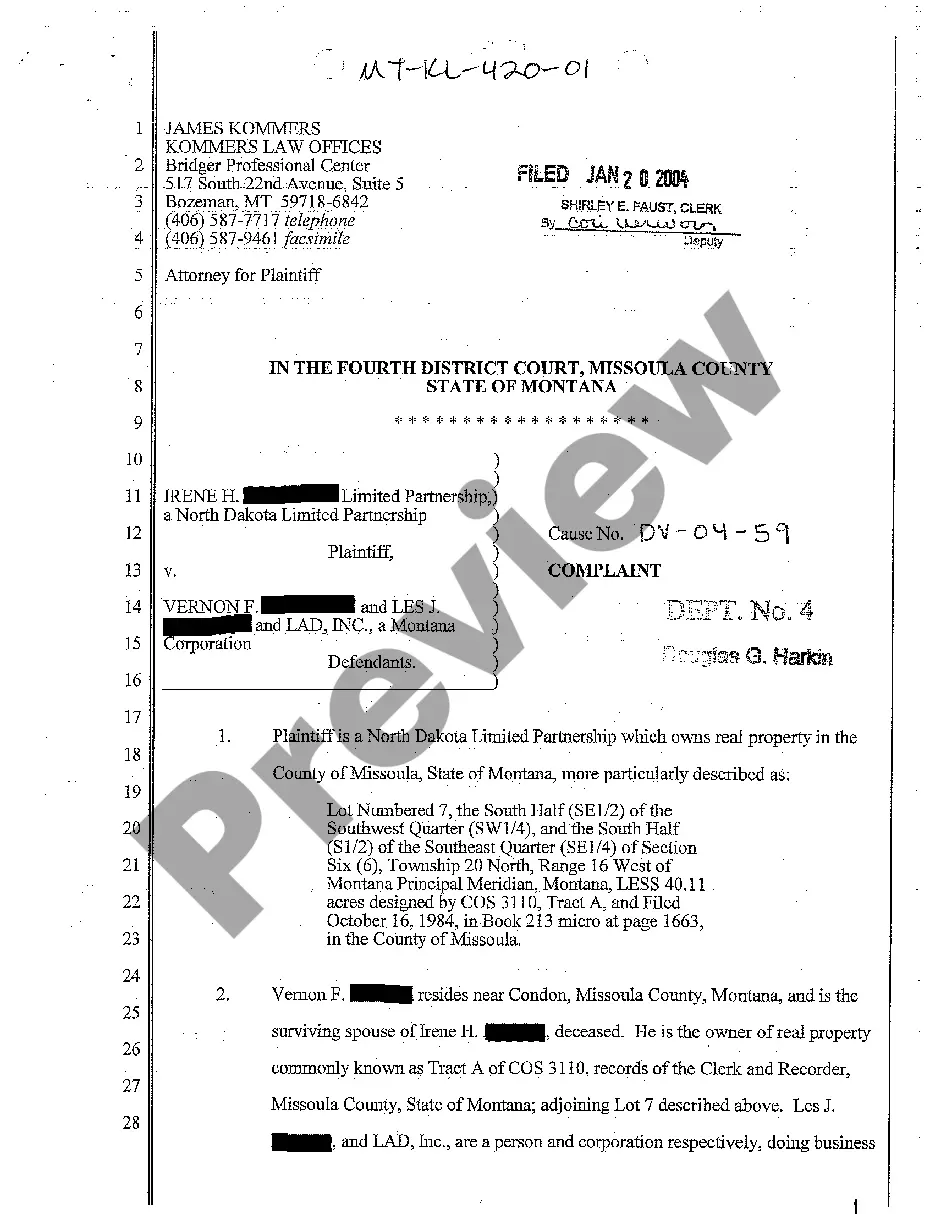

Are you inside a situation where you need documents for both organization or person purposes almost every working day? There are plenty of legitimate papers layouts accessible on the Internet, but finding kinds you can depend on is not effortless. US Legal Forms provides a large number of kind layouts, just like the Alabama Stock Option Grants and Exercises and Fiscal Year-End Values, that are created to fulfill federal and state requirements.

When you are previously informed about US Legal Forms site and possess a merchant account, basically log in. After that, it is possible to download the Alabama Stock Option Grants and Exercises and Fiscal Year-End Values design.

If you do not provide an bank account and would like to start using US Legal Forms, follow these steps:

- Obtain the kind you require and ensure it is to the proper city/county.

- Take advantage of the Preview switch to examine the shape.

- See the explanation to actually have chosen the proper kind.

- If the kind is not what you are looking for, take advantage of the Research field to obtain the kind that suits you and requirements.

- If you discover the proper kind, click on Get now.

- Opt for the prices plan you would like, fill out the desired details to make your account, and buy your order with your PayPal or Visa or Mastercard.

- Select a practical paper format and download your version.

Discover all the papers layouts you might have purchased in the My Forms menu. You can get a more version of Alabama Stock Option Grants and Exercises and Fiscal Year-End Values at any time, if necessary. Just go through the essential kind to download or printing the papers design.

Use US Legal Forms, by far the most considerable collection of legitimate varieties, to conserve efforts and steer clear of blunders. The assistance provides appropriately manufactured legitimate papers layouts which can be used for a range of purposes. Produce a merchant account on US Legal Forms and start producing your daily life a little easier.

Form popularity

FAQ

When an employee exercises stock options, you'll credit Common Stock for the number of shares x par value, debit Cash for the number of shares x the exercise price, then debit Additional Paid-In Capital for the difference, representing the increase in value of the shares during the service period.

Current accounting standards require firms to recognize as an expense (deduct from their income) the value of the compensation they provide in the form of employee stock options. For some types of employee stock options they grant, however, firms can choose how to measure that value.

What kinds of loans are available to exercise stock options? Personal (or consumer) loans. A personal or consumer loan is any kind of loan that you can get straight from a bank or consumer-lending startup. ... Home equity loans. ... Margin loans (or portfolio lines of credit) ... Company loans.

If the plan was a nonstatutory stock option, your basis is the sum of these: Price you paid for the stock. Any ordinary income reported on your W-2 when you exercised the option.

A stock option is the right to buy a specific number of shares of company stock at a pre-set price, known as the ?exercise? or ?strike price.? You take actual ownership of granted options over a fixed period of time called the ?vesting period.? When options vest, it means you've ?earned? them, though you still need to ...

When you buy an open-market option, you're not responsible for reporting any information on your tax return. However, when you sell an option?or the stock you acquired by exercising the option?you must report the profit or loss on Schedule D of your Form 1040.

An employee stock option plan gives you the right to buy a certain number of shares of company stock at a set price called the ?grant price? (also known as the ?exercise price? or ?strike price?) over a set period of time. Your options have an expiration date and a vesting date.

Under the fair value method of the current accounting standard, the value of employee stock options is measured when they are granted. However, the options' value might also be measured at the end of the vesting period or when they are exercised, and arguments for measuring value at those points have been made.