Alabama Approval of performance goals for bonus

Description

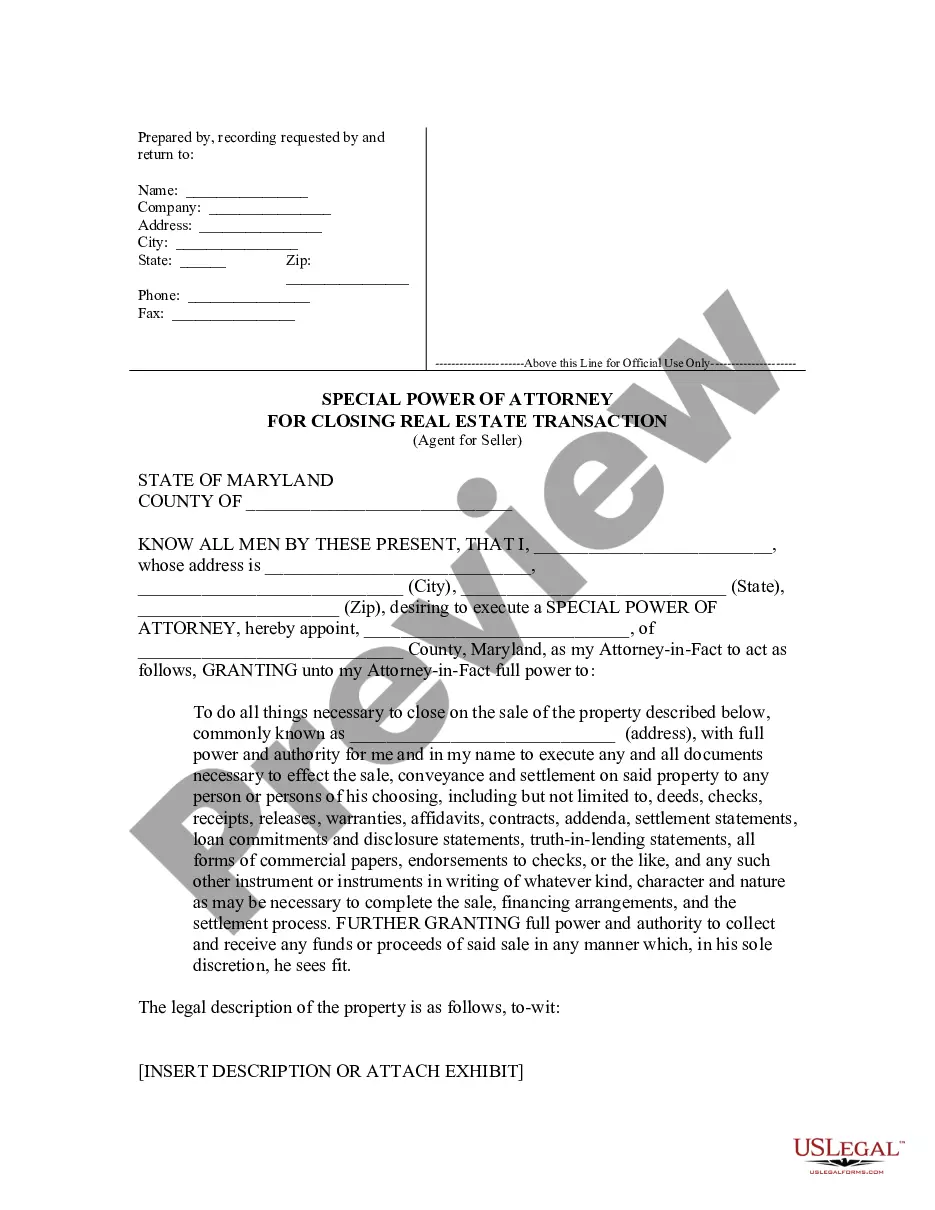

How to fill out Approval Of Performance Goals For Bonus?

You are able to spend several hours on the web trying to find the lawful document format that fits the federal and state demands you want. US Legal Forms offers a large number of lawful kinds that happen to be analyzed by professionals. It is possible to down load or printing the Alabama Approval of performance goals for bonus from your assistance.

If you already have a US Legal Forms profile, you may log in and click the Download option. Following that, you may comprehensive, modify, printing, or indicator the Alabama Approval of performance goals for bonus. Every single lawful document format you buy is your own for a long time. To have yet another duplicate of any obtained kind, proceed to the My Forms tab and click the related option.

Should you use the US Legal Forms internet site the first time, follow the easy recommendations under:

- Initially, make sure that you have chosen the correct document format for your state/city of your choice. See the kind outline to ensure you have picked out the correct kind. If accessible, utilize the Review option to look through the document format as well.

- If you want to get yet another model from the kind, utilize the Research discipline to find the format that meets your requirements and demands.

- Upon having identified the format you desire, simply click Buy now to carry on.

- Select the rates strategy you desire, key in your references, and register for a free account on US Legal Forms.

- Full the deal. You can use your Visa or Mastercard or PayPal profile to purchase the lawful kind.

- Select the structure from the document and down load it to the device.

- Make alterations to the document if necessary. You are able to comprehensive, modify and indicator and printing Alabama Approval of performance goals for bonus.

Download and printing a large number of document templates utilizing the US Legal Forms website, which offers the most important collection of lawful kinds. Use expert and condition-specific templates to handle your small business or person requirements.

Form popularity

FAQ

The gross amount of the employee bonus is $400.00. All full-time and part-time state employees are eligible for the entire bonus amount (no proration for length of service).

David Bronner: $834,034 He is the highest-paid state employee in Alabama, raking in a whopping $834,034 in 2021, almost twice the salary of Dr. Anthony Fauci, the highest-paid federal employee.

The House voted 105-0 for HB 124, sponsored by Ways and Means General Fund Chairman Rex Reynolds, R-Huntsville, which provides $3 billion to the General Fund budget that provides broad funding increases for most state agencies and includes a 2% pay raise for state employees. The legislation moves to the Senate.

Workers in many industries depend on bonuses in addition to whatever wage or salary they make. While an employer is not required to offer them, once an employer promises one or has an existing bonus program, they may become obligated to pay employees who qualify for the bonus.

Yes. Bonuses are taxed more than regular pay because they are considered supplemental income.

Upon approval and implementation of an employee suggestion that is meritorious, the Employees' Suggestion Incentive Board shall award the employee submitting the suggestion a one-time cash award of one thousand dollars ($1,000).

If you were supposed to be paid a bonus conditioned on performance, and you met the conditions for the bonus, you may have a basis to sue. Similarly, if the bonus was not taken into account in the overtime pay that has been paid to you, you may also have a basis to sue.