Alabama Deferred Compensation Agreement by First Florida Bank, Inc. for Key Employees

Description

How to fill out Deferred Compensation Agreement By First Florida Bank, Inc. For Key Employees?

US Legal Forms - among the most significant libraries of authorized varieties in the States - gives a wide range of authorized document themes you are able to down load or print. Making use of the web site, you can find a large number of varieties for company and individual purposes, categorized by groups, states, or key phrases.You will find the most up-to-date types of varieties like the Alabama Deferred Compensation Agreement by First Florida Bank, Inc. for Key Employees within minutes.

If you have a monthly subscription, log in and down load Alabama Deferred Compensation Agreement by First Florida Bank, Inc. for Key Employees through the US Legal Forms collection. The Down load button will appear on each kind you view. You get access to all formerly acquired varieties inside the My Forms tab of the account.

If you want to use US Legal Forms initially, listed here are easy directions to get you started out:

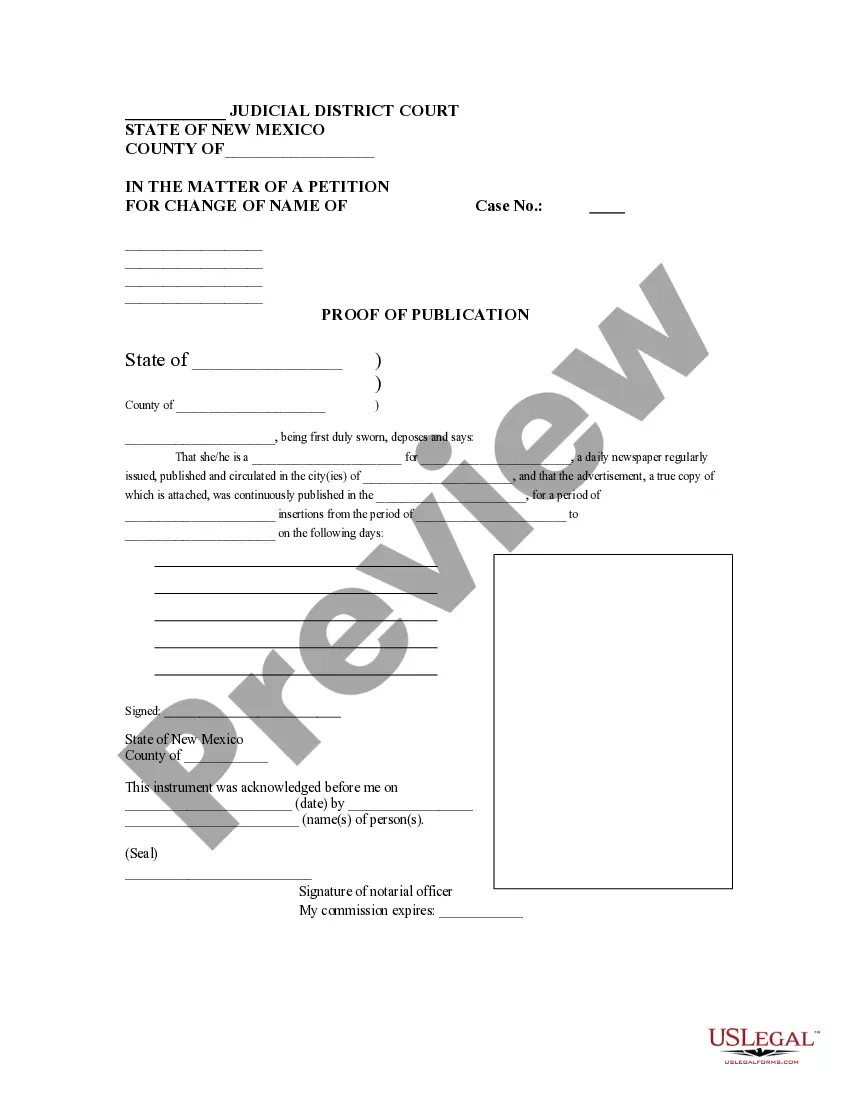

- Make sure you have picked the proper kind for your personal city/state. Go through the Preview button to analyze the form`s content. Look at the kind description to actually have chosen the proper kind.

- If the kind doesn`t suit your specifications, take advantage of the Research discipline at the top of the display to get the one that does.

- When you are happy with the form, verify your option by clicking the Buy now button. Then, choose the prices prepare you like and offer your credentials to register for an account.

- Method the financial transaction. Use your bank card or PayPal account to perform the financial transaction.

- Find the structure and down load the form on the product.

- Make alterations. Fill out, revise and print and signal the acquired Alabama Deferred Compensation Agreement by First Florida Bank, Inc. for Key Employees.

Each template you added to your account lacks an expiration time which is your own for a long time. So, in order to down load or print yet another version, just go to the My Forms section and click in the kind you require.

Get access to the Alabama Deferred Compensation Agreement by First Florida Bank, Inc. for Key Employees with US Legal Forms, probably the most extensive collection of authorized document themes. Use a large number of skilled and express-distinct themes that satisfy your organization or individual requirements and specifications.

Form popularity

FAQ

You can take out small or large sums anytime, or you can set up automatic, periodic payments. If your plan allows it, you may be able to have direct deposit which allows for fast transfer of funds. Unlike a check, direct deposit typically doesn't include a hold on the funds from your account.

RSA-1 is an Internal Revenue Code Section 457 deferred compensation plan for public employees. This voluntary plan allows you to save and invest extra money for retirement, tax deferred. Not only will you defer taxes immediately, your contributions and any earnings will grow on a tax-deferred basis as well.

Key Takeaways. Deferred compensation plans allow employees to withhold a certain amount of their salaries or wages for a specific purpose. Deferred compensation plans can be qualified or non-qualified. Qualified plans fall under the Employee Retirement Income Security Act and include 401(k)s and 403(b)s.

The Florida Deferred Compensation Plan is a supplemental retirement plan for employees of the State of Florida, including OPS employees and employees of the State University System, State Board of Administration, Division of Rehab and Liquidation, Special Districts*, and Water Management Districts* [established under ...

Deferred compensation plans are an incentive that employers use to hold onto key employees. Deferred compensation can be structured as either qualified or non-qualified under federal regulations. Some deferred compensation is made available only to top executives.

Your Contributions One easy way to increase your retirement savings is to contribute a percentage of your income to your Deferred Compensation Plan (DCP) account. Consider saving between 7% and 10% of your salary.

The Bottom Line. If you have a qualified plan and have passed the vesting period, your deferred compensation is yours, even if you quit with no notice on very bad terms. If you have a non-qualified plan, you may have to forfeit all of your deferred compensation by quitting depending on your plan's specific terms.

Deferred compensation plans don't have required minimum distributions, either. Based upon your plan options, generally, you may choose 1 of 2 ways to receive your deferred compensation: as a lump-sum payment or in installments.