Alabama Determining Self-Employed Independent Contractor Status

Description

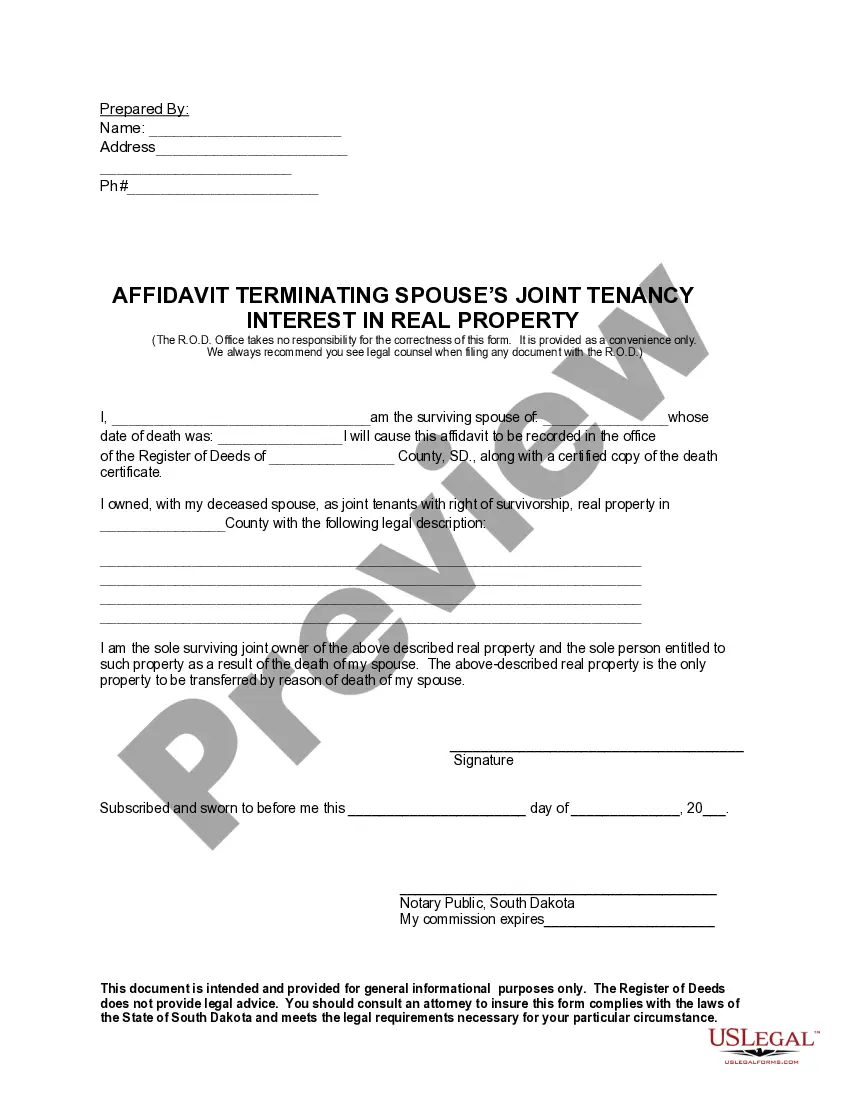

How to fill out Determining Self-Employed Independent Contractor Status?

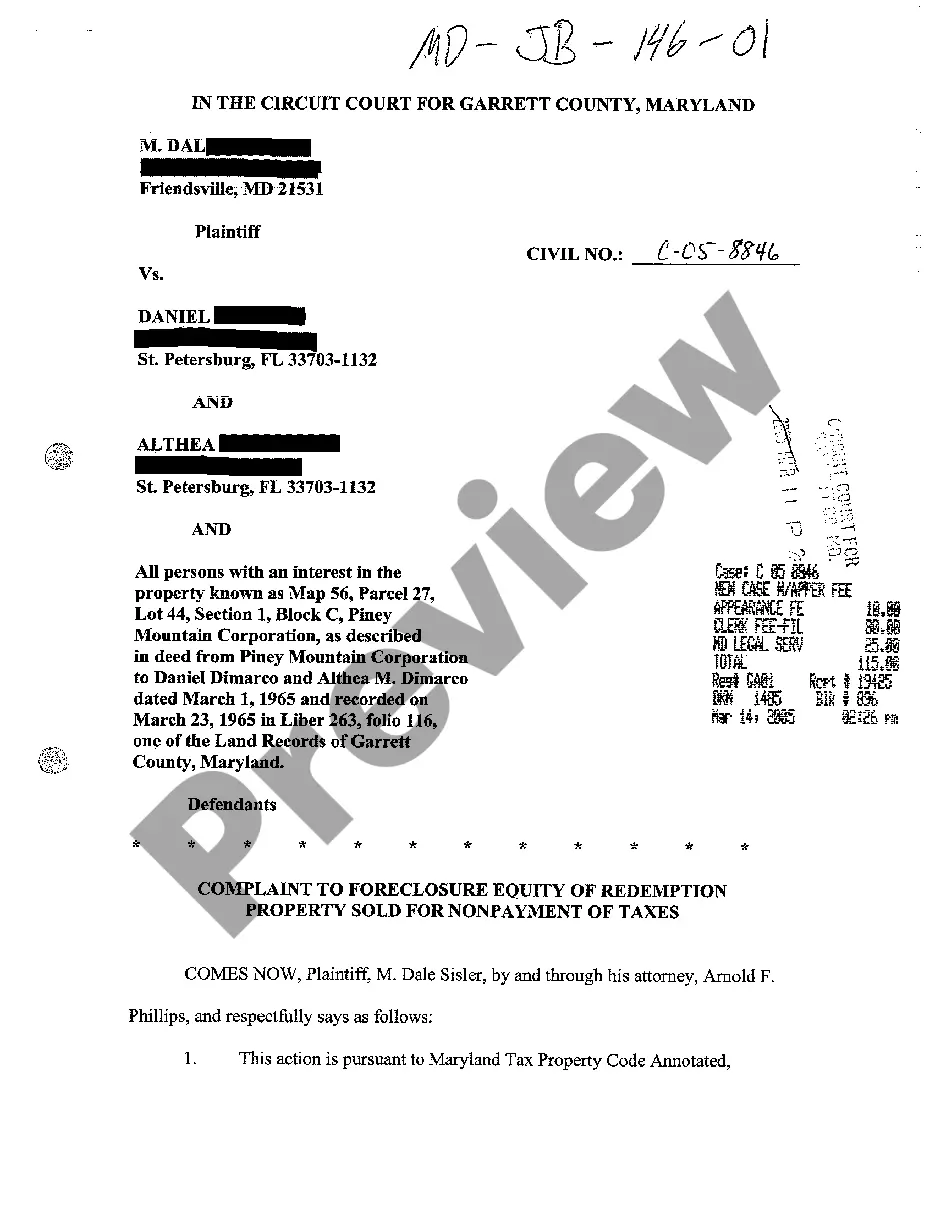

Locating the appropriate legal document template can be a challenge. Certainly, there is a multitude of templates online, but how do you track down the legal form you require? Turn to the US Legal Forms website. This service offers thousands of templates, including the Alabama Determining Self-Employed Independent Contractor Status, suitable for business and personal needs. All forms are vetted by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Download button to obtain the Alabama Determining Self-Employed Independent Contractor Status. Use your account to browse the legal forms you have previously acquired. Visit the My documents section of your account to download another copy of the document you need.

If you are a new user of US Legal Forms, here are simple steps you should follow: First, make sure you have chosen the correct form for your city/region. You can review the form using the Preview button and examine the form details to ensure it is the right one for you. If the form does not satisfy your needs, make use of the Search field to find the correct form. Once you are certain that the form is accurate, click the Purchase now button to obtain the form. Select the pricing plan you prefer and enter the required information. Create your account and complete the order using your PayPal account or credit card. Choose the file format and download the legal document template to your device. Complete, modify, print, and sign the received Alabama Determining Self-Employed Independent Contractor Status.

US Legal Forms is the largest repository of legal forms where you can find numerous document templates. Utilize this service to obtain properly constructed papers that adhere to state regulations.

- Thousands of templates are available online.

- Forms are vetted by experts.

- They comply with state and federal regulations.

- Easy to navigate for new users.

- Options to preview and search for forms.

- Account management for previously acquired forms.

Form popularity

FAQ

The basic test for determining whether a worker is an independent contractor or an employee is whether the principal has the right to control the manner and means by which the work is performed.

What Is an Independent Contractor? An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

Four ways to verify your income as an independent contractorIncome-verification letter. The most reliable method for proving earnings for independent contractors is a letter from a current or former employer describing your working arrangement.Contracts and agreements.Invoices.Bank statements and Pay stubs.

Paying yourself as an independent contractor Independent contractor pay allows your business the opportunity to stay on budget for projects rather than hire via a third party. As an independent contractor, you will need to pay self-employment taxes on your wages. You will file a W-9 with the LLC.

How to demonstrate that you are an independent worker on your resumeMention that time when you had to work on a project on your own.Talk about projects that required extra accountability.Describe times when you had to manage several projects all at once.More items...

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

What Is an Independent Contractor? An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.