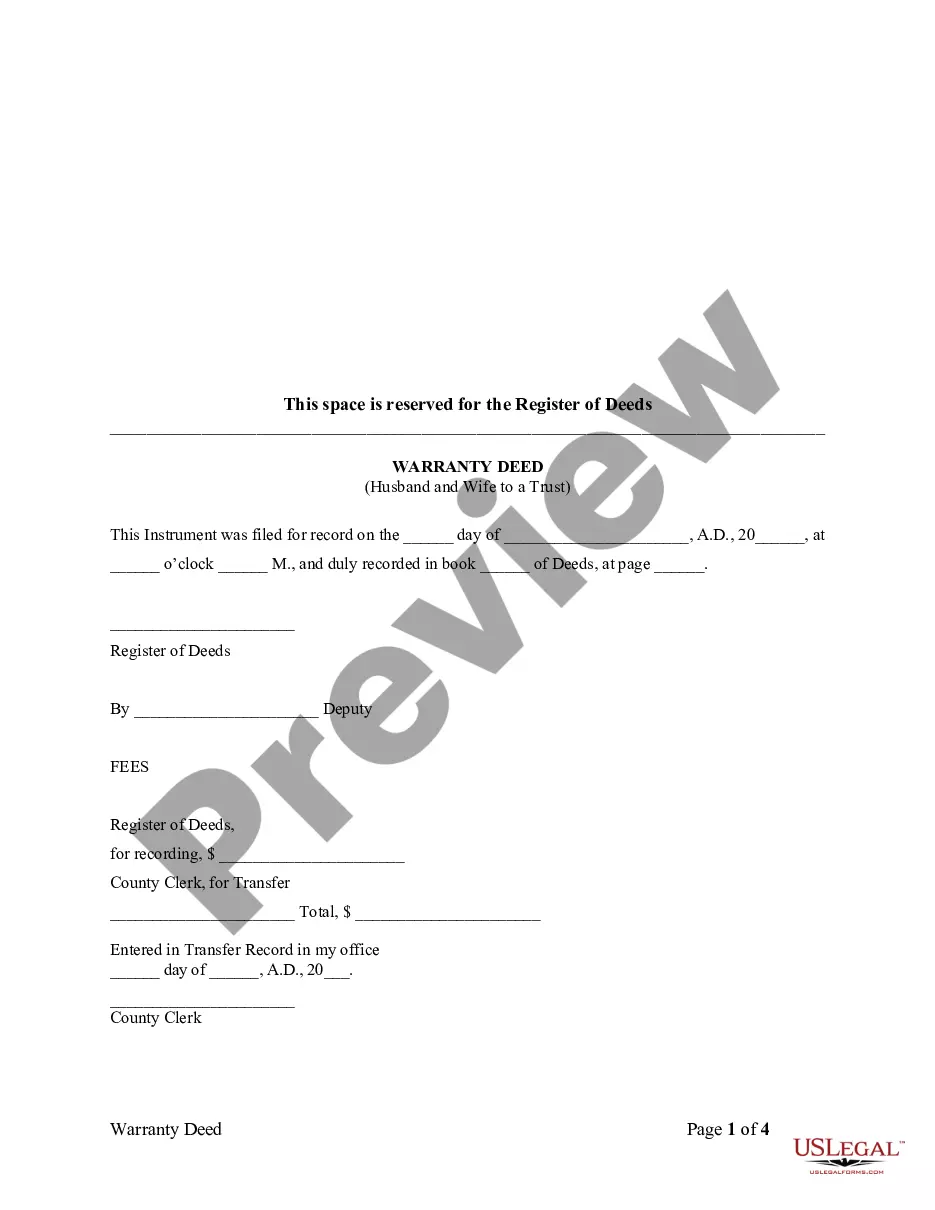

Nebraska Sample Letter for Land Deed of Trust

Description

How to fill out Sample Letter For Land Deed Of Trust?

You are able to commit several hours on the web searching for the authorized papers format that suits the state and federal demands you require. US Legal Forms offers a large number of authorized varieties that are examined by experts. It is simple to acquire or print the Nebraska Sample Letter for Land Deed of Trust from my assistance.

If you currently have a US Legal Forms account, you may log in and then click the Download option. After that, you may full, revise, print, or signal the Nebraska Sample Letter for Land Deed of Trust. Each authorized papers format you purchase is yours eternally. To acquire one more backup of the purchased form, proceed to the My Forms tab and then click the related option.

If you work with the US Legal Forms website the first time, stick to the straightforward instructions below:

- Initial, be sure that you have chosen the right papers format to the state/city of your choosing. Browse the form outline to make sure you have chosen the proper form. If offered, use the Preview option to appear with the papers format at the same time.

- If you want to locate one more version from the form, use the Lookup field to discover the format that fits your needs and demands.

- When you have discovered the format you desire, simply click Purchase now to move forward.

- Pick the rates strategy you desire, type your accreditations, and sign up for a free account on US Legal Forms.

- Comprehensive the transaction. You can utilize your charge card or PayPal account to pay for the authorized form.

- Pick the formatting from the papers and acquire it to your system.

- Make modifications to your papers if required. You are able to full, revise and signal and print Nebraska Sample Letter for Land Deed of Trust.

Download and print a large number of papers themes using the US Legal Forms web site, which provides the most important selection of authorized varieties. Use expert and state-certain themes to handle your business or personal requirements.

Form popularity

FAQ

A deed of trust is an agreement between a home buyer and a lender at the closing of a property. The agreement states that the home buyer will repay the home loan and the mortgage lender will hold the property's legal title until the loan is paid in full.

The Nebraska Trust Deeds Act is the statue that governs foreclosures in this state. Under this statue, foreclosure is a non-judicial remedy. The deed of trust, which secures the title to the property, is transferred to the foreclosing entity in a power of sale.

The main difference between a deed and a deed of trust is that a deed is a transfer of ownership, while a deed of trust is a security interest. A deed of trust is used to secure a loan, while a deed is used to transfer ownership of a property.

There are two basic types of Deeds of Trust, the Long Form and the Short Form. The Long Form, which could be 20-30 pages long, is the one used by institutional lenders. The Short Form is the one that is most usually prepared by your Escrow Officer.

A "Short Form Deed of Trust" is a document that is used to secure a promissory note by using real estate as collateral. When filing a Deed of Trust, it places a lien against the property.

A fictitious/master deed of trust is a blank, unsigned long form deed of trust with a cover sheet attached, requesting recording for reference purposes only. By referencing the recorded instrument information on the fictitious DOT, all rights and obligations of the parties are preserved.

A deed of trust is a legal agreement that's similar to a mortgage, which is used in real estate transactions. Whereas a mortgage only involves the lender and a borrower, a deed of trust adds a neutral third party that holds rights to the real estate until the loan is paid or the borrower defaults.

NOTE: All deeds must contain a full, current legal description of the property, name of the party transferring the property (grantor), name of the party receiving the property (grantee) and must be signed by grantor(s) and notarized.