Nebraska Sample Letter for Note and Deed of Trust

Description

How to fill out Sample Letter For Note And Deed Of Trust?

Are you currently in the place where you will need files for possibly organization or personal reasons virtually every day? There are a lot of legitimate document templates accessible on the Internet, but getting versions you can depend on is not straightforward. US Legal Forms gives a huge number of type templates, like the Nebraska Sample Letter for Note and Deed of Trust, which are published in order to meet federal and state demands.

If you are currently familiar with US Legal Forms website and have your account, simply log in. Next, it is possible to obtain the Nebraska Sample Letter for Note and Deed of Trust design.

If you do not offer an account and would like to start using US Legal Forms, abide by these steps:

- Find the type you require and ensure it is for the right city/county.

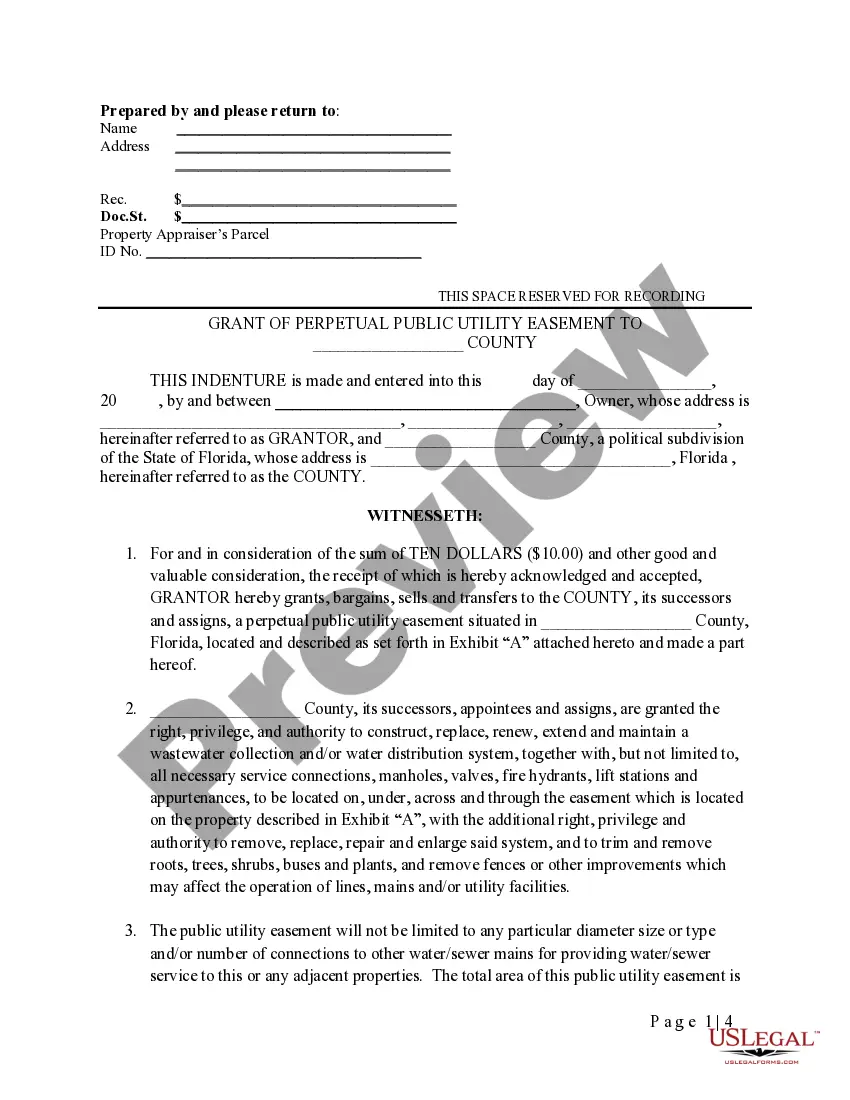

- Utilize the Review button to examine the form.

- Look at the information to actually have selected the appropriate type.

- In case the type is not what you`re trying to find, use the Look for field to discover the type that suits you and demands.

- Once you discover the right type, click on Buy now.

- Select the pricing plan you need, submit the required details to create your account, and purchase the transaction utilizing your PayPal or charge card.

- Pick a hassle-free document structure and obtain your backup.

Find every one of the document templates you may have bought in the My Forms food selection. You may get a further backup of Nebraska Sample Letter for Note and Deed of Trust at any time, if required. Just go through the required type to obtain or printing the document design.

Use US Legal Forms, the most extensive assortment of legitimate forms, in order to save time as well as steer clear of faults. The service gives appropriately created legitimate document templates that can be used for an array of reasons. Make your account on US Legal Forms and commence generating your life a little easier.

Form popularity

FAQ

Deeds of trust are the most common instrument used in the financing of real estate purchases in Alaska, Arizona, California, Colorado, the District of Columbia, Idaho, Maryland, Mississippi, Missouri, Montana, Nebraska, Nevada, North Carolina, Oregon, Tennessee, Texas, Utah, Virginia, Washington, and West Virginia, ...

What Is A Deed Of Trust? A deed of trust is an agreement between a home buyer and a lender at the closing of a property. The agreement states that the home buyer will repay the home loan and the mortgage lender will hold the property's legal title until the loan is paid in full.

Introduction to Trust Deeds Under the Act, a borrower conveys property to a trustee in trust for the benefit of the lender. A trust deed may secure for any kind of indebtedness where the owner of the property has a property right that can be conveyed.

The property owner signs the note, which is a written promise to repay the borrowed money. A trust deed gives the third-party ?trustee? (usually a title company or real estate broker) legal ownership of the property.

The promissory note is held by the lender until the loan is paid in full, and generally is not recorded with the county recorder or registrar of titles (sometimes also referred to as the county clerk, register of deeds, or land registry) whereas a deed of trust is recorded.

The Nebraska Trust Deeds Act is the statue that governs foreclosures in this state. Under this statue, foreclosure is a non-judicial remedy. The deed of trust, which secures the title to the property, is transferred to the foreclosing entity in a power of sale.

Mortgage States and Deed of Trust States StateMortgage StateDeed of Trust StateMississippiYMissouriYMontanaYYNebraskaY47 more rows

What Is Assignment in a Deed of Trust? In real estate law, "assignment" is simply the transfer of a deed of trust from one party to another. This usually happens when the beneficiary of a trust deed sells their loan to another lender.