Alabama General Partnership Agreement - Complex

Description

How to fill out General Partnership Agreement - Complex?

Are you currently in a role where you need documents for both organizational or specific purposes almost every time.

There are many legitimate document templates available online, but finding ones you can trust is not easy.

US Legal Forms offers thousands of form templates, including the Alabama General Partnership Agreement - Complex, which can be customized to meet federal and state requirements.

Once you find the right form, click Get now.

Select the pricing plan you prefer, fill in the required information to create your account, and pay for your order using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Alabama General Partnership Agreement - Complex template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

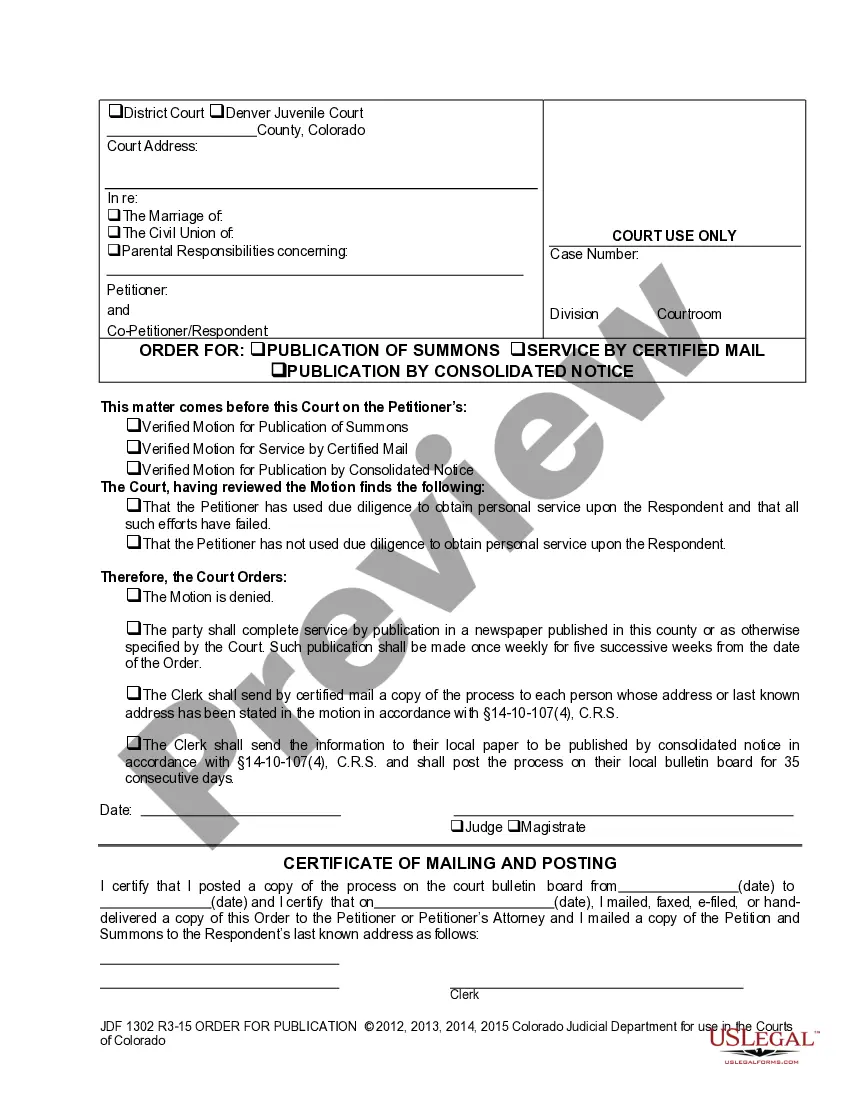

- Click the Review button to examine the form.

- Review the details to ensure you have chosen the correct form.

- If the form is not what you're looking for, use the Search field to locate the form that meets your needs and requirements.

Form popularity

FAQ

General partnerships face several disadvantages, including the aforementioned unlimited liability and potential for conflicts. Additionally, decision-making can be complicated, as all partners typically have equal say. This dynamic can lead to delays or frustration when consensus is not easily reached. Utilizing an Alabama General Partnership Agreement - Complex helps address these concerns by laying out a structured approach to decision-making and clarifying how disputes should be resolved.

Partnerships must file Form SS-4 with the Internal Revenue Service. Form SS-4 is used to get an employer identification number, also known as a federal tax ID number, from the IRS. The IRS allows a partnership to file Form SS-4 online using the IRS website, by telephone, by fax or by mail.

How to Start a General Partnership in Alabama Confirm you should start a general partnership. Determine if you need to register your business name. Check name availability. File an Alabama Trade Name Application. Create a Partnership Agreement. Get a Federal Employer Identification Number.More items...

A general partnership has no separate legal existence distinct from the partners. Unlike a private limited company or limited liability partnership, it does not need to be registered at or make regular filings to Companies House, which can help keep things simple.

A general partnership is created any time two or more people agree to go into business together. There's no legal requirement for a contract or written agreement when you enter into a general partnership, but it's best to formalize the details of the arrangement in a written partnership agreement.

What to Include in Your Partnership AgreementName of the partnership. One of the first things you must do is agree on a name for your partnership.Contributions to the partnership.Allocation of profits, losses, and draws.Partners' authority.Partnership decision making.

To have a general partnership, two conditions must be true:The company must have two or more owners.All partners must agree to have unlimited personal responsibility for any debts or legal liabilities the partnership might incur.

It is not mandatory to register a partnership firm as per the provisions of the Partnership Act, 1932. However, it is better to register a partnership firm. If the firm is not registered it cannot avail any legal benefits provided to the firm under the Partnership Act, 1932.

The state of Alabama doesn't require any official formation for general partnerships, and they're also not required to pay any formation fees or participate in ongoing maintenance filings like annual reports.

Partnerships are unique business relationships that don't require a written agreement. However, it's always a good idea to have such a document.