Alabama Telecommuting Policy

Description

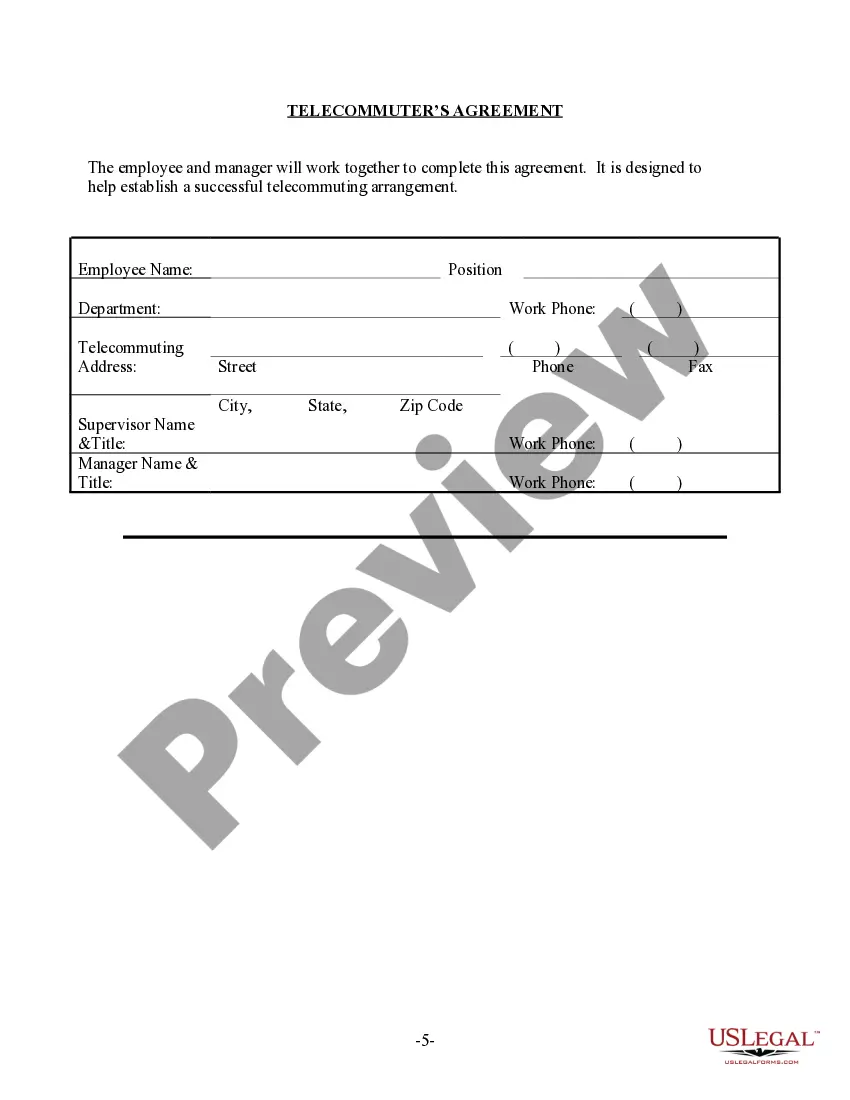

How to fill out Telecommuting Policy?

If you desire to be thorough, procure, or produce sanctioned document formats, utilize US Legal Forms, the premier assortment of legal templates available online.

Employ the website's straightforward and convenient search feature to locate the documents you require. Various templates for business and personal applications are categorized by types and states, or keywords.

Use US Legal Forms to find the Alabama Telecommuting Policy with just a few clicks.

Step 6. Choose the format of the legal form and download it to your device.

Step 7. Complete, modify, and print or sign the Alabama Telecommuting Policy. Every legal document template you obtain is yours indefinitely. You will have access to every form you saved in your account. Navigate to the My documents section and select a form to print or download again.

- If you are a current US Legal Forms user, sign in to your account and click the Download button to access the Alabama Telecommuting Policy.

- You can also retrieve forms you previously saved in the My documents section of your account.

- Step 1. Verify that you have selected the form for the correct city/state.

- Step 2. Utilize the Review option to inspect the form’s details. Don't forget to read the description.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the page to find alternative types of the legal form template.

- Step 4. Once you have located the form you need, select the Get now button. Choose the pricing plan you prefer and enter your credentials to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

Form popularity

FAQ

The hybrid work policy at the University of Alabama allows employees to split their time between remote work and on-campus activities. This approach fosters flexibility while maintaining critical in-person interactions. Understanding the specifics of this policy can guide employees to ensure compliance with the Alabama Telecommuting Policy.

According to Massachusetts, internet cookies and apps are enough to establish a physical presence. Having even a single out-of-state remote employee can create a tax nexus in certain states. If you have payroll in another state, it most likely creates a nexus.

Under the executive order, the California Franchise Tax Board (FTB) provided guidance that a business would not have tax nexus with the state merely because of remote employees teleworking from a location in California, and that those employees would be treated as a de minimis activity for the purposes of the

In general, if you're working remotely you'll only have to file and pay income taxes in the state where you live. However, in some cases, you may be required to file tax returns in two different states. This depends on your particular situation, the company you work for, and the tax laws of the states involved.

The taxpayer's sales in California exceed the lesser of $500,000 or 25% of the taxpayer's total sales. The real property and tangible personal property of the taxpayer in this state exceed the lesser of $50,000 or 25% of the taxpayer's total real property and tangible personal property combined.

Though often away from the office, a teleworker is different from a remote employee because there occasionally some in-person office attendance required though this is not always the case. Another key difference is that a teleworker is often geographically closer to the main office location than a remote worker.

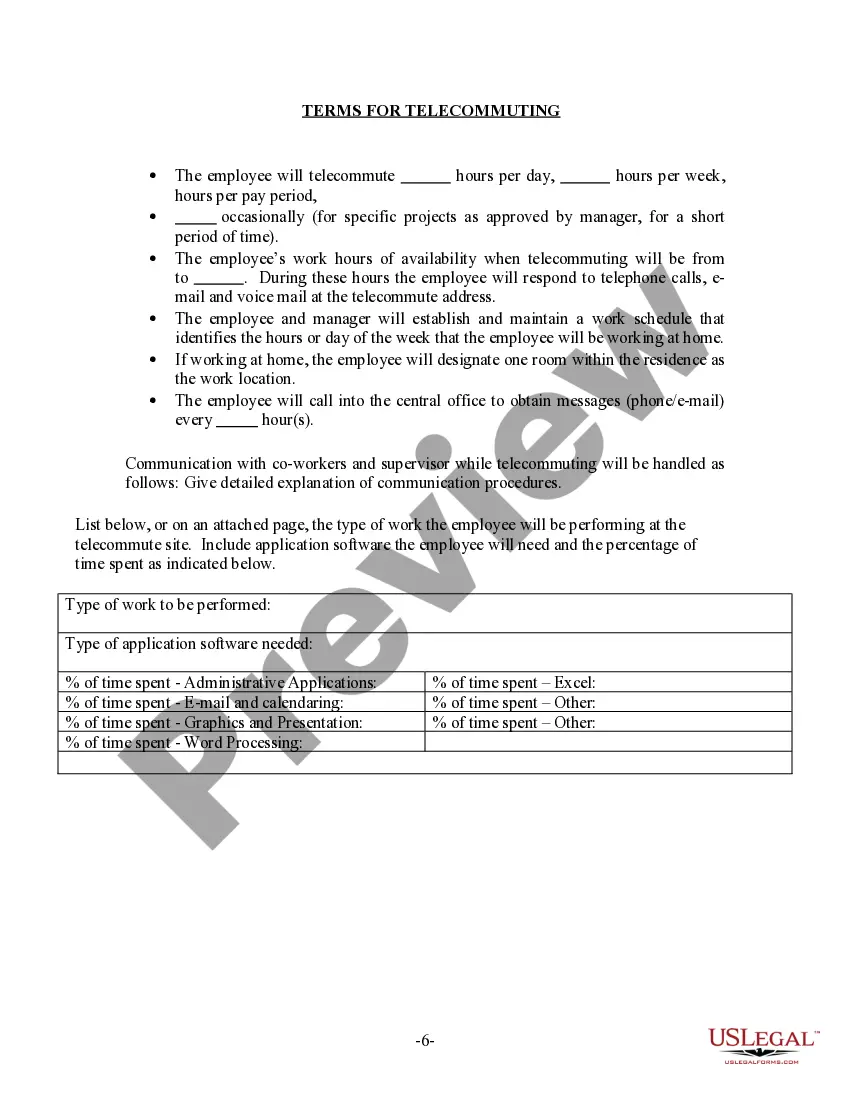

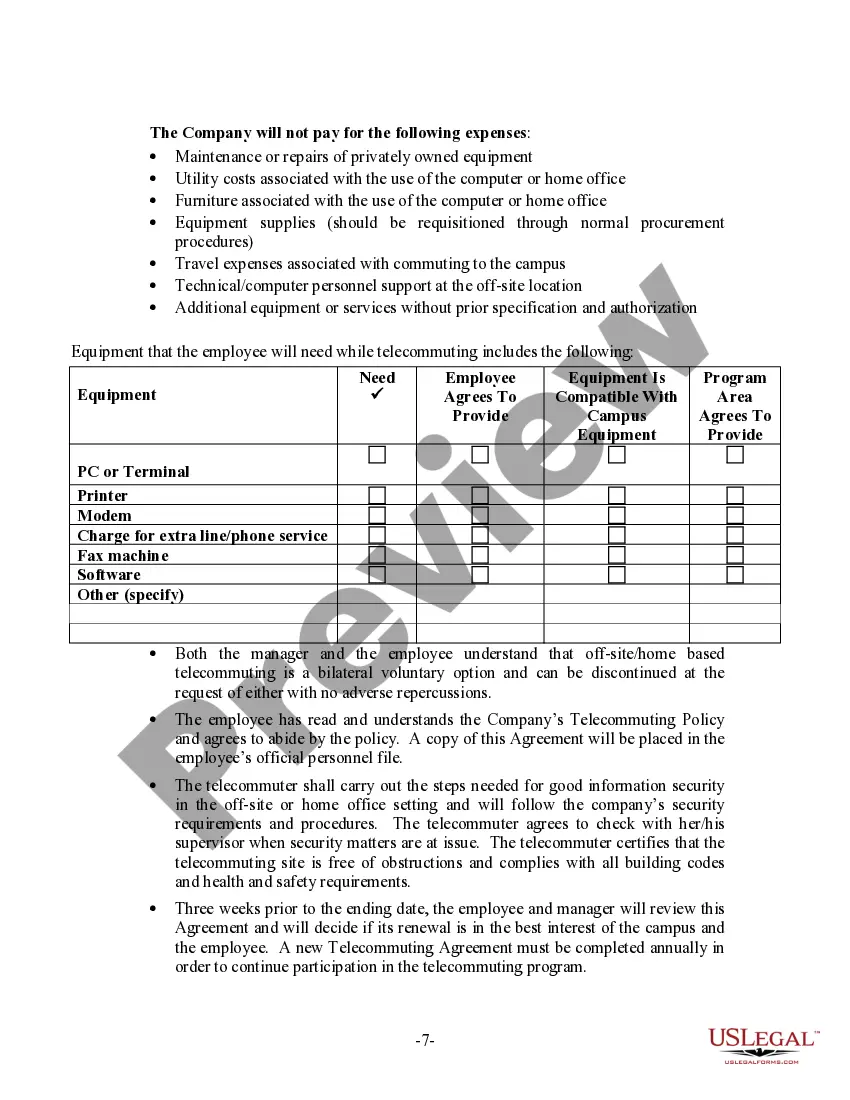

Telecommuting is the ability for an employee to complete work assignments from outside the traditional workplace by using telecommunications tools such as email, phone, chat and video apps.

Texas: Presence of Single Employee in State Creates Nexus.

Remote work, also called distance working, telework, teleworking, working from home (WFH), mobile work, remote job, and work from anywhere (WFA) is an employment arrangement in which employees do not commute to a central place of work, such as an office building, warehouse, or retail store.

Sales tax nexus is the connection between a seller and a state that requires the seller to register then collect and remit sales tax in the state. Certain business activities, including having a physical presence or reaching a certain sales threshold, may establish nexus with the state.