Alabama Personal Appearance

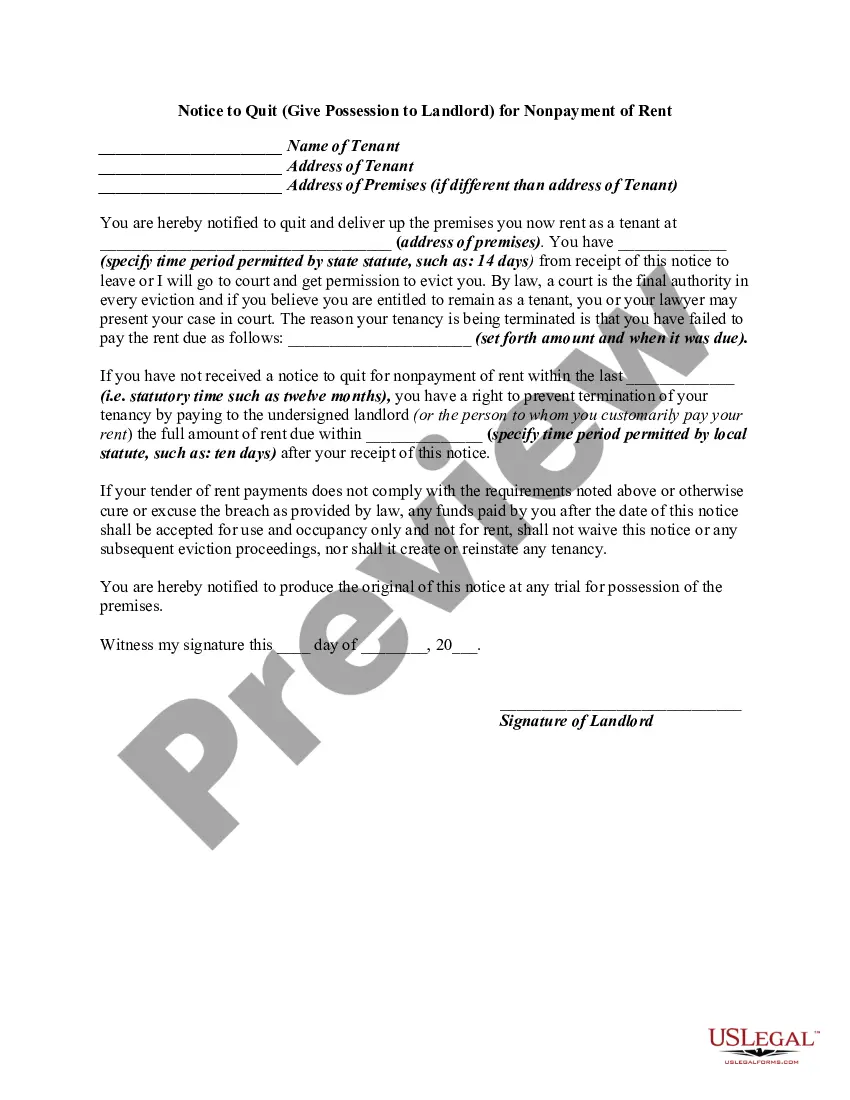

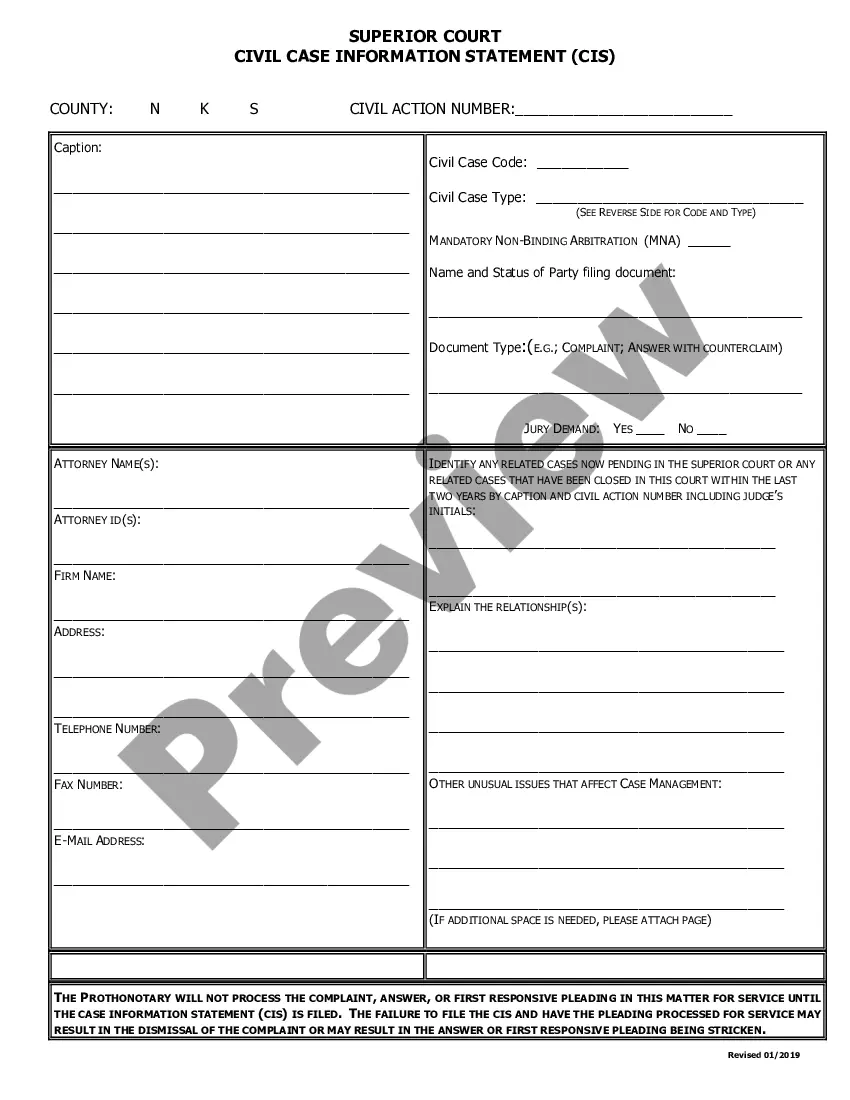

Description

How to fill out Personal Appearance?

You might spend hours online trying to locate the legal document template that meets the federal and state requirements you need.

US Legal Forms provides a vast array of legal documents that are reviewed by experts.

You can easily download or print the Alabama Personal Appearance from the service.

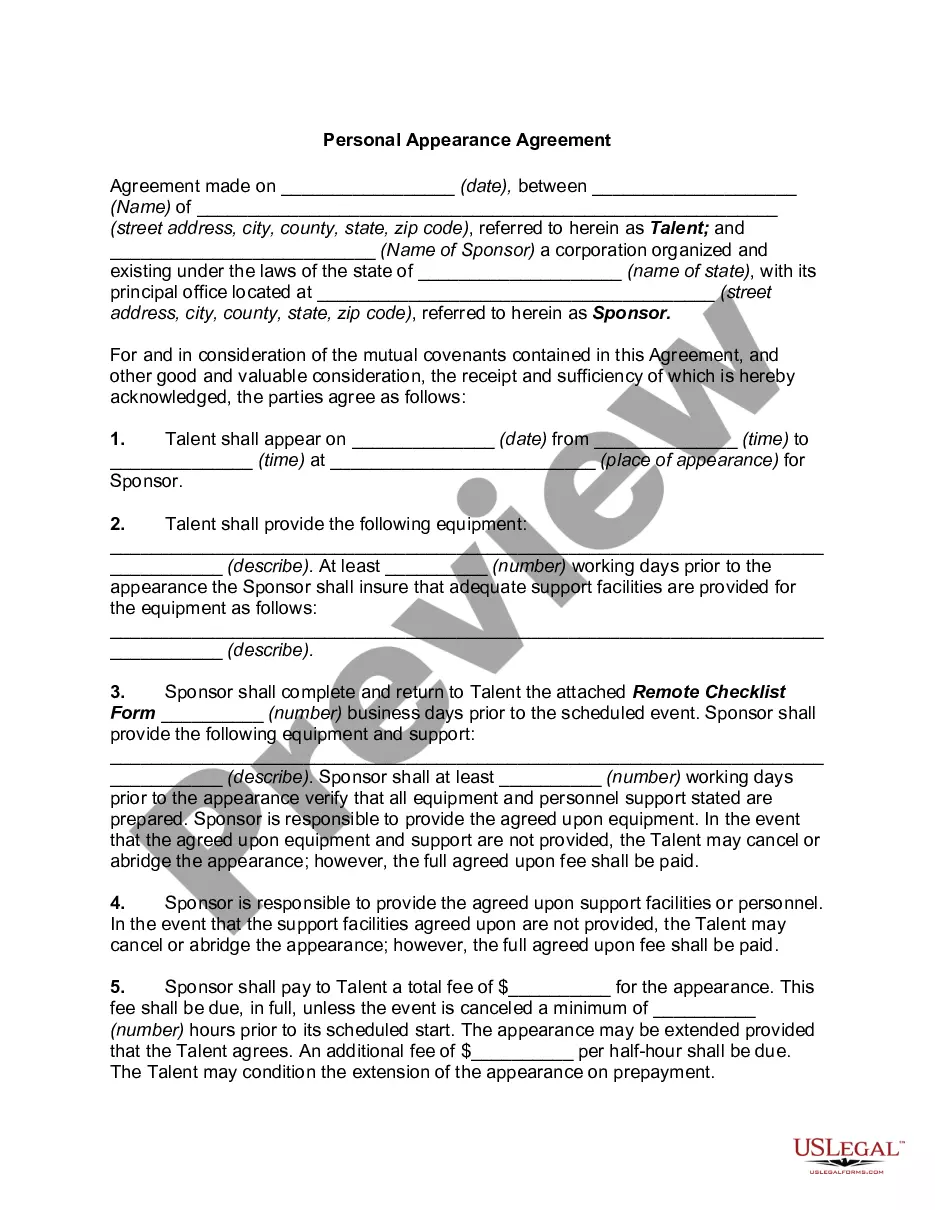

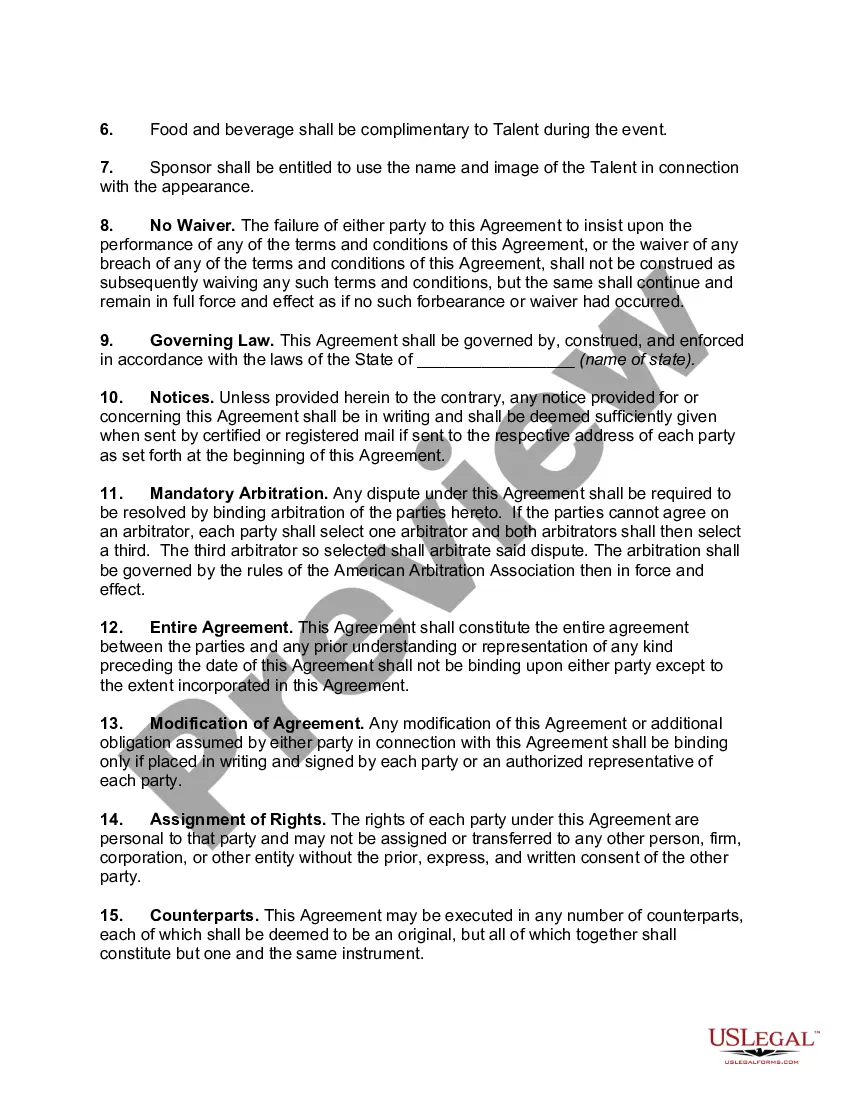

If available, utilize the Preview button to review the document template as well.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- Then you can complete, modify, print, or sign the Alabama Personal Appearance.

- Every legal document template you download is yours forever.

- To obtain another copy of any acquired form, visit the My documents section and click the corresponding button.

- If you're using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the state/city of your choice.

- Review the form description to confirm you have chosen the right document.

Form popularity

FAQ

A passing score on the bar exam in Alabama is 260. This score demonstrates sufficient legal understanding and readiness to practice law within the state. If you're aiming to pass the exam, leveraging study aids and practice questions from US Legal Forms can greatly enhance your preparation and boost your confidence when test day arrives.

A score of 270 on the bar exam meets the passing requirement in Alabama, indicating a competent grasp of the necessary legal knowledge. While it is a passing score, many candidates might strive for higher results to bolster their confidence and job prospects. Engaging with resources from US Legal Forms can provide you with the support needed to improve your studying strategies and exam performance.

A score of 280 on the bar exam in Alabama is above the passing threshold, reflecting a strong understanding of legal principles. However, while it's an encouraging score, aspiring lawyers often aim for higher scores to enhance job opportunities and competitiveness. Utilizing study tools offered by US Legal Forms can help you reach your full potential on the exam.

In Alabama, the passing score for the bar exam is 260 out of a possible 400. This benchmark indicates a sufficient understanding of state law and procedures, which is essential for practicing law in Alabama. Preparing carefully for this exam can improve your chances of success, and you can find helpful resources through US Legal Forms to aid your study process.

The income threshold that triggers the requirement to file taxes in Alabama varies based on your filing status and age. Generally, if your income exceeds a specific level, you will need to file. For personalized advice tailored to your situation regarding Alabama Personal Appearance, consider consulting the resources from US Legal Forms.

In Alabama, corporations and certain LLCs must file annual reports to maintain good standing. This requirement ensures transparency and compliance with state regulations. To simplify your understanding of Alabama Personal Appearance and reporting obligations, explore the tools offered by US Legal Forms.

Personal property in Alabama includes all tangible items not classified as real estate, such as vehicles, furniture, and equipment. This type of property is often subject to different tax regulations than real property. For insights on managing your Alabama Personal Appearance related to personal property, you can utilize the resources available at US Legal Forms.

In Alabama, property tax exemptions may apply to seniors aged 65 and older, allowing them to reduce or eliminate their tax liability. However, specific rules may vary based on local jurisdictions. It’s a good idea to consult with US Legal Forms for comprehensive information on Alabama Personal Appearance, including property tax exemptions.

Certain individuals in Alabama may not need to file a state tax return, including those whose income falls below the filing threshold. Additionally, if you are a full-time student or you are claimed as a dependent, your requirements might differ. For detailed guidance related to Alabama Personal Appearance, check the official guidelines or resources provided by US Legal Forms.

Yes, you may be required to file an Alabama tax return if your income meets or exceeds specified limits. This obligation ensures compliance with state tax regulations. To navigate the complexities of Alabama Personal Appearance, you can use resources like US Legal Forms for assistance in determining your filing obligations.