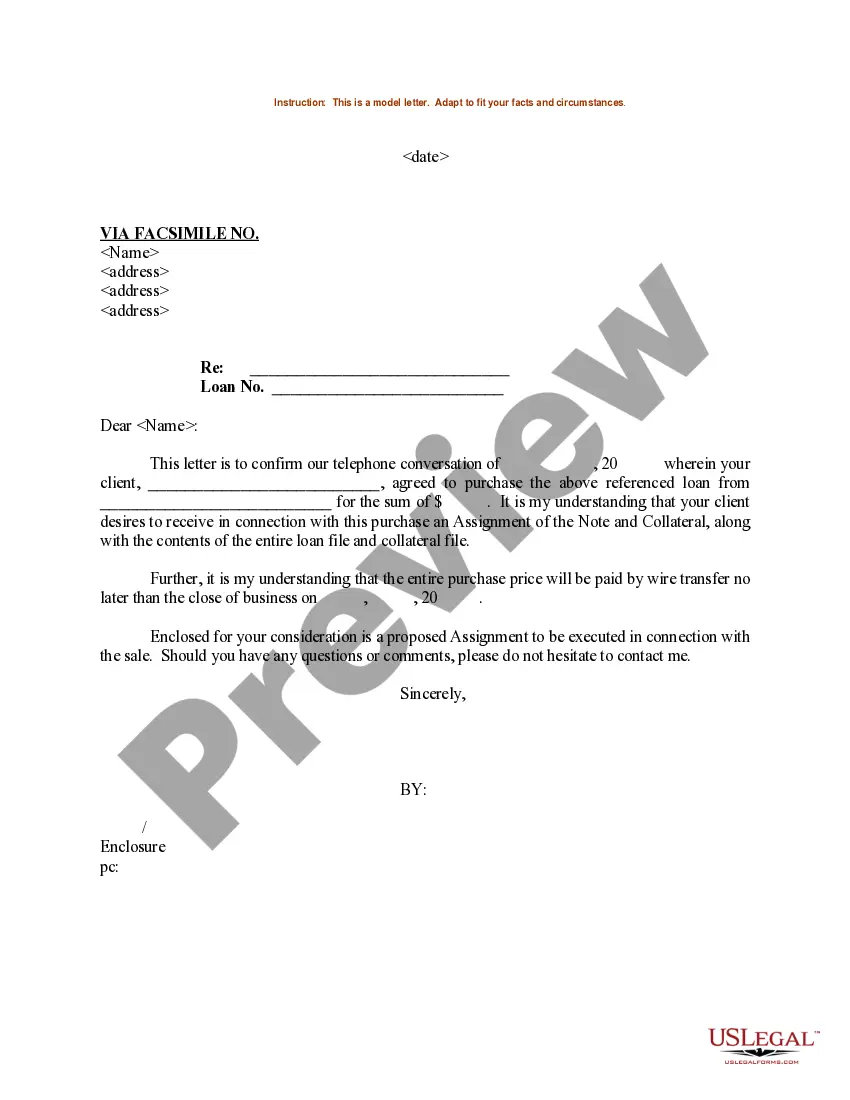

Alabama Sample Letter for Purchase of Loan

Description

How to fill out Sample Letter For Purchase Of Loan?

Finding the appropriate valid document template can be a challenge.

Naturally, there are numerous templates available online, but how can you locate the correct one you require.

Utilize the US Legal Forms website. This service provides thousands of templates, such as the Alabama Sample Letter for Purchase of Loan, that you can use for business and personal needs.

You may review the form using the Review button and read the form details to confirm this is suitable for you.

- All the forms are vetted by experts and comply with federal and state regulations.

- If you're already registered, Log In to your account and click the Download button to obtain the Alabama Sample Letter for Purchase of Loan.

- Use your account to review the legal forms you've previously downloaded.

- Navigate to the My documents section of your account and get another copy of the form you need.

- If you are a new user of US Legal Forms, here are simple steps to follow.

- First, ensure you have chosen the correct form for your city/state.

Form popularity

FAQ

When writing a simple loan agreement between friends, clarity is key. Include the total amount borrowed, the repayment schedule, and any interest agreed upon. Despite the informal nature, it is wise to document the agreement thoroughly to prevent future disputes. An Alabama Sample Letter for Purchase of Loan may serve as a helpful reference for drafting this agreement.

A simple loan letter should state the loan amount, the repayment timeline, and the names of both the lender and borrower. Use clear and direct language to avoid any confusion. A template such as an Alabama Sample Letter for Purchase of Loan can help you create a professional and effective loan letter.

To write a short loan letter, focus on the essential details: the borrower's name, the loan amount, and the repayment terms. Keep your language straightforward and to the point. Resources like an Alabama Sample Letter for Purchase of Loan can provide a structure that ensures all critical aspects are included without unnecessary detail.

A simple loan note should include key details such as the principal amount, repayment schedule, and interest rate, if applicable. Make sure both parties sign the note to validate it legally. This document serves as a record of the loan, and resources like an Alabama Sample Letter for Purchase of Loan can guide you in creating a clear and concise note.

In a letter of explanation for a loan, start by clearly stating the reason for the letter. Address any concerns the lender might have about your credit or financial history. Provide supporting details and documentation if necessary. Using an Alabama Sample Letter for Purchase of Loan can help you structure your letter to effectively convey your explanation to the lender.

A simple loan agreement letter should include the names of the lender and borrower, the amount being loaned, the repayment terms, and any interest rates. It is essential to be clear and detailed to avoid misunderstandings later on. You can find templates or guides that offer an Alabama Sample Letter for Purchase of Loan, helping you craft a precise agreement.

To obtain a loan approval letter, you should first complete the application process with your lender. They will review your financial information, credit score, and income to determine your eligibility. Once approved, your lender will provide a formal loan approval letter, which outlines the loan amount, terms, and conditions. You can streamline this process by using an Alabama Sample Letter for Purchase of Loan.

To write a loan letter request, begin with a formal greeting and clearly articulate your request in the opening paragraph. Include details about the loan amount, term, and how you plan to use the funds. Look at the Alabama Sample Letter for Purchase of Loan for formality and content that will help you structure your request effectively.

A bank letter for a loan is a formal document from the bank verifying your loan application, including key details like the loan amount and purpose. This letter can serve as a crucial part of your loan documentation. For inspiration on how to create similar letters, refer to the Alabama Sample Letter for Purchase of Loan.

A letter of explanation for a loan should open with a clear and respectful salutation. Explain your situation succinctly, covering the key reasons for the loan and any relevant details that support your application. Using the Alabama Sample Letter for Purchase of Loan can help shape your letter effectively and professionally.