Alabama Sample Letter for Loan

Description

How to fill out Sample Letter For Loan?

Are you presently in a situation where you require documents for business or personal purposes nearly every day.

There are numerous legal document templates accessible online, but finding reliable ones isn't straightforward.

US Legal Forms offers thousands of template options, such as the Alabama Sample Letter for Loan, which are designed to comply with state and federal regulations.

Once you find the correct form, click Get now.

Choose the pricing plan you prefer, provide the necessary information to create your account, and pay for the order using PayPal or a credit card. Select a convenient paper format and download your copy. You can access all the document templates you have purchased in the My documents section. You may obtain another version of the Alabama Sample Letter for Loan anytime if needed. Just click on the required form to download or print the document template. Utilize US Legal Forms, the largest collection of legal forms, to save time and prevent mistakes. The service offers professionally crafted legal document templates for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Then, you can download the Alabama Sample Letter for Loan template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your specific city/state.

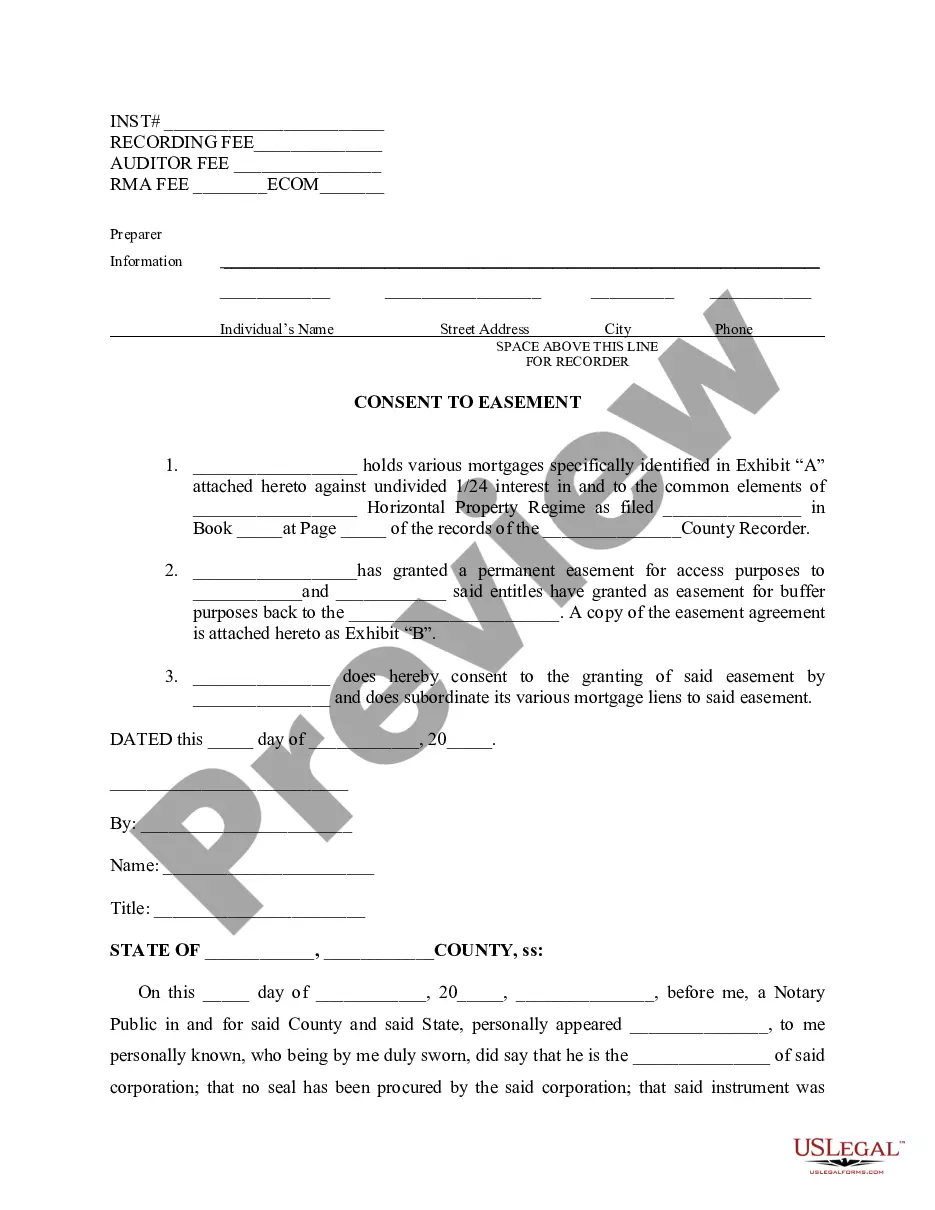

- Use the Review button to inspect the form.

- Check the information to confirm that you've selected the correct form.

- If the form isn't what you're looking for, utilize the Search field to locate the form that fits your requirements.

Form popularity

FAQ

The explanation asked for can be as simple as late payments to something as big as discrepancies in your accounts. You may also have to provide a letter of explanation in situations such as: if you had a late payment on your house. if you had a late payment on your rent.

The key to writing a great letter of explanation is to keep it short, simple and informative. Be clear and write with as much detail as you can since someone else will need to understand your situation. Avoid including irrelevant information or answers to questions the underwriter didn't ask.

Begin the letter with the date, a salutation, and an introduction of the incident or issue. Provide a short but detailed description without having to add unnecessary terms and phrases. Provide an explanation of the steps you've taken to rectify the error or to complete the missing information.

Be polite, but firm, in your tone. For example, if you are writing with regard to a personal loan, you could begin by saying: "As you are aware, on date you contacted me for help regarding your delinquent car payment. I lent you the sum of dollar amount and you promised to pay back the money within time period."

Here are ten strategies for writing a settlement demand letter:Stay Focused.Do Not Threaten.Make Your Case Stand Out.Understand Policy Limits Before Writing.Support Your Claim.Include All of Your Damages.Do Not Make a Specific Demand.Do Not Offer a Recorded Statement.More items...

Frequently Asked Questions (FAQ)Type your letter.Concisely review the main facts.Be polite.Write with your goal in mind.Ask for exactly what you want.Set a deadline.End the letter by stating you will promptly pursue legal remedies if the other party does not meet your demand.Make and keep copies.More items...

How to write a letter of explanationThe lender's name and address.Your name and your application number.The date you're submitting the letter and expected closing date (if you know it)A short statement that helps an underwriter fully understand your situation in regards to the reason for concern.More items...?

A demand letter is a letter, usually written by an attorney on a client's behalf, demanding that the recipient of the letter take or cease a certain action.

Commonly referred to as an 'LOE' or 'LOX,' letters of explanation are often requested by lenders to gain more specific information on a mortgage borrower and their situation. An LOX can necessary when there is inconsistent, incomplete, or unclear information on a loan application.

A demand letter is a document that you give to the person that you think owes you money. Within the letter, you set out why you are entitled to the payment and demand it. You'd be surprised how often a simple demand letter can work without you having to go to court.