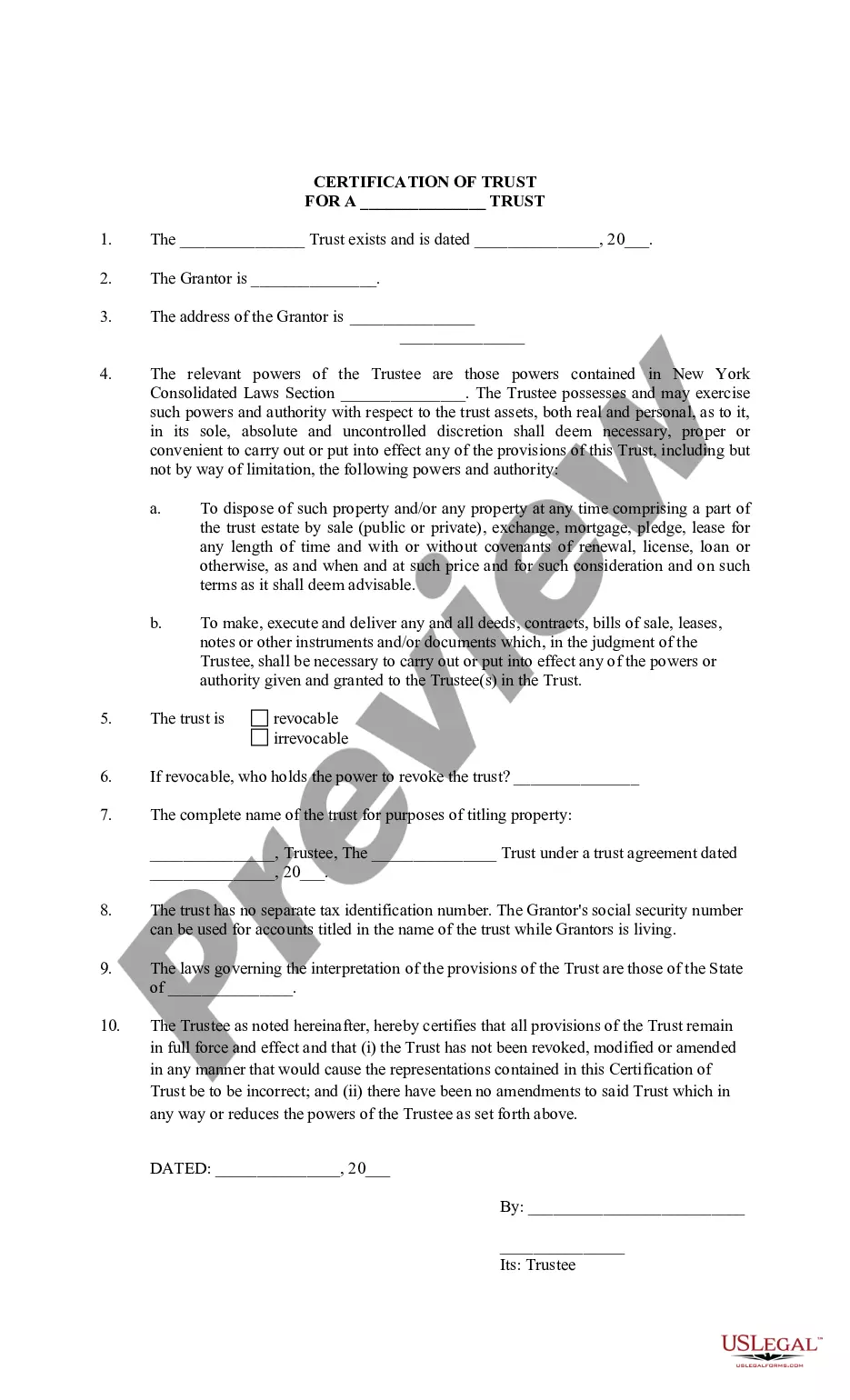

Alabama Sample Letter for Applying Check to Accounts

Description

How to fill out Sample Letter For Applying Check To Accounts?

Have you been in a situation in which you will need papers for both company or personal purposes just about every working day? There are plenty of authorized papers templates accessible on the Internet, but getting ones you can depend on is not simple. US Legal Forms gives 1000s of kind templates, like the Alabama Sample Letter for Applying Check to Accounts, which are composed to fulfill federal and state requirements.

If you are currently familiar with US Legal Forms web site and also have an account, merely log in. Following that, you are able to down load the Alabama Sample Letter for Applying Check to Accounts format.

Unless you come with an profile and would like to start using US Legal Forms, abide by these steps:

- Get the kind you need and ensure it is for the appropriate town/state.

- Use the Review button to check the shape.

- See the information to ensure that you have chosen the proper kind.

- In the event the kind is not what you`re looking for, make use of the Research industry to obtain the kind that suits you and requirements.

- Whenever you find the appropriate kind, just click Buy now.

- Choose the pricing program you would like, submit the desired details to produce your account, and purchase the transaction utilizing your PayPal or Visa or Mastercard.

- Choose a practical document formatting and down load your duplicate.

Discover every one of the papers templates you have purchased in the My Forms menu. You may get a additional duplicate of Alabama Sample Letter for Applying Check to Accounts at any time, if necessary. Just click on the needed kind to down load or printing the papers format.

Use US Legal Forms, one of the most substantial collection of authorized types, in order to save efforts and stay away from errors. The service gives appropriately made authorized papers templates which you can use for a variety of purposes. Create an account on US Legal Forms and commence creating your lifestyle easier.

Form popularity

FAQ

Using an Angry Tone. Writing in an angry tone or personally attacking the other party is the worst thing you can do in a demand letter. If you let your emotions speak, you'll only invite the receiver to respond in the same tone. The 7 Most Common Mistakes: When Writing a Demand Letter - Legalhood legalhood.com ? blog ? the-most-common-... legalhood.com ? blog ? the-most-common-...

As you write a demand letter, it's crucial that each element is included: Establish facts. Don't assume everyone knows the facts. ... Refer to evidence. ... Make a demand. ... Set a deadline and establish method of payment. ... Offer a consequence. How to Write a Strong Demand Letter for Payment - Enjuris Enjuris ? Personal Injury Law Enjuris ? Personal Injury Law

If required, the deposit amount for a residential account is twice the average monthly bill of the residence.

[Client Name], I hope you're doing well. I'm reaching out to you to remind you that your payment of [payment total] for invoice [invoice number] with us is [number of days] overdue. ing to our records, you should've received the invoice I'm referring to in the mail on July 5, 2022. How to Ask for Payment Politely (Letters, Emails, Phonecalls, Etc.) etactics.com ? blog ? ask-for-payment-politely etactics.com ? blog ? ask-for-payment-politely

How to write demand letters Your information and the debtors' information (contact details, address etc.) The date when the debt began and the amount of money owed. Details and dates of any disputes relating to this payment. Description of the nature of the agreement and breach of contract.

Frequently Asked Questions (FAQ) Type your letter. ... Concisely review the main facts. ... Be polite. ... Write with your goal in mind. ... Ask for exactly what you want. ... Set a deadline. ... End the letter by stating you will promptly pursue legal remedies if the other party does not meet your demand. Make and keep copies. How to Write a Demand Letter | WashingtonLawHelp.org WashingtonLawHelp.org ? Legal Topics WashingtonLawHelp.org ? Legal Topics