Alabama Invoice Template for Cook

Description

How to fill out Invoice Template For Cook?

It is feasible to spend hours online searching for the legal document template that complies with the state and federal requirements you need.

US Legal Forms offers thousands of legal templates that are reviewed by experts.

You can download or print the Alabama Invoice Template for Cook from my service.

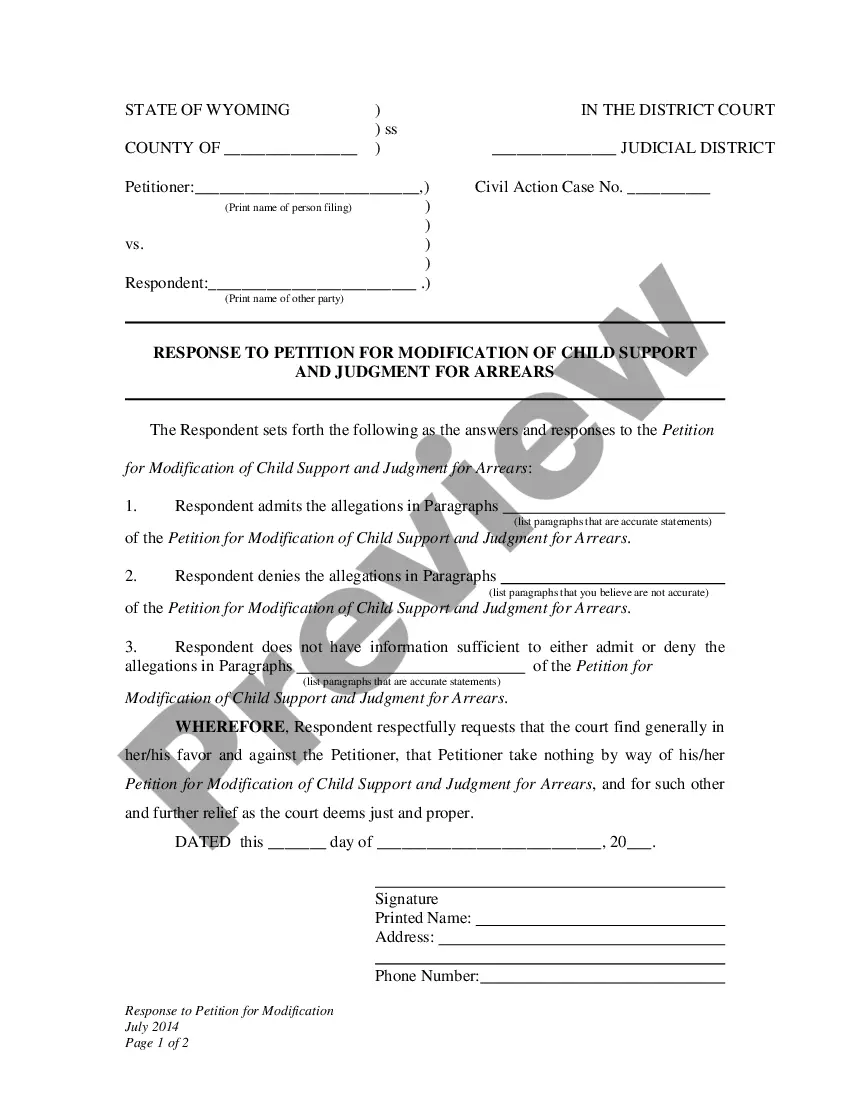

If available, use the Review button to browse through the document template as well. If you would like to find an additional version of the document, use the Search field to find the template that meets your needs and specifications.

- If you already have a US Legal Forms account, you can Log In and then click the Acquire button.

- After that, you can complete, modify, print, or sign the Alabama Invoice Template for Cook.

- Every legal document template you purchase belongs to you indefinitely.

- To obtain another copy of any purchased document, go to the My documents tab and click the respective button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the area/city that you choose.

- Review the document description to confirm that you have selected the right document.

Form popularity

FAQ

Yes, Alabama is accepting state returns, and you can submit yours electronically or by mail. During tax season, it's wise to keep updated on any changes to regulations or submission deadlines. Furthermore, using the Alabama Invoice Template for Cook can ensure your records are in order, making filing easier for you.

You need to file an Alabama state Personal Property Tax (al-ppt) if you own personal property subject to taxation. This includes businesses and individuals with specific assets. Keeping accurate records will help you in the filing process. The Alabama Invoice Template for Cook can aid in tracking your property-related expenses effectively.

Yes, you can electronically file your Alabama tax return through approved e-filing platforms. This method streamlines the filing process, allowing you to submit your return quickly. It’s important to double-check that all information is accurate before submission. To support your financial records, consider using the Alabama Invoice Template for Cook.

Absolutely, you can file your Alabama state taxes electronically. This method saves time and reduces the chances of errors associated with manual filing. Ensure that you use an IRS-approved software or service for e-filing. The Alabama Invoice Template for Cook can simplify the process by helping you keep thorough records of your transactions.

In Alabama, the taxation of labor depends on the type of service provided. Generally, labor charges related to tangible personal property are taxable, while some professional services may be exempt. Clarifying these details is crucial when preparing invoices. The Alabama Invoice Template for Cook can assist you in documenting taxable and non-taxable charges clearly.

Yes, you can file your Alabama state taxes online using the Alabama Department of Revenue’s e-filing system. This option allows for a quicker and more efficient filing process. Be sure to gather all necessary documentation beforehand to ensure a seamless submission. The Alabama Invoice Template for Cook can help you organize your financial records effectively.

You can file your Alabama state taxes directly through the Alabama Department of Revenue website. It provides clear instructions and necessary forms for electronic filing. If you prefer a physical approach, you can send your completed forms to the designated mailing address. Utilizing the Alabama Invoice Template for Cook can help you keep track of your expenses, making this process smoother.

Setting up an invoice template involves defining your layout and standardizing your information. Utilize tools like the Alabama Invoice Template for Cook to create a customizable invoice format that includes your branding, services, and payment details. Once set up, you can easily replicate this template for all future invoices, saving you time and effort.

Yes, you can definitely create an invoice yourself, and it's quite easy with the Alabama Invoice Template for Cook. This template helps you structure your invoice properly, ensuring you include all necessary information. By creating your invoice, you maintain full control over the details and format, making it tailored to your business needs.

Creating your own invoice can be straightforward with tools like the Alabama Invoice Template for Cook. Begin by choosing a format that suits your needs, then enter your details, including the date, services rendered, and payment terms. Save or print it to distribute it to your clients, ensuring all necessary information is clear and complete.