US Legal Forms - one of several most significant libraries of legitimate varieties in the USA - provides an array of legitimate file themes it is possible to download or print out. Making use of the web site, you may get thousands of varieties for organization and specific purposes, sorted by types, states, or key phrases.You will find the most up-to-date models of varieties like the Alabama Application and Loan Agreement for a Business Loan with Warranties by Borrower in seconds.

If you currently have a monthly subscription, log in and download Alabama Application and Loan Agreement for a Business Loan with Warranties by Borrower from your US Legal Forms catalogue. The Down load switch will appear on every kind you perspective. You have access to all earlier acquired varieties from the My Forms tab of the accounts.

If you want to use US Legal Forms for the first time, here are basic guidelines to help you started out:

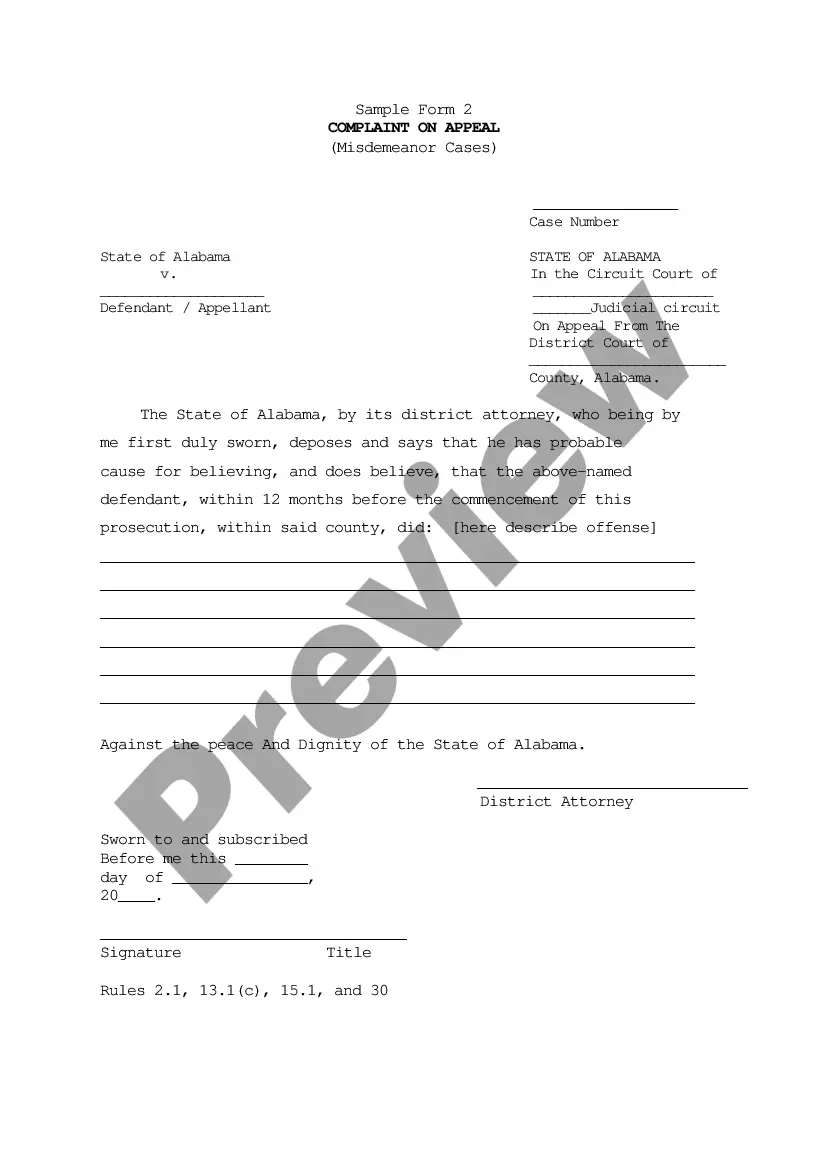

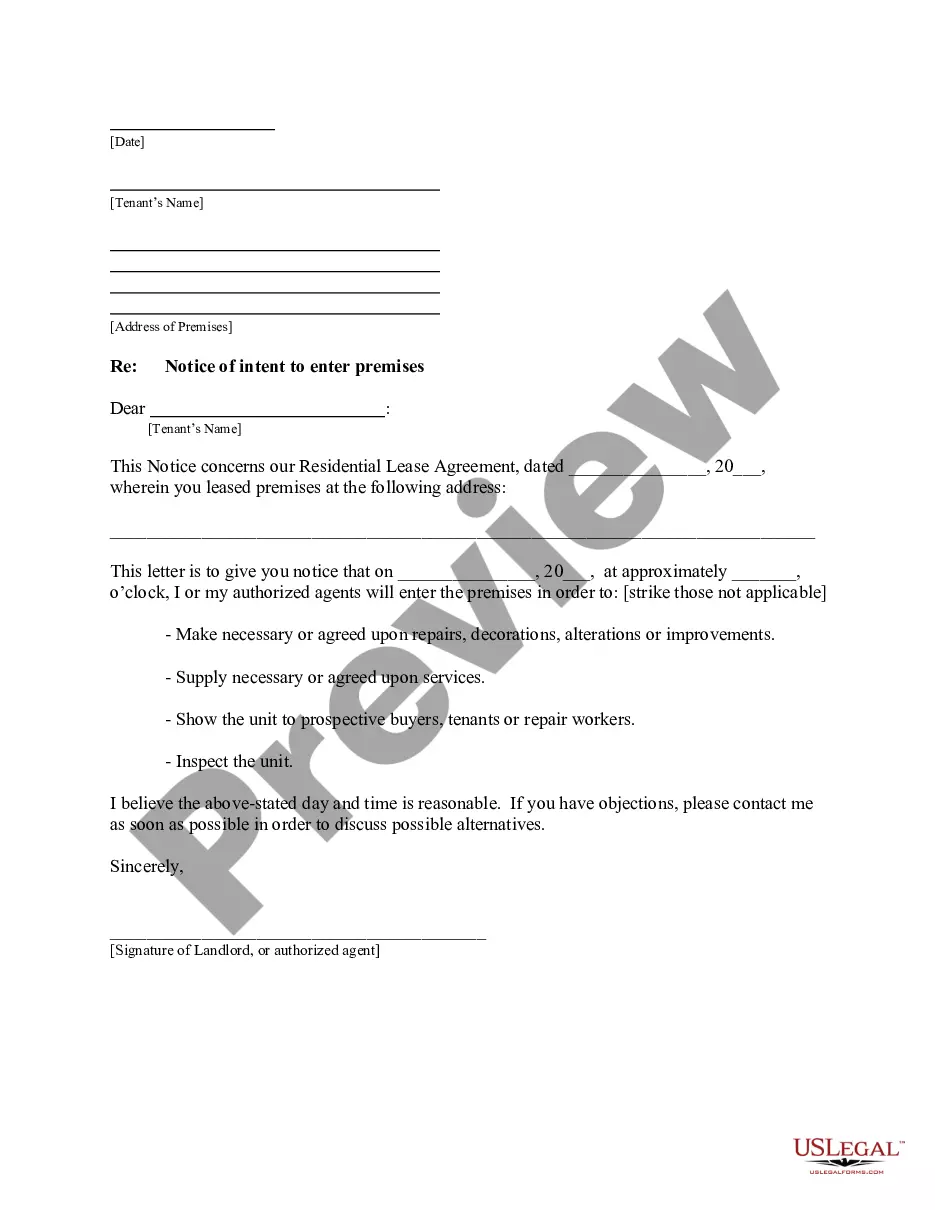

- Be sure you have picked out the correct kind for the city/county. Click on the Preview switch to analyze the form`s content. Browse the kind description to ensure that you have chosen the proper kind.

- When the kind doesn`t satisfy your requirements, make use of the Search area near the top of the display to get the the one that does.

- Should you be satisfied with the form, validate your option by visiting the Purchase now switch. Then, pick the rates plan you favor and offer your accreditations to register to have an accounts.

- Approach the purchase. Utilize your charge card or PayPal accounts to complete the purchase.

- Find the file format and download the form on the product.

- Make changes. Complete, change and print out and signal the acquired Alabama Application and Loan Agreement for a Business Loan with Warranties by Borrower.

Every single design you added to your account lacks an expiry time and it is your own for a long time. So, if you would like download or print out an additional backup, just visit the My Forms portion and click on on the kind you require.

Get access to the Alabama Application and Loan Agreement for a Business Loan with Warranties by Borrower with US Legal Forms, one of the most extensive catalogue of legitimate file themes. Use thousands of skilled and state-specific themes that fulfill your company or specific needs and requirements.