Alabama Articles of Incorporation, Not for Profit Organization, with Tax Provisions

Description

The proper form and necessary content of articles or certificates of incorporation for a nonprofit corporation depend largely on the requirements of the state nonprofit corporation act in the state of incorporation. Typically nonprofit corporations have no capital stock and therefore have members, not stockholders. Because federal tax-exempt status will be sought for most nonprofit corporations, the articles or certificate of incorporation must be carefully drafted to include specific language designed to ensure qualification for tax-exempt status.

How to fill out Articles Of Incorporation, Not For Profit Organization, With Tax Provisions?

Are you in a situation the place you need to have papers for either organization or person purposes nearly every day time? There are tons of legal document layouts available on the Internet, but locating types you can rely on is not easy. US Legal Forms offers a huge number of form layouts, such as the Alabama Articles of Incorporation, Not for Profit Organization, with Tax Provisions, which can be written to fulfill federal and state specifications.

If you are already acquainted with US Legal Forms internet site and get a free account, merely log in. After that, you may down load the Alabama Articles of Incorporation, Not for Profit Organization, with Tax Provisions web template.

Unless you have an profile and would like to begin to use US Legal Forms, adopt these measures:

- Obtain the form you want and ensure it is to the right area/county.

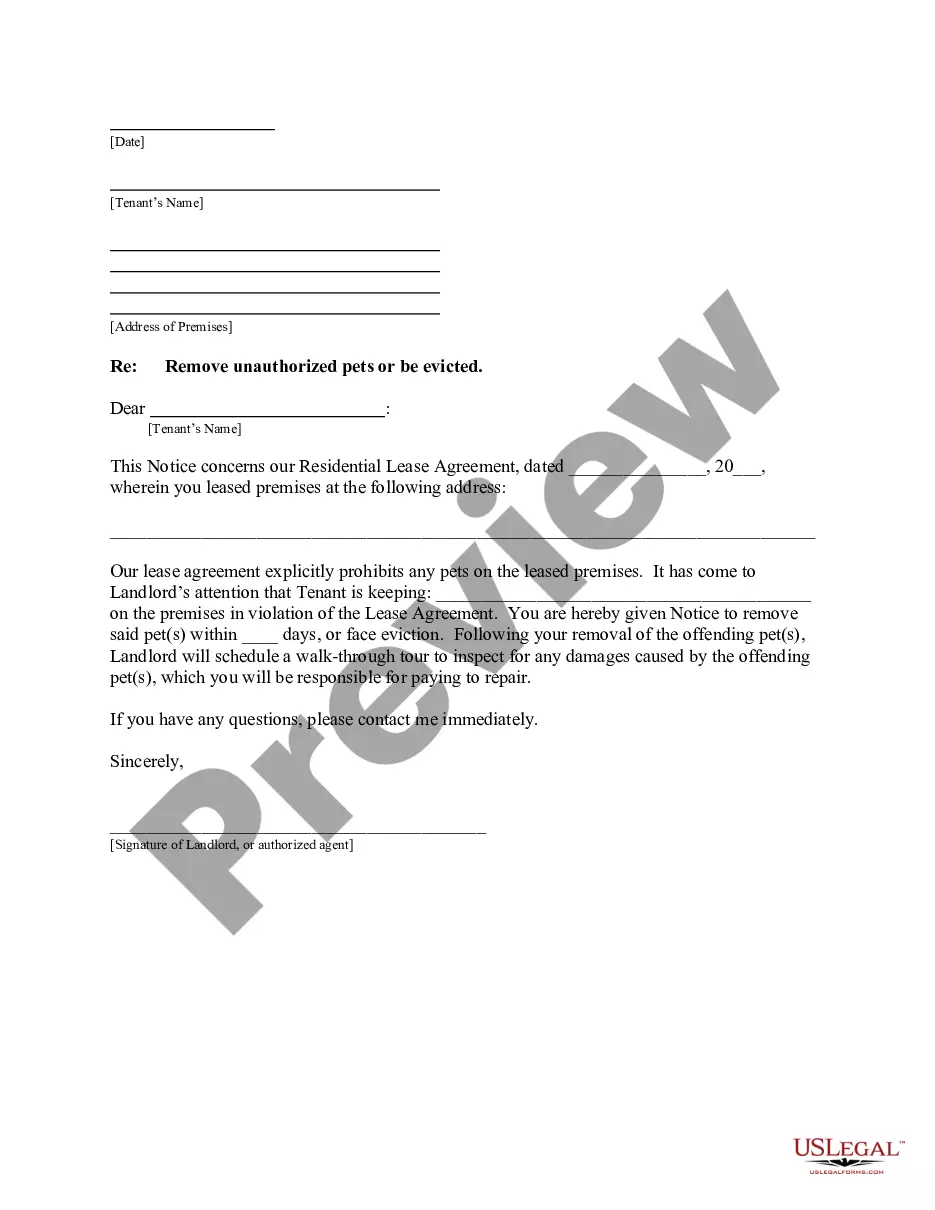

- Utilize the Review option to analyze the shape.

- Browse the information to ensure that you have chosen the proper form.

- In the event the form is not what you are looking for, use the Lookup discipline to discover the form that suits you and specifications.

- Whenever you find the right form, simply click Acquire now.

- Pick the prices plan you would like, submit the desired information and facts to make your money, and pay money for an order with your PayPal or bank card.

- Select a practical data file file format and down load your copy.

Find each of the document layouts you may have purchased in the My Forms menu. You can get a further copy of Alabama Articles of Incorporation, Not for Profit Organization, with Tax Provisions any time, if needed. Just go through the necessary form to down load or produce the document web template.

Use US Legal Forms, one of the most comprehensive assortment of legal types, to conserve some time and avoid blunders. The service offers professionally manufactured legal document layouts that can be used for a variety of purposes. Generate a free account on US Legal Forms and begin creating your daily life a little easier.

Form popularity

FAQ

Preparing and filing your articles of organization is the first step in starting your limited liability company (LLC). Approval of this document secures your business name and creates the legal entity of the LLC.

Required documents: The state of Alabama requires businesses to file Articles of Incorporation as well as a Certificate of Name Reservation, if not previously filed.

Immediate Processing: You may acquire copies and certified copies online at .sos.alabama.gov. Click on Business Services (below the picture, Business Entity Record Copies.

Steps on How to Start Your LLC in Alabama Reserve Your LLC Name With the Alabama Secretary of State. ... Designate a Registered Agent. ... File a Certificate of Formation. ... Create an Operating Agreement. ... Request an IRS Employer Identification Number (EIN) ... Fulfill Ongoing Obligations.

Are Nonprofits Taxed? Nonprofit organizations are exempt from federal income taxes under subsection 501(c) of the Internal Revenue Service (IRS) tax code. A nonprofit organization is an entity that engages in activities for both public and private interest without pursuing the goal of commercial or monetary profit.

Alabama nonprofits do not need to obtain a state-level business license or permit. However, your nonprofit should check with your city and county clerk's office to determine whether there are any local requirements you must follow.

To start a corporation in Alabama, you must file a Certificate of Formation with the Alabama Secretary of State. The Certificate of Formation and required name reservation cost $228 to file ($236 online).

Nonprofit organizations, including charities, have no special exemption from Alabama sales and use taxes. However, there is a list of exempt AL nonprofit organizations listed under sections 40-23-31 and 40-23-83 of the Code of Alabama. But as a general rule, no, your nonprofit is not eligible for state tax exemption.