Alabama Judgment Foreclosing Mortgage and Ordering Sale

Description

How to fill out Judgment Foreclosing Mortgage And Ordering Sale?

Are you inside a position where you will need papers for both organization or specific functions virtually every day? There are a lot of authorized papers web templates accessible on the Internet, but finding ones you can depend on isn`t simple. US Legal Forms gives 1000s of kind web templates, just like the Alabama Judgment Foreclosing Mortgage and Ordering Sale , which can be written to satisfy state and federal demands.

When you are presently acquainted with US Legal Forms website and have an account, merely log in. Afterward, you may obtain the Alabama Judgment Foreclosing Mortgage and Ordering Sale format.

Should you not have an accounts and want to begin using US Legal Forms, adopt these measures:

- Find the kind you will need and ensure it is for your appropriate metropolis/region.

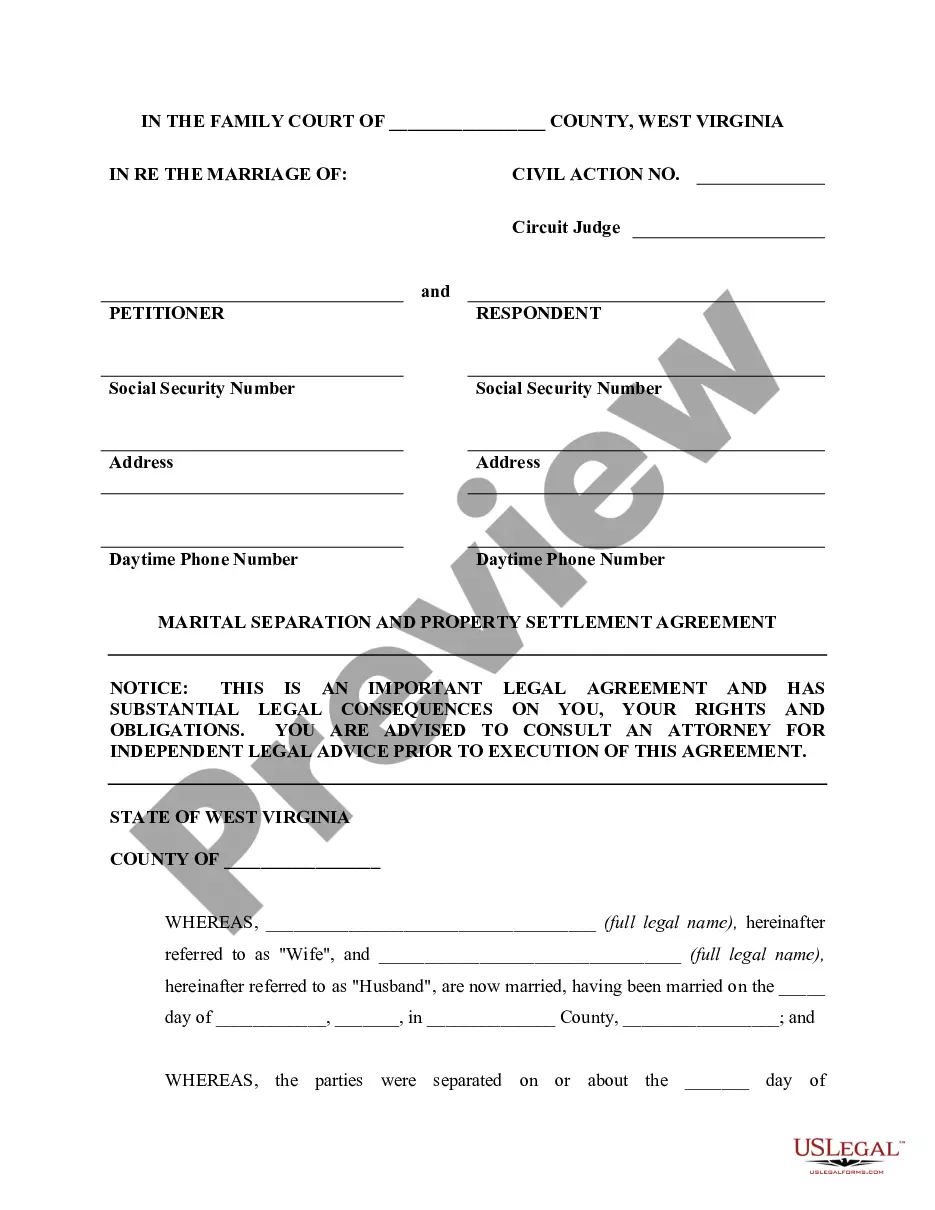

- Utilize the Preview switch to review the form.

- Browse the description to actually have selected the appropriate kind.

- If the kind isn`t what you`re looking for, use the Look for industry to get the kind that meets your requirements and demands.

- When you get the appropriate kind, click Get now.

- Select the rates program you need, fill out the necessary information and facts to generate your bank account, and buy the transaction making use of your PayPal or Visa or Mastercard.

- Choose a handy data file file format and obtain your version.

Locate all of the papers web templates you have purchased in the My Forms food selection. You can obtain a extra version of Alabama Judgment Foreclosing Mortgage and Ordering Sale anytime, if possible. Just go through the required kind to obtain or produce the papers format.

Use US Legal Forms, by far the most extensive selection of authorized types, to save lots of efforts and prevent faults. The services gives professionally manufactured authorized papers web templates which you can use for a variety of functions. Make an account on US Legal Forms and commence making your life a little easier.

Form popularity

FAQ

Power of sale is a mortgage clause that permits the lender to foreclose on and sell a property in default in order to recover the remainder of the loan. This clause, which is legal in many U.S. states, allows for a foreclosure process that circumvents the courts for speedier outcomes.

How Do Foreclosure Sales in Alabama Work? At the sale, which is a public auction, the lender usually makes a credit bid. The lender can bid up to the total amount owed, including fees and costs, or it may bid less.

Alabama has no definite statute of limitations as to when a lender must begin foreclosure proceedings. If you are behind with your mortgage payments, the lender can begin foreclosure proceedings at any time.

A defeasance clause is a provision in some mortgage contracts indicating that the borrower will receive the title to the property once all of the mortgage payments have been made.

The right of redemption allows the original owner to redeem the property by paying off back taxes and/or liens against the property within one year of the date of the foreclosure sale. The redemption period for homestead property is 180 days.