A corporation is owned by its shareholders. An ownership interest in a corporation is represented by a share or stock certificate. A certificate of stock or share certificate evidences the shareholder's ownership of stock. The ownership of shares may be transferred by delivery of the certificate of stock endorsed by its owner in blank or to a specified person. Ownership may also be transferred by the delivery of the certificate along with a separate assignment. This form is a sample of an agreement to purchase common stock from another stockholder.

North Dakota Agreement to Purchase Common Stock from another Stockholder

Description

How to fill out Agreement To Purchase Common Stock From Another Stockholder?

If you require to comprehensive, acquire, or produce legal document templates, leverage US Legal Forms, the largest variety of legal forms, which are accessible online.

Utilize the site’s straightforward and user-friendly search to locate the documents you need. Numerous templates for business and individual purposes are organized by categories and states, or keywords.

Use US Legal Forms to find the North Dakota Agreement to Purchase Common Stock from another Stockholder with just a couple of clicks.

Every legal document format you purchase is yours indefinitely. You have access to every form you downloaded in your account. Navigate to the My documents section and select a form to print or download again.

Complete and acquire, and print the North Dakota Agreement to Purchase Common Stock from another Stockholder using US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- If you are currently a US Legal Forms user, sign in to your account and click on the Obtain button to search for the North Dakota Agreement to Purchase Common Stock from another Stockholder.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are utilizing US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Preview option to review the content of the form. Don't forget to check the description.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have located the form you need, select the Acquire now button. Choose the pricing plan you prefer and provide your credentials to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Select the format of your legal document and download it to your device.

- Step 7. Complete, modify, print, or sign the North Dakota Agreement to Purchase Common Stock from another Stockholder.

Form popularity

FAQ

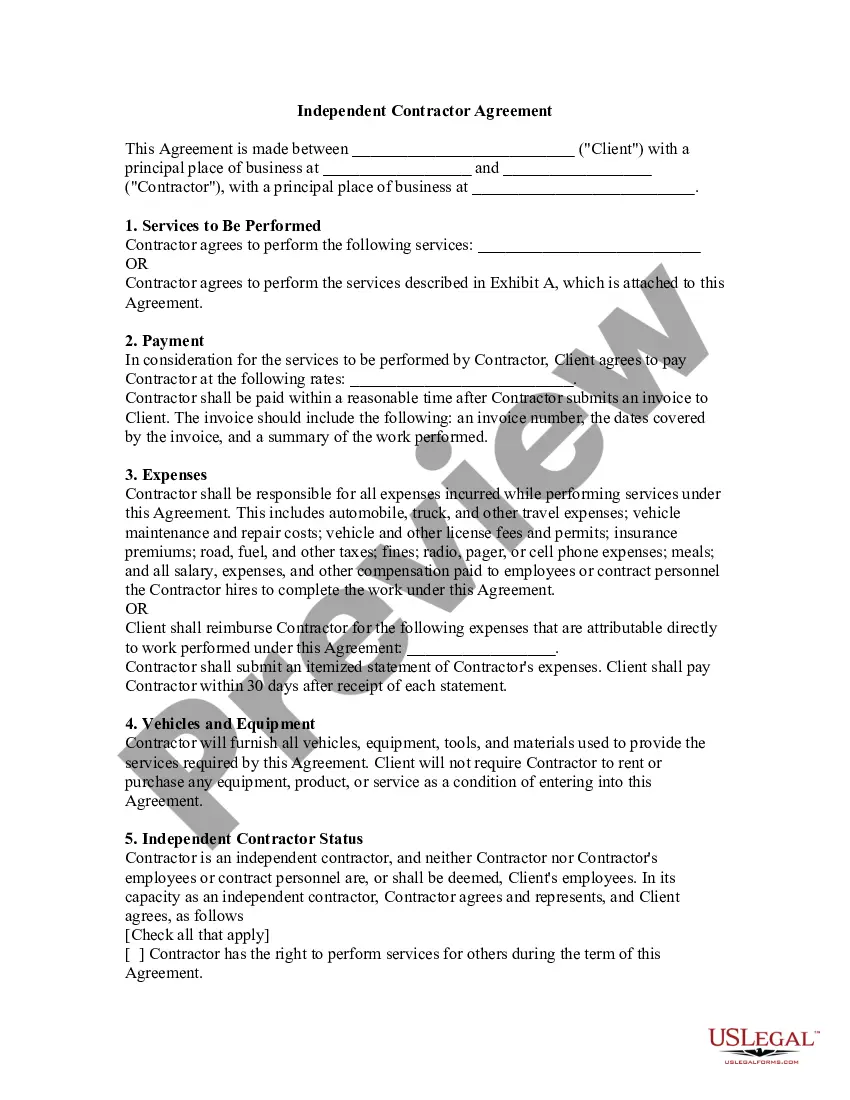

A stock purchase agreement, also known as an SPA, is a contract between buyers and sellers of company shares. This legal document transfers the ownership of stock and detail the terms of shares bought and sold by both parties.

Common Stock Offering Meaning Common stocks are ordinary shares that companies issue as an alternative to selling debt or issuing a different class of shares known as preferred stock. The first time that a company issues a public offering of common stock, it does so via an initial public offering.

Stock purchase agreements are legal documents that lay out the terms and conditions for a sale of company stocks. They are legally binding contracts that create obligations and rights for all the parties involved.

Stock Purchase Agreement: Everything You Need to KnowName of company.Purchaser's name.Par value of shares.Number of shares being sold.When/where the transaction takes place.Representations and warranties made by purchaser and seller.Potential employee issues, such as bonuses and benefits.More items...?

A stock purchase agreement is an agreement that two parties sign when shares of a company are being bought or sold. These agreements are often used by small corporations who sell stock. Either the company or shareholders in the organization can sell stock to buyers.

Stocks and equity are same, as both represent the ownership in an entity (company) and are traded on the stock exchanges. Equity by definition means ownership of assets after the debt is paid off. Stock generally refers to traded equity. Stock is the type of equity that represents equity investment.

Common Stock Agreement means an agreement between the Company and a Grantee evidencing the terms and conditions of an individual Common Stock grant. The Stock Grant agreement is subject to the terms and conditions of the Plan.

As discussed above, a purchase agreement should contain buyer and seller information, a legal description of the property, closing dates, earnest money deposit amounts, contingencies and other important information for the sale.

You typically see the following in a stock purchase agreement:Your company's name.The name and mailing address of the entity buying shares in your company's stocks.The par value (essentially the sale price) of the stocks being sold.The number of stocks the buyer is purchasing.The transaction's date, time and location.More items...

Common stock is a security that represents ownership in a corporation. Holders of common stock elect the board of directors and vote on corporate policies. This form of equity ownership typically yields higher rates of return long term.