Alabama Assignment of Property in Attached Schedule

Description

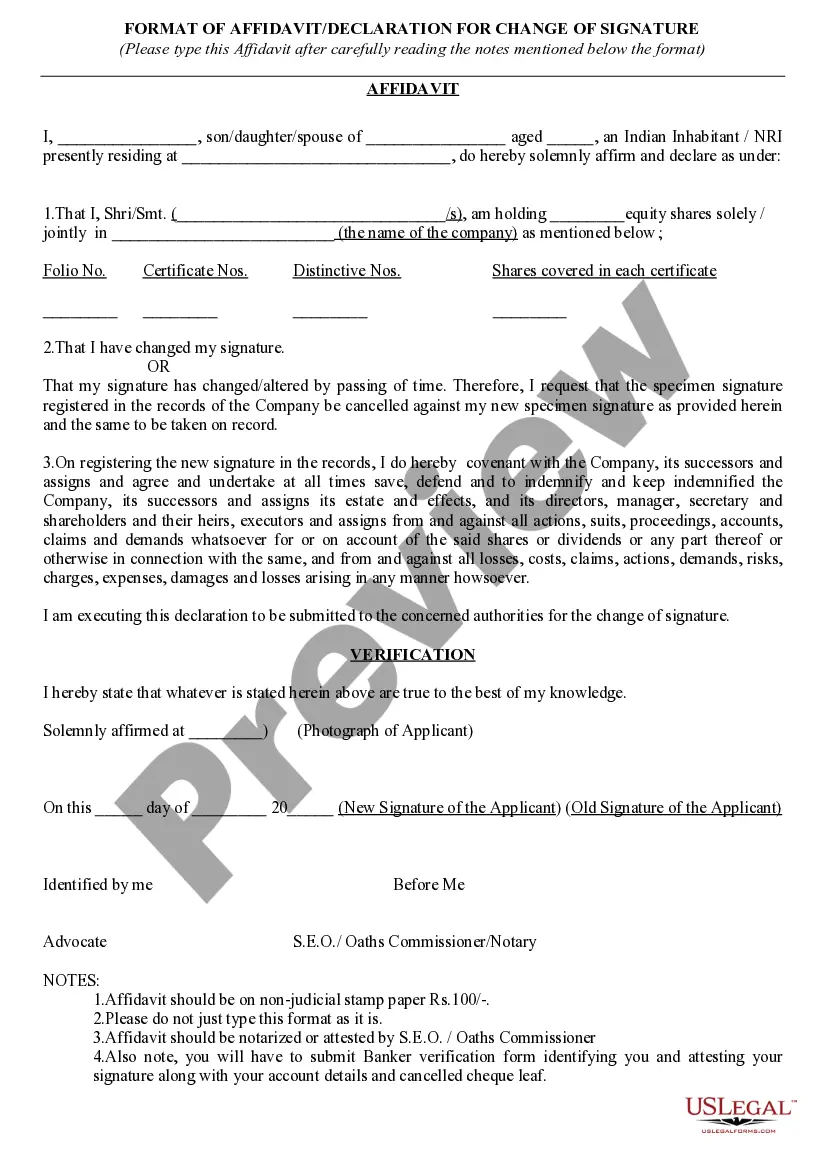

How to fill out Assignment Of Property In Attached Schedule?

If you wish to finalize, download, or generate legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Make use of the site's simple and convenient search to locate the documents you require. Numerous templates for business and personal purposes are organized by categories and states, or keywords.

Employ US Legal Forms to find the Alabama Assignment of Property in Attached Schedule in just a few clicks.

Every legal document template you obtain is yours forever. You will have access to each form you downloaded in your account.

Click on the My documents section and select a form to print or download again. Finalize and download, and print the Alabama Assignment of Property in Attached Schedule with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and then click the Download button to locate the Alabama Assignment of Property in Attached Schedule.

- You can also access forms you have previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form’s content. Remember to check the details.

- Step 3. If you are dissatisfied with the form, utilize the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click on the Acquire now button. Select the pricing plan you prefer and enter your credentials to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to process the transaction.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Alabama Assignment of Property in Attached Schedule.

Form popularity

FAQ

Form 40NR is used for Alabama non-resident income tax returns. Non-residents must report any income sourced from Alabama, and this form helps ensure compliance with state tax laws. If your situation involves the Alabama Assignment of Property in Attached Schedule, it's important to correctly complete this form to reflect property-related income. For seamless navigation of these forms and guidelines, you can rely on US Legal Forms to find accurate and up-to-date information.

The 40 18 80.1 code refers to a specific statute regarding property taxation within the state of Alabama. This code outlines matters related to property assessment and tax calculations, ensuring fair treatment for property owners. For those dealing with property management, understanding the implications of the Alabama Assignment of Property in Attached Schedule is crucial for compliance. If you require documentation related to these matters, US Legal Forms can provide the necessary resources.

Alabama imposes a property gains tax on the profit from the sale of real estate. The state typically taxes the capital gains at the same rates as ordinary income, which can range from 2% to 6.5%. Understanding the Alabama Assignment of Property in Attached Schedule could provide insight into how gains tax may influence your financial planning. For clarity, consider utilizing US Legal Forms to access legal documents that can assist in navigating these tax laws.

In Alabama, the tax rate for pass-through entities (PTE) can depend on various factors, including the type of entity and income levels. Generally, PTEs are subject to Alabama's income tax, which ranges from 2% to 6.5%. It’s essential to consider the implications of Alabama Assignment of Property in Attached Schedule, as it may affect your overall tax obligations. For detailed guidance, consult a tax professional or utilize resources from US Legal Forms.

Yes, machinery is generally regarded as personal property. This includes equipment used in various industries, from construction to manufacturing. Accurately including machinery in your Alabama Assignment of Property in Attached Schedule is essential for legal compliance and clarity in ownership.

The 40 18 86 code relates to property tax exemptions in Alabama for certain types of manufactured homes. Understanding this code is vital for property owners when dealing with the Alabama Assignment of Property in Attached Schedule. It may affect how property is evaluated and assessed for taxes.

Livestock is classified as personal property in Alabama law. This includes cattle, sheep, and other farm animals owned by individuals or businesses. When engaging with the Alabama Assignment of Property in Attached Schedule, including livestock could impact the assignment or transfer of property rights.

Yes, tractors are typically classified as personal property. They are not permanently fixed to a location and can be transferred between owners. When creating an Alabama Assignment of Property in Attached Schedule, remember to include such agricultural equipment to ensure accurate records.

Personal property equipment refers to movable items that businesses use in their operations. This might include computers, machinery, and tools necessary for production or service delivery. In the context of the Alabama Assignment of Property in Attached Schedule, identifying your equipment correctly ensures a more comprehensive legal framework.

Personal property includes items you own that are not attached to land or real estate. This typically covers furniture, vehicles, and equipment. When dealing with the Alabama Assignment of Property in Attached Schedule, understanding what qualifies as personal property can be crucial for your legal documentation.