Generally, a license in respect of real property (since it is a mere personal privilege), cannot be assigned or transferred by the licensee. A license does not pass with the title to the property, but is only binding between the parties, expiring upon the death of either party. This form is an example of such.

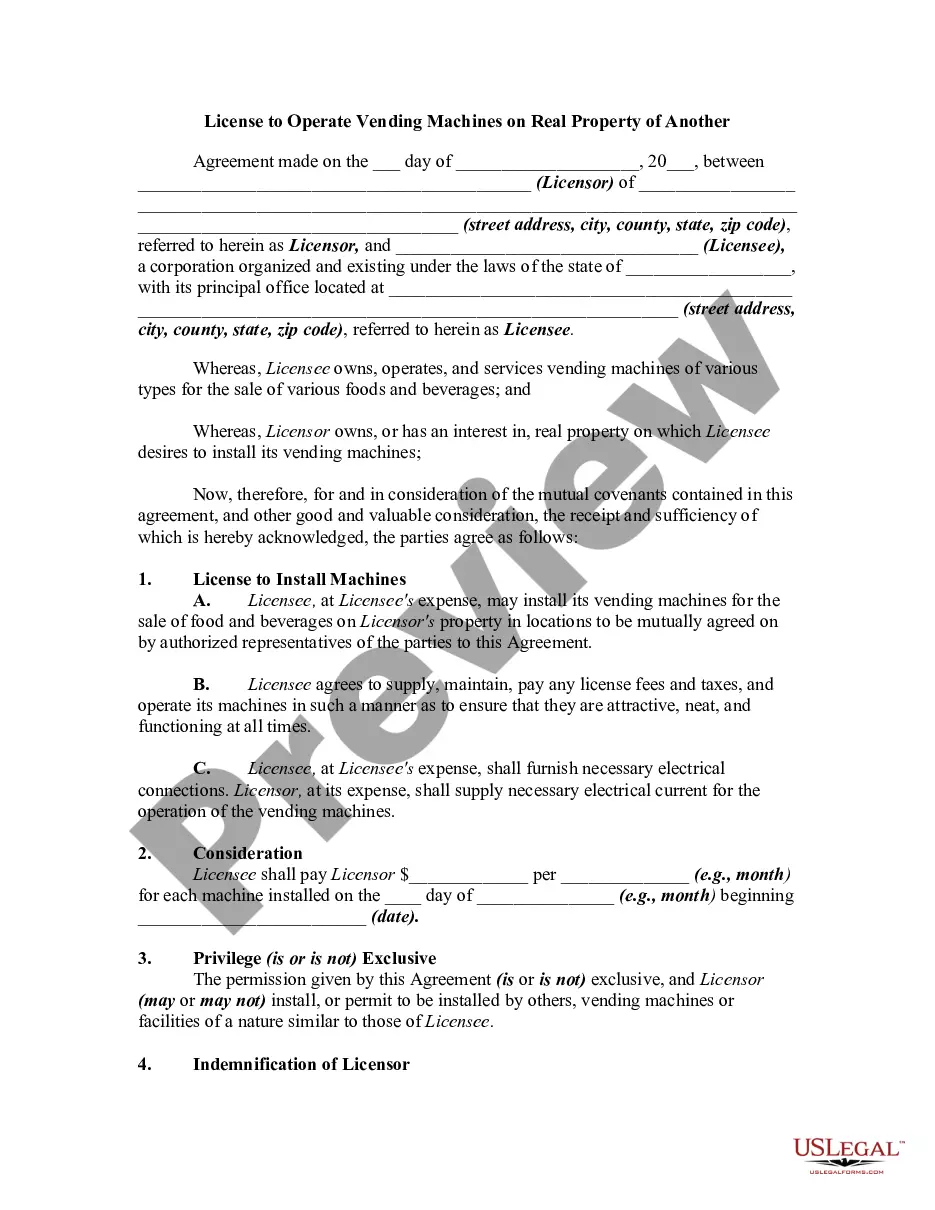

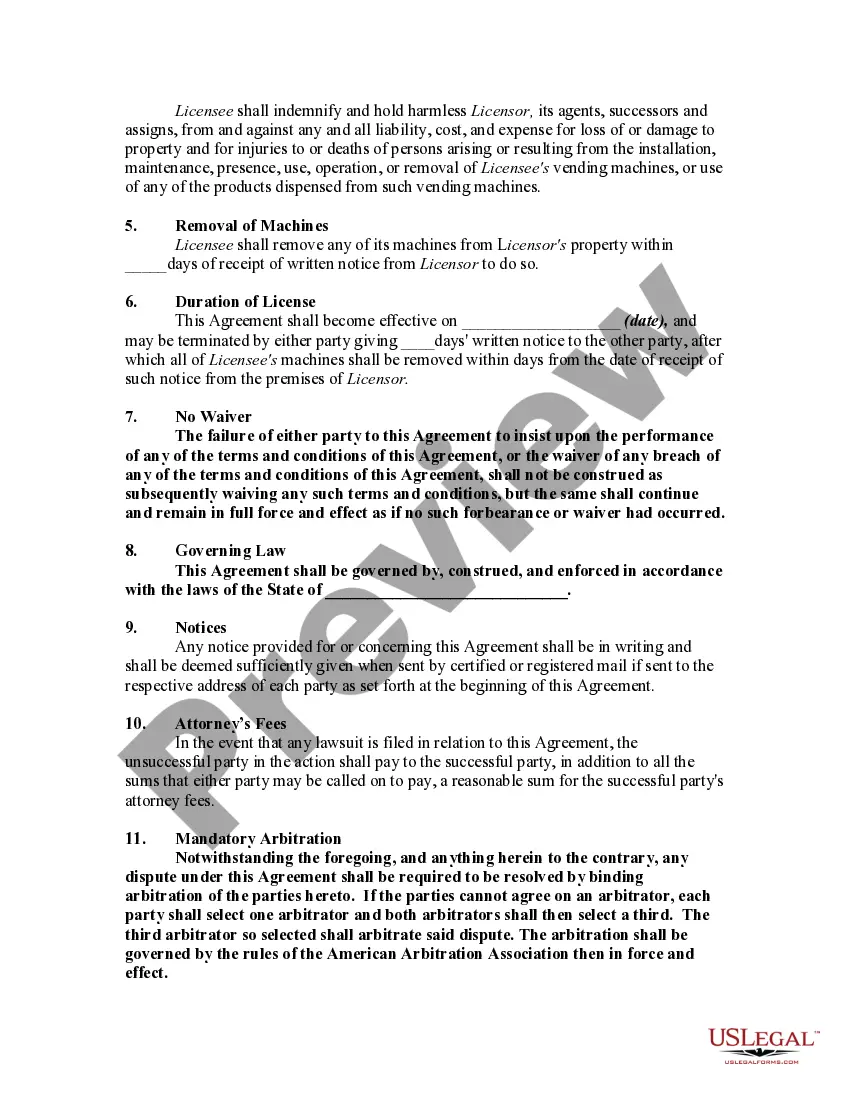

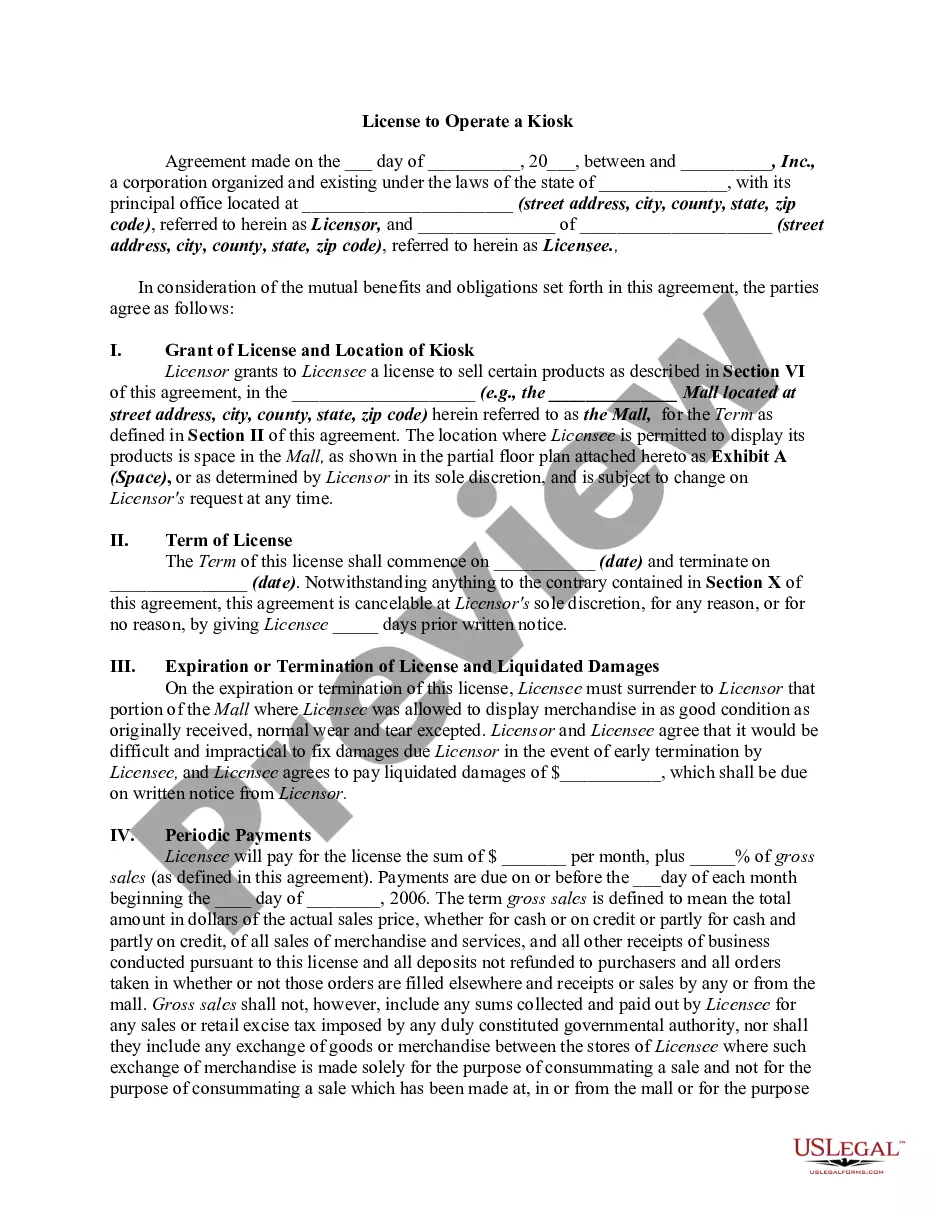

Alabama License to Operate Vending Machines on Real Property of Another

Description

How to fill out License To Operate Vending Machines On Real Property Of Another?

If you wish to collect, acquire, or print legitimate document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Take advantage of the site’s straightforward and user-friendly search to find the documents you require.

Various templates for business and personal purposes are categorized by type and state, or keywords.

Step 3. If you are not content with the form, utilize the Search field at the top of the page to find other variations of the legal form template.

Step 4. Once you have found the form you need, click the Get now option. Choose the pricing plan you prefer and enter your details to create an account.

- Use US Legal Forms to locate the Alabama License to Operate Vending Machines on Real Property of Another in just a few clicks.

- If you are an existing US Legal Forms user, Log In to your account and click the Download button to acquire the Alabama License to Operate Vending Machines on Real Property of Another.

- You can also access forms you previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you select the form for the correct city/state.

- Step 2. Use the Review function to inspect the form’s details. Be sure to read through the description.

Form popularity

FAQ

Section 40 14A 22 of Alabama law pertains to the registration and operation of certain businesses, including vending machine operations. This section emphasizes the need for obtaining an Alabama License to Operate Vending Machines on Real Property of Another to ensure legal operation in the state. By adhering to these regulations, operators can avoid legal pitfalls and foster reliable business practices. For guidance, the US Legal Forms platform offers relevant resources to help navigate these requirements smoothly.

The 40 12 262 code in Alabama relates to the licensing and taxation of vending machine operations. This section specifies the tax obligations connected to the operation of vending machines and stresses the importance of securing an Alabama License to Operate Vending Machines on Real Property of Another. Compliance with this code ensures that operators fulfill their fiscal responsibilities, thereby avoiding penalties. This knowledge is vital for maintaining a successful vending business within the state.

Section 40 12 255 of the Code of Alabama 1975 establishes the regulations and requirements for obtaining an Alabama License to Operate Vending Machines on Real Property of Another. This section outlines the need for proper licensing to ensure compliance with state laws and standards. It protects both operators and property owners by setting clear rules regarding vending machine placement and operation. Understanding this section is crucial for anyone looking to enter the vending machine business in Alabama.

To obtain a business privilege license in Alabama, you must complete an application with the Alabama Department of Revenue. This includes providing information on your vending machine operations and paying the requisite fees. If you're acquiring an Alabama License to Operate Vending Machines on Real Property of Another, use our platform, UsLegalForms, to simplify the process and access all necessary documents. It’s a straightforward pathway to ensure compliance.

The business privilege tax rate in Alabama varies depending on the income level of your business. Generally, it ranges from $100 to $15,000, based on your gross receipts. If you hold an Alabama License to Operate Vending Machines on Real Property of Another, understand that your vending income will influence your tax obligations. Prepare to budget accordingly for your business expenses.

Yes, you need a permit to operate vending machines in Alabama. This includes obtaining an Alabama License to Operate Vending Machines on Real Property of Another, which ensures your operation complies with state regulations. Additionally, ensure that you check local laws for any extra permitting needs. It's essential to secure all necessary licenses to operate legally.

A Section 51 privilege license in Alabama relates to operating specific types of businesses, including vending services. This license allows business owners to legally operate vending machines on premises owned by others. If you are seeking an Alabama License to Operate Vending Machines on Real Property of Another, acquiring this license can be a necessary step. Always verify licensing requirements to ensure legitimate operations.

Section 40 23 68 of the Alabama Code pertains to the taxation of businesses operating in Alabama, including vending machine operations. This section outlines the obligations for filing and paying the business privilege tax. Understanding this legislation is vital for compliance when obtaining an Alabama License to Operate Vending Machines on Real Property of Another. Always review this code to stay updated on your responsibilities.

Every business operating in Alabama must file a business privilege tax return. This includes businesses licensing for vending machines under the Alabama License to Operate Vending Machines on Real Property of Another. If you own a vending machine business, ensure you comply with the tax requirements to avoid penalties. Consult the Alabama Department of Revenue for specific guidelines.

Alabama Code 40 23 101 defines the legal framework for collecting taxes from vending machine sales. This code outlines tax rates and reporting requirements that vending machine operators must follow. Understanding this code can help ensure compliance when applying for an Alabama License to Operate Vending Machines on Real Property of Another, helping you avoid potential legal issues.