Alabama Corporate Resolution Authorizing a Charitable Contribution

Description

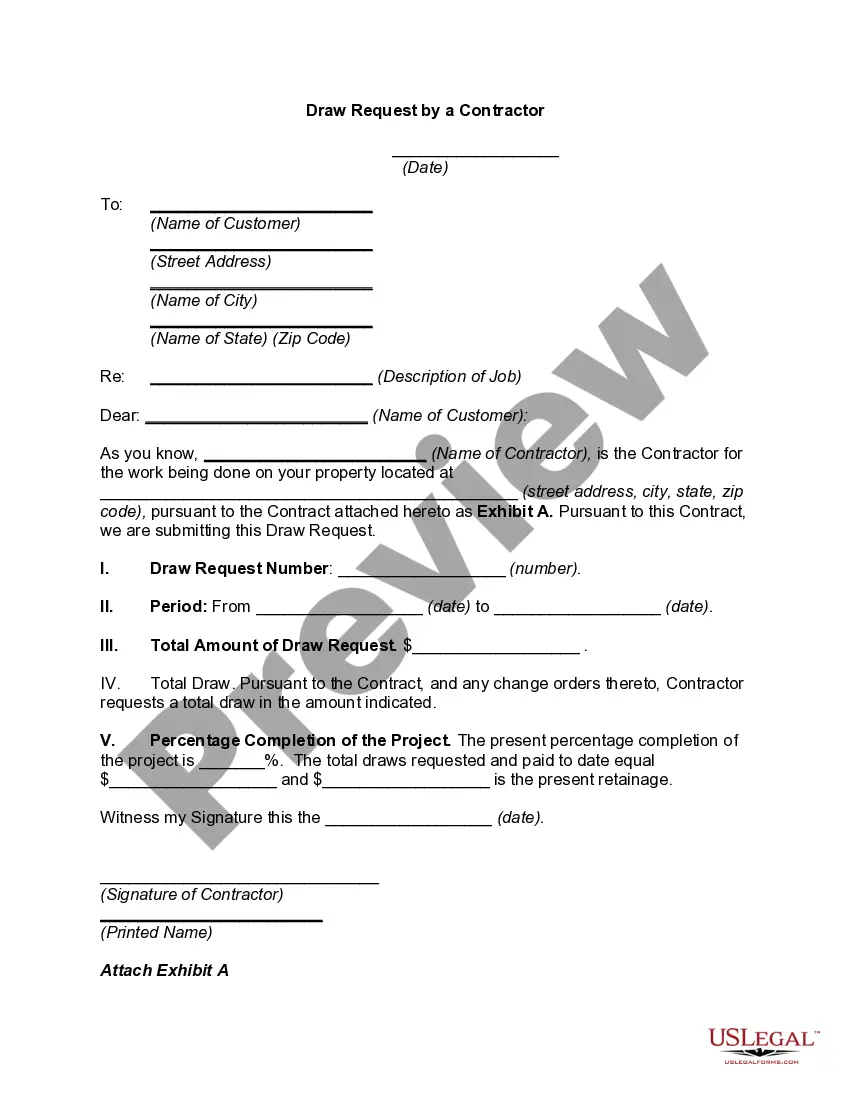

The RMBCA even authorizes a corporation to make charitable contributions. The following form is a sample of a corporate resolution authorizing a charitable contribution.

How to fill out Corporate Resolution Authorizing A Charitable Contribution?

Locating the correct valid document template can be a challenge.

Of course, there are numerous templates accessible online, but how do you discover the valid form you require? Utilize the US Legal Forms website.

The service provides thousands of templates, including the Alabama Corporate Resolution Authorizing a Charitable Contribution, which you can use for both business and personal purposes.

Ensure you have selected the appropriate form for your locality/state. You can preview the document using the Review button and read the form description to confirm that it is indeed the right one for you.

- All the forms are vetted by professionals and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to access the Alabama Corporate Resolution Authorizing a Charitable Contribution.

- Utilize your account to search through the valid forms you may have requested in the past.

- Visit the My documents section of your account to obtain another copy of the necessary document.

- If you are a new user of US Legal Forms, follow these simple instructions.

Form popularity

FAQ

Starting a nonprofit in Alabama typically involves various costs, including state filing fees, legal fees, and other startup expenses that can range from a few hundred to several thousand dollars. You may also need to consider ongoing costs like fundraising and operational expenses. Planning your budget carefully will help ensure your nonprofit’s sustainability. Creating an Alabama Corporate Resolution Authorizing a Charitable Contribution can help you formalize your financial commitments early on.

Starting a non-profit business in Alabama involves a few critical steps, including outlining your mission and recruiting board members. You'll need to file your organization's articles of incorporation with the state. After that, applying for federal tax-exempt status is essential. To streamline your process, consider using USLegalForms for assistance with documentation, including an Alabama Corporate Resolution Authorizing a Charitable Contribution.

To start a charity in Alabama, you need to establish your mission and form a board of directors. Next, you must file articles of incorporation with the state and apply for tax-exempt status. Following these initial steps, obtain the necessary permits and licenses. Utilizing USLegalForms can help you create an Alabama Corporate Resolution Authorizing a Charitable Contribution that aligns with your charity's goals.

The minimum number of board members for a nonprofit in Alabama is three. This requirement applies regardless of the size or scope of the organization. Having multiple board members helps to promote collaboration and accountability within the organization. An Alabama Corporate Resolution Authorizing a Charitable Contribution can further enhance your organization's transparency and operational integrity.

In Alabama, a nonprofit organization must have at least three board members. This requirement ensures diverse perspectives in decision-making and governance. It is crucial for nonprofits to maintain a balanced board to support the effective management of the organization. By having an Alabama Corporate Resolution Authorizing a Charitable Contribution, you reinforce your commitment to good governance.

In Alabama, charitable solicitation is governed by specific statutes that aim to protect the public from fraudulent fundraising practices. Organizations seeking to solicit donations must adhere to these laws to ensure transparency and accountability. When creating an Alabama Corporate Resolution Authorizing a Charitable Contribution, organizations should be aware of registration requirements and reporting guidelines imposed by the state. This ensures compliance and builds donor trust, enabling effective fundraising efforts.

To start a non-profit organization in Alabama, you must first define your mission and purpose clearly. Next, create a board of directors and draft your bylaws. It's crucial to file your Articles of Incorporation with the state and to obtain an Employer Identification Number (EIN). Finally, to authorize any charitable contributions, you will need an Alabama Corporate Resolution Authorizing a Charitable Contribution, which outlines how you plan to manage and use donations effectively.

Yes, Alabama allows deductions for charitable contributions on federal income tax returns, as long as the donations are made to qualified organizations. This can benefit both individuals and corporations looking to give back. An Alabama Corporate Resolution Authorizing a Charitable Contribution can be a key step in managing and documenting these contributions for tax purposes.

The 15/5/30 law in Alabama refers to regulations concerning charitable organizations' fundraising expenses and transparency. This law mandates that nonprofits spend at least 15% of their contributions on charitable programs. An Alabama Corporate Resolution Authorizing a Charitable Contribution can help you outline your financial responsibilities while ensuring compliance with this law.

The charitable solicitation law in Alabama regulates how organizations can request donations from the public. These laws ensure accountability and protect donors. Incorporating an Alabama Corporate Resolution Authorizing a Charitable Contribution can assist organizations in adhering to these solicitation laws, providing a clearer pathway for fundraising efforts.