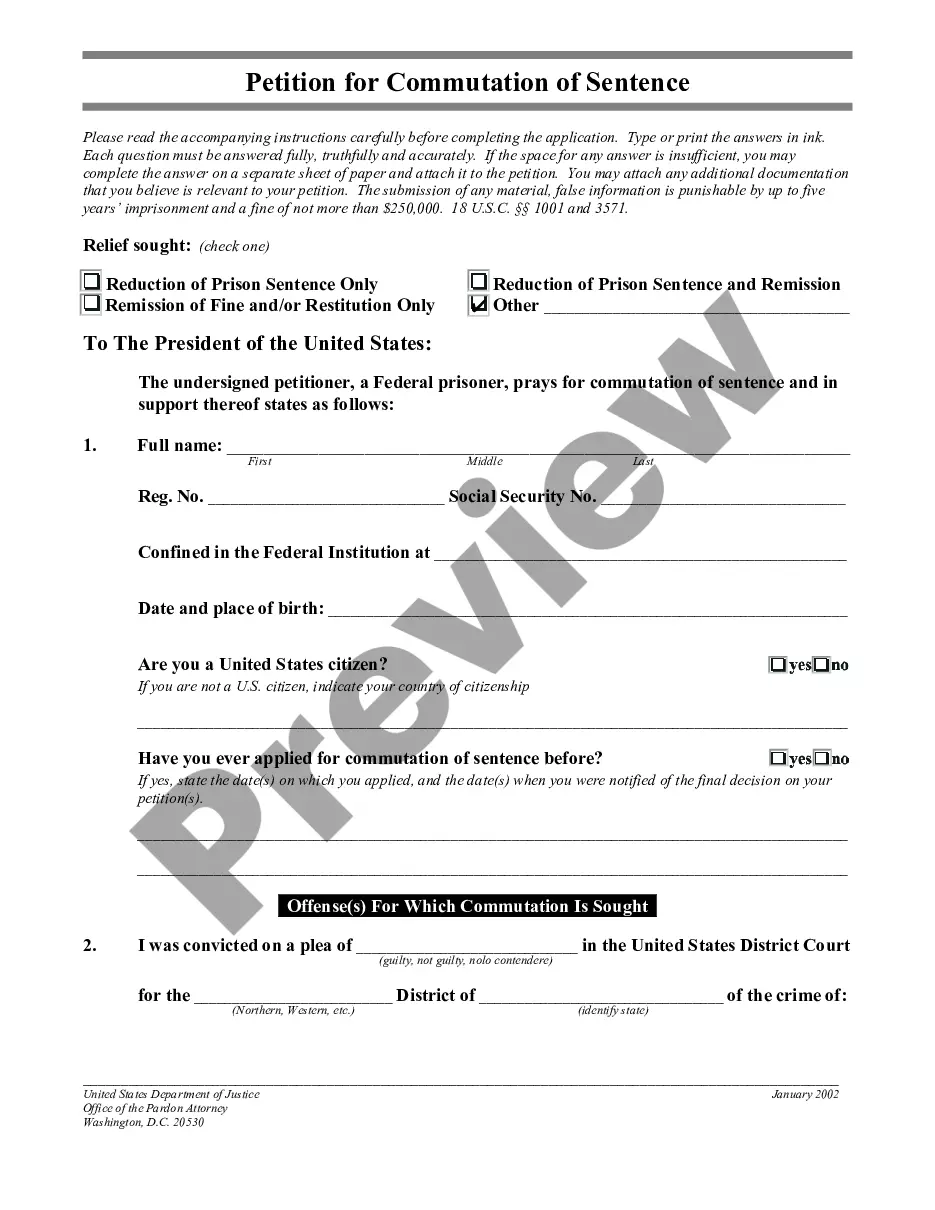

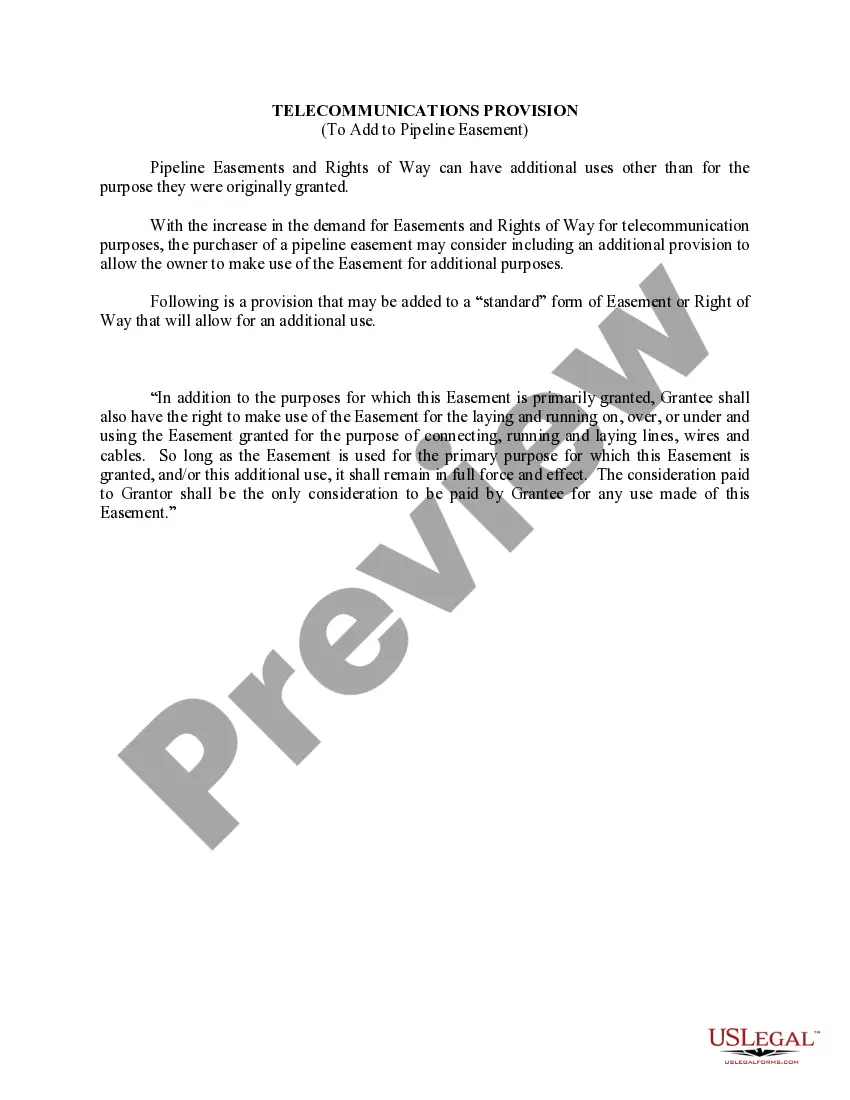

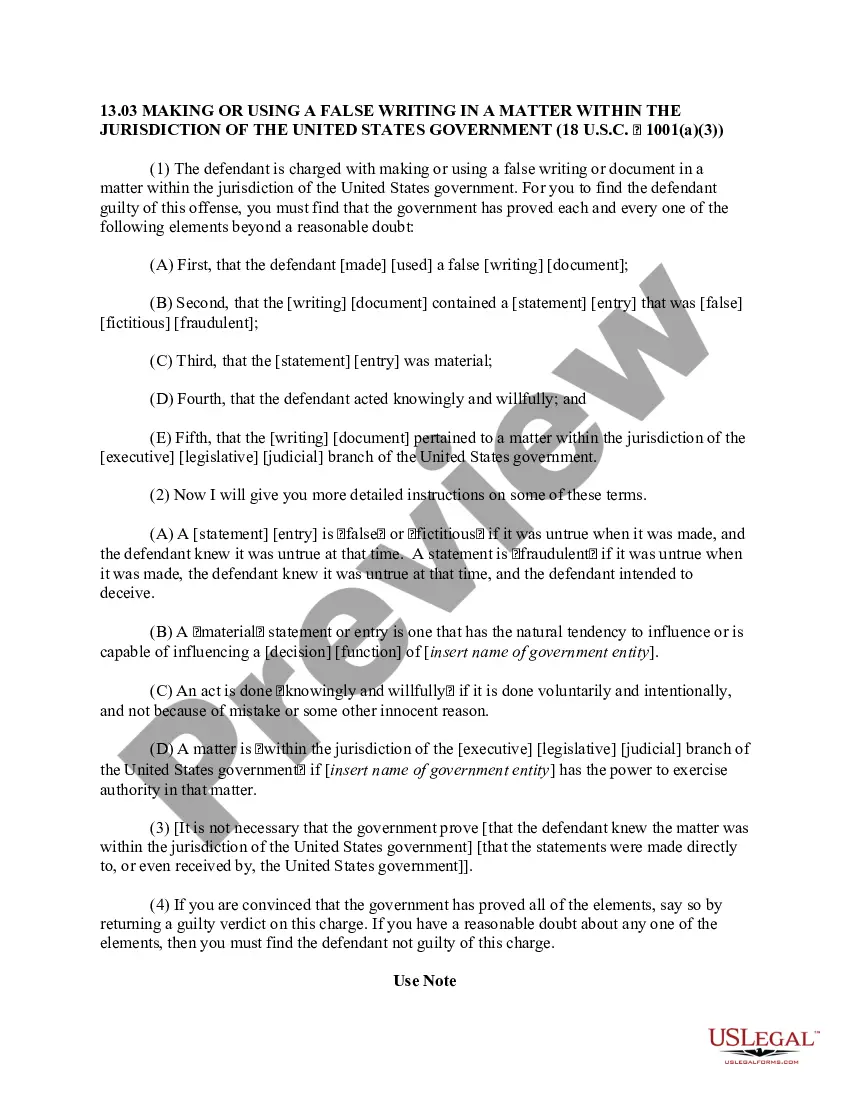

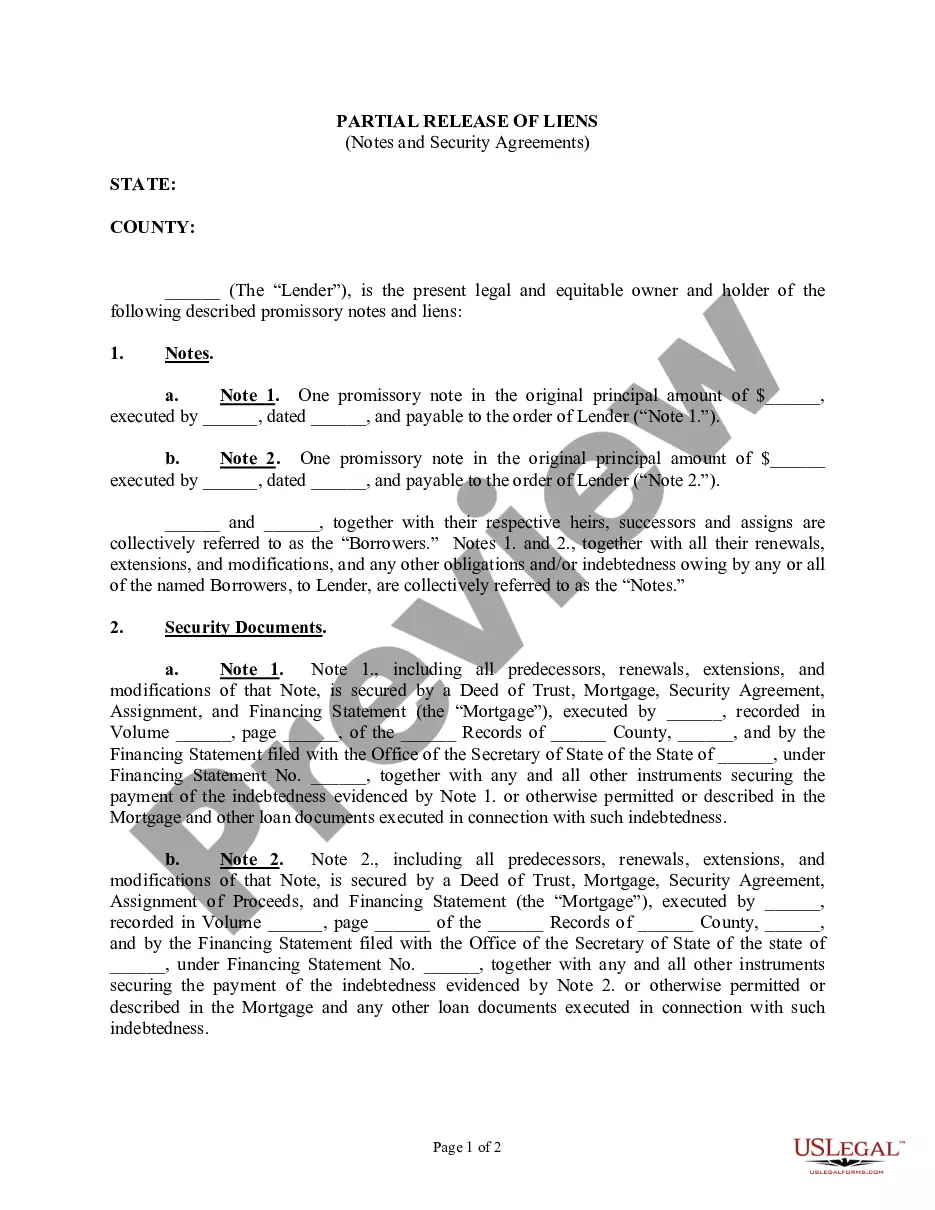

This form is an Application for Release of Right to Redeem Property from IRS After Foreclosure. Check for compliance with your specific facts and circumstances.

Alabama Application for Release of Right to Redeem Property from IRS After Foreclosure

Description

How to fill out Application For Release Of Right To Redeem Property From IRS After Foreclosure?

Have you found yourself in a scenario where you need documents for either business or personal purposes nearly every day.

There are numerous legal document templates accessible online, but finding ones you can rely on isn't straightforward.

US Legal Forms offers thousands of form templates, such as the Alabama Application for Release of Right to Redeem Property from IRS After Foreclosure, which are designed to meet federal and state requirements.

Choose the pricing plan you prefer, enter the necessary details to create your account, and pay for the transaction using your PayPal or credit card.

Select a preferred file format and download your copy. Access all the document templates you have purchased in the My documents list. You can download another copy of the Alabama Application for Release of Right to Redeem Property from IRS After Foreclosure at any time if desired. Click on the required form to download or print the document template. Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors. This service offers professionally crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start making your life simpler.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Alabama Application for Release of Right to Redeem Property from IRS After Foreclosure template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/county.

- Utilize the Review button to inspect the form.

- Check the description to make sure you have selected the right form.

- If the form isn't what you're looking for, use the Search box to find the form that suits your needs and requirements.

- Once you locate the correct form, click on Buy now.

Form popularity

FAQ

Form 14135, which is related to the release of a federal tax lien, should be filed with the IRS. It's important to ensure that you provide complete and accurate information to avoid delays. If you are navigating the complexities of this process, using resources like US Legal Forms can help you prepare and file the Alabama Application for Release of Right to Redeem Property from IRS After Foreclosure effectively.

The IRS 7 year rule relates to the timeframe in which the IRS can assess and collect tax liabilities. If you have unpaid taxes, the IRS can pursue collection for up to seven years from the date of assessment. By understanding this rule, you can better strategize your financial decisions, including when to file the Alabama Application for Release of Right to Redeem Property from IRS After Foreclosure.

Foreclosure redeemed refers to the process in which a property owner pays the necessary debts to reclaim their property after a foreclosure. This process can help restore ownership and clear outstanding liens. Utilizing the Alabama Application for Release of Right to Redeem Property from IRS After Foreclosure can facilitate this redemption, ensuring you have the support needed to reclaim your home.

In Alabama, the timeframe to redeem property after a tax sale typically lasts for three years. This redemption period gives property owners a chance to reclaim their property by paying off the tax debts. It is essential to understand this timeline, as timely filing of the Alabama Application for Release of Right to Redeem Property from IRS After Foreclosure can significantly impact your situation.

The IRS right of redemption allows the IRS to reclaim property after a foreclosure sale if tax debts are owed. This means that even after a foreclosure, the IRS can step in and assert its claim. Filing the Alabama Application for Release of Right to Redeem Property from IRS After Foreclosure can be a vital step in navigating this complex process.

After a foreclosure, the federal tax lien may remain attached to the property. However, if you file the Alabama Application for Release of Right to Redeem Property from IRS After Foreclosure, you can potentially remove this lien. Understanding the implications of a federal tax lien is crucial, as it can affect your financial future and property ownership.

The right of redemption allows you to reclaim your property after foreclosure by settling the outstanding debts, while the right of reinstatement focuses on bringing the mortgage current without losing ownership. Both options offer pathways to retain your property, but they serve different purposes. By using the Alabama Application for Release of Right to Redeem Property from IRS After Foreclosure, you can clarify your rights and choose the best option for your situation.

The IRS right to redeem foreclosure refers to the ability of the IRS to reclaim property that has been sold due to unpaid tax debts. This right allows the IRS to take ownership of the property and sell it to recover the owed taxes. If you find yourself in this situation, consider the Alabama Application for Release of Right to Redeem Property from IRS After Foreclosure to understand your options better.

The right to redeem property after foreclosure is a legal entitlement that allows borrowers to regain ownership by paying the required amount to settle their debts. This right is crucial as it provides a safety net for borrowers facing financial difficulties. By utilizing the Alabama Application for Release of Right to Redeem Property from IRS After Foreclosure, you can ensure that you have the right documentation to reclaim your property.

Redemption in foreclosure means the opportunity for a borrower to reclaim their property after it has been sold. This process involves paying off the mortgage balance, including any fees incurred during the foreclosure. By completing the Alabama Application for Release of Right to Redeem Property from IRS After Foreclosure, you can effectively navigate this process and regain your property.