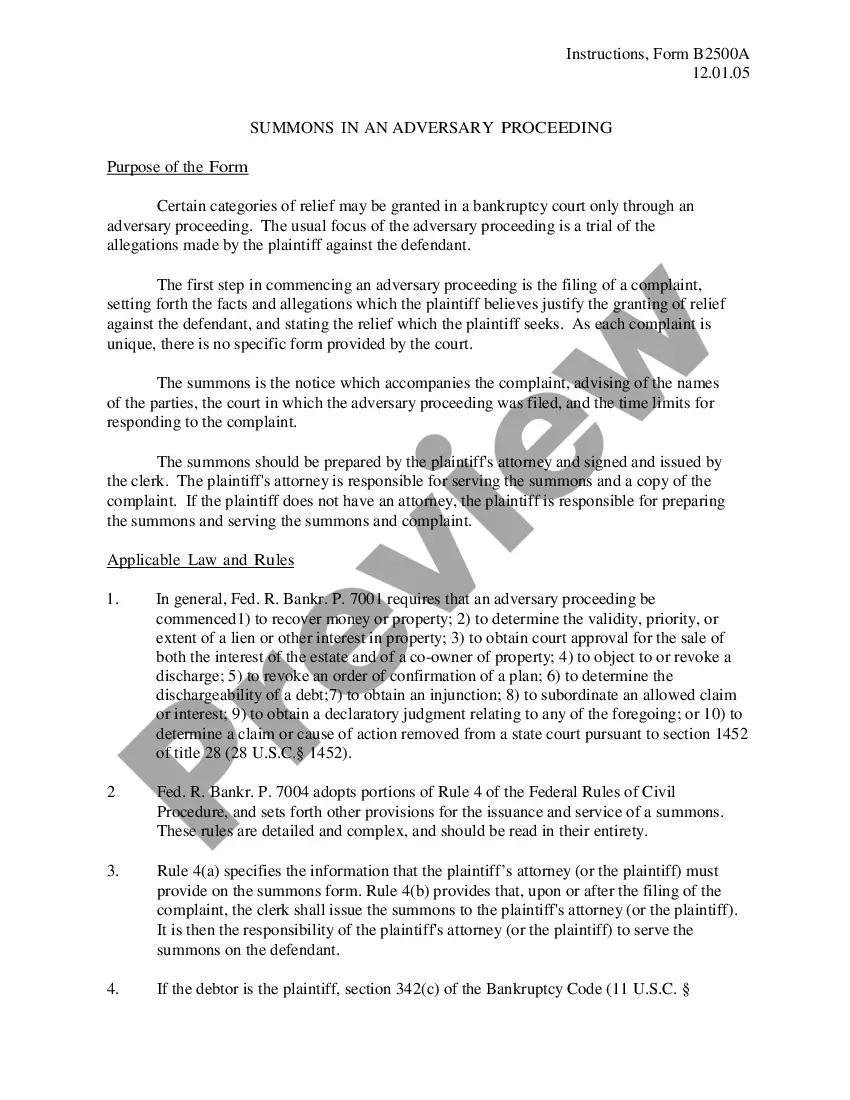

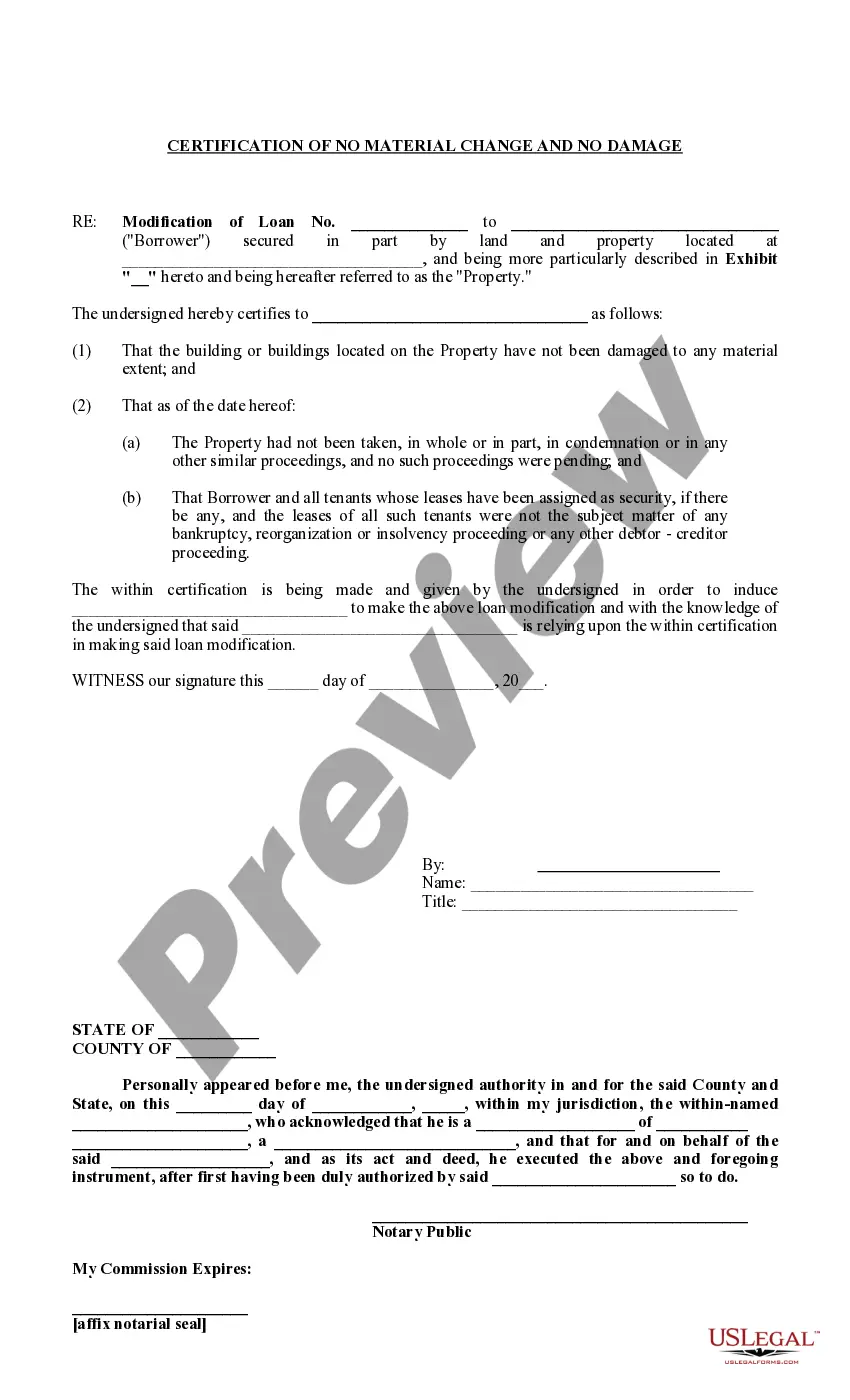

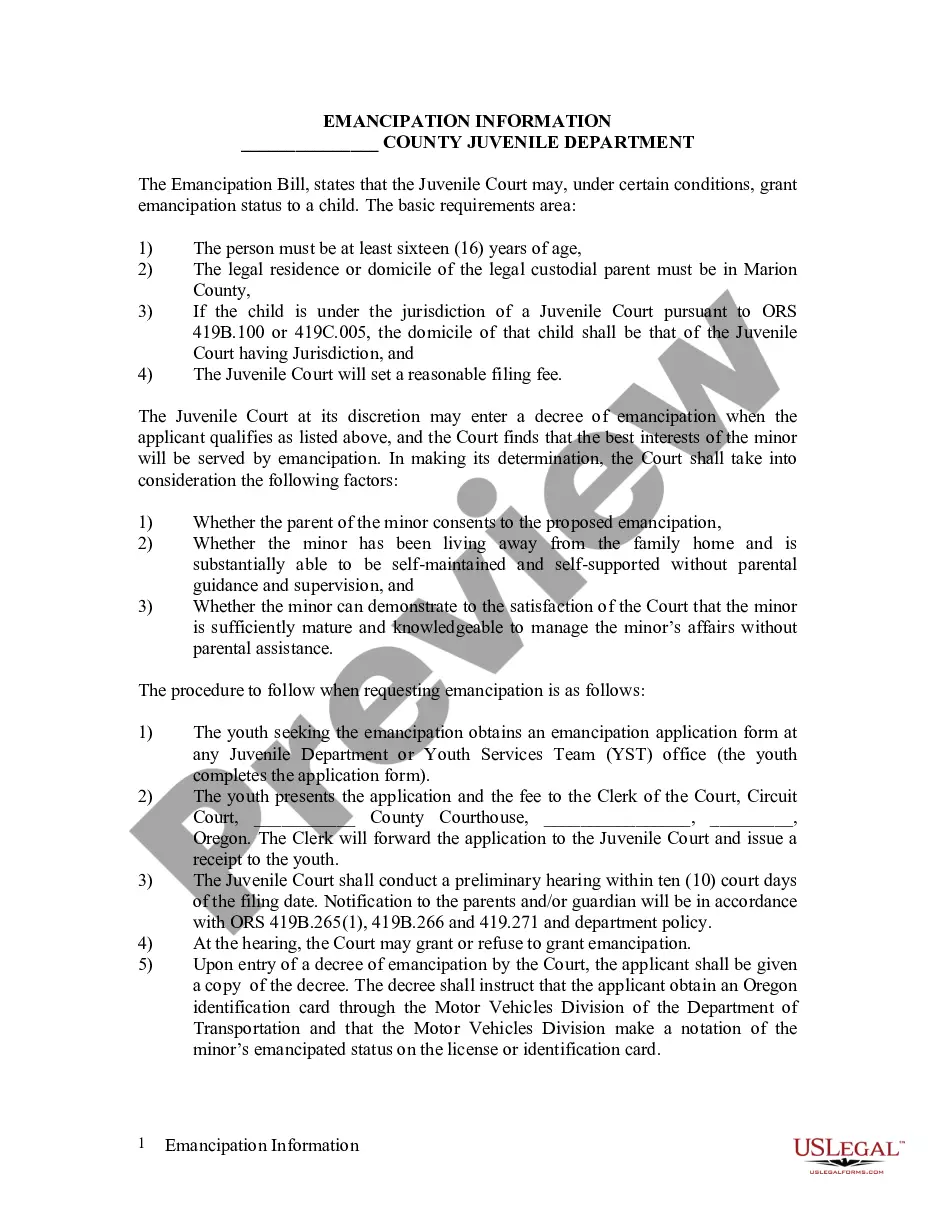

This form is an Application for Certificate of Discharge of IRS Lien. Use to obtain certificate of release when lien has been removed or satisfied. Check for compliance with your specific circumstances.

Alabama Application for Certificate of Discharge of IRS Lien

Description

How to fill out Application For Certificate Of Discharge Of IRS Lien?

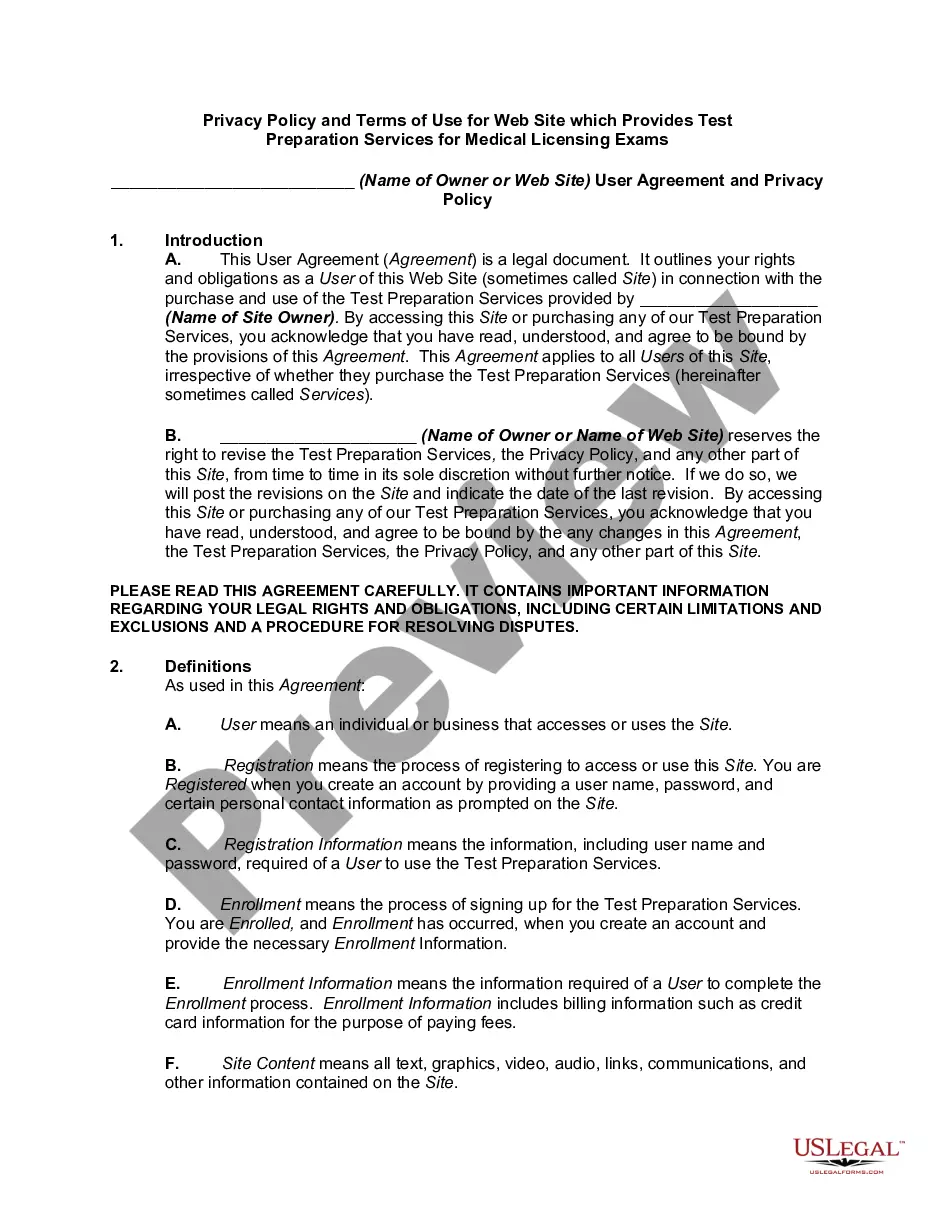

US Legal Forms - one of the largest collections of legal documents in the USA - offers a range of legal form templates you can access or create.

By utilizing the website, you can discover countless forms for business and personal use, categorized by types, states, or keywords. You can obtain the latest versions of forms such as the Alabama Application for Certificate of Discharge of IRS Lien in just minutes.

If you already have a monthly subscription, Log In and retrieve the Alabama Application for Certificate of Discharge of IRS Lien from the US Legal Forms catalog. The Download button will appear on each document you view. You have access to all previously downloaded forms within the My documents section of your account.

Process the transaction. Use your credit card or PayPal account to complete the transaction.

Choose the format and download the document to your device. Make modifications. Fill out, edit, and print and sign the downloaded Alabama Application for Certificate of Discharge of IRS Lien. Each template you add to your account has no expiration date and is yours indefinitely. So, if you wish to download or print another copy, just go to the My documents section and click on the document you need. Access the Alabama Application for Certificate of Discharge of IRS Lien with US Legal Forms, the most extensive collection of legal document templates. Utilize a vast array of professional and state-specific templates that meet your business or personal needs.

- If you wish to use US Legal Forms for the first time, here are straightforward steps to help you get started.

- Ensure you have selected the correct document for your region/state.

- Click on the Review button to examine the form’s content.

- Check the form summary to confirm you have chosen the right document.

- If the document does not meet your needs, use the Search box at the top of the page to find one that does.

- When you are satisfied with the form, confirm your choice by clicking on the Get now button.

- Then, select the pricing plan you prefer and provide your details to register for the account.

Form popularity

FAQ

You can obtain the lien release form, specifically Form 668(Z), directly from the IRS website or through the uslegalforms platform. This platform provides easy access to necessary forms and instructions tailored for the Alabama Application for Certificate of Discharge of IRS Lien. By using uslegalforms, you can simplify the process and ensure you have the correct documentation.

To request a certificate of release of a federal tax lien, you may need to file Form 668(Z) or use Form 14135 if you are seeking a discharge. The release confirms that the IRS has removed the lien from your property. This step is vital to restoring your creditworthiness and financial options.

The IRS form used for this purpose is Form 14135, which specifically outlines the Alabama Application for Certificate of Discharge of IRS Lien. By completing and submitting this form, you can request a discharge for specific properties affected by a federal tax lien. Ensure that you include all necessary details about your tax situation to avoid delays.

To obtain an IRS lien payoff letter, you should contact the IRS directly or utilize their online services. This letter will provide you with the exact amount required to satisfy your tax debt and release the lien. It is essential to have this letter ready if you are applying for a certificate of discharge or planning to sell the property.

The IRS form for lien withdrawal is Form 12277. This form allows you to request the withdrawal of a federal tax lien once you have made arrangements to resolve your tax debt. By completing and submitting Form 12277, you can initiate the process of removing the lien, which can be crucial for maintaining your credit score and securing loans.

Time Limitations In most cases, the department has three years from the date a tax return is due or filed, whichever is later, to audit your tax return and assess any additional tax, penalty, and interest due. A taxpayer also generally has three years to claim a refund of any tax overpaid.

Paying taxes on property does not constitute ownership. State law allows taxes to be paid by persons other than the owner(s).

There is no in person registration or in person auction beginning this 2022 tax year. The tax lien auction will be conducted online through .govease.com beginning May 9th from AM to PM and continue day to day until all liens are offered for auction.

Once the lien has arisen, it will continue until the liability for the amount assessed is satisfied, released or becomes unenforceable by reason of lapse of time (i.e. 10 years from the date the lien is filed) (Code Sections 40-1-2, 40-29-20, and 49-29-21).

Bidders will purchase the tax liens for the property in the amount of past-due taxes, which equals the principal amount of the delinquent taxes, the amount of accrued and accruing interest thereon, and penalties, fees, and costs proposed through the day of the tax lien auction or sale.