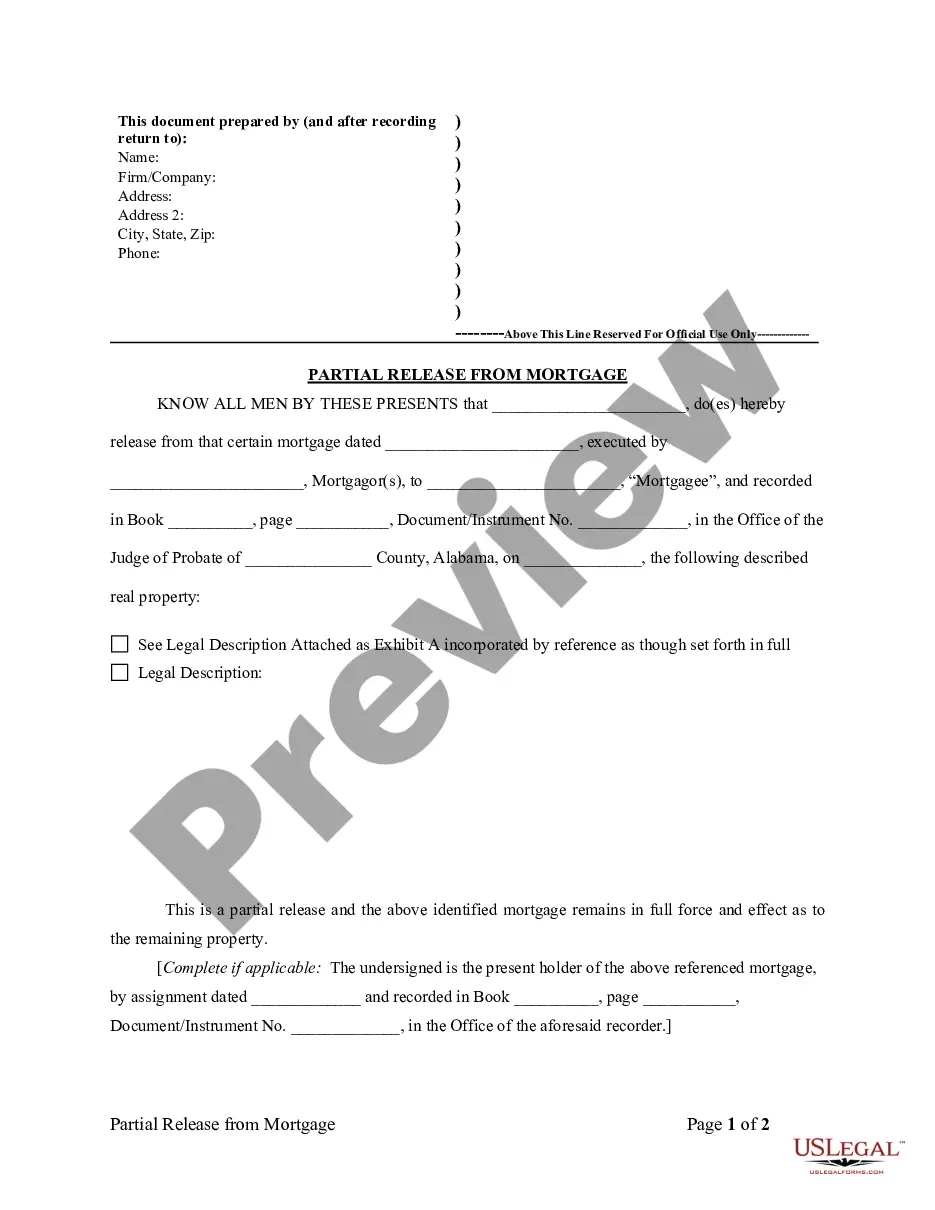

This is a sample partial release of property from mortgage issued by an individual. A portion of the real property used to secure a promissory note is released however, the secured lien as to the remaining property remains in full force and effect.

Alabama Partial Release of Property From Mortgage for Corporation

Description

How to fill out Alabama Partial Release Of Property From Mortgage For Corporation?

Utilizing Alabama Partial Release of Property From Mortgage for Corporation samples crafted by experienced attorneys allows you to avoid complications when filing paperwork.

Simply download the example from our site, complete it, and request a lawyer to verify it.

This will conserve you significantly more time and expenses than having an attorney draft a document tailored to your specifications.

Remember to thoroughly verify all entered information for accuracy before submitting or mailing it. Reduce the time you spend on document preparation with US Legal Forms!

- If you have already obtained a US Legal Forms subscription, just Log In to your account and navigate back to the form page.

- Locate the Download button adjacent to the template you are reviewing.

- After downloading a template, your saved samples can be found in the My documents section.

- If you do not have a subscription, there’s no need for concern.

- Simply adhere to the outlined steps to register for an account online, acquire, and finalize your Alabama Partial Release of Property From Mortgage for Corporation template.

- Verify and confirm that you are downloading the correct state-specific form.

Form popularity

FAQ

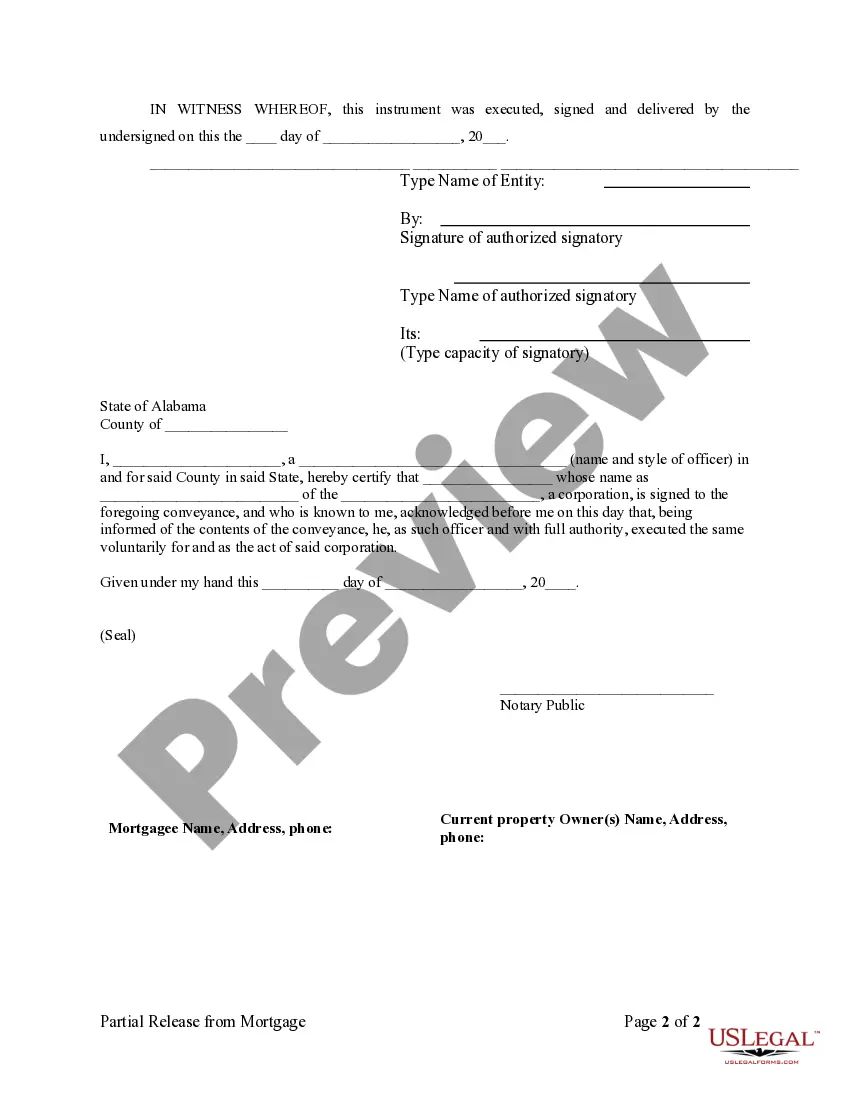

To execute an Alabama Partial Release of Property From Mortgage for Corporation, you must first have a clear understanding of the property involved. The corporation needs to submit a request to the lender, specifying the portions of the property to be released. Additionally, proper documentation, including the original mortgage agreement and any amendments, should be provided. It's essential to ensure that all financial obligations related to the remaining mortgage are up to date, as lenders typically require this before processing a partial release.

Mortgages for commercial properties often contain partial release clauses as a standard feature. These clauses allow corporations to leverage their property by strategically releasing portions of collateral as needed. When navigating the Alabama Partial Release of Property From Mortgage for Corporation, understanding these clauses can provide great flexibility in financial planning.

To obtain a partial release of mortgage, you typically need a written request that outlines the specific property to be released. Along with this request, you may need to provide proof of payment or a letter from your mortgage lender. It is essential to understand that the Alabama Partial Release of Property From Mortgage for Corporation process varies by lender, so reviewing your mortgage agreement is crucial.

A partial release clause in a mortgage agreement specifies the conditions under which portions of the mortgage can be released. This clause allows property owners, particularly corporations, to manage their assets more effectively by providing the ability to release specific properties from the mortgage without paying the full balance. Incorporating this clause can be beneficial when drafting mortgage documents tailored to the Alabama Partial Release of Property From Mortgage for Corporation.

A partial discharge of a mortgage refers to the elimination of a lien on a specific part of the property while keeping the rest of the mortgage intact. This allows the property owner, or corporation, to gain greater control over their assets without compromising the entire mortgage agreement. When navigating this process, the Alabama Partial Release of Property From Mortgage for Corporation can be a useful reference.

A partial release is typically included in situations where a property owner wishes to sell a portion of their property without paying off the entire mortgage. This may occur in cases of refinancing, acquisitions, or changes in business strategy, particularly for corporations. In the realm of the Alabama Partial Release of Property From Mortgage for Corporation, this flexibility can enhance operational efficiency and value.

To obtain a partial release of a mortgage, the corporation must first consult with their lender to understand the specific requirements. This often involves submitting a formal request along with documentation that details the property to be released. Utilizing resources like uslegalforms can simplify this process by providing templates and guidance tailored for the Alabama Partial Release of Property From Mortgage for Corporation.

Similar to the previous question, the grantor on a partial release of a mortgage is the entity that has legal ownership of the property tied to the mortgage. In this case, it could be a corporation acting under the Alabama Partial Release of Property From Mortgage for Corporation framework. The grantor seeks to have a specific portion of their property released from the mortgage to streamline financial activities.

The grantor on a partial release of mortgage is usually the property owner or corporation that holds the mortgage. In the context of the Alabama Partial Release of Property From Mortgage for Corporation, this means the corporation that originally took out the mortgage. This party typically requests the partial release to relieve a specific part of the property from the mortgage obligation, allowing for greater flexibility in asset management.

To get a mortgage discharged, start by settling your mortgage balance in full and obtaining a release of lien from your lender. Once you have the release document, file it with the county recorder's office for it to be officially recognized. Utilizing resources like the US Legal Forms platform can facilitate this process, particularly when dealing with an Alabama Partial Release of Property From Mortgage for Corporation.