Alabama Partial Release of Property From Mortgage for Corporation

About this form

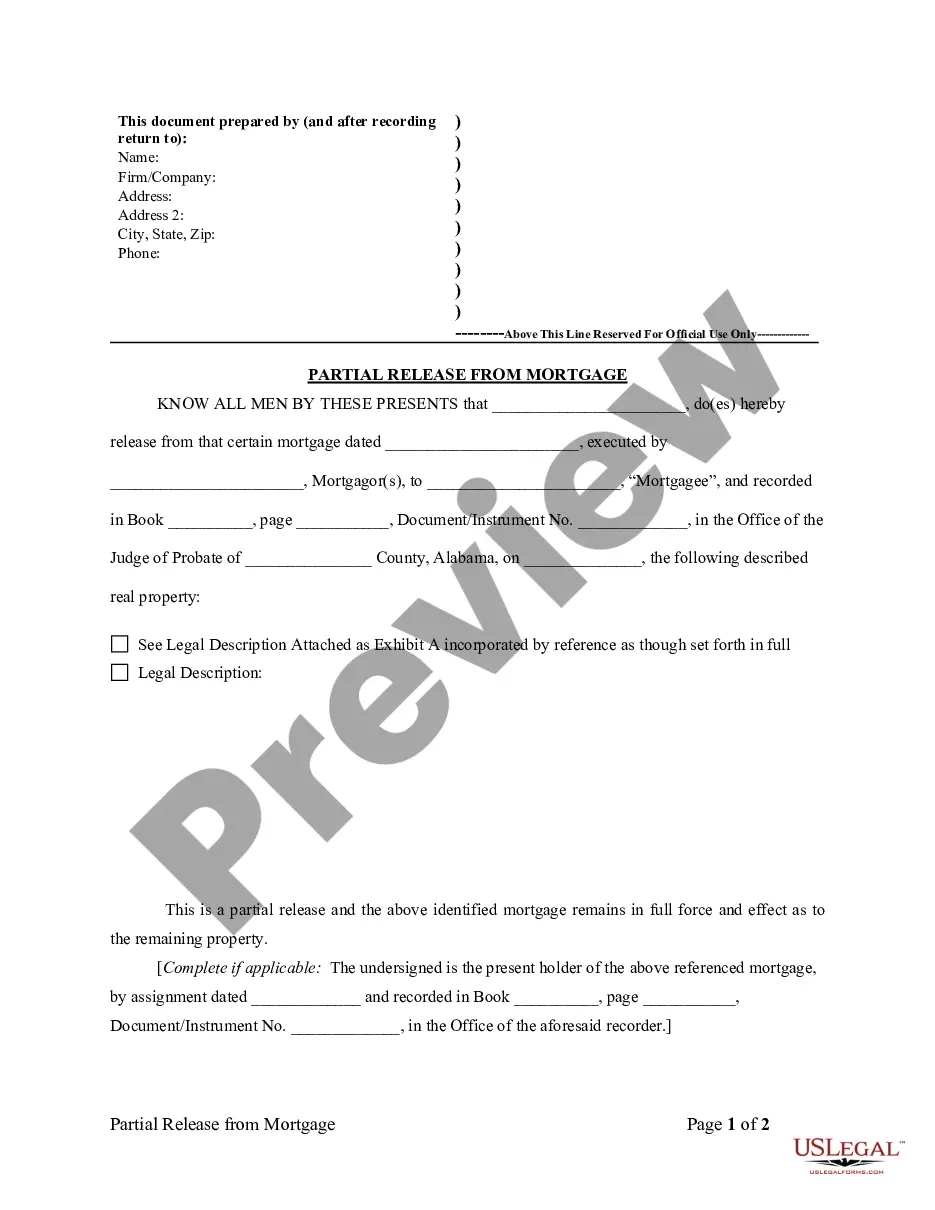

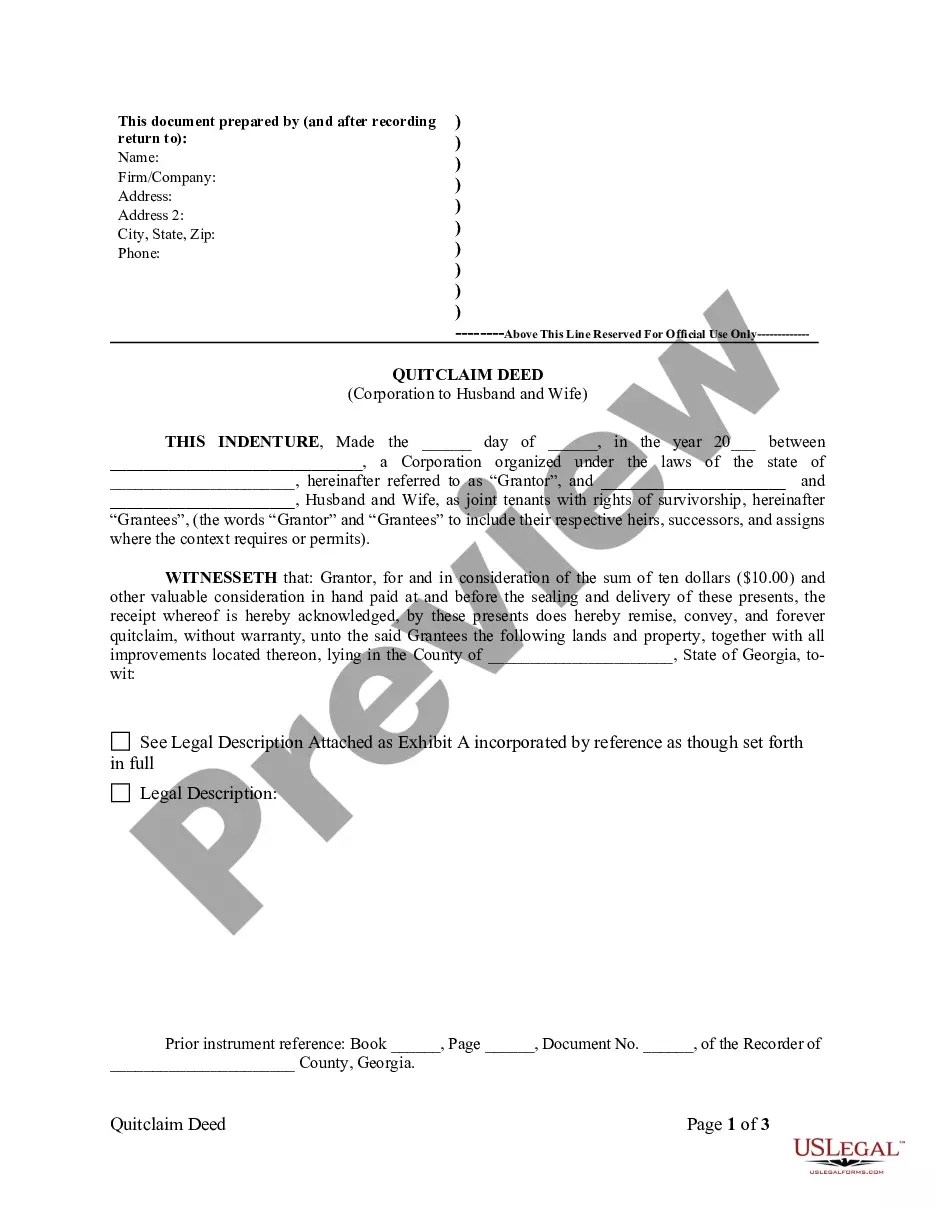

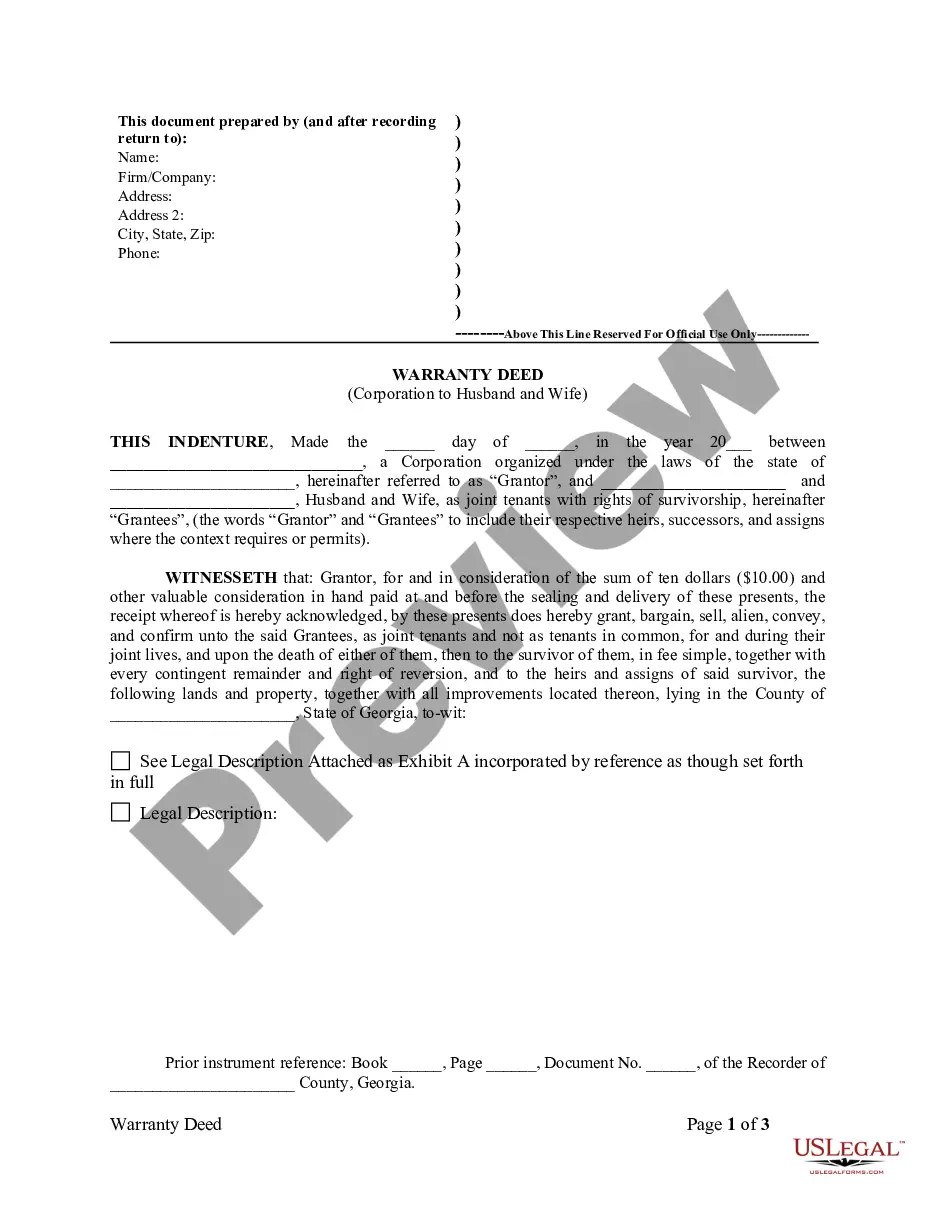

The Partial Release of Property From Mortgage for Corporation is a legal document that allows a corporation to release a portion of real property that is secured by a mortgage. This form differs from a complete release of mortgage by allowing the corporation to maintain a lien on the remaining property while discharging part of its obligations. This form is essential for corporations looking to adjust their mortgage agreements without losing all their secured interests in the property.

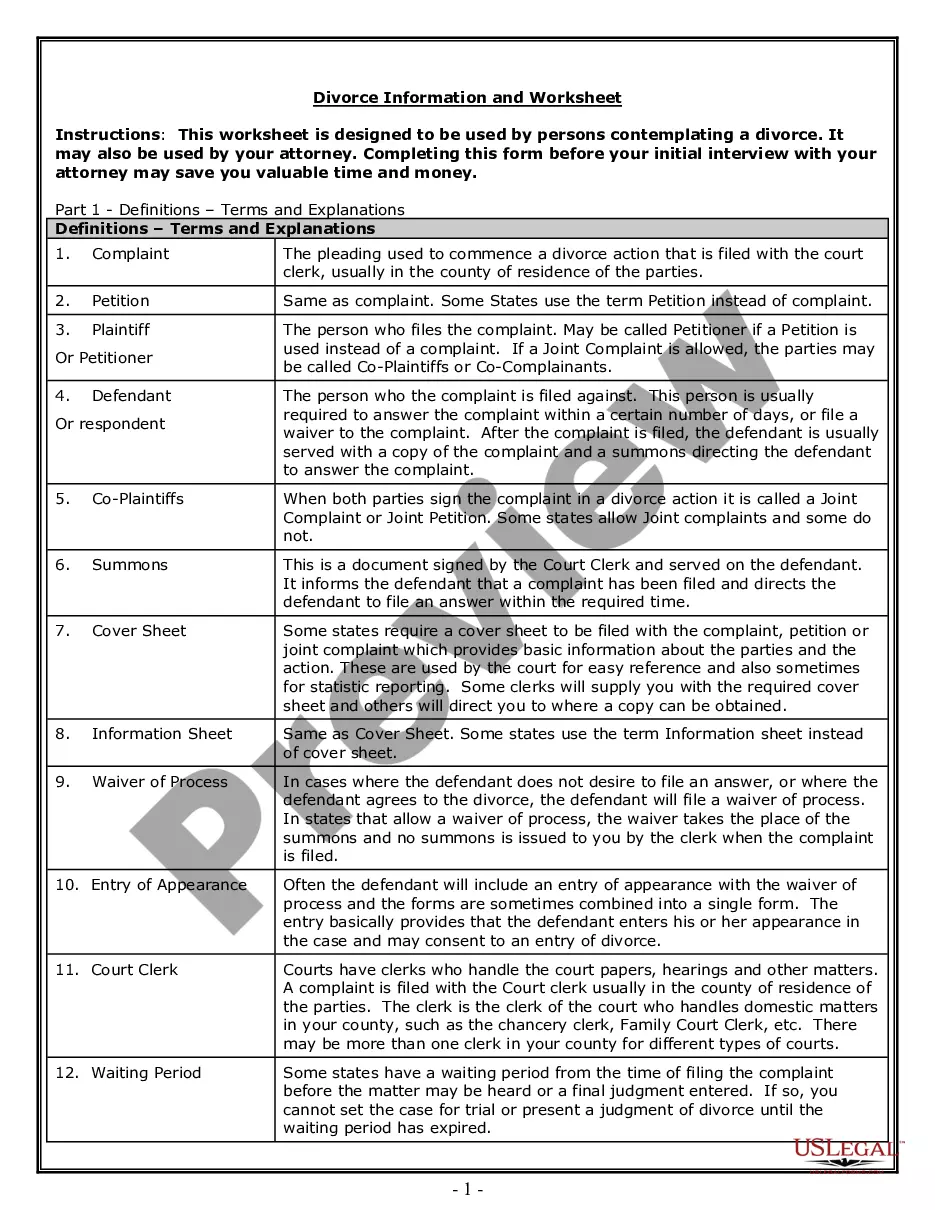

What’s included in this form

- Details of the present holder of the mortgage.

- Clear identification of the mortgage by its assignment date and record information.

- Signature block for the undersigned, including date of execution.

- County information for legal recording purposes.

- Space for the Notary Public to certify the document.

- Contact information for the mortgagee, including name and address.

Common use cases

This form is typically used when a corporation needs to partially release a property from mortgage obligations. This situation may arise during the sale of a portion of the secured property or when a corporation seeks to refinance part of its mortgage. Using this form ensures that the remaining loan obligations are still enforceable while allowing for flexible property management.

Who needs this form

- Corporations holding mortgages on real properties.

- Business owners looking to sell or refinance part of their property.

- Attorneys representing corporations in real estate transactions.

- Financial institutions needing a formal process for releasing mortgage claims on portions of a property.

How to complete this form

- Identify the corporation as the present holder of the mortgage.

- Provide the mortgage assignment date and include the recording book and page number.

- Specify the date of execution and ensure that it is signed by the relevant corporate authority.

- Fill in the county name where the document will be recorded.

- Include the Notary Public information to certify the signing.

- Provide the mortgagee's name, address, and contact number.

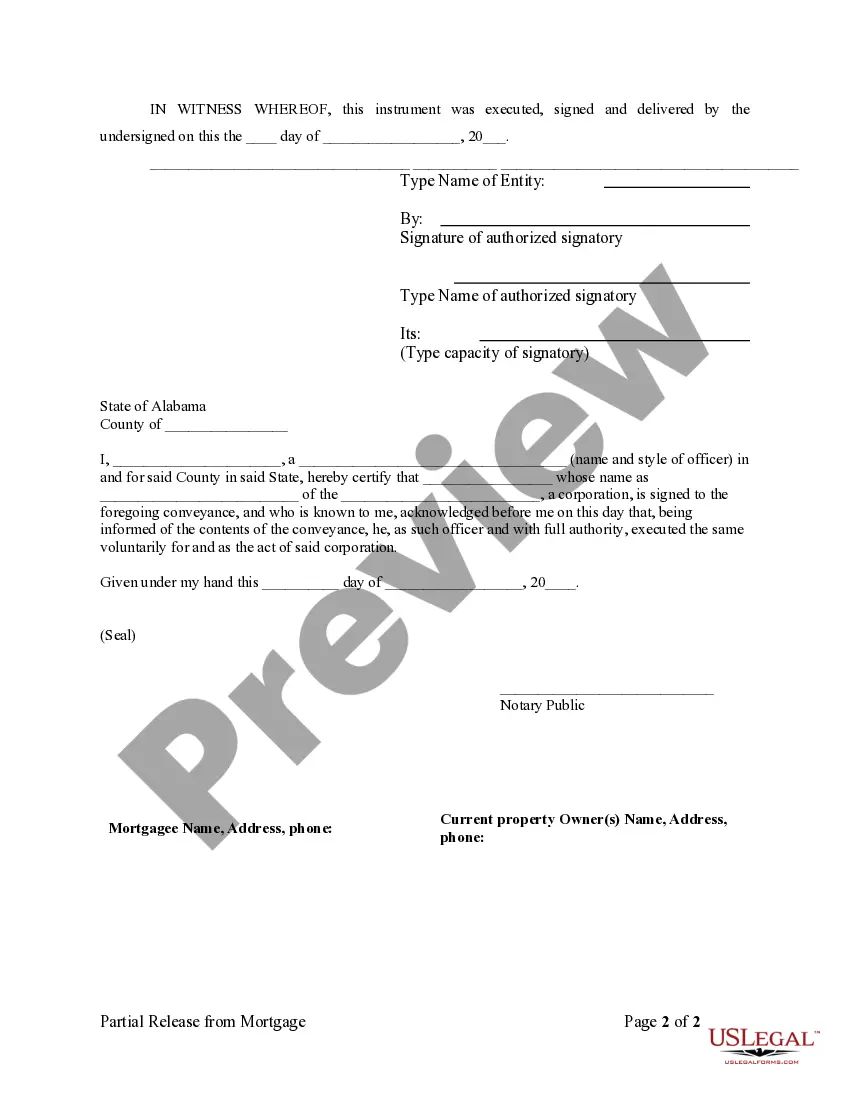

Does this document require notarization?

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to provide correct recording information, which may invalidate the release.

- Not having the document notarized if required by local laws.

- Leaving any fields blank, particularly the signatures and dates.

- Using this form without confirming state-specific requirements for partial releases.

Benefits of using this form online

- Convenient access to download and complete the form at any time.

- Editability allows for corrections and adjustments before printing.

- Reliable legal templates drafted by licensed attorneys ensure compliance.

Key takeaways

- The Partial Release of Property From Mortgage for Corporation allows for partial property release while maintaining lien on the rest.

- It is important for corporations engaged in real estate transactions.

- Complete all fields accurately to avoid common mistakes.

Looking for another form?

Form popularity

FAQ

To execute an Alabama Partial Release of Property From Mortgage for Corporation, you must first have a clear understanding of the property involved. The corporation needs to submit a request to the lender, specifying the portions of the property to be released. Additionally, proper documentation, including the original mortgage agreement and any amendments, should be provided. It's essential to ensure that all financial obligations related to the remaining mortgage are up to date, as lenders typically require this before processing a partial release.

Mortgages for commercial properties often contain partial release clauses as a standard feature. These clauses allow corporations to leverage their property by strategically releasing portions of collateral as needed. When navigating the Alabama Partial Release of Property From Mortgage for Corporation, understanding these clauses can provide great flexibility in financial planning.

To obtain a partial release of mortgage, you typically need a written request that outlines the specific property to be released. Along with this request, you may need to provide proof of payment or a letter from your mortgage lender. It is essential to understand that the Alabama Partial Release of Property From Mortgage for Corporation process varies by lender, so reviewing your mortgage agreement is crucial.

A partial release clause in a mortgage agreement specifies the conditions under which portions of the mortgage can be released. This clause allows property owners, particularly corporations, to manage their assets more effectively by providing the ability to release specific properties from the mortgage without paying the full balance. Incorporating this clause can be beneficial when drafting mortgage documents tailored to the Alabama Partial Release of Property From Mortgage for Corporation.

A partial discharge of a mortgage refers to the elimination of a lien on a specific part of the property while keeping the rest of the mortgage intact. This allows the property owner, or corporation, to gain greater control over their assets without compromising the entire mortgage agreement. When navigating this process, the Alabama Partial Release of Property From Mortgage for Corporation can be a useful reference.

A partial release is typically included in situations where a property owner wishes to sell a portion of their property without paying off the entire mortgage. This may occur in cases of refinancing, acquisitions, or changes in business strategy, particularly for corporations. In the realm of the Alabama Partial Release of Property From Mortgage for Corporation, this flexibility can enhance operational efficiency and value.

To obtain a partial release of a mortgage, the corporation must first consult with their lender to understand the specific requirements. This often involves submitting a formal request along with documentation that details the property to be released. Utilizing resources like uslegalforms can simplify this process by providing templates and guidance tailored for the Alabama Partial Release of Property From Mortgage for Corporation.

Similar to the previous question, the grantor on a partial release of a mortgage is the entity that has legal ownership of the property tied to the mortgage. In this case, it could be a corporation acting under the Alabama Partial Release of Property From Mortgage for Corporation framework. The grantor seeks to have a specific portion of their property released from the mortgage to streamline financial activities.

The grantor on a partial release of mortgage is usually the property owner or corporation that holds the mortgage. In the context of the Alabama Partial Release of Property From Mortgage for Corporation, this means the corporation that originally took out the mortgage. This party typically requests the partial release to relieve a specific part of the property from the mortgage obligation, allowing for greater flexibility in asset management.

To get a mortgage discharged, start by settling your mortgage balance in full and obtaining a release of lien from your lender. Once you have the release document, file it with the county recorder's office for it to be officially recognized. Utilizing resources like the US Legal Forms platform can facilitate this process, particularly when dealing with an Alabama Partial Release of Property From Mortgage for Corporation.