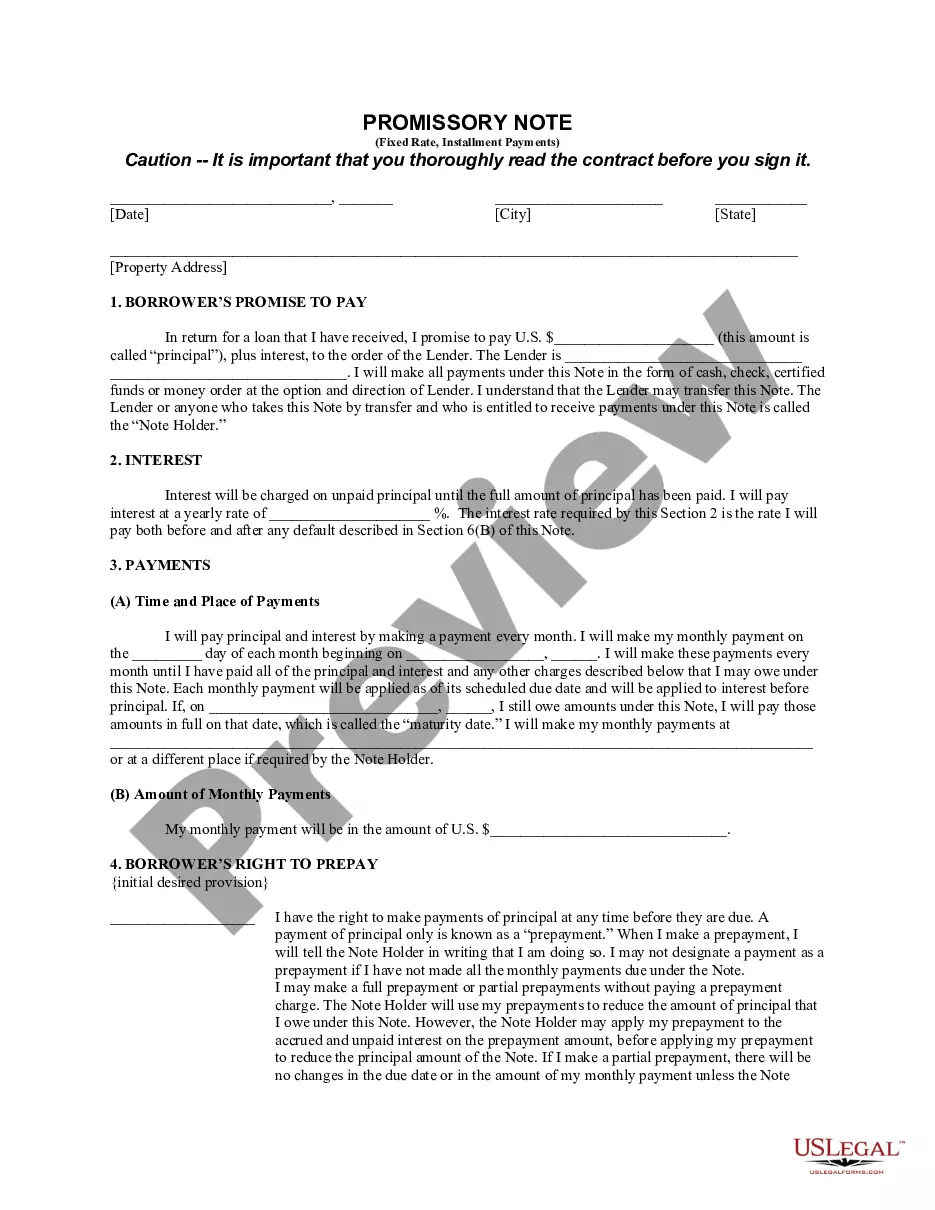

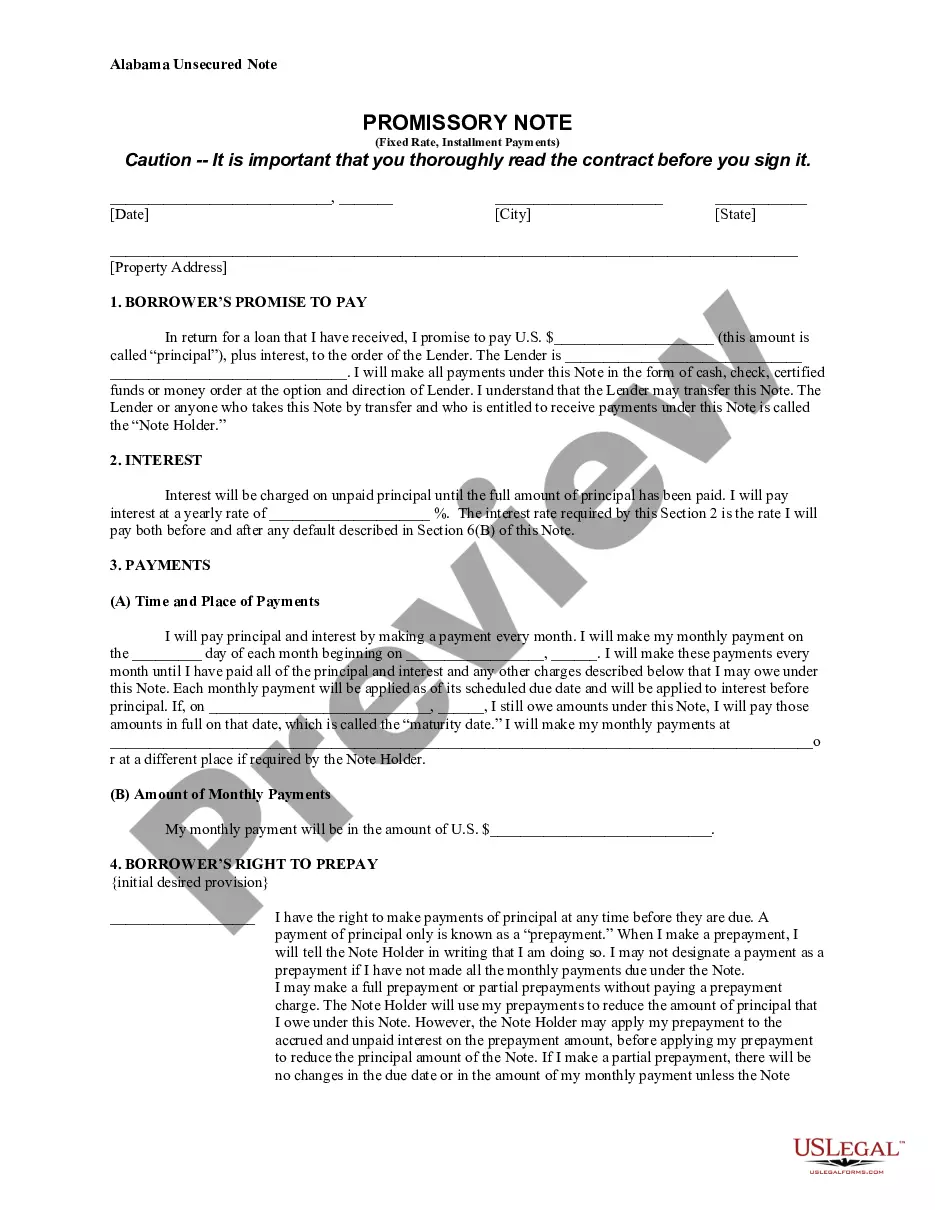

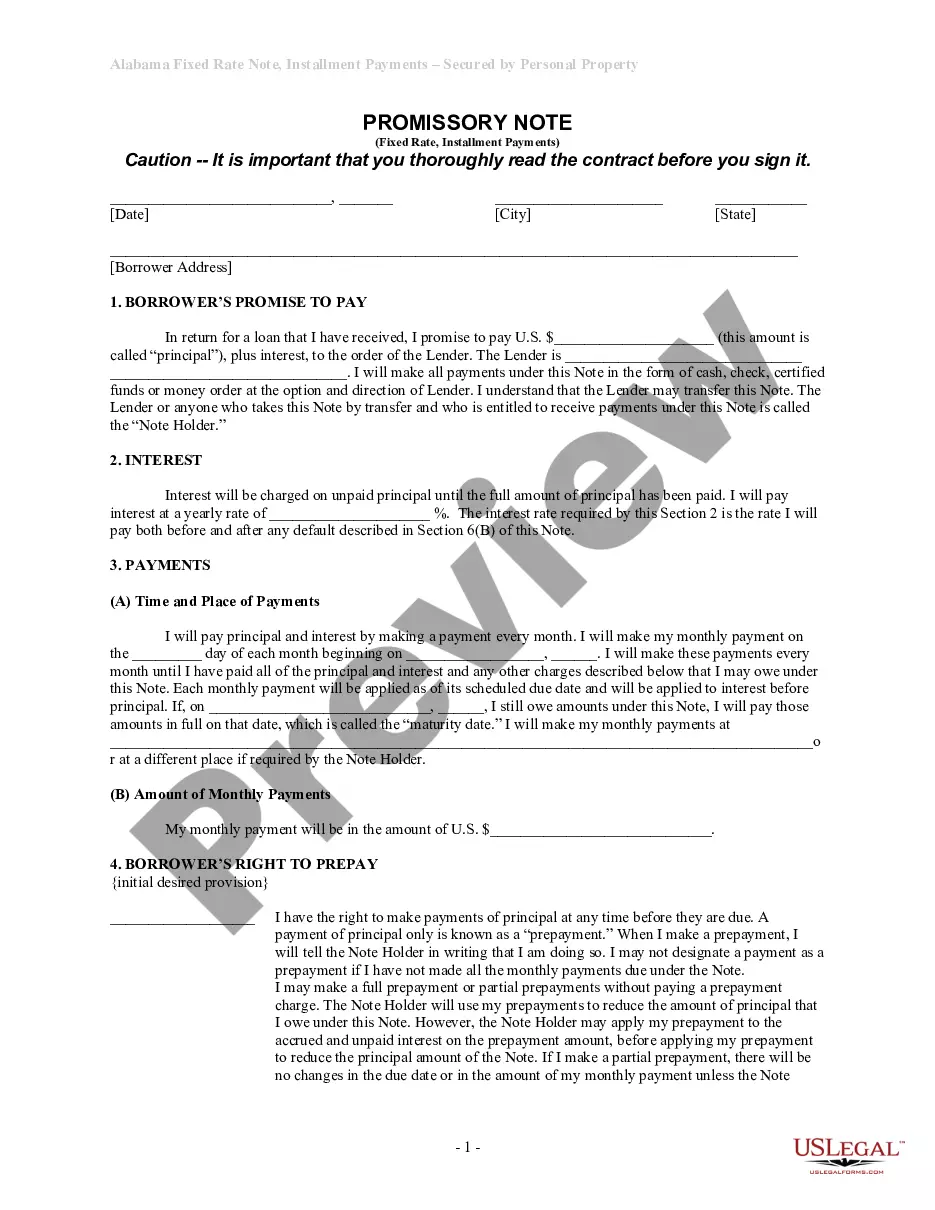

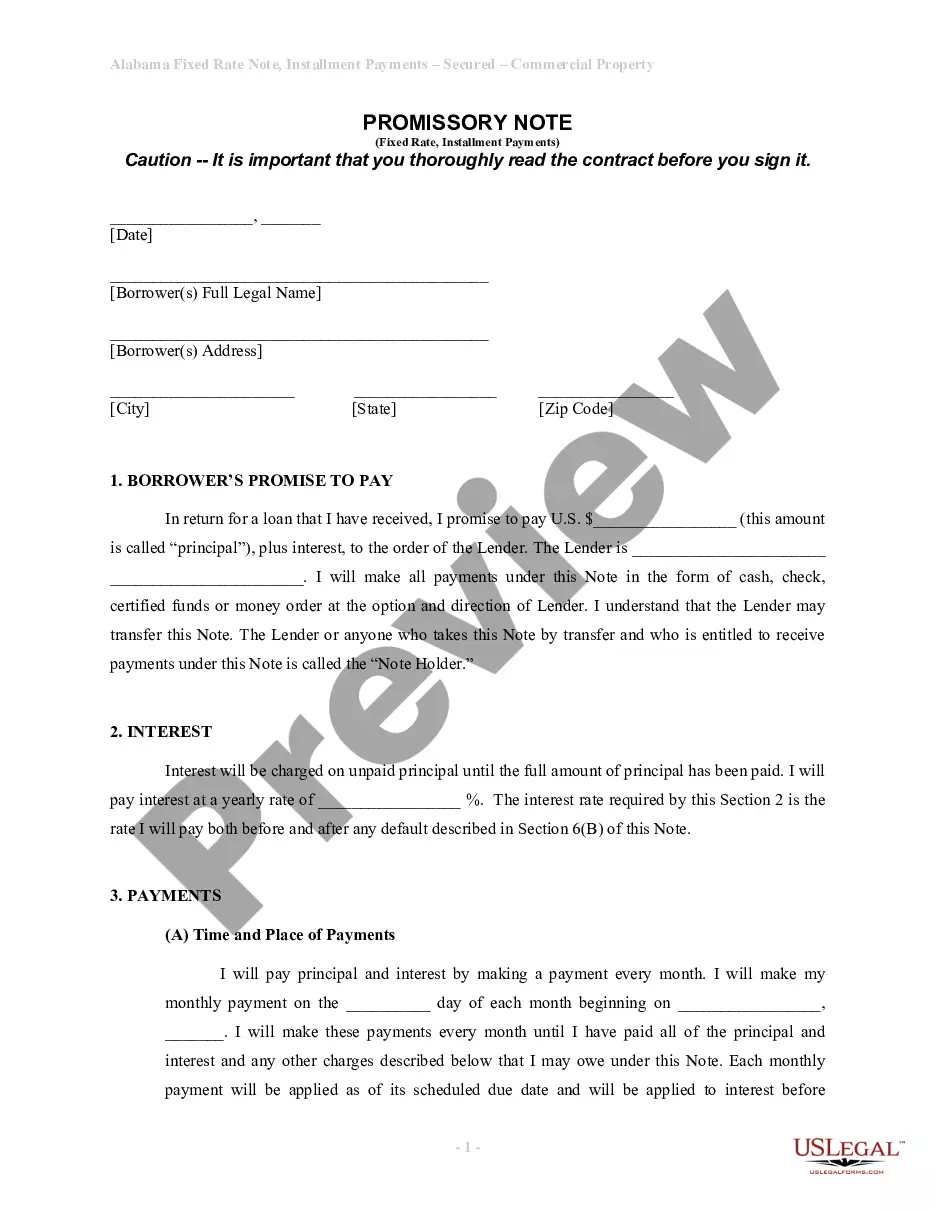

This is a Promissory Note for use where residential property is security for the loan. A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand, or at a fixed or determined future time a particular sum of money to or to the order of a specified person or to the bearer. A separate deed of trust or mortgage is also required.

Alabama Installments Fixed Rate Promissory Note Secured by Residential Real Estate

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Alabama Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

Utilizing Alabama Installments Fixed Rate Promissory Note Secured by Residential Real Estate templates created by expert attorneys allows you to avoid complications during the document submission process.

Simply download the sample from our site, complete it, and seek legal advice to confirm its accuracy. This can save you significantly more time and expenses than hiring a legal expert to create a document from scratch for you.

If you already possess a US Legal Forms subscription, just Log In to your account and revisit the form page. Locate the Download button adjacent to the templates you are reviewing. After downloading a document, you will find all your saved samples in the My documents section.

Choose a file format and download your document. Once you have completed all the above steps, you will be able to fill out, print, and sign the Alabama Installments Fixed Rate Promissory Note Secured by Residential Real Estate template. Be sure to thoroughly review all entered information for accuracy before finalizing or sending it out. Reduce the time you invest in completing documents with US Legal Forms!

- If you do not have a subscription, it’s not an issue. Just follow the detailed guide below to create an account online, acquire, and complete your Alabama Installments Fixed Rate Promissory Note Secured by Residential Real Estate template.

- Verify that you are downloading the correct state-specific form.

- Use the Preview feature and read the description (if present) to determine if you need this particular example and if you do, click Buy Now.

- If required, search for another template using the Search field.

- Select a subscription plan that suits your requirements.

- Begin with your credit card or PayPal.

Form popularity

FAQ

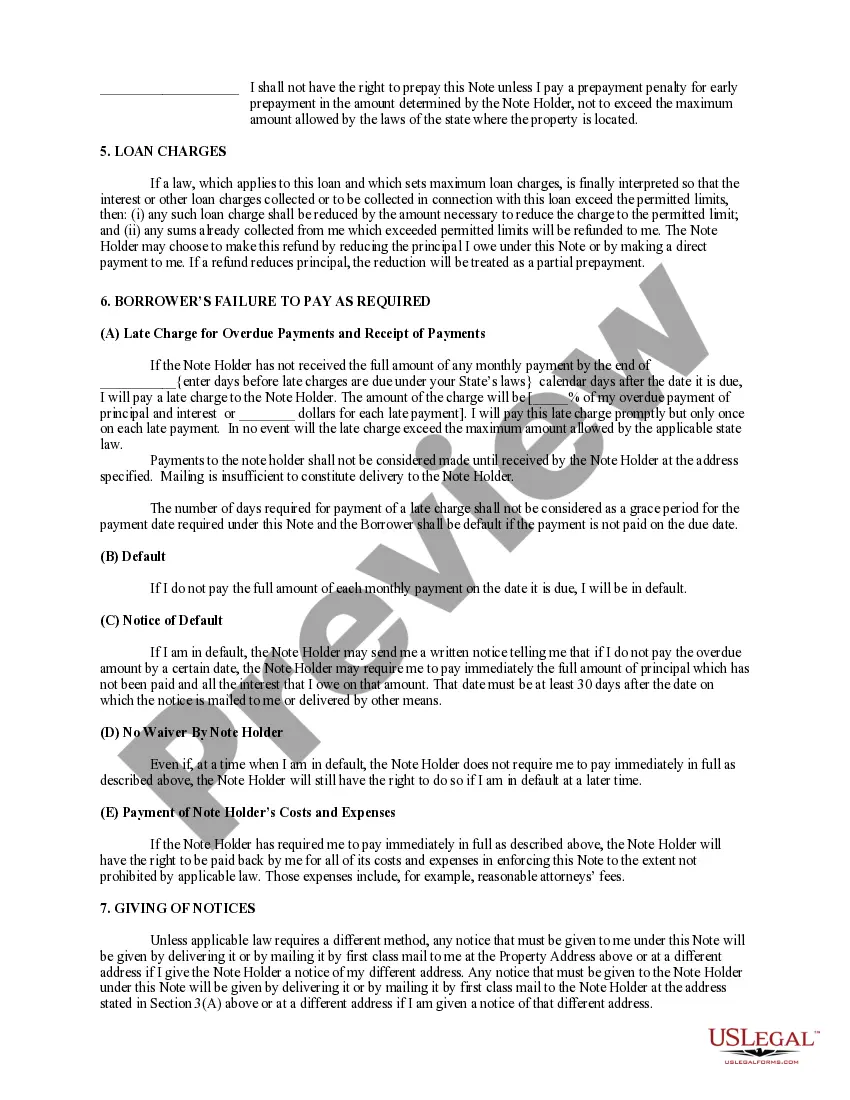

Securing a promissory note with real estate involves creating a lien on the property that acts as collateral. First, initiate a formal agreement that outlines the terms and attaches the property as security for the note. Next, file the necessary documents with your local government office to perfect the lien. Using an Alabama Installments Fixed Rate Promissory Note Secured by Residential Real Estate can simplify this process.

A promissory note can be voided under certain conditions, such as fraud, lack of capacity, or if it is not supported by consideration. If one party did not genuinely agree to the terms, the note may not be enforceable. Furthermore, mistakes in the text or improper execution can also result in a void note. To ensure reliability, consider using an Alabama Installments Fixed Rate Promissory Note Secured by Residential Real Estate.

As stated earlier, a promissory note does not, by itself, create a lien. However, when incorporated into an Alabama Installments Fixed Rate Promissory Note Secured by Residential Real Estate and associated with a security agreement, it does help establish a lien on the property, giving the lender protection.

You can obtain a promissory note through various channels, including banks, credit unions, and online legal document providers. US Legal Forms offers customizable templates, including an Alabama Installments Fixed Rate Promissory Note Secured by Residential Real Estate, enabling you to create a note that meets your specific needs easily and effectively.

To create a lien on a property, you usually need a mortgage or a deed of trust. In the context of an Alabama Installments Fixed Rate Promissory Note Secured by Residential Real Estate, the security agreement accompanying the note establishes the lien, providing the lender a claim against the property until the debt is repaid.

A promissory note alone does not create a lien on a property. However, when you use an Alabama Installments Fixed Rate Promissory Note Secured by Residential Real Estate, you typically also sign a security agreement. This agreement secures the note with the property, thus creating a lien.

To secure a promissory note with real property, the borrower must pledge the property as collateral in a legally binding document, such as a mortgage agreement. This process ensures that if the borrower defaults, the lender has the right to take possession of the property. Creating an Alabama Installments Fixed Rate Promissory Note Secured by Residential Real Estate makes this process clear and legally robust.

To create a secured promissory note, start by drafting the document with essential details, including the borrower's information, repayment terms, interest rate, and the security offered. Ensure the note specifies the use of residential real estate as collateral. Using the US Legal platform can assist you in generating a legally sound Alabama Installments Fixed Rate Promissory Note Secured by Residential Real Estate.

In Alabama, a promissory note does not legally need to be notarized; however, notarization can provide additional protection. Notarizing the Alabama Installments Fixed Rate Promissory Note Secured by Residential Real Estate can establish clearer evidence of the agreement. This can be particularly beneficial if disputes arise in the future. If you're unsure, consulting a legal professional is a wise step.