File to qualify existing eligible partnership as a limited liability partnership.

Statement of Qualification for Florida or Foreign LLP

Description

How to fill out Statement Of Qualification For Florida Or Foreign LLP?

Utilize the most comprehensive collection of sanctioned forms. US Legal Forms is a platform where you can discover any document specific to your state within moments, such as the Statement of Qualification for Florida or Foreign LLP formats.

No need to squander valuable time searching for a court-acceptable sample. Our qualified experts guarantee that you receive updated documents every time.

To utilize the documents library, select a subscription and set up your account. If you've already created it, just Log In and then click Download. The Statement of Qualification for Florida or Foreign LLP file will automatically save in the My documents section (a section for every document you download on US Legal Forms).

That's it! You should complete the Statement of Qualification for Florida or Foreign LLP form and submit it. To ensure accuracy, consult your local legal advisor for assistance. Register and effortlessly find over 85,000 useful forms.

- If you're planning to use a state-specific template, make sure you specify the correct state.

- If possible, review the description to grasp all the details of the document.

- Utilize the Preview feature if available to examine the document's content.

- If everything is correct, click on the Buy Now button.

- After selecting a pricing plan, create an account.

- Make payment using a credit card or PayPal.

- Download the document to your computer by clicking Download.

Form popularity

FAQ

Choosing between an LLP and an LLC depends on your specific business needs and goals. An LLP may be better for professional groups who want to share management responsibilities and limit individual liability, whereas an LLC suits a wider range of businesses looking for flexibility and simplicity. Both entities require proper documentation, such as the Statement of Qualification for Florida or Foreign LLP, to ensure compliance and protections.

Yes, an LLP can protect your personal assets from business liabilities. This protection means that if the business faces legal issues, your personal finances remain separate and safe. When you file the Statement of Qualification for Florida or Foreign LLP, you ensure that you gain this important benefit, making it a desirable choice for many professionals.

The primary difference between a Limited Liability Company (LLC) and a Limited Liability Partnership (LLP) in Florida lies in their management structure and liability protections. An LLC offers liability protection to all members, while an LLP protects individual partners from malpractice claims made against other partners. When filing the Statement of Qualification for Florida or Foreign LLP, it is important to understand these distinctions for making informed decisions.

One downside of a Limited Liability Partnership (LLP) is that it may require a more complex structure than a sole proprietorship or a general partnership. Partners in an LLP might face higher legal and tax obligations. Additionally, the Statement of Qualification for Florida or Foreign LLP often involves paperwork and fees that some entrepreneurs find burdensome.

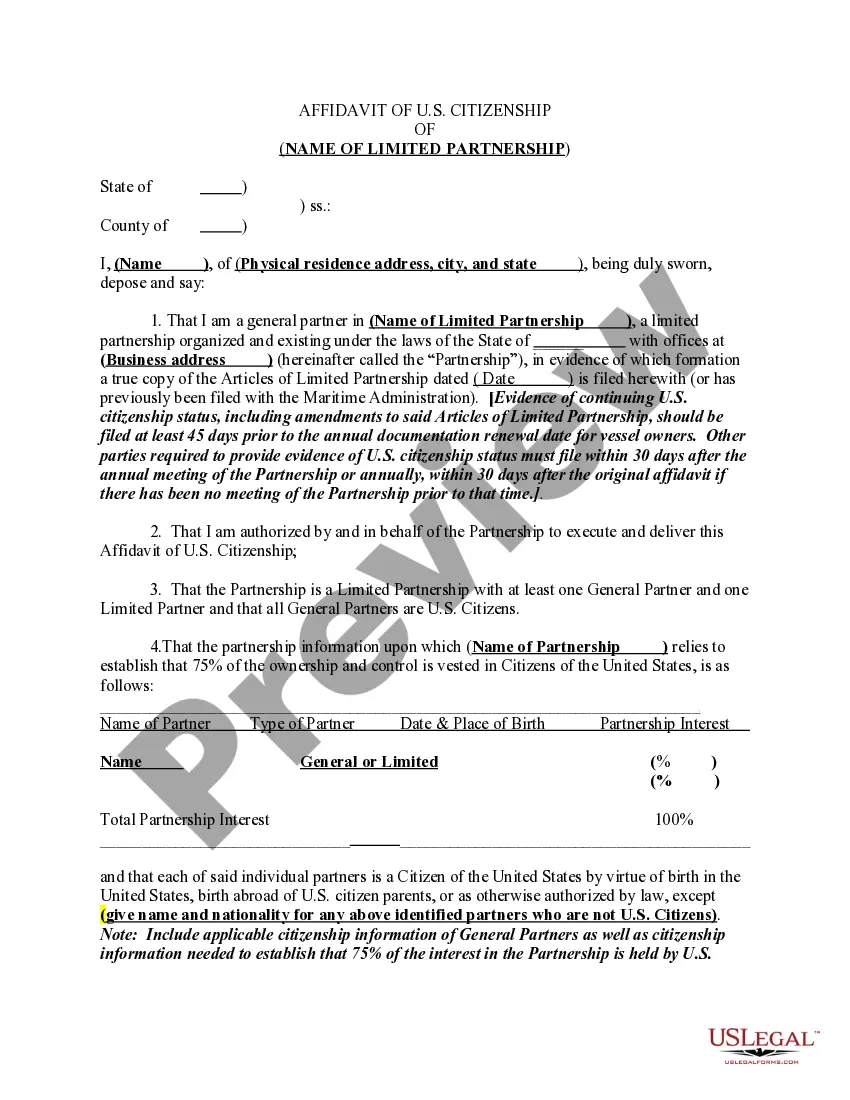

A statement of qualification is a legal document that signifies the formation and registration of a business entity, such as an LLP, within a specific jurisdiction. For a Florida or Foreign LLP, this statement is vital in ensuring compliance with state laws and regulations. Essentially, it establishes your business's legitimacy and allows it to enjoy the benefits of protection against personal liability.

The statement of account of an LLP provides a summary of the financial transactions, including income and expenses, related to the limited liability partnership. This document is crucial for maintaining transparency among partners and ensuring proper accounting practices. By keeping accurate statements of account, an LLP can better manage its finances and prepare for tax obligations.

A Statement of Qualification for Florida or Foreign LLP is a formal document that allows a limited liability partnership (LLP) to register and operate legally in Florida or to establish foreign status. This statement confirms that your LLP meets all legal requirements and enables it to conduct business within the state. By filing this statement, your LLP gains access to essential legal protections and advantages under Florida law.

The statement of qualifications for LLP is a crucial step in forming a Limited Liability Partnership. It confirms your LLP's compliance with the legal requirements of a particular jurisdiction, setting it apart as a legal entity. This statement often includes key information like the LLP's name and registered office, allowing for a smoother process in launching your Florida or foreign LLP.

The statement of qualification for LLP is a document that officially registers your Limited Liability Partnership with the state where you intend to operate. It provides legal recognition and outlines essential details, such as the name of the LLP and the address of its registered office. This statement is particularly important for individuals looking to establish a Florida or foreign LLP to ensure compliance and protect their business interests.

An LLP agreement should include the roles and responsibilities of each partner, profit-sharing arrangements, and procedures for adding new partners or handling exits. Furthermore, it often outlines the management structure of the LLP and how disputes between partners will be resolved. Having this information clearly documented protects all partners involved and ensures smooth operations.