Alabama Installments Fixed Rate Promissory Note Secured by Personal Property

About this form

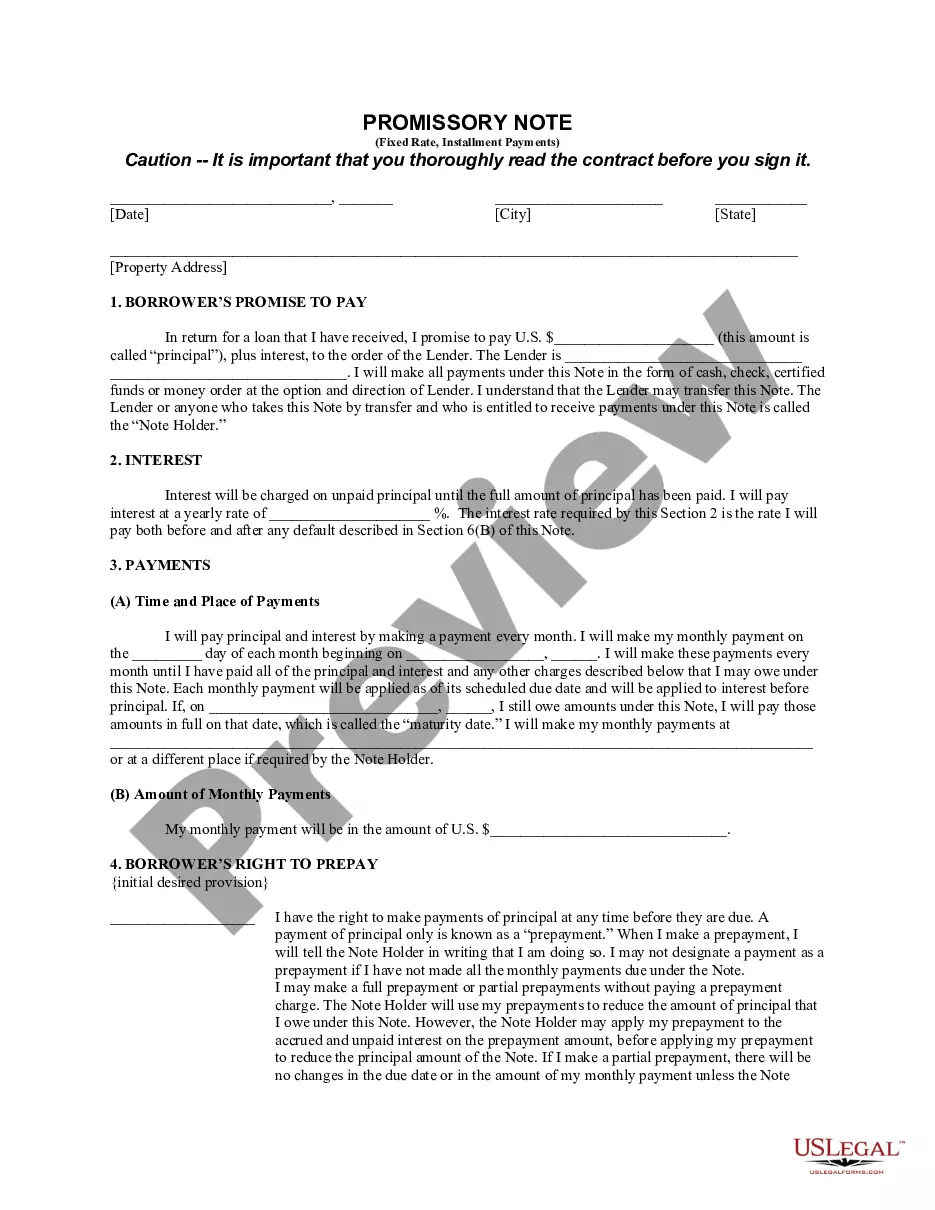

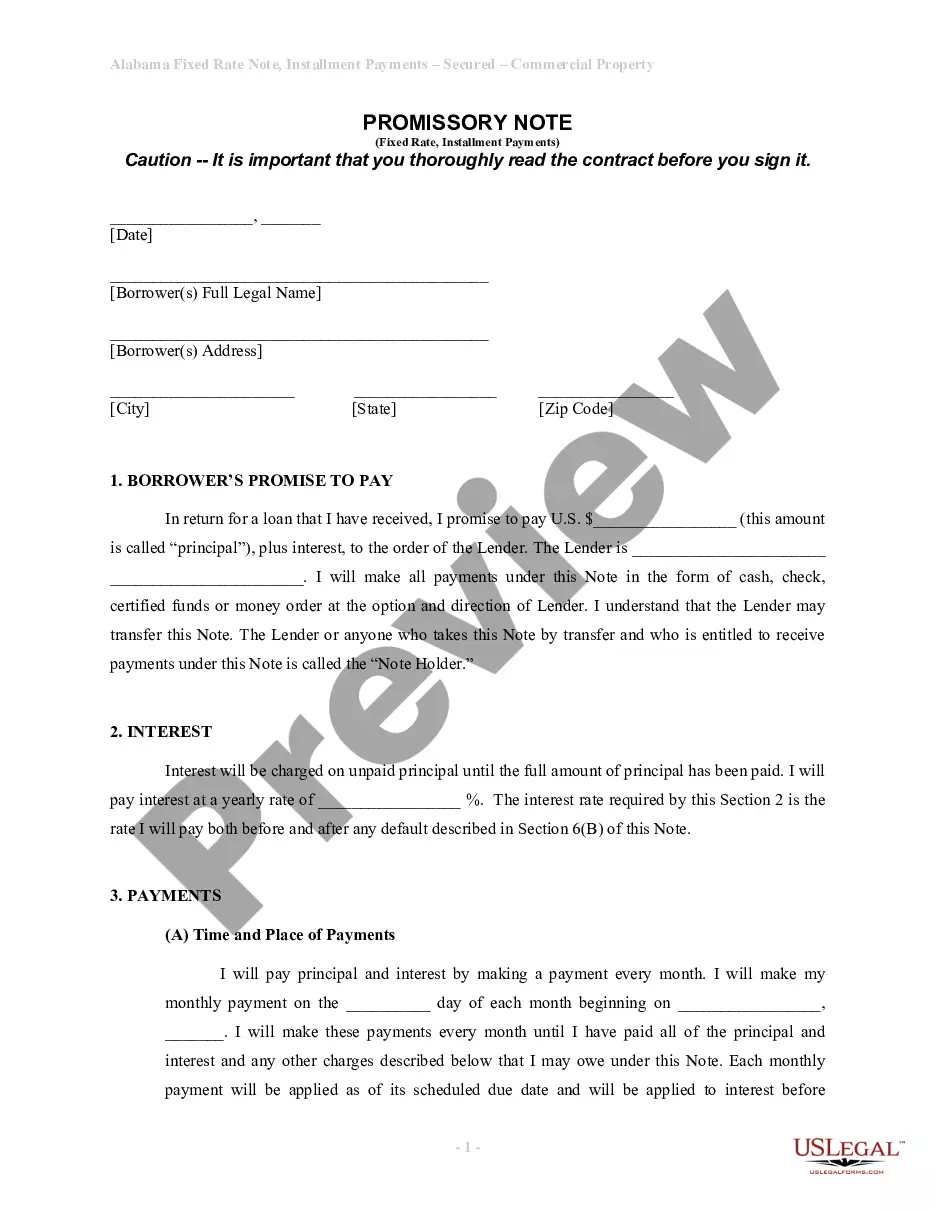

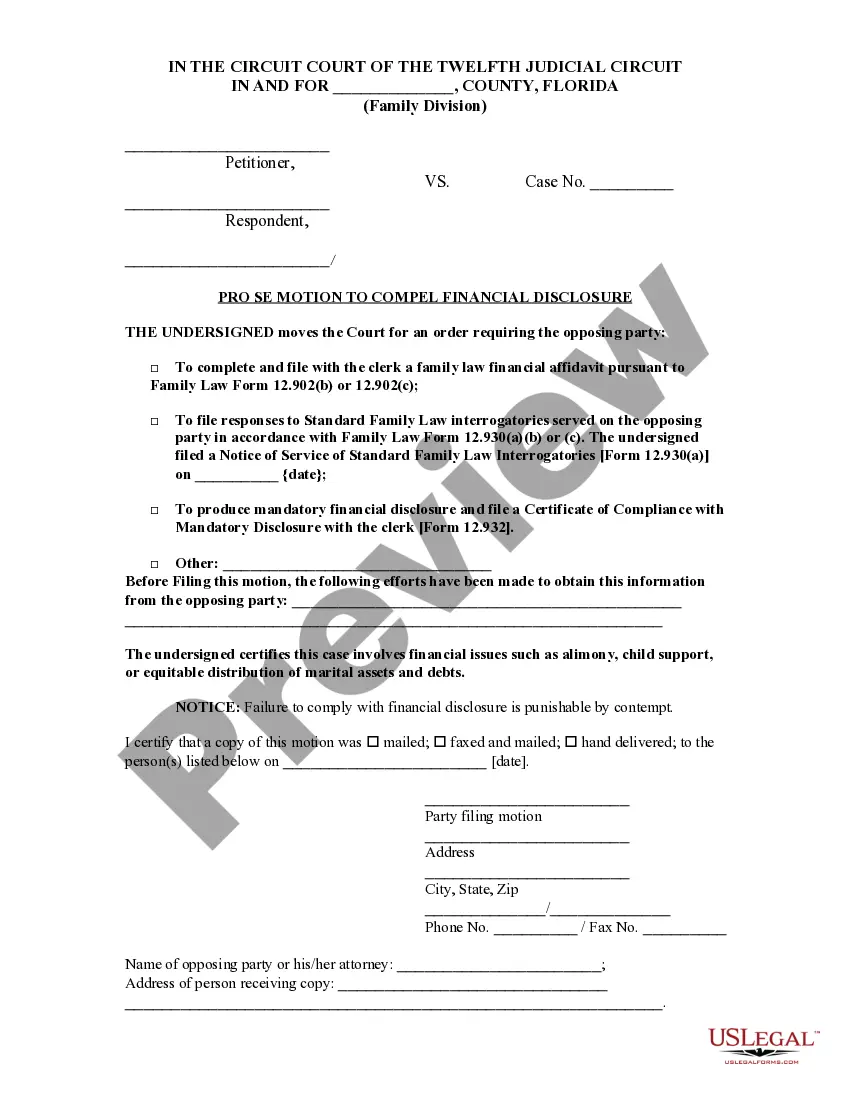

The Alabama Installments Fixed Rate Promissory Note Secured by Personal Property is a legal document that establishes a loan agreement between a borrower and a lender, where the loan is secured by personal property. This form outlines the promises made by the borrower to repay the principal amount plus interest in fixed monthly installments. Unlike unsecured promissory notes, this form provides a level of protection for the lender by securing the loan with specific personal property as collateral.

Key parts of this document

- Borrower's Promise to Pay: This section includes the borrower's commitment to repay the loan amount plus interest.

- Interest Terms: Specifies the interest rate applied to the unpaid principal and outlines when it accrues.

- Payment Schedule: Details the timing and amount of monthly payments until the loan is fully repaid.

- Prepayment Rights: Describes the borrower's right to make early payments and conditions for doing so.

- Default Conditions: Outlines what constitutes a default and the lender's rights upon default.

- Secured Note Clause: Indicates that the loan is secured by specific personal property as collateral.

When to use this form

This form is useful when you are borrowing money and need to formalize the terms of the loan. It is particularly applicable when the lender requires security in the form of personal property to ensure repayment. Typical scenarios include financing personal purchases such as vehicles or equipment where the lender wishes to have a lien on the purchased item until the loan is repaid.

Who needs this form

- Individuals seeking to borrow money and willing to provide personal property as collateral.

- Lenders who want to establish clear terms and security for a loan to reduce risk.

- People involved in private financing agreements that require legal documentation of loans.

Instructions for completing this form

- Identify the parties: Fill in the names and addresses of the borrower and lender.

- Specify the loan amount: Enter the total principal sum being borrowed.

- Set the interest rate: Provide the agreed-upon annual interest rate.

- Outline the payment terms: Specify the amount and due date of each monthly installment.

- Describe secured property: Clearly define the personal property that secures the loan.

- Sign and date the document: Ensure all parties sign the form in the designated fields.

Does this document require notarization?

In most cases, this form does not require notarization. However, some jurisdictions or signing circumstances might. US Legal Forms offers online notarization powered by Notarize, accessible 24/7 for a quick, remote process.

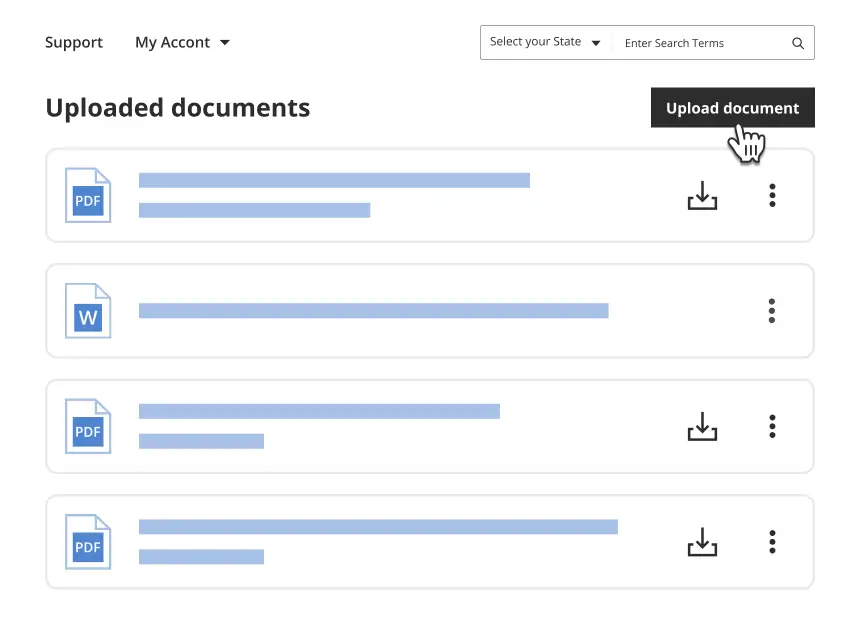

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

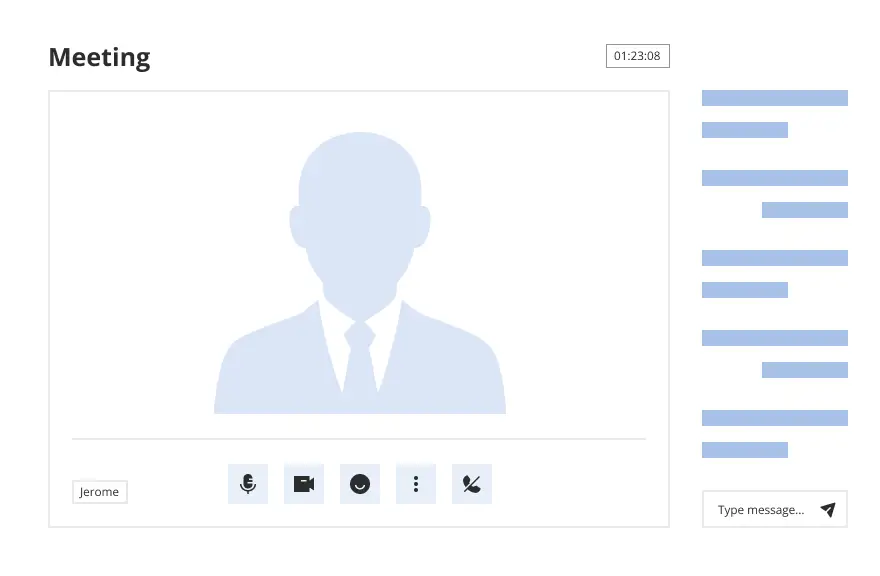

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to enter accurate loan amounts or payment due dates.

- Not including the necessary details of the secured property.

- Neglecting to obtain all required signatures from all parties involved.

Why use this form online

- Convenience of downloading and accessing the form from anywhere.

- Editability allows users to tailor the terms to their specific needs before printing.

- Reliability of professionally drafted language that meets legal standards.

Looking for another form?

Form popularity

FAQ

Yes, the Alabama Installments Fixed Rate Promissory Note Secured by Personal Property is specifically designed to be secured by collateral. This means that if the borrower fails to make payments, the lender can claim the specified personal property as a form of security. This arrangement provides reassurance for both parties, ensuring the lender's investment while giving the borrower access to necessary funds. By using a reliable platform like US Legal Forms, you can easily draft and manage your promissory note to meet all legal requirements.

Yes, a promissory note can be secured by real property, which forms a lien against the property in case of default. This type of security interest provides additional protection to the lender. If you prefer personal property, the Alabama Installments Fixed Rate Promissory Note Secured by Personal Property remains a suitable option, ensuring you have flexibility depending on your specific situation. Understanding the security options can empower you to choose what best suits your circumstances.

Yes, you can write your own promissory note. However, it is essential to include all necessary details to avoid confusion later. The Alabama Installments Fixed Rate Promissory Note Secured by Personal Property template available on uslegalforms can guide you through the writing process, ensuring that you do not overlook any crucial elements. Using a template can help ensure that your note adheres to Alabama's legal standards.

While notarization is not strictly required for a secured promissory note in Alabama, it is a best practice. Having a notary public witness the agreement can strengthen the document's validity. A notarized Alabama Installments Fixed Rate Promissory Note Secured by Personal Property is less likely to encounter disputes. Thus, ensuring proper execution can provide peace of mind for both lenders and borrowers.

In Alabama, recording a secured promissory note is not always necessary, but it is often recommended. This process provides public notice of the security interest, which can protect your rights as a lender. By utilizing the Alabama Installments Fixed Rate Promissory Note Secured by Personal Property, you can enhance the visibility of your agreement. This action can safeguard your investment and clarify the terms for both parties.

To fill out a promissory demand note, start by clearly stating the borrower's name and the amount owed. Next, outline the repayment terms, including any interest rates and due dates. It is also important to include a description of the collateral that secures the Alabama Installments Fixed Rate Promissory Note Secured by Personal Property. Finally, both parties should sign and date the document to formalize the agreement.

The document that secures the promissory note to the real property is typically called a mortgage or deed of trust. In the context of an Alabama Installments Fixed Rate Promissory Note Secured by Personal Property, this document legally outlines the lender’s rights over the property. It provides the framework for enforcement if the borrower fails to meet the payment terms. Having this document is essential for protecting both parties involved.

To secure a promissory note with real property, you need to create a mortgage or deed of trust. The Alabama Installments Fixed Rate Promissory Note Secured by Personal Property will outline the terms, including the lender's right to the property if the borrower defaults. This formalizes the security interest and ensures legal protection for the lender. Properly filing these documents is crucial for validity.

In Alabama, a promissory note does not necessarily need to be notarized to be valid. However, notarization adds an extra layer of protection and authenticity to the Alabama Installments Fixed Rate Promissory Note Secured by Personal Property. It can help prove the terms of the agreement if a dispute arises. Always consider consulting legal advice to ensure compliance with local laws.

Yes, promissory notes can indeed be backed by collateral. In the case of an Alabama Installments Fixed Rate Promissory Note Secured by Personal Property, the collateral often includes personal assets. This backing gives the lender a form of security. If the borrower defaults, the lender has the right to claim the collateral.