Alabama Installments Fixed Rate Promissory Note Secured by Personal Property

Understanding this form

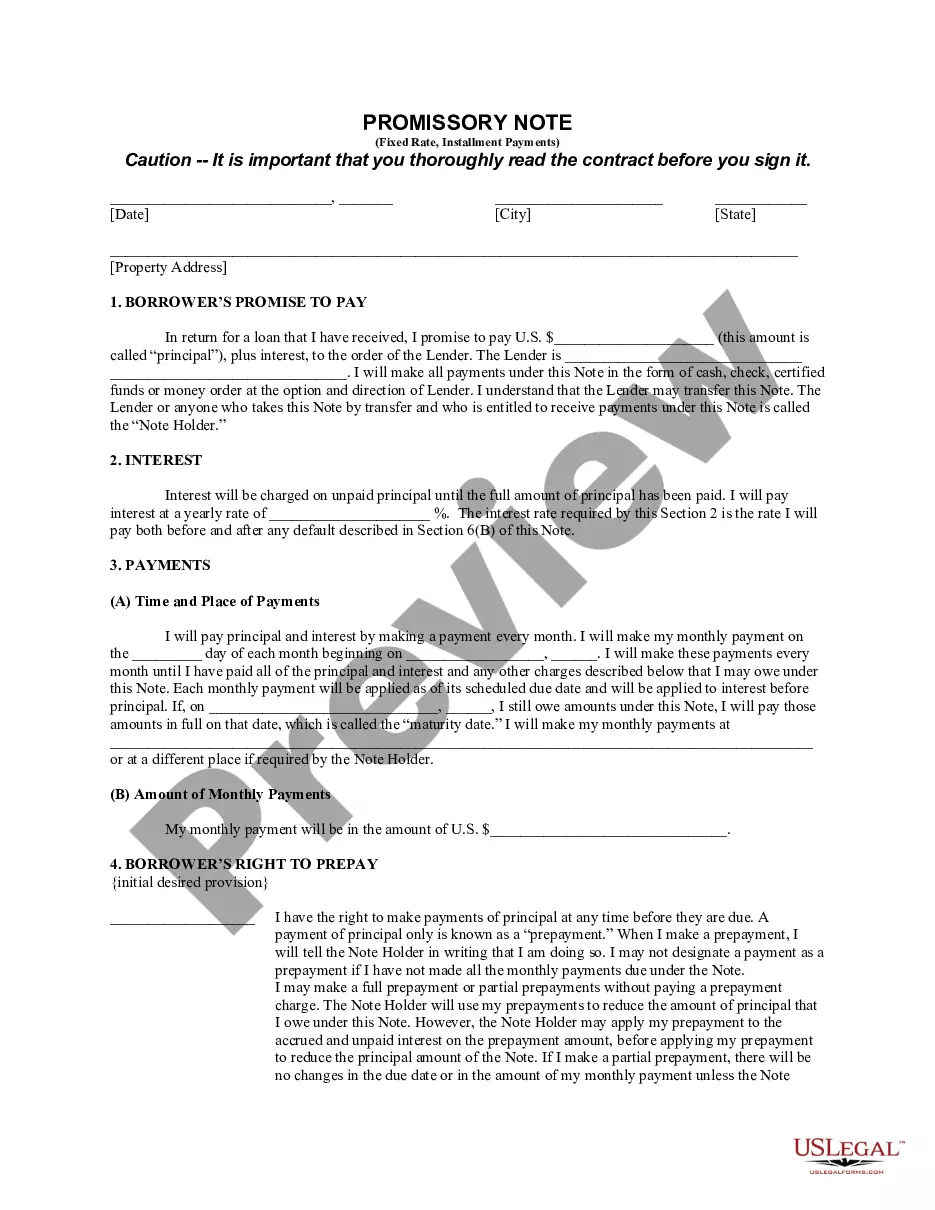

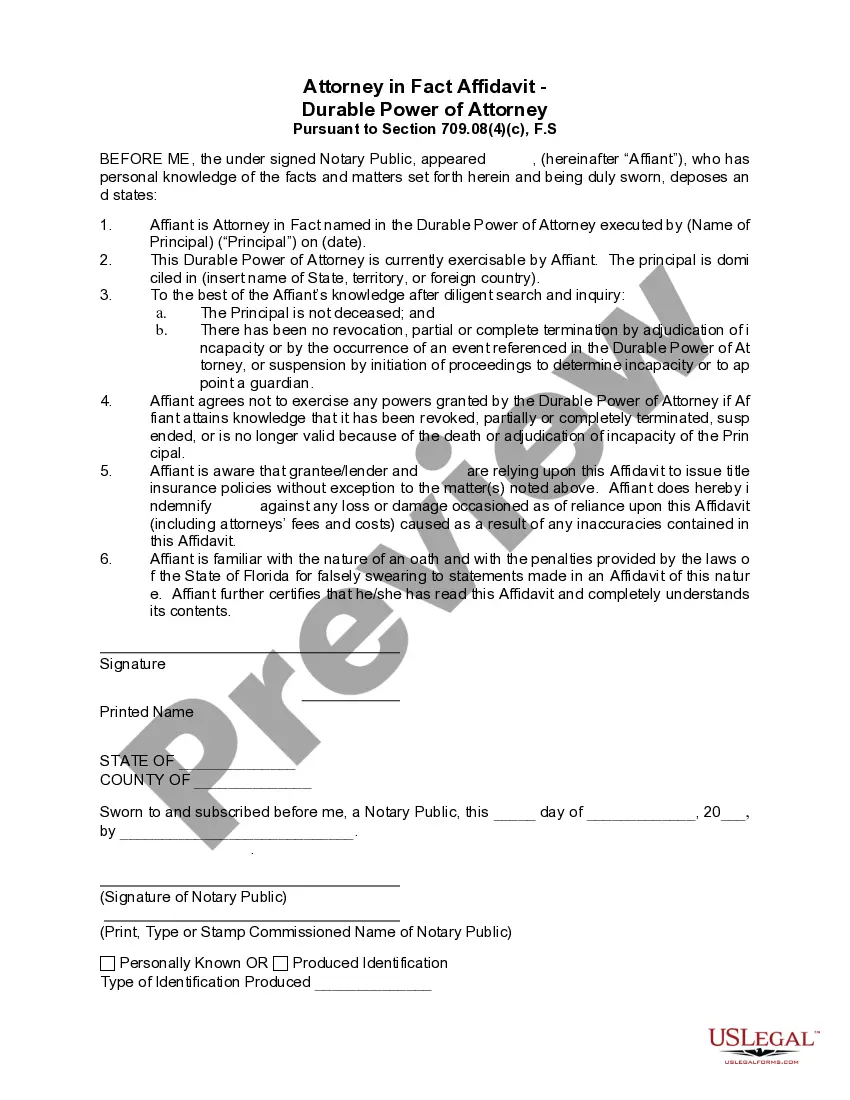

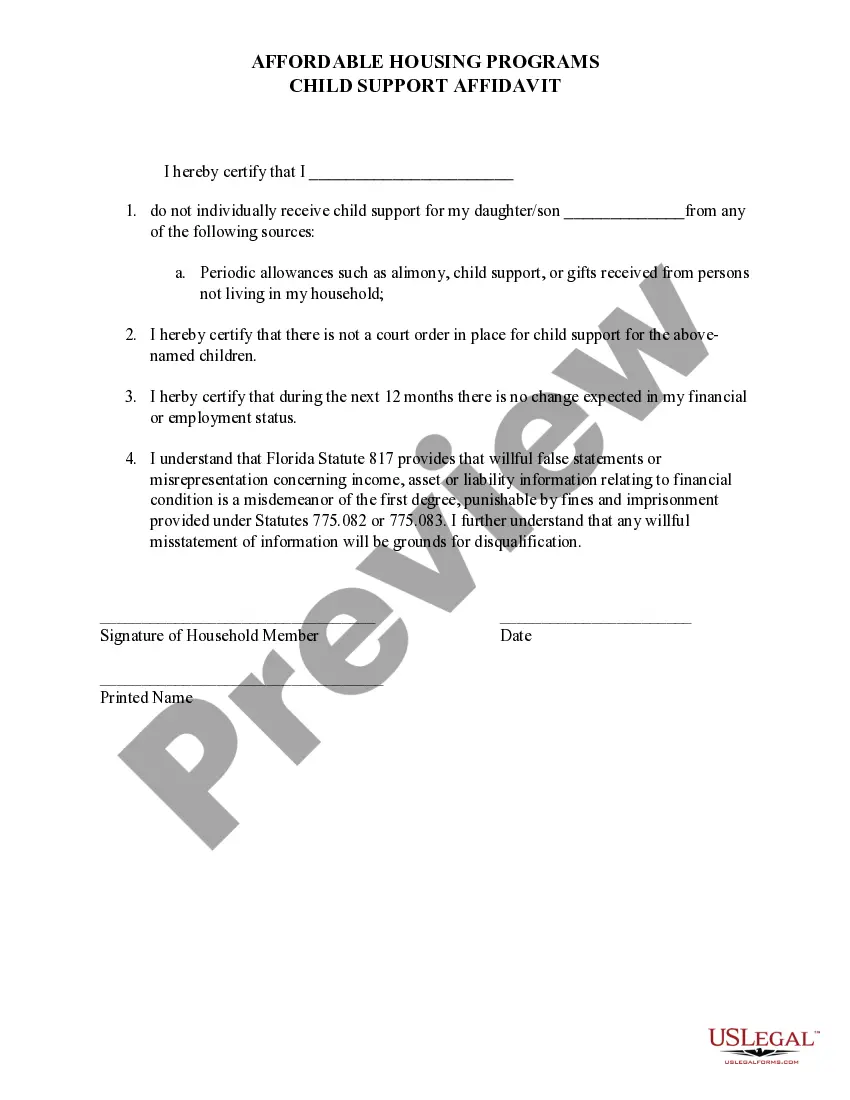

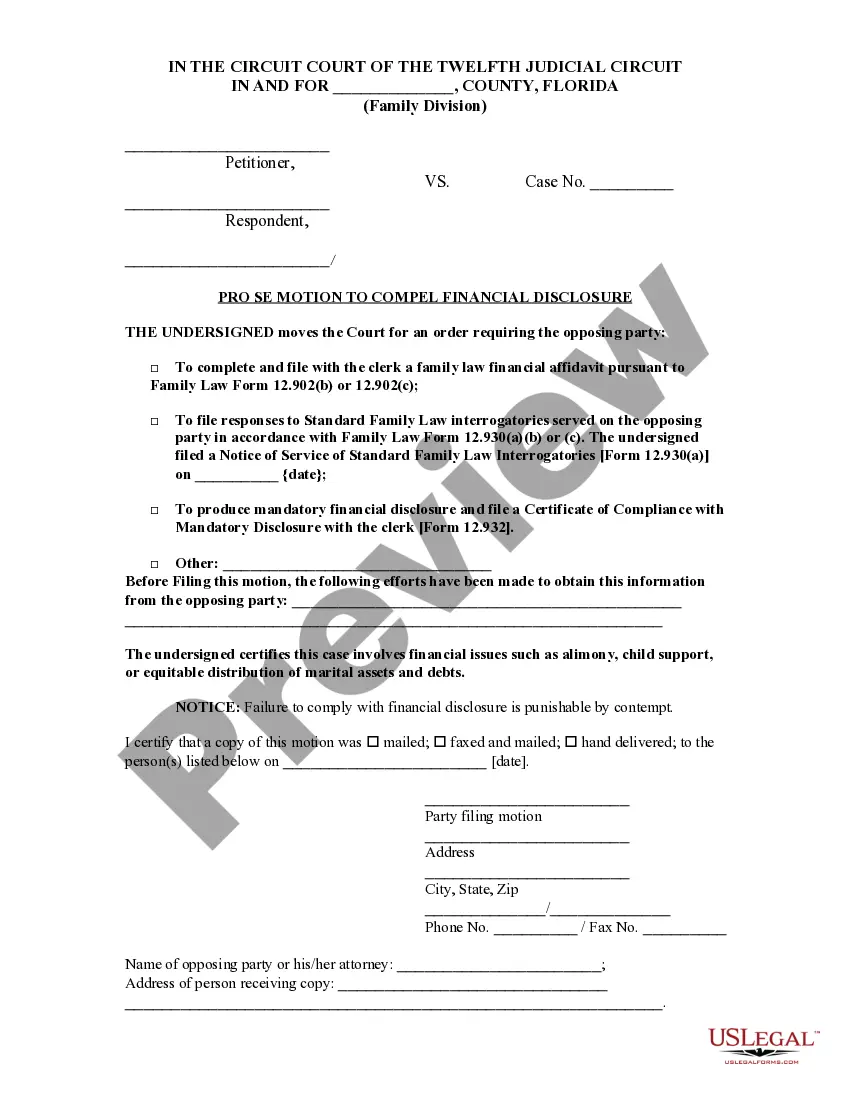

The Alabama Installments Fixed Rate Promissory Note Secured by Personal Property is a legally binding document that outlines a borrower's promise to repay a loan at a fixed interest rate, with installment payments. This form is specifically tailored for situations where personal property serves as collateral for the loan, distinguishing it from unsecured loan agreements.

What’s included in this form

- Borrower's promise to pay: Details the principal amount and the lender's identity.

- Interest: Specifies the annual interest rate and terms for unpaid principal.

- Payment schedule: Outlines the timing and amounts of monthly payments.

- Borrower's right to prepay: Allows early payments on the loan with conditions.

- Loan charges: Describes potential charges and how they will be handled.

- Default terms: Explains consequences of late or missed payments.

When this form is needed

This form is used when an individual or business wishes to secure a loan with personal property as collateral. It is suitable for straightforward lending arrangements where both parties agree on fixed installments and terms of payment. Consider using this form when you need clarity on terms and conditions or when seeking to protect the lender's interests.

Who needs this form

- Individuals borrowing money to finance purchases or consolidate debt.

- Businesses seeking loans secured by inventory or equipment.

- Lenders who require a formal agreement outlining repayment terms.

- Anyone wanting to ensure legal protection for both parties involved in the loan.

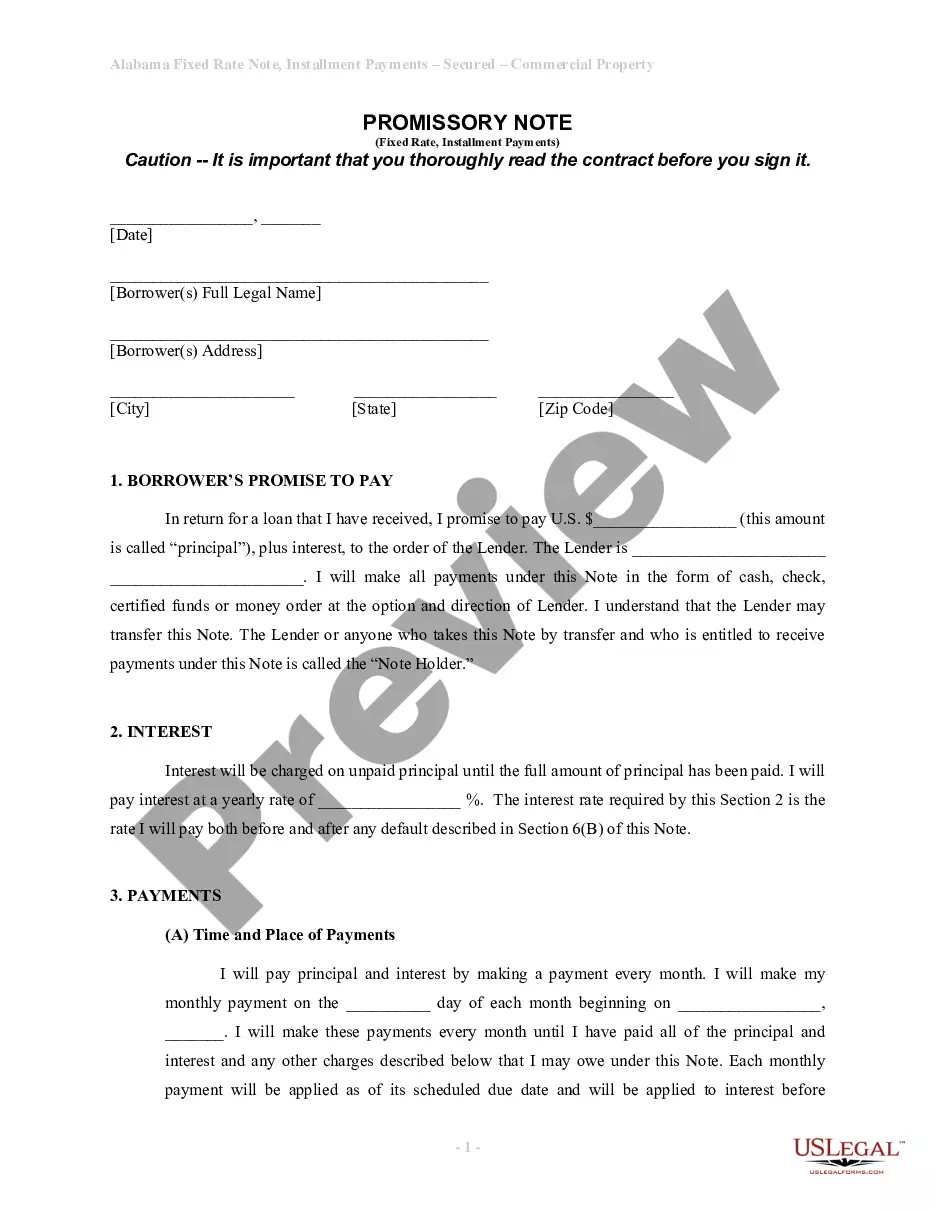

How to prepare this document

- Identify the parties by entering the names and addresses of the borrower and the lender.

- Specify the loan amount and interest rate in the respective fields.

- Fill in the payment schedule, including the total number of months and due dates for payments.

- Include the details regarding personal property used as collateral.

- Sign and date the document, ensuring all parties acknowledge their commitment.

Notarization requirements for this form

In most cases, this form does not require notarization. However, some jurisdictions or signing circumstances might. US Legal Forms offers online notarization powered by Notarize, accessible 24/7 for a quick, remote process.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to clearly define the interest rate and payment amounts.

- Not including adequate descriptions of the personal property used as collateral.

- Leaving out signatures or dates, which may render the document unenforceable.

- Overlooking local laws regarding maximum allowable interest rates and fees.

Benefits of using this form online

- Convenience of accessing and completing the form from anywhere, anytime.

- Editability that allows users to customize the form to their specific loan amount and terms.

- Reliability, as the form is drafted by licensed attorneys to ensure legal compliance.

- Immediate download capability for quick use and processing.

Looking for another form?

Form popularity

FAQ

Yes, the Alabama Installments Fixed Rate Promissory Note Secured by Personal Property is specifically designed to be secured by collateral. This means that if the borrower fails to make payments, the lender can claim the specified personal property as a form of security. This arrangement provides reassurance for both parties, ensuring the lender's investment while giving the borrower access to necessary funds. By using a reliable platform like US Legal Forms, you can easily draft and manage your promissory note to meet all legal requirements.

Yes, a promissory note can be secured by real property, which forms a lien against the property in case of default. This type of security interest provides additional protection to the lender. If you prefer personal property, the Alabama Installments Fixed Rate Promissory Note Secured by Personal Property remains a suitable option, ensuring you have flexibility depending on your specific situation. Understanding the security options can empower you to choose what best suits your circumstances.

Yes, you can write your own promissory note. However, it is essential to include all necessary details to avoid confusion later. The Alabama Installments Fixed Rate Promissory Note Secured by Personal Property template available on uslegalforms can guide you through the writing process, ensuring that you do not overlook any crucial elements. Using a template can help ensure that your note adheres to Alabama's legal standards.

While notarization is not strictly required for a secured promissory note in Alabama, it is a best practice. Having a notary public witness the agreement can strengthen the document's validity. A notarized Alabama Installments Fixed Rate Promissory Note Secured by Personal Property is less likely to encounter disputes. Thus, ensuring proper execution can provide peace of mind for both lenders and borrowers.

In Alabama, recording a secured promissory note is not always necessary, but it is often recommended. This process provides public notice of the security interest, which can protect your rights as a lender. By utilizing the Alabama Installments Fixed Rate Promissory Note Secured by Personal Property, you can enhance the visibility of your agreement. This action can safeguard your investment and clarify the terms for both parties.

To fill out a promissory demand note, start by clearly stating the borrower's name and the amount owed. Next, outline the repayment terms, including any interest rates and due dates. It is also important to include a description of the collateral that secures the Alabama Installments Fixed Rate Promissory Note Secured by Personal Property. Finally, both parties should sign and date the document to formalize the agreement.

The document that secures the promissory note to the real property is typically called a mortgage or deed of trust. In the context of an Alabama Installments Fixed Rate Promissory Note Secured by Personal Property, this document legally outlines the lender’s rights over the property. It provides the framework for enforcement if the borrower fails to meet the payment terms. Having this document is essential for protecting both parties involved.

To secure a promissory note with real property, you need to create a mortgage or deed of trust. The Alabama Installments Fixed Rate Promissory Note Secured by Personal Property will outline the terms, including the lender's right to the property if the borrower defaults. This formalizes the security interest and ensures legal protection for the lender. Properly filing these documents is crucial for validity.

In Alabama, a promissory note does not necessarily need to be notarized to be valid. However, notarization adds an extra layer of protection and authenticity to the Alabama Installments Fixed Rate Promissory Note Secured by Personal Property. It can help prove the terms of the agreement if a dispute arises. Always consider consulting legal advice to ensure compliance with local laws.

Yes, promissory notes can indeed be backed by collateral. In the case of an Alabama Installments Fixed Rate Promissory Note Secured by Personal Property, the collateral often includes personal assets. This backing gives the lender a form of security. If the borrower defaults, the lender has the right to claim the collateral.